Worst Quarter For REITs Since 2008 [Daily Recap]

- On a rather calm day by coronavirus-era standards, U.S. equity markets finished modestly lower, giving back some of yesterday's gains and mercifully ending the worst quarter for stocks since 2008.

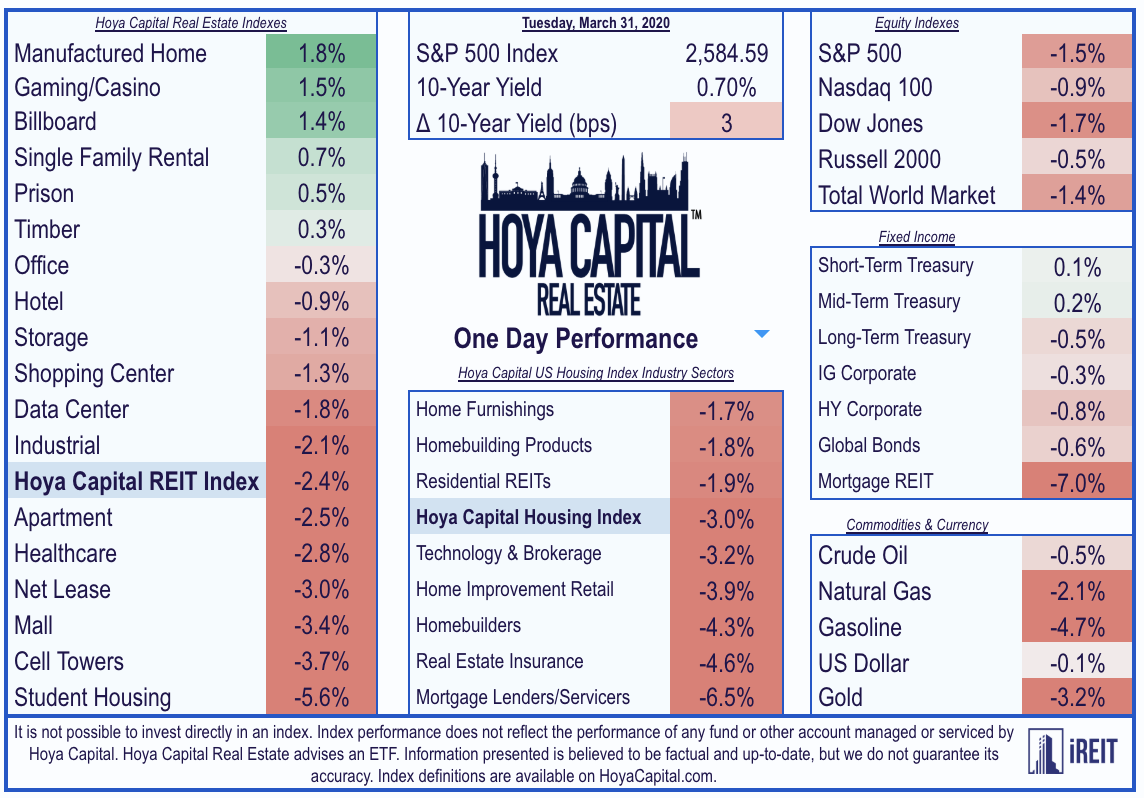

- After gaining 3.3% yesterday, the S&P 500 finished lower by 1.6% while the Dow Jones Industrial Average gave back 410 points after yesterday's 690 point gain.

- Following gains of 2.2% yesterday, the broad-based commercial Real Estate ETFs declined by 2.4% on the day with 6 of the 18 REIT sectors finishing in positive territory.

- It was another rough day for Mortgage REITs as well, which dipped another 7.0% after yesterday's similar-sized drop as more mREITs announced the damage to book values following the period of violent volatility earlier in the month.

- Today's losses capped off the worst quarter for essentially every major U.S. equity index since at least 2008. The S&P 500 finished lower by 19.9% while REITs fell by 25.0%, salvaged by last week's historic rally.

Real Estate Daily Recap

On a rather calm day by coronavirus-era standards, U.S. equity markets finished modestly lower, giving back some of yesterday's gains and mercifully ending the worst quarter for financial markets since 2008. After gaining 3.3% yesterday, the S&P 500 ETF(SPY) finished lower by 1.6% while theDow Jones Industrial Average(DIA) gave back 410 points after yesterday's 690 point gain. Giving back gains of 2.2% yesterday, the broad-based commercial Real Estate ETF(VNQ) declined by 2.4% on the day with 6 of the 18 REIT sectors finishing in positive territory. It was another rough day for Mortgage REITs(REM) as well, which dipped another 7.0% after yesterday's 9% drop as more mREITs announced the damage to book values following the period of violent volatility and forced selling earlier in the month.