Tech Correction • Prologis Earnings • Strong Housing Data

Summary

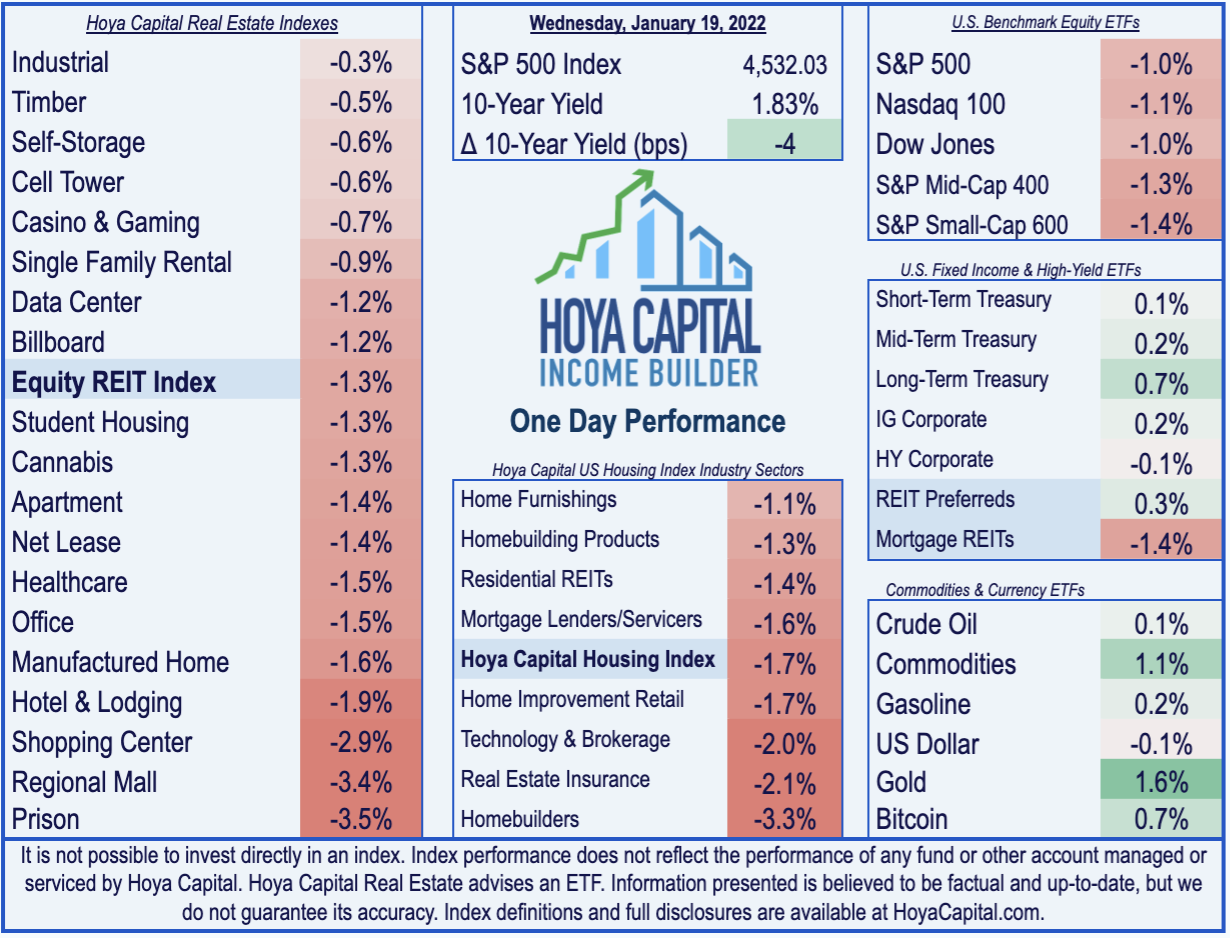

- U.S. equity markets remained under pressure Wednesday - sending the tech-heavy Nasdaq into "correction territory" - as investors continue to sell-off longer duration assets amid intensifying stagflation concerns.

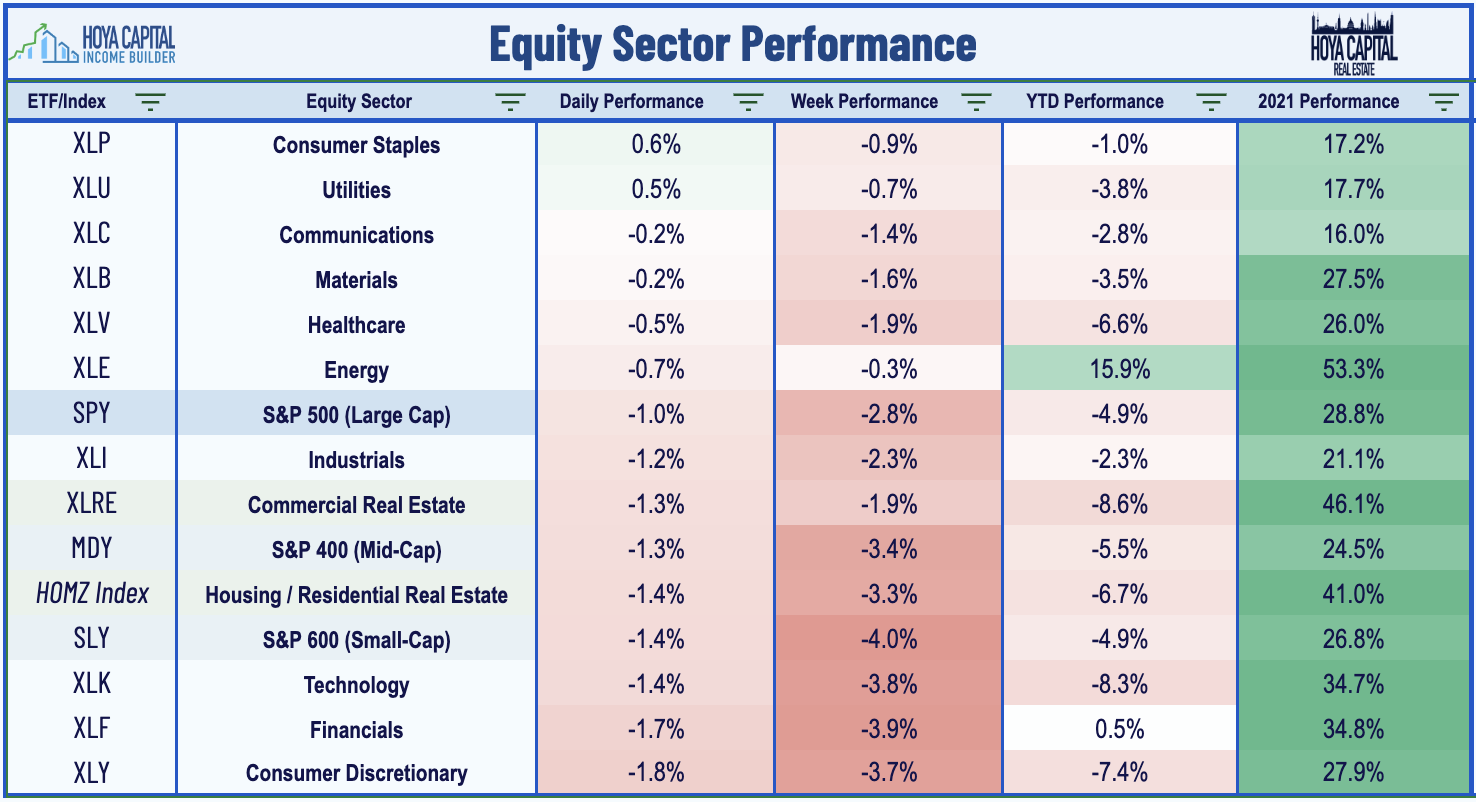

- Adding to declines of 1.8% yesterday, the S&P 500 slipped another 1.0% today while the tech-heavy Nasdaq 100 fell by 1.1%. Mid-Caps declined 1.3% while Small-Caps slipped 1.4%.

- Real estate equities were broadly lower as well today with the Equity REIT Index declining by 1.3% with all 19 property sectors in negative territory while Mortgage REITs declined 1.4%.

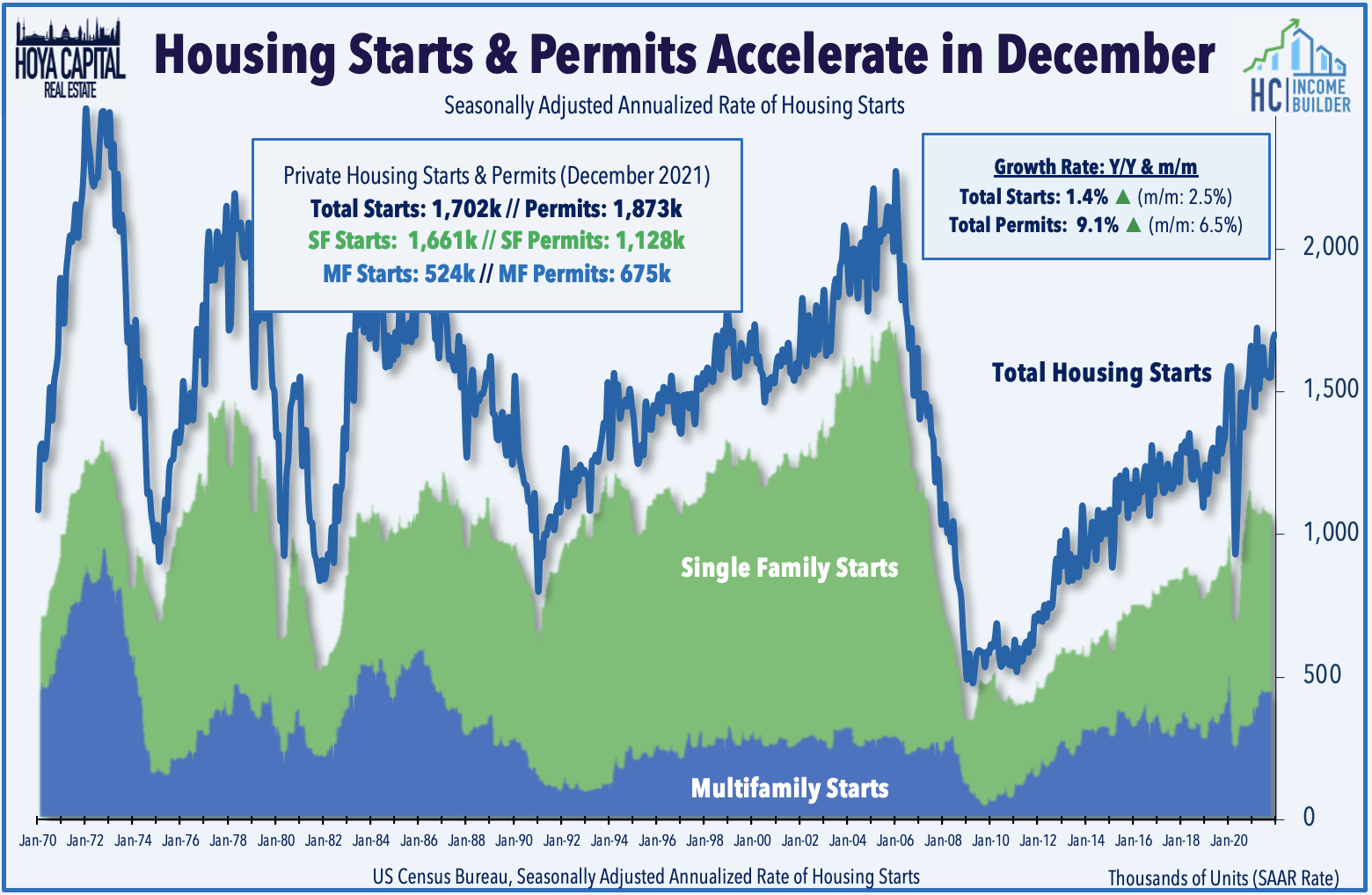

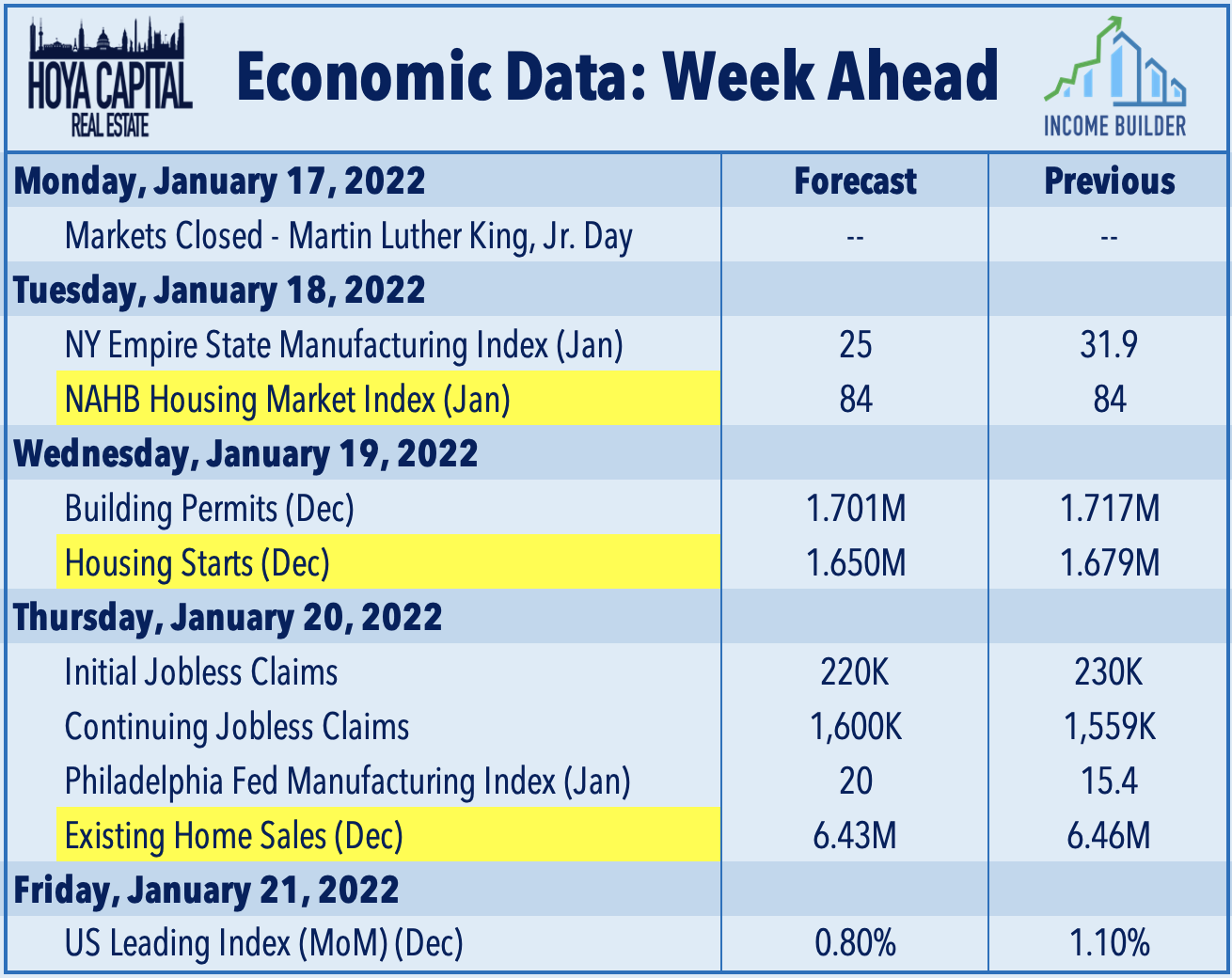

- Housing Starts and Permits data today showed that U.S. homebuilding activity accelerated to nine-month highs in December despite ongoing supply chain constraints.

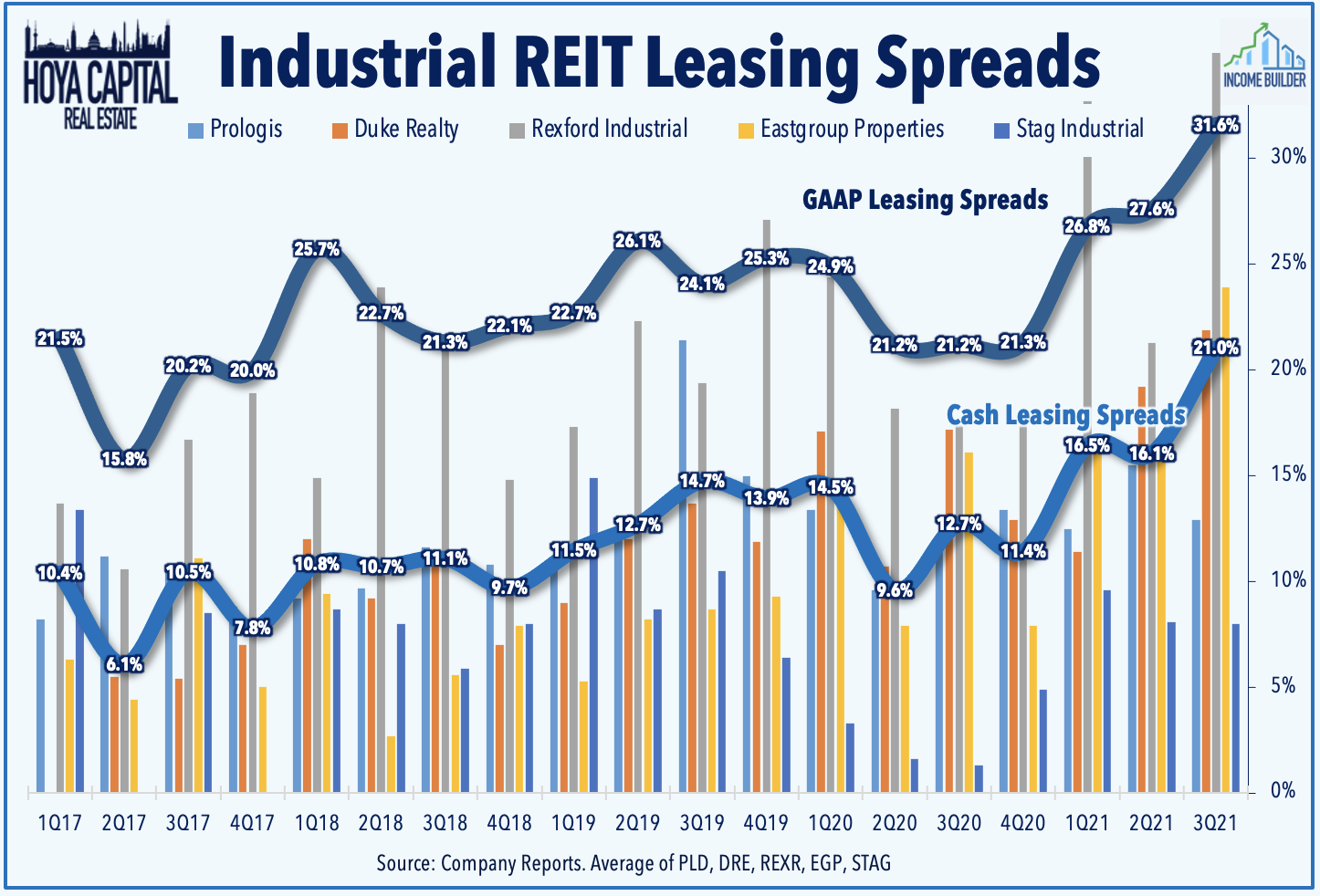

- Prologis (PLD) was among the leaders today after kicking off 4Q REIT earnings season with another strong beat-and-raise report. PLD delivered Core FFO growth of 9.2% in full-year 2021 and its initial guidance calls for 8.4% growth in 2022.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets remained under pressure Wednesday - sending the tech-heavy Nasdaq into "correction territory" - as investors continue to sell off longer duration assets amid intensifying stagflation concerns. Adding to declines of 1.8% yesterday, the S&P 500 slipped another 1.0% today while the tech-heavy Nasdaq 100 declined 1.1%. The Mid-Cap 400 declined 1.3% while the Small-Cap 600 finished lower by 1.4%. Real estate equities were broadly lower as well today with the Equity REIT Index declining by 1.3% with all 19 property sectors in negative territory while Mortgage REITs declined 1.4%.

The hope for moderating inflation has been disrupted by an intensification of supply chain disruptions resulting from Omicron and the surge in energy prices with Crude Oil prices climbing to fresh seven-year highs on the day. The 10-Year Treasury Yield retreated slightly today after reaching its highest level since late 2019. Nine of the eleven GICS equity sectors finished lower on the day, dragged on the downside by the Consumer Discretionary (XLY), Financials (XLF), and Technology sectors. The Energy (XLE) and Financials (XLF) sectors are now the lone equity sectors in positive territory for 2022.

The housing industry has remained a steady source of strength, and Housing Starts and Permits data today showed that U.S. homebuilding activity accelerated to nine-month highs in December despite ongoing supply chain constraints. Driven by strength in the multi-family category, Housing Starts climbed 1.4% to a seasonally adjusted annual rate of 1.702 million units last month, the highest level since March, which offset a modest decline in single family starts. Yesterday, we published Homebuilders: Growth At Very Reasonable Prices which discussed how the largest homebuilders have more-than-offset rising costs through higher prices, sending profit margins to record-highs in 2021.

Equity REIT Daily Recap

Industrial: Prologis (PLD) was among the leaders today after kicking off 4Q REIT earnings season with another strong beat-and-raise report. PLD delivered Core FFO growth of 9.2% in full-year 2021 and its initial guidance calls for 8.4% growth in 2022. Same-store NOI growth is expected to rise 6.5% this year, an acceleration from its full-year NOI growth of 6.1%. Leasing spreads were particularly impressive with cash rents rising 19.6%, its highest on record. Consistent with our forecast in Industrial REITs: Empty Shelves, Ample Opportunity, CEO Hamid Moghadam commented, "Demand for our 1 billion square foot global portfolio shows no signs of slowing."

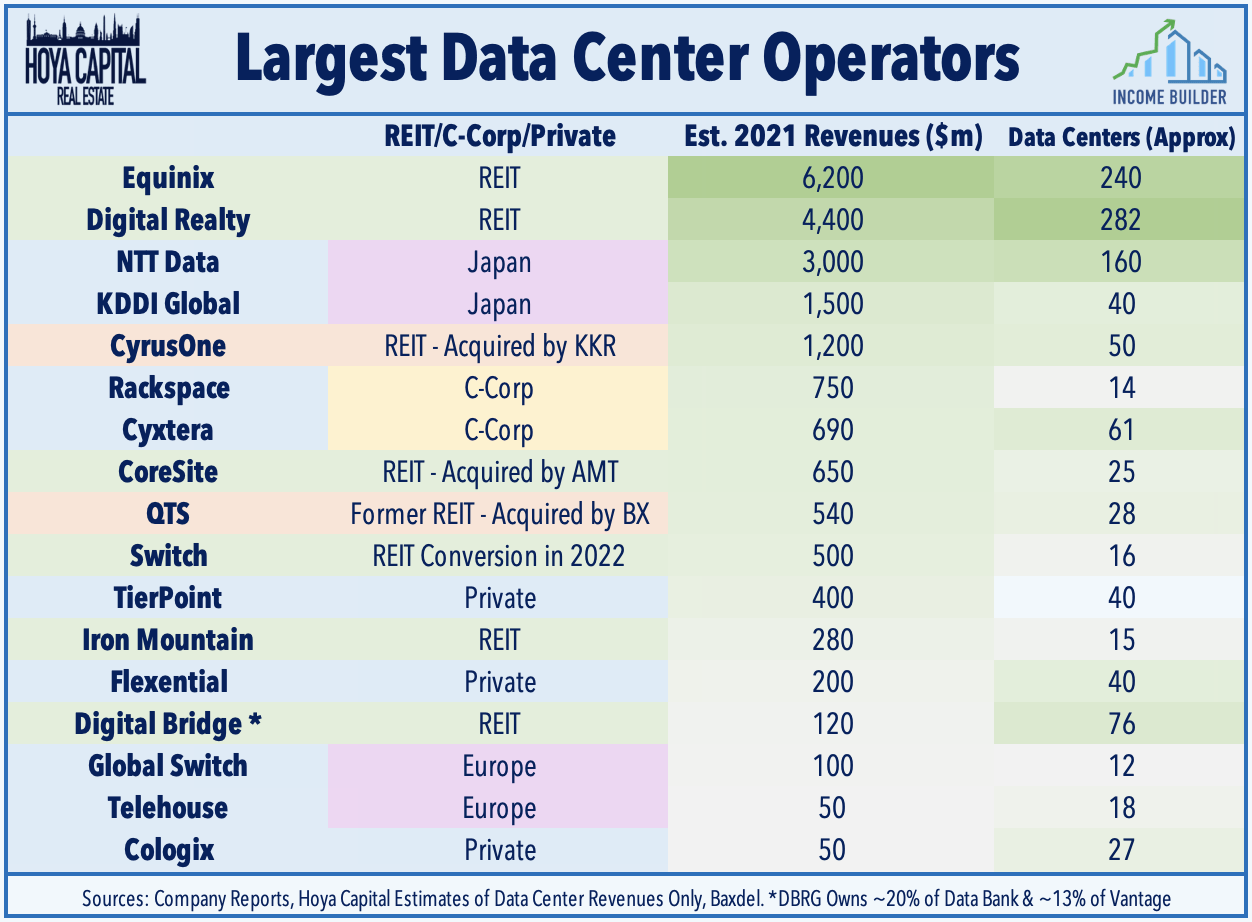

Data Center: Digital Bridge (DBRG) announced today that its portfolio company DataBank agreed to acquire four existing data centers in Houston, Texas from former REIT - CyrusOne - for $670M.CyrusOne was acquired by KKR (KKR) in 2021, part of a wave of privatization that included QTS Realty and CoreSite. The transaction - which is expected to close late in 1Q22 - will make DataBank the largest data center provider in Houston. The transaction will be funded by an investor group led by DigitalBridge, which will contribute $80M from its balance sheet to maintain its 20% ownership position in DataBank.

Economic Data This Week

The jam-packed week of housing market data continues tomorrow with Existing Home Sales data for December which increased for a third-straight month in November to fresh 11-month highs. We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook report published this weekend.

We're excited to announce the launch of our new investment research service here on Seeking Alpha - Hoya Capital Income Builder. We've put together a great team of contributors from across the REIT, dividend, and ETF industry, so whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.