Daily Recap: Worries Wane | Yields Climb | REITs Fade

Reports that the US and China are moving closer to "Phase One" of a trade deal - a deal that may now include rollbacks of some existing tariffs - prompted another "risk-on" day in the US equity markets. A better-than-expected ISM services print this morning further eased investor worries, sending the Nasdaq ETF (QQQ) to another all-time record high while the S&P 500 ETF (SPY) finished roughly unchanged. A repeat of the trading action yesterday, the 10-Year Treasury Yield (IEF) climbed higher by another 7 basis points to 1.87%, flirting with the highest levels since the September 14th close at 1.90%.

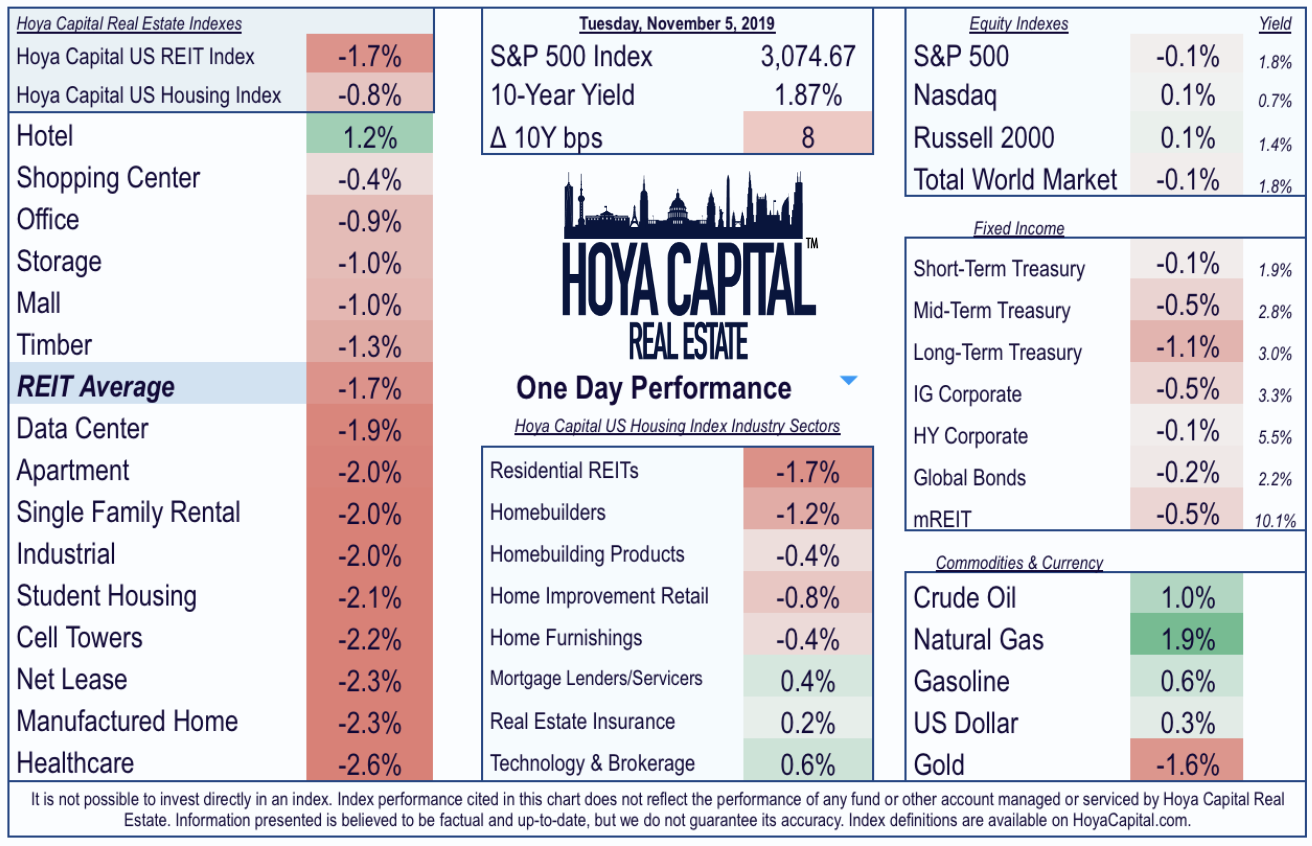

Defensive and yield-oriented equity sectors, which have led this year's market rally, lagged for the second straight day. The broad-based Real Estate ETF (VNQ) ended the day lower by 1.7%, dragged to the downside by the defensively-oriented manufactured housing, healthcare, and net lease sectors. Hotel REITs were the lone real estate sector finishing in the green. Despite the past month's underperformance, the broad-based REIT ETFs are still clinging to a thin margin of YTD outperformance compared to the S&P 500.

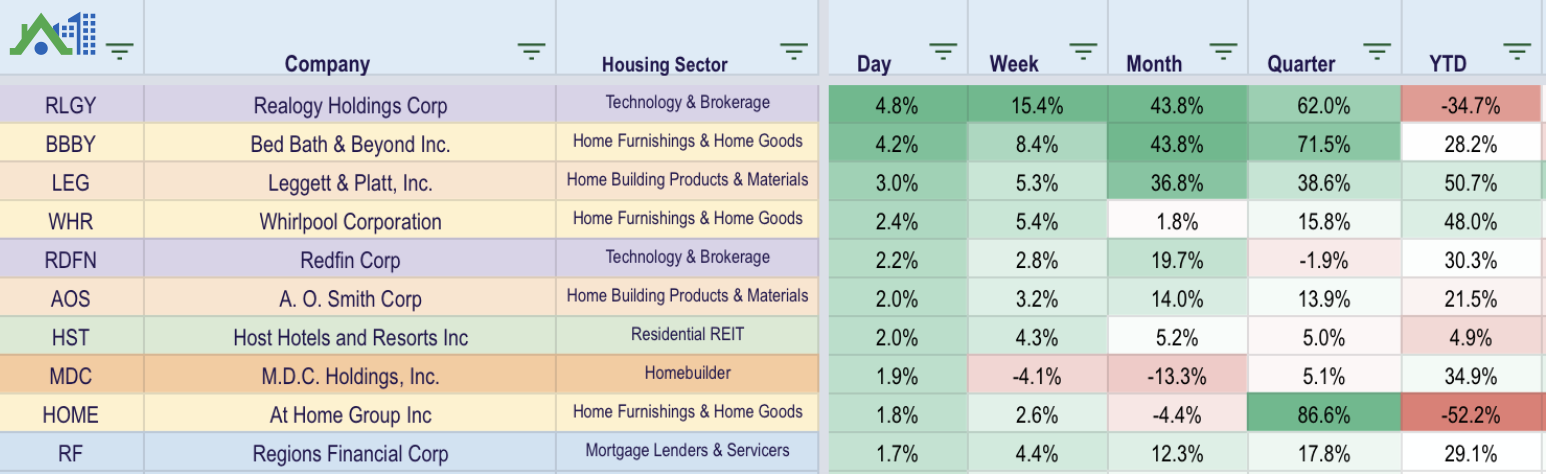

The Hoya Capital Housing Index, the benchmark that tracks the performance of the US housing industry, finished the day lower by 0.7% as strength from the real estate technology and brokerage sector, as well as the mortgage lending and servicing sector, was offset by weakness from the residential REITs and homebuilders. The recently resurgent Realogy (RLGY) led the gains for the second straight day while homebuilding products companies Leggett & Platt (LEG), Whirlpool (WHR), and AO Smith all climbed by at least 2% on the day.

Besides a few stragglers next week, real estate earnings season will wrap up this week with another 30 REITs reporting results including Host Hotels (HST), Omega Healthcare (OHI), and Kite Realty (KRG) reporting after the bell today. Below we compiled the notable earnings that we're watching across the residential and commercial real estate sectors.

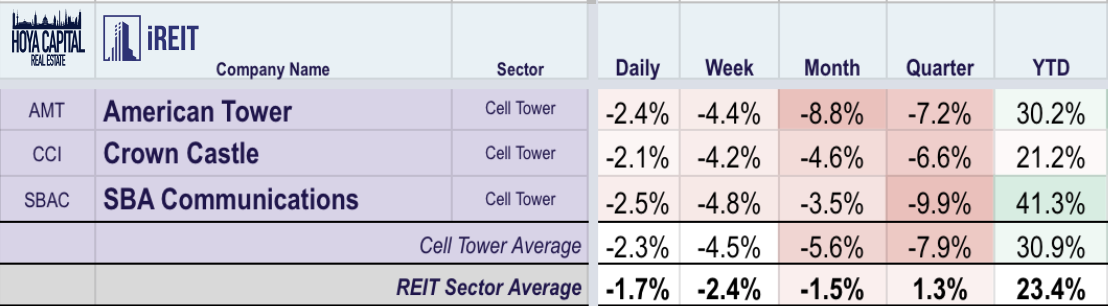

The recently high-flying Cell Tower REITs American Tower (AMT), Crown Castle (CCI), and SBA Communications (SBAC) all ended lower by more than 2% on news that the FCC has approved the T-Mobile (TMUS) and Sprint (S) merger, one of the last major hurdles before final approval. We'll have a full analysis of recent developments in our Cell Tower REIT update next week.

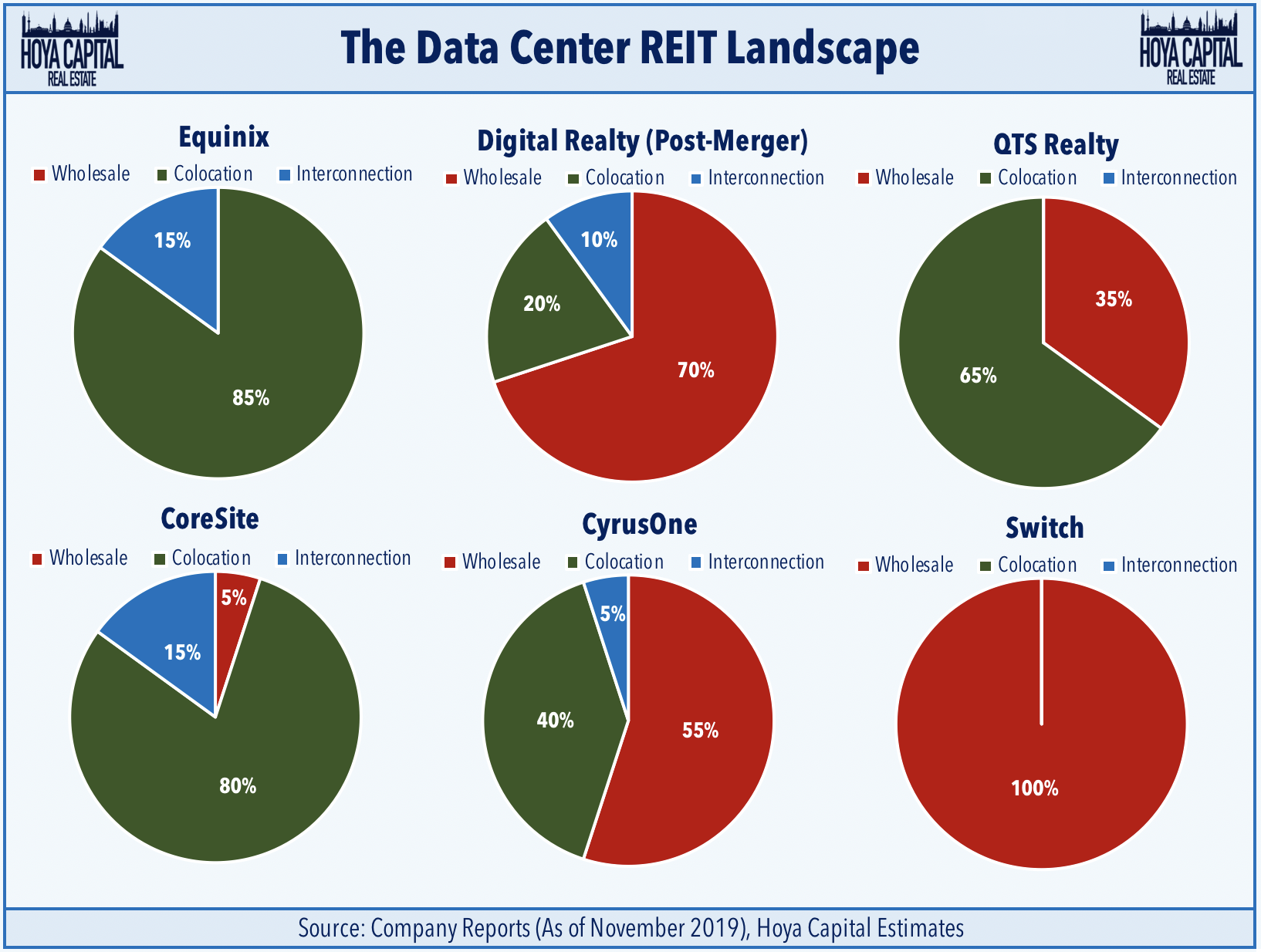

Tomorrow, we will publish our analysis of the data center REIT sector. The growth engine of the real estate sector over the past half-decade, data center REITs have returned to their winning ways this year following a rough 2018. Digital Realty (DLR) shook the data center landscape yet again last week with it's announced $8 billion acquisition of European data center giant Interxion. Digital Realty significantly expanded its interconnection and colocation business. Interconnection, which relies on "network effects," can translate into a competitive advantage owned by REITs that hyperscalers have more difficulty replicating.

Subscribe to our email list for free access to our full research library including coverage of Apartments, Homebuilders, Student Housing, Single-Family Rentals, Manufactured Housing, Cell Towers, Healthcare, Industrial, Data Center, Malls, Net Lease, Shopping Centers, Hotels, Office, Storage, Timber, and Real Estate Crowdfunding.