Summer To Remember | WFH Woes | Jobs Week

Daily Recap

- U.S. equity markets finished mostly lower Monday ahead of a critical week of employment data that should offer investors a real-time indication of the status of the economic recovery.

- Finishing August higher by 7.2% - its fifth-straight month of gains - the S&P 500 finished lower by 0.2% today after gaining 3.3% last week. The Nasdaq gained 0.7% today.

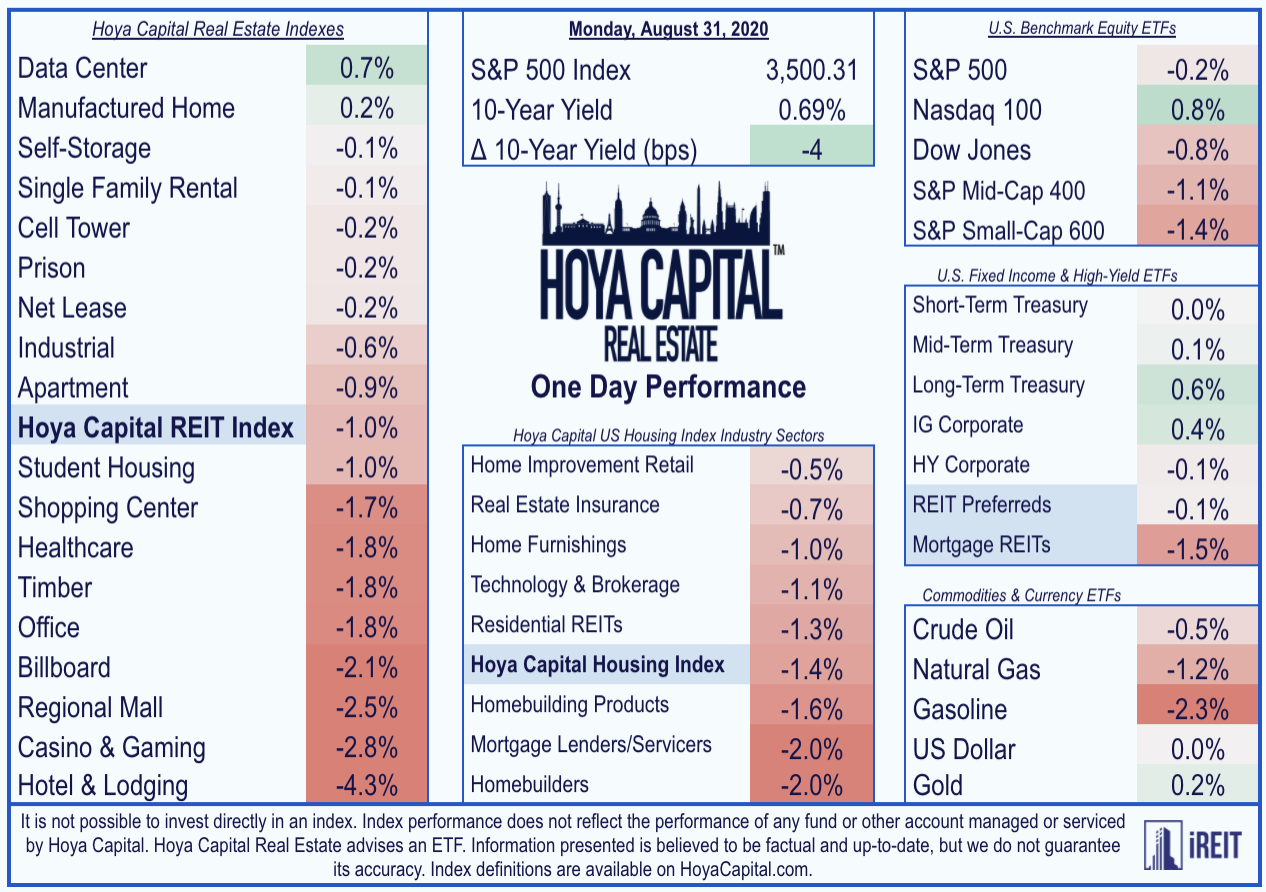

- Coming off gains of 2.2% last week, the Equity REIT finished lower by 1.0% today with 16 of 18 property sectors in negative territory. Mortgage REITs pulled back 1.5%.

- The nearly 60% rebound in the S&P 500 from its lows in late March has been extended over recent weeks amid a bullish convergence of positive economic and coronavirus data and a dovish tack by the Federal Reserve.

- Economists are looking for employment gains of roughly 1.4 million in August following July's better-than-expected gain of 1.8 million with the unemployment rate pulling back below 10%.

Our Real Estate Daily Recap discusses the notable news and events in the real estate sector over the last trading day and highlights sector-by-sector performance. We publish this note every afternoon at HoyaCapital.com and occasionally on Seeking Alpha to cover significant news and events. Subscribe to our free mailing list to make sure you never miss the latest developments in the commercial and residential real estate sectors. You can also follow our real-time commentary on Twitter and LinkedIn.

U.S. equity markets finished mostly lower Monday ahead of a critical week of employment data that should offer investors a real-time indication of the status of the economic recovery. Finishing August higher by 7.2% - its fifth-straight month of gains - the S&P 500 ETF (SPY) finished lower by 0.2% today after gaining 3.3% last week. The Dow Jones Industrial Average (DJI) dipped 224 points while the Nasdaq 100 ETF (QQQ) gained 0.7%. Coming off gains of 2.2% last week, the Equity REIT ETF (VNQ) finished lower by 1.0% today with 16 of 18 property sectors in negative territory. The Mortgage REIT ETF (REM) finished lower by 1.5% today after 2.9% gains last week.

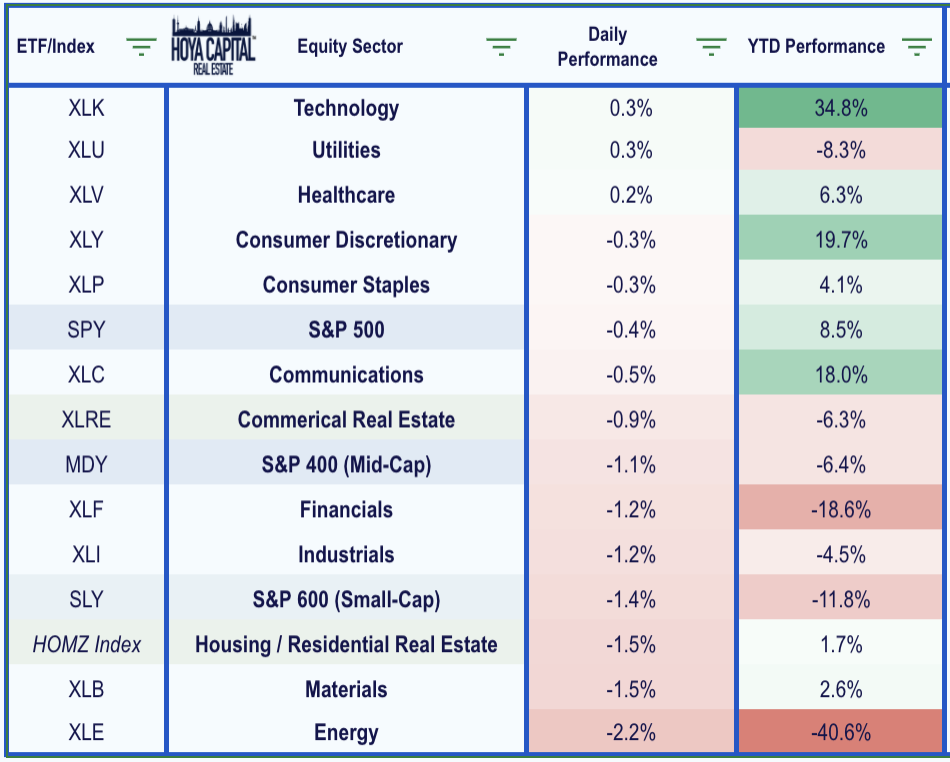

As we discussed in our Real Estate Weekly Outlook, U.S. equity markets have extended their relentless rally over the last several weeks amid a bullish convergence of positive economic and housing data, encouraging coronavirus trends, and a dovish tack from the Federal Reserve in which the central bank signaled its intentions to keep rates lower for longer. 3 of the 11 GICS sectors finished in positive territory today, led by the Technology (XLK), Utilities (XLU), and Healthcare (XLV) sectors. The high-flying homebuilders have cooled over the last week, dragging on the Hoya Capital Housing Index today while Mid-Cap (MDY) and Small-Cap (SLY) stocks lagged on the day. The 10-Year Treasury Yield pulled back 4 basis points to close at 0.69%.

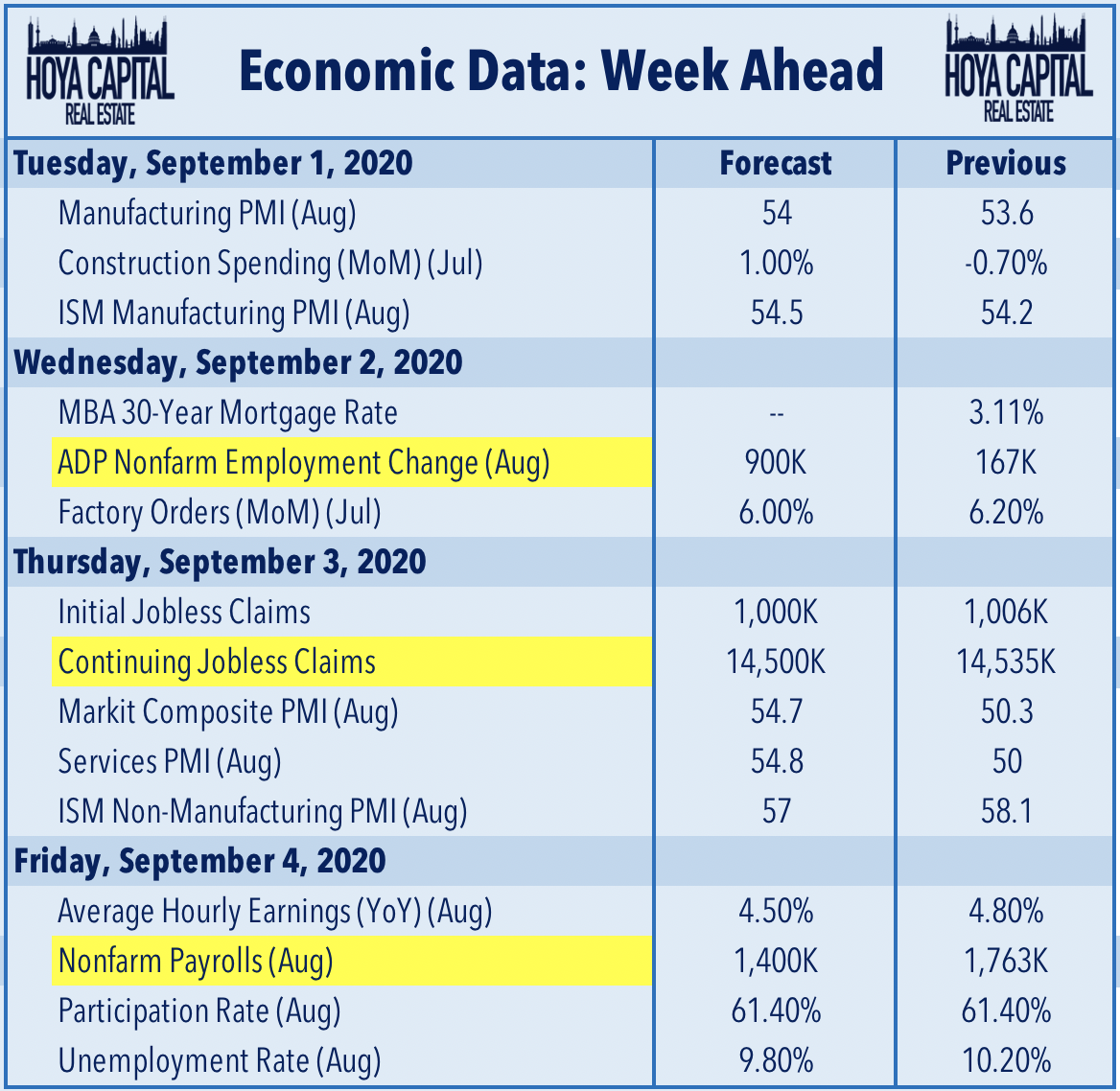

Employment data highlights this week's busy economic calendar, headlined by ADP data on Wednesday, jobless claims on Thursday, and the BLS nonfarm payrolls report on Friday. Economists are looking for employment gains of roughly 1.4 million in August following July's better-than-expected gain of 1.8 million while the headline unemployment rate is expected to pull back below 10%. We'll also see Construction Spending data on Tuesday and a flurry of PMI data throughout the week.