Solid Home Sales • Mortgage REIT Update • Week Ahead

- U.S. equity markets finished mostly lower Monday following strong gains in the prior week as investors looked ahead to a potentially consequential slate of inflation and economic data this week.

- Following gains of nearly 7% last week- just its second positive week in the past twelve- the S&P 500 finished lower by 0.3% but the Mid-Cap Small-Cap Indexes posted gains.

- Real estate equities also posted mixed performance today as gains from residential REITs and homebuilders were offset by declines from industrial and technology REITs.

- Homebuilders were again notable outperformers today following better-than-expected Pending Home Sales data which followed similarly solid Existing and New Home Sales data last week and surprisingly strong results from two of the largest homebuilders.

- Invesco Mortgage (IVR) - one of the more highly-levered REITs which has experienced sharp swings over the past two weeks amid the interest rate volatility - provided a business update after the close today. IVR held its dividend steady while providing an updated BVPS that is above analyst consensus.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets finished mostly lower Monday following robust gains in the prior week as investors looked ahead to a potentially consequential slate of inflation and economic data in the week ahead. Following gains of nearly 7% last week - which was just its second positive week in the past twelve - the S&P 500 finished lower by 0.3% today but the Mid-Cap 400 and Small-Cap 600 each posted modest gains. Real estate equities also posted mixed performance today as gains from residential REITs and homebuilders were offset by declines from industrial and technology REITs. The Equity REIT Index declined by 0.2% today with 10 of the 19 property sectors in positive territory while Mortgage REIT Index finished lower by 0.4%.

As discussed in our Real Estate Weekly Outlook, market sentiment has improved over the past several sessions as interest rates have moderated on signs of softening global growth while resilient housing data has helped to calm market jitters. The benchmark 10-Year Treasury Yield rebounded 7 basis points to close at 3.19% today, still well below its high last week of 3.50% before the FOMC meeting. Among the eleven GICS industry groups, the Energy (XLE) sector led the way as Crude Oil prices gained 2% to roughly $110 per barrel - about 10% below its recent highs in early June, but still higher by about 45% on the year. Homebuilders and the broader Hoya Capital Housing Index were again notable outperformers today following better-than-expected Pending Home Sales data which followed similarly solid Existing and New Home Sales data last week.

We'll see another busy slate of economic data in the week ahead with several key inflation and housing market reports. Following the better-than-expected Pending Home Sales data today, we'll see home price data on Tuesday with reports from Case Shiller and the FHFA but due to the nearly two-month lag in these indexes, the effect of the recent cooldown is unlikely to be reflected for several months. The most closely-watched report of the week will be PCE Price Index on Thursday which investors - and the Fed - are hoping will finally show some signs of moderating price pressures. We'll also be watching Construction Spending on Friday and a flurry of Purchasing Managers' Index ("PMI") data and consumer sentiment surveys throughout the week.

Real Estate Daily Recap

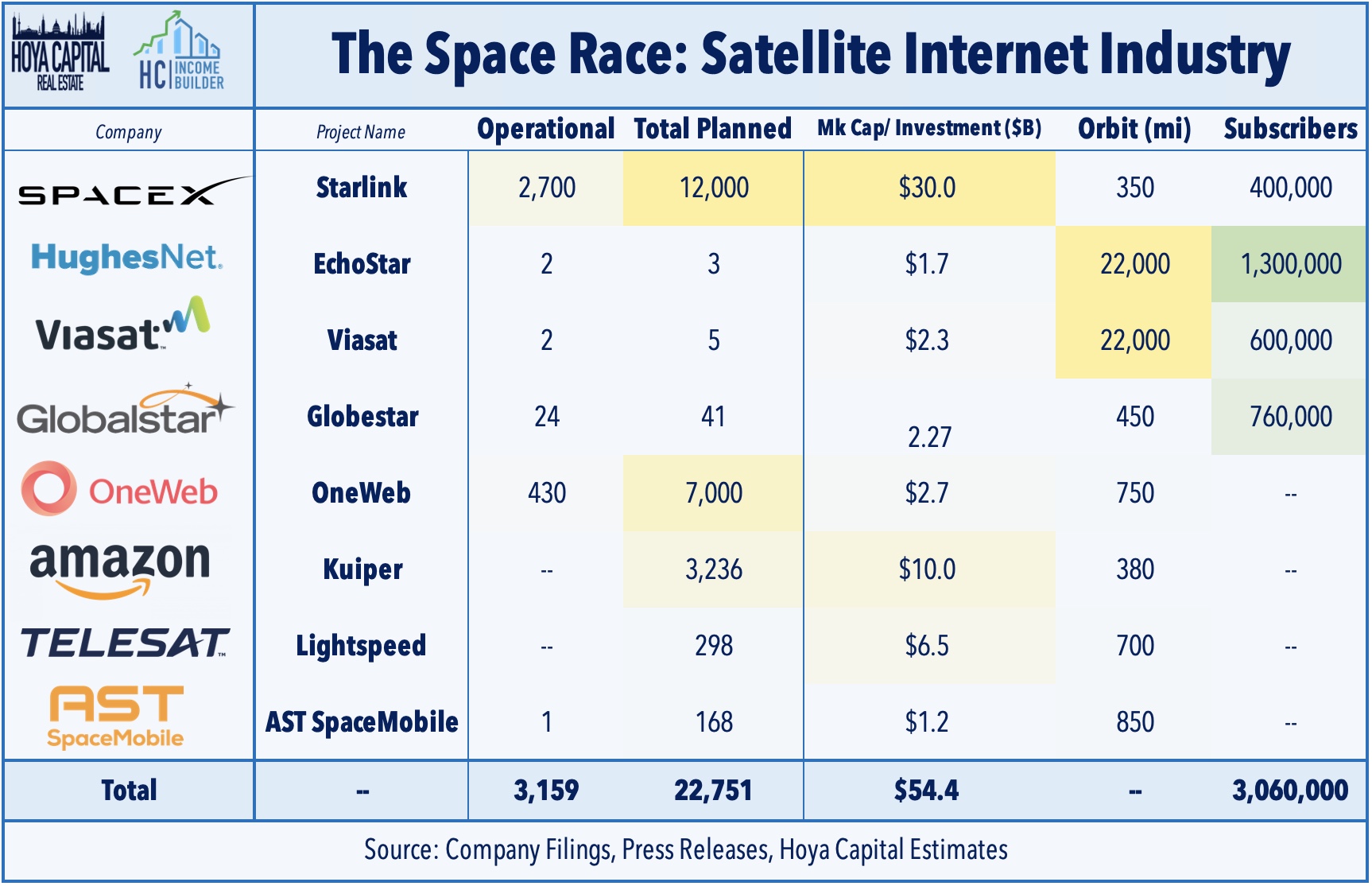

Cell Tower: Last Friday, we published Cell Tower REITs: For 5G, 4 Beats 3. After uncharacteristically lagging for most of the year, Cell Tower REITs have been the best-performing property sector over the past quarter, benefiting from favorable macro shifts and positive industry-specific catalysts. One of the most “recession-resistant” property sectors, strong earnings results highlighted the underappreciated inflation-hedging characteristics of cell tower REITs as international lease escalators are typically linked with local CPI. DISH Network commercially launched its 5G network, becoming the fourth national wireless carrier alongside AT&T, Verizon, and T-Mobile. Given the industry skepticism over DISH’s viability, any level of success is incremental for tower REITs. We continue to monitor - and be impressed by - the pace of Low Earth Orbit satellite service deployment, led by Starlink and OneWeb. While there is some risk of disintermediation to towers if the mobility of satellite connections improves, we see a higher likelihood that LEO networks will be “customers” rather than “competitors” to tower REITs.

Manufactured Housing: This evening, we'll publish an updated report on the MH REIT sector to the Income Builder marketplace. Like their cell tower REIT peers, a rotation back into "essential" property sectors has benefited manufactured housing REITs, which have been among the best-performing REIT sectors over the past month after lagging in early 2022. MH REITs are among the most interest-rate-sensitive property sectors, resulting primarily from the remarkable consistency in delivering mid-single-digit rent growth regardless of the macroeconomic environment. We continue to expect rent growth to significantly exceed analyst forecasts. As the most affordable housing option, rent growth tends to track broader inflation rates (Cost-of-Living Adjustments), which have been substantial. The secular tailwinds resulting from the intensifying affordable housing shortage should persist into the back half of the 2020s, if not longer.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were mixed today following gains of more than 10% last week. After the close today, Invesco Mortgage (IVR) - one of the more highly-levered REITs which has experienced sharp swings over the past two weeks amid the interest rate volatility - provided a business update after the close today. Encouragingly, IVR held its quarterly dividend steady at $0.90 per share while providing an updated Book Value Per Share ("BVPS") that is above the current anlayst consensus. IVR estimated that its BVPS was in a range of $15.94 to $16.60 - down roughly 22% at the midpoint of its range from the end of Q1. IVR's share price during this period is lower by more than 41%.

REIT Preferreds & Capital Raising

Per the Income Builder Preferred Tracker available to Income Builder subscribers, REIT Preferred stocks finished higher by 0.45% today, on average. REIT Preferreds are lower by roughly 13% on a total return basis this year after ending 2021 with price returns of roughly 8.0% and total returns of roughly 14%. There are now roughly 180 REIT-issued exchange-listed preferred and debt securities with an average current yield of 7.06%.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing asset classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.