Correction Deepens • Solid Job Gains • REIT Dividend Hikes

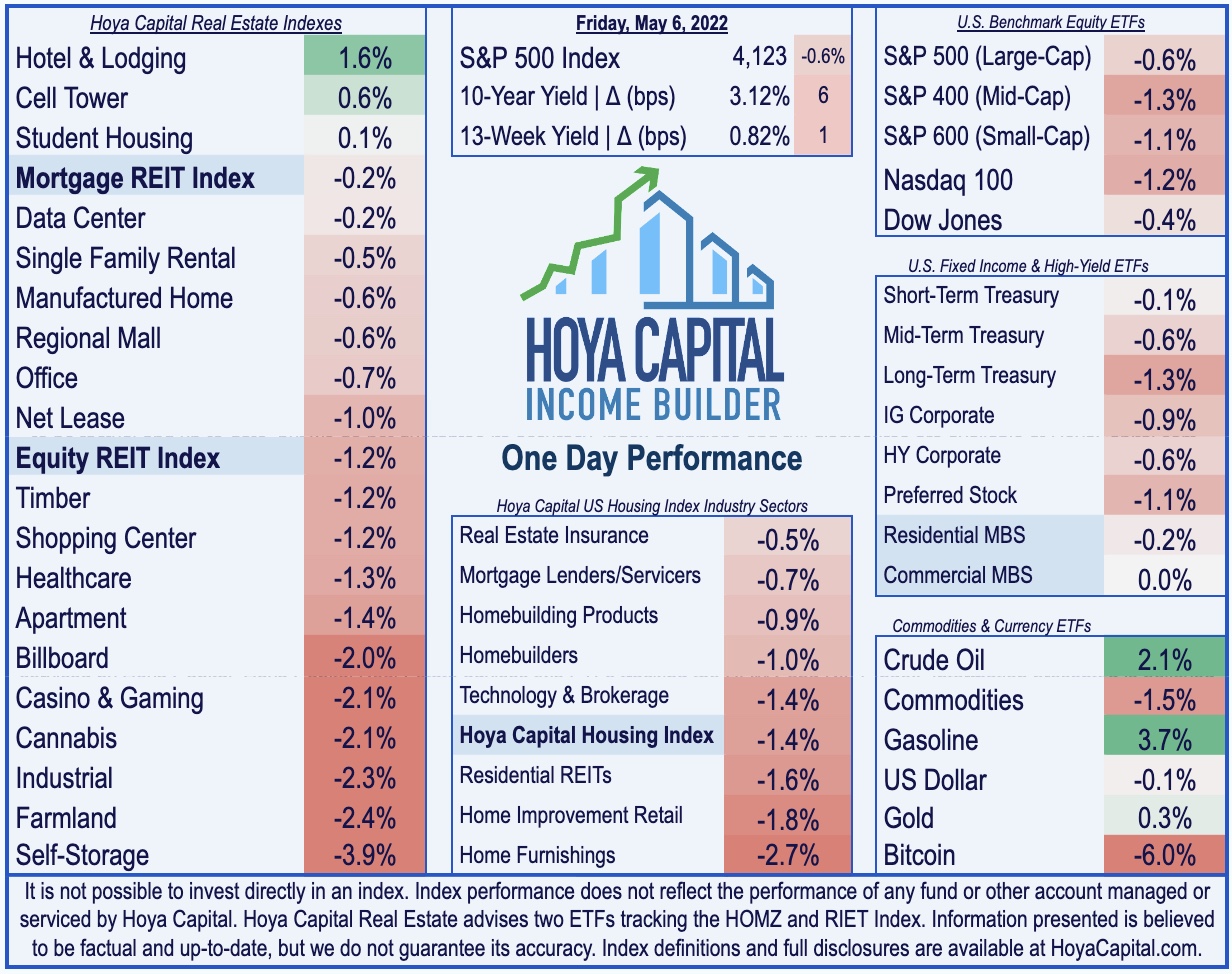

- U.S. equity markets were broadly lower again Friday - notching their fifth-straight week of declines- in yet another volatile session as strong employment data was unable to quell stagflation concerns.

- Posting its worst two-day performance since early 2020, the S&P 500 declined 0.6% today while the tech-heavy Nasdaq 100 declined another 1.2% to push its drawdown to over 23%.

- Mortgage REIT Arbor Realty (ABR) was among the leaders after reporting better-than-expected results and raising its dividend for the second-time this year, which also marked its eighth consecutive quarterly increase.

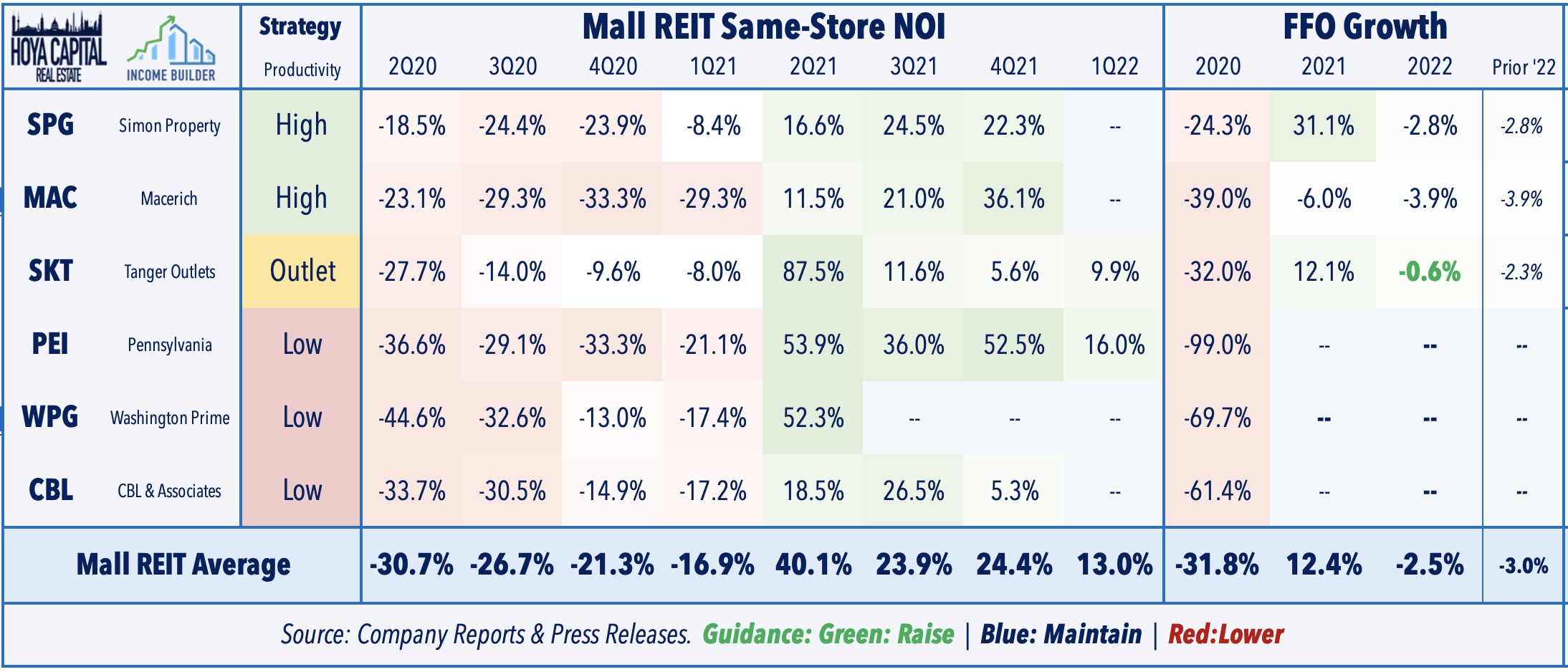

- Tanger Outlets (SKT) slumped despite raising its full-year outlook and snapping a twelve-quarter streak of negative rent spreads dating back to Q1 of 2019. Tanger's FFO is still expected to be 24% below 2019-levels.

- DiamondRock (DHR) rallied today after noting that it expects 2022 hotel revenues to meet or exceed 2019-levels. DHR also announced that it expects its common stock dividend to resume in Q3 of 2022.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

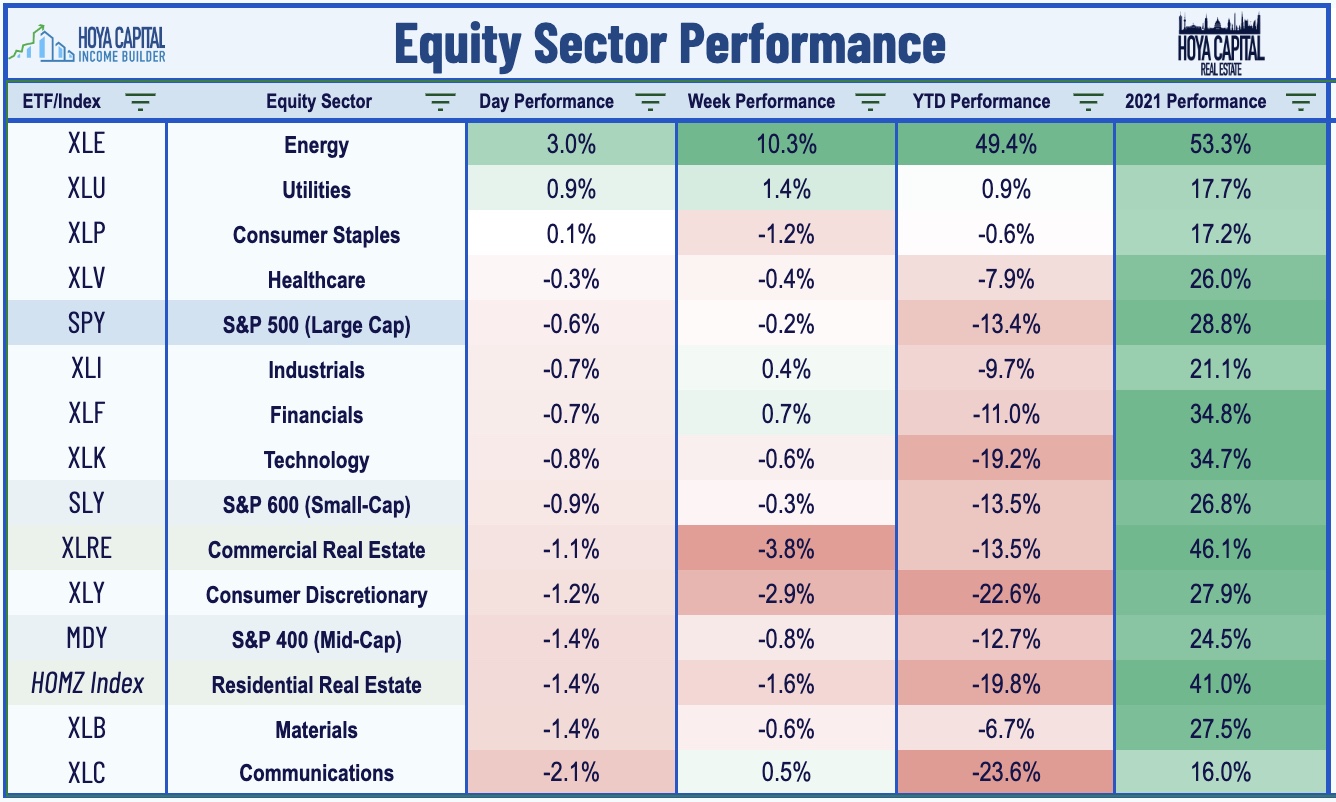

U.S. equity markets were broadly lower again Friday - notching their fifth-straight week of declines - in yet another volatile session as strong employment data was unable to quell stagflation concerns. Posting its worst two-day performance since early 2020, the S&P 500 declined 0.6% today while the tech-heavy Nasdaq 100 declined another 1.2% to push its drawdown to over 23%. Real estate equities were laggards throughout the week despite a strong slate of earnings results as the Equity REIT Index declined 1.2% today - and nearly 4% on the week - but Mortgage REITs were roughly flat today and were higher by 3.5% on the week.

Solid nonfarm payrolls which showed 428k jobs added in April - the 12th straight month of job growth above 400k - did little to improve the sour investor sentiment. Nine of the eleven GICS equity sectors were lower on the day with Energy (XLE) and Utilities (XLU) as the lone sectors finishing higher. Bonds were under pressure yet again as both the 10-Year Treasury Yield and the 2-Year Treasury Yield each climbed to their highest levels since 2018. We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook published this weekend.

Real Estate Daily Recap

Mall: Tanger Outlets (SKT) finished lower by 1% today despite reporting solid first-quarter results - highlighted by positive leasing spreads - and lifting its full-year guidance. Notably, Tanger recorded a 1.3% increase in blended rental rate on renewed leases, snapping a twelve-quarter streak of negative rent spreads dating back to Q1 of 2019. Tanger also boosted its full-year FFO growth outlook by 290 basis points to -0.6%, but this would still be 24% below its full-year 2019 FFO. We'll hear results next week from Simon (SPG) and Macerich (MAC).

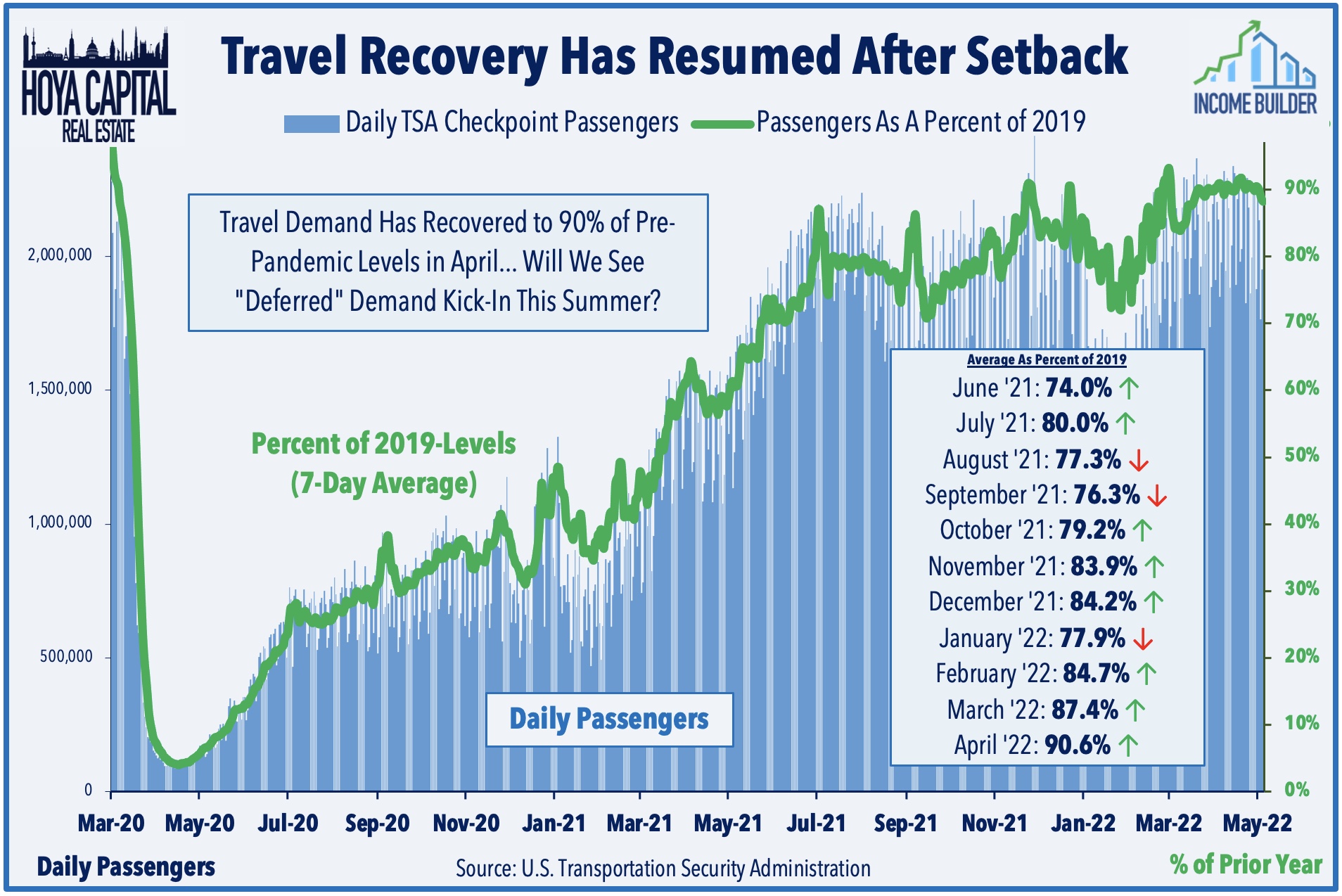

Hotel: DiamondRock (DRH) rallied 2% today after reporting a continued recovery in its hotel portfolio with RevPAR levels that were just 3.5% below 2019-levels in Q1 and noted that it expects 2022 hotel revenues to meet or exceed 2019-levels. DRH also announced that it expects its common stock dividend to resume in Q3 of 2022. Apple Hospitality (APLE) - which we hold in the REIT Dividend Growth Portfolio - also reported strong results, highlighted by preliminary data showing RevPAR for the month of April 2022 exceeded April 2019. APLE was the first hotel REIT to meaningfully restore its dividend when it resumed its monthly payouts earlier this year. Recent TSA Checkpoint data has shown that domestic travel recovered to 90% of pre-pandemic levels in April, but has trended sideways throughout the month.

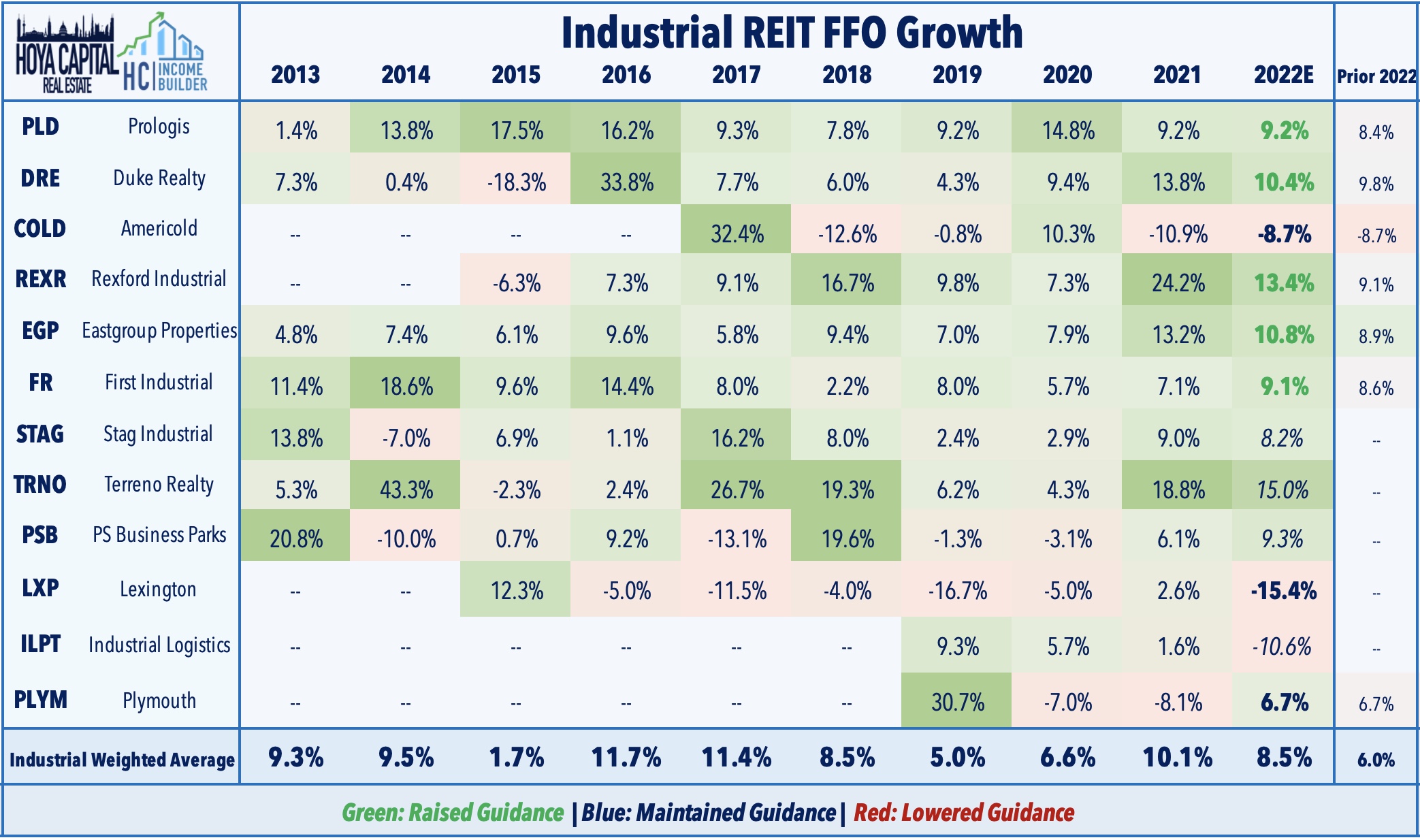

Industrial: Cold storage operator Americold (COLD) - which has been among the worst-performing industrial REITs amid operational challenges in its services-heavy business model - was among the better performers today after reporting in-line results and reiterating its full-year earnings outlook which calls for an 8.7% decline in FFO per share. COLD noted that while cold storage demand remains strong, "supply chain and labor disruptions continue to impact the global food supply chain... the labor market remains very challenged and continues to strain our customers' ability to produce at pre-COVID levels." COLD did slightly increase its same-store NOI growth outlook to 2.0% - up 200 basis points from its prior outlook.

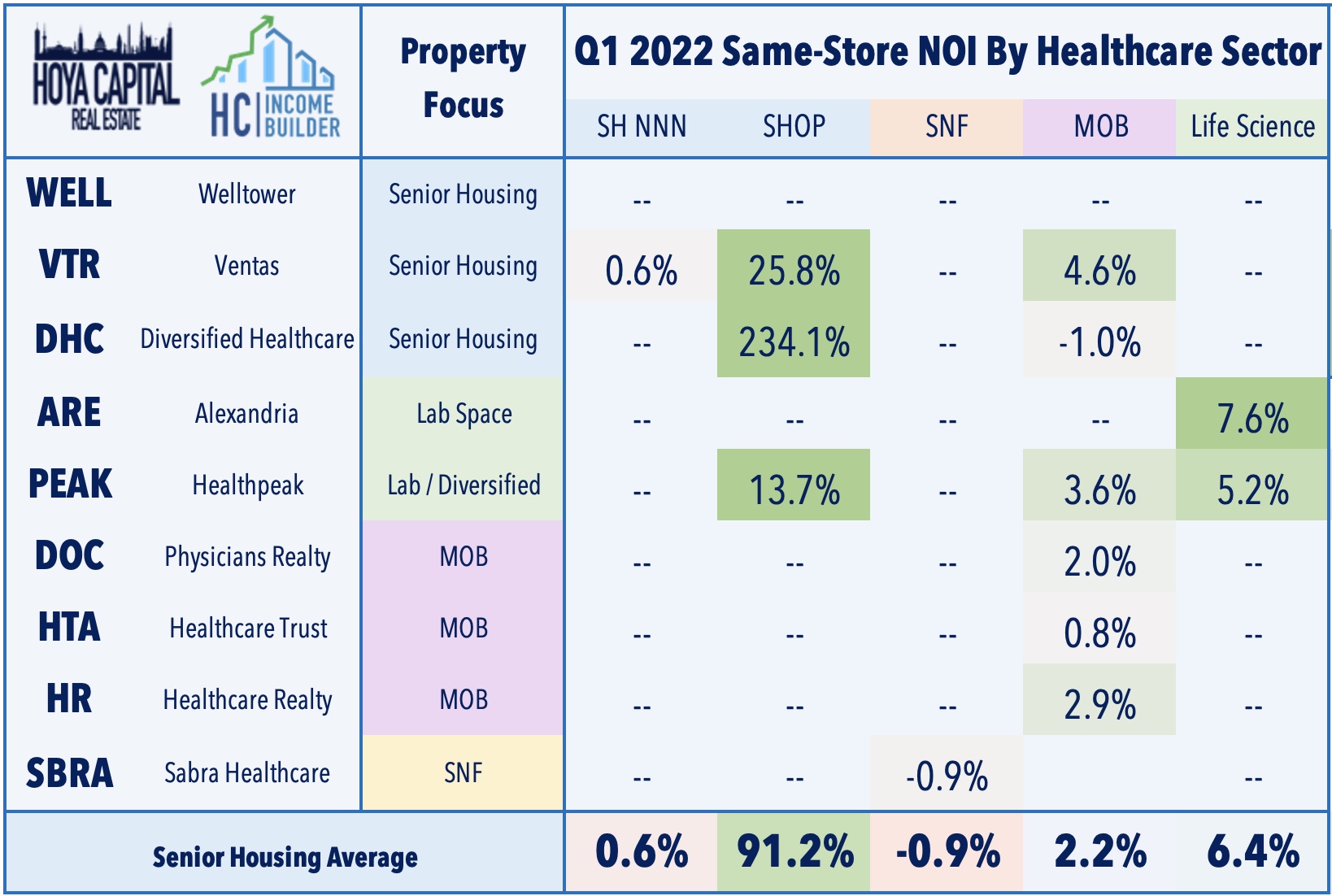

Healthcare: Ventas (VTR) was also among the outperformers today after reporting better-than-expected results driven by "continued robust demand, increased occupancy and pricing power, which outpaced inflationary expense pressures and the continuing impacts of COVID-19 in the quarter." VTR recorded same-store NOI growth of 25.8% in its Senior Housing Operating segment resulting from a 420 basis point increase in occupancy to 83.0%. CareTrust (CTRE) finished slightly lower today after reporting in-line results and noted that it collected 95% of rents in Q1 "as most of our operators are making the necessary moves to manage through the current headwinds.” We'll hear earnings results from Welltower (WELL) next Tuesday.

Mortgage REIT Daily Recap

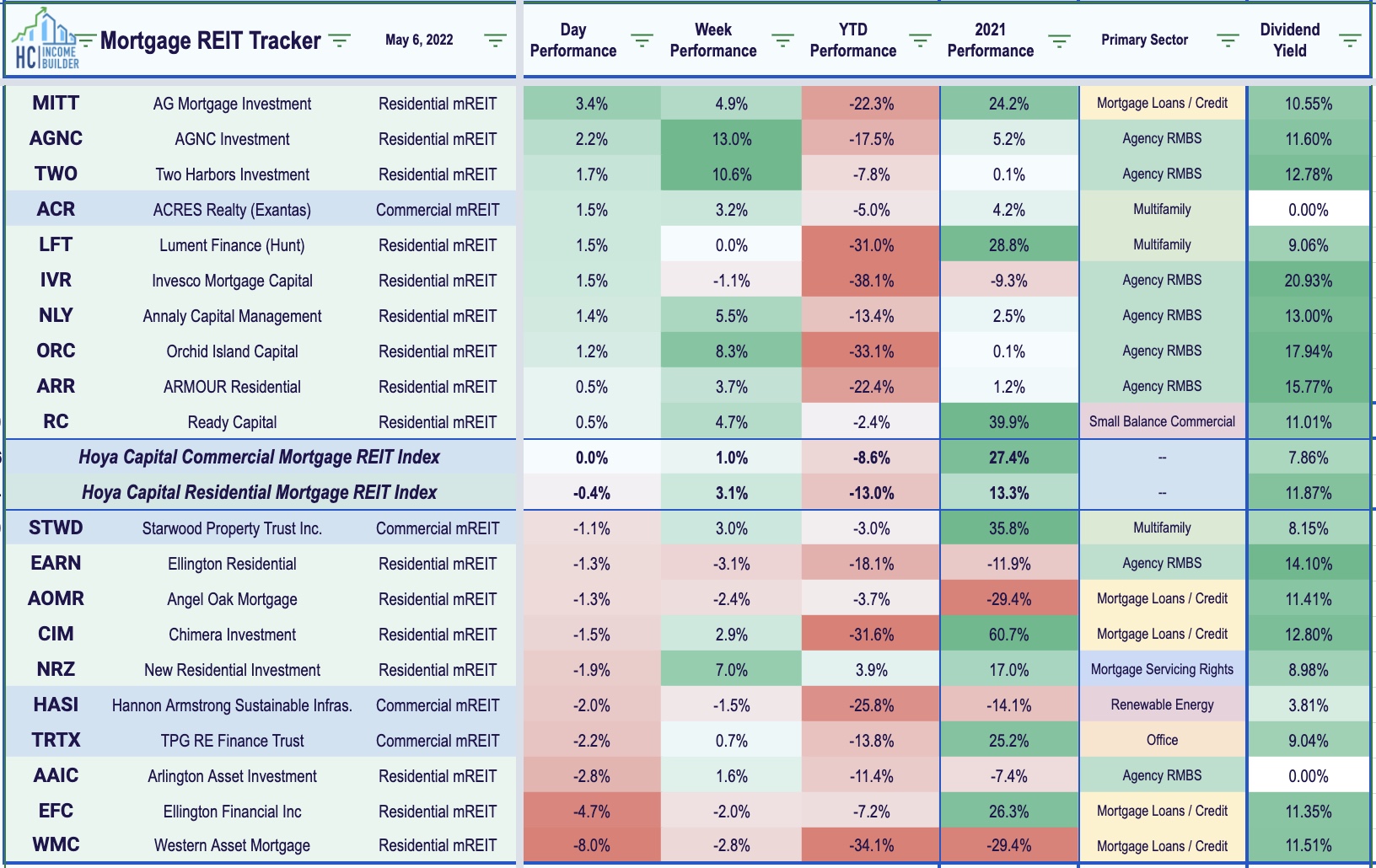

Per the REIT Rankings Tracker available to Income Builder subscribers, mREITs remain among the best-performing sectors this week following better-than-expected earnings results. Arbor Realty (ABR) gained 0.5% after reporting better-than-expected results and raising its dividend for the second time this year, which also marked the eighth consecutive quarterly increase for the residential lender. ACRES Commercial (ACR) advanced 1.7% after reporting that its BVPS increased 1% to $24.10 while noting that it plans to continue its share buyback program in lieu of a dividend. Elsewhere, Ready Capital (RC) reported that its BVPS was roughly flat in Q1 at $15.22. PennyMac (PMT) reported that its BVPS declined 3.5% to $17.74 in Q1. On the downside, Ellington Financial (EFC) slipped 5% after reporting that its BVPS declined 6.1% to $17.87 in Q1. Western Asset (WMC) slid 8% after reporting that its BVPS dipped 14.6% to $2.73 in Q1 - the sixth steepest decline among the 41 mREITs in our coverage.

Economic Data This Week

We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook published this weekend.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.