Double-Digit PPI • Yields Dip • REIT Dividend Hike

- U.S. equity markets continued their skid Thursday in another turbulent session following another hotter-than-expected inflation report, but concerns over global economic growth dragged down longer-term interest rates.

- Flirting with "bear-market" territory before paring its declines late in the session, the S&P 500 declined another 0.2% today while the Dow declined for a sixth-straight session.

- Real estate equities were relative outperformers for a second-straight session amid the pull-back in yields as the Equity REIT Index advanced by 0.8% today with 14-of-19 property sectors in positive.

- The Bureau of Labor Statistics reported this morning that Producer Prices soared at an 11.0% annual rate in April - above consensus estimates of 10.7% - and marked the second-highest annual inflation rate on record behind the 11.5% rate in March.

- Shopping center REIT Kite Realty (KRG) - which we hold in the REIT Dividend Growth Portfolio - advanced nearly 3% after it hiked its dividend for the third time this year.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets continued their skid Thursday in another turbulent session following another hotter-than-expected inflation report, but concerns over global economic growth dragged down longer-term interest rates. Flirting with "bear-market" territory before paring its declines late in the session, the S&P 500 declined another 0.2% today while the Dow declined for a sixth-straight session, but the Small-Cap 600 advanced 1.2% and the Mid-Cap 400 advanced 0.9%. Real estate equities were relative outperformers for a second-straight session amid the pull-back in yields as the Equity REIT Index advanced by 0.8% today with 14-of-19 property sectors in positive territory while Mortgage REITs slipped 1.1%.

Markets continue to reflect expectations of U.S. economic outperformance with the U.S. Dollar strengthening to fresh-two-decade highs. Despite the hotter-than-expected PPI report, long-term interest rates were pulled lower for a second-straight session as the 10-Year Treasury Yield dipped 10 basis points to 2.82% after climbing above 3.20% on Monday. Supported by the moderation in interest rates, homebuilders and the broader Hoya Capital Housing Index were among the leaders today. Elsewhere, energy prices rebounded with Crude Oil prices pushing back above $106/barrel while domestic gasoline prices hit a fresh-record high at $4.41/gallon. Bitcoin continued to deflate - dipping below $30,000 - consistent with the broader exodus out of speculative asset classes.

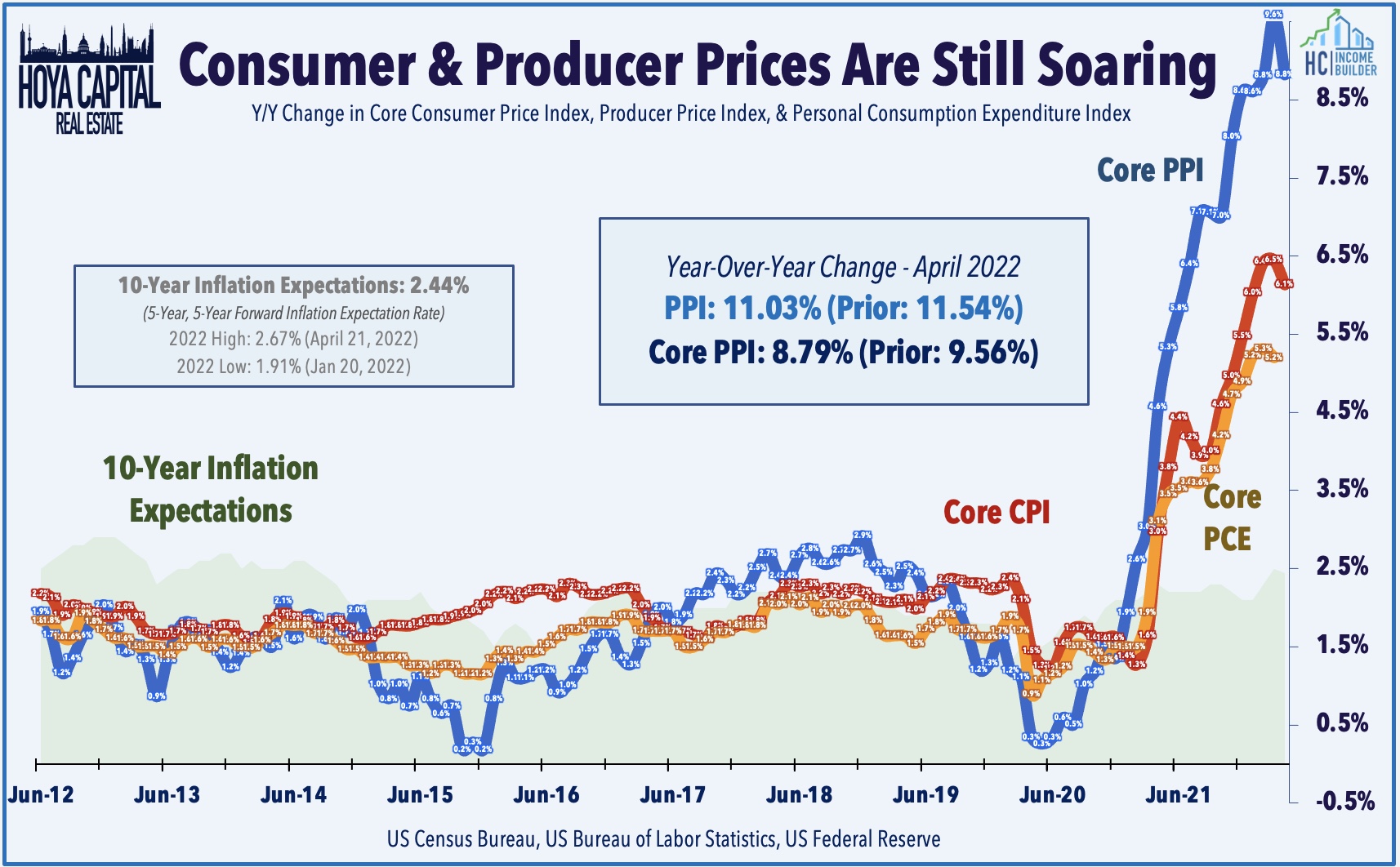

Inflation Stays Red-Hot: The Bureau of Labor Statistics reported this morning that Producer Prices soared at a 11.0% annual rate in April - above consensus estimates of 10.7% - and marked the second-highest annual inflation rate on record behind the 11.5% rate in March. Driving the increases on the goods-side were the prices of motor vehicles, diesel fuel, chicken eggs, jet fuel, and electric power. On the services side, prices for truck transportation drove the producer price increases. Yesterday, the BLS reported that consumer prices also rose at a hotter-than-expected pace in April but did ease slightly from the four-decade-high rate set last month as cost increases for food, airline fares, and vehicles kept persistent upward pressure on prices. The headline Consumer Price Index (CPI-U) increased 0.3% in April to bring its year-over-year increase to 8.3% - higher than consensus estimates of 8.1%.

Real Estate Daily Recap

Data Center: Yesterday, we published Data Center REITs: Value In Hotbed Of M&A on the Income Builder Marketplace. Unable to avoid the broader 'Tech Wreck', Data Center REITs are among the worst-performing real estate sectors this year with declines of nearly 30% - their steepest drawdown on record. Cloud computing demand remains insatiable and has historically been unaffected by uncertain economic conditions, but this "steadiness" has been a burden amid a sharp 'growth-to-value' rotation within the REIT sector. Valuations now appear quite attractive for these perennial performance leaders, however, particularly given the red-hot M&A environment and earnings results showing record levels of leasing demand and renewed pricing power. We discussed how we're investing in the sector - including a compelling high-yield opportunity within the REIT Preferred space.

Earlier this week, we published our REIT Earnings Recap: REITs Are Suddenly Cheap. REIT earnings results were generally better-than-expected with roughly 85% of equity REITs beating consensus FFO estimates while nearly 70% of the REITs that provide forward guidance raised their full-year outlook. Despite the strong slate of earnings reports across most property sectors, however, performance trends continue to be dominated by macroeconomic factors and the broader sell-off across essentially all asset classes. While the pace of dividend increases has slowed a bit over the past month, shopping center REIT Kite Realty (KRG) - which we hold in the REIT Dividend Growth Portfolio - advanced nearly 3% after it hiked its dividend for the third time this year, declaring a $0.21/share quarterly dividend, a 5% increase from its prior dividend of $0.20.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, Orchid Island (ORC) was little-changed today after holding its dividend monthly steady at $0.045/share, representing a forward yield of 18.82%. ORC had previously reduced its dividend from its prior-year rate of $0.065 Rounding out earnings season, we'll hear results this afternoon from Angel Oak (AOMR) and Arlington Asset (AAIC). In our Earnings Recap published yesterday, we noted that Residential mREIT Book Value Per Share ("BVPS") metrics declined by 8.5%, on average, in Q1 with a range of +10% to -28%. Book value changes across the commercial mREIT space were more muted with an average BVPS increase of 0.1% ranging from a high of 3.8% to a low of 1.9%.

Economic Data In The Week Ahead

Inflation data and commentary from Fed members highlight the busy slate of economic data in the week ahead. On Wednesday, the BLS reported the Consumer Price Index and on Thursday we saw the Producer Price Index. On Friday, we'll also get our first look at Michigan Consumer Sentiment for May to see if the unexpected rebound in confidence seen last month can be sustained or if it resumes the downward trend that began last August amid persistent anxiety about inflation.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.