Mall REIT Dissolves • Solid Jobs Data • Risk-On Rotation

- U.S. equity markets inched lower Friday- but held onto weekly gains- as solid employment data eased recession concerns, sparking a bid for risk assets while sending benchmark yields higher.

- Holding onto weekly gains of nearly 2%, the S&P 500 finished lower by 0.1% today while the tech-heavy Nasdaq 100 advanced 0.1% to push its weekly gains to nearly 5%.

- The "risk-on" pattern was evident across real estate equities as economically-sensitive sectors rebounded this week while defensive sectors lagged.

- Troubled mall owner Seritage Growth Properties (SRG) surged 80% today after the company's board approved a plan to sell all of the company's assets and then dissolve.

- Job growth impressed to the upside in June according to the latest nonfarm payrolls report released this morning as the U.S. economy added 372k jobs last month - higher than the 270k expected - a contrast to the recent weakness seen across most other economic datasets.

Income Builder Daily Recap

U.S. equity markets inched lower Friday - but held onto gains for the week - as solid employment data eased recession concerns, sparking a bid for risk assets while sending benchmark interest rates higher. Holding onto weekly gains of nearly 2%, the S&P 500 finished lower by 0.1% today while the tech-heavy Nasdaq 100 advanced 0.1% to push its weekly gains to nearly 5%. The "risk-on" pattern was evident across real estate equities as economically-sensitive sectors rebounded this week while defensive sectors lagged. The Equity REIT Index finished lower by 0.5% today - and 0.7% for the week - while the Mortgage REIT Index gained 0.1% to push its weekly gains to nearly 1%.

Job growth impressed to the upside in June according to the latest nonfarm payrolls report released this morning as the U.S. economy added 372k jobs last month - higher than the 270k expected - a contrast to the recent weakness seen across most other economic datasets. The benchmark 10-Year Treasury Yield climbed another 9 basis points today to 3.10% - above its July low of 2.78% but still well below its June high of 3.50%. Eight of the eleven GICS equity sectors finished lower today with Materials (XLB) stocks lagging on the downside, but homebuilders continued their recent outperformance as solid jobs data eased some concerns over the possibility of a "hard landing" in employment and housing markets.

We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook published this weekend.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Mall: Troubled mall owner Seritage Growth Properties (SRG) surged 80% today after the company's board approved a plan to sell all of the company's assets and then dissolve. The plan, if approved by shareholders, would distribute the net proceeds of the sale of 161 properties totaling about 19M SF to shareholders. SRG - which was formed in the mid-2010s to own former Sears and Kmart sites - has posted dismal returns since its public listing in 2015, encumbered by the strong headwinds faced by lower-tier malls. SRG technically revoked its REIT status last year as it began a strategic review. Mall transitions are few and far between in the U.S. and there have been few active buyers in recent years, but several potential bidders on SRG's properties include Simon Property (SPG), Brookfield (BAM), and Macerich (MAC).

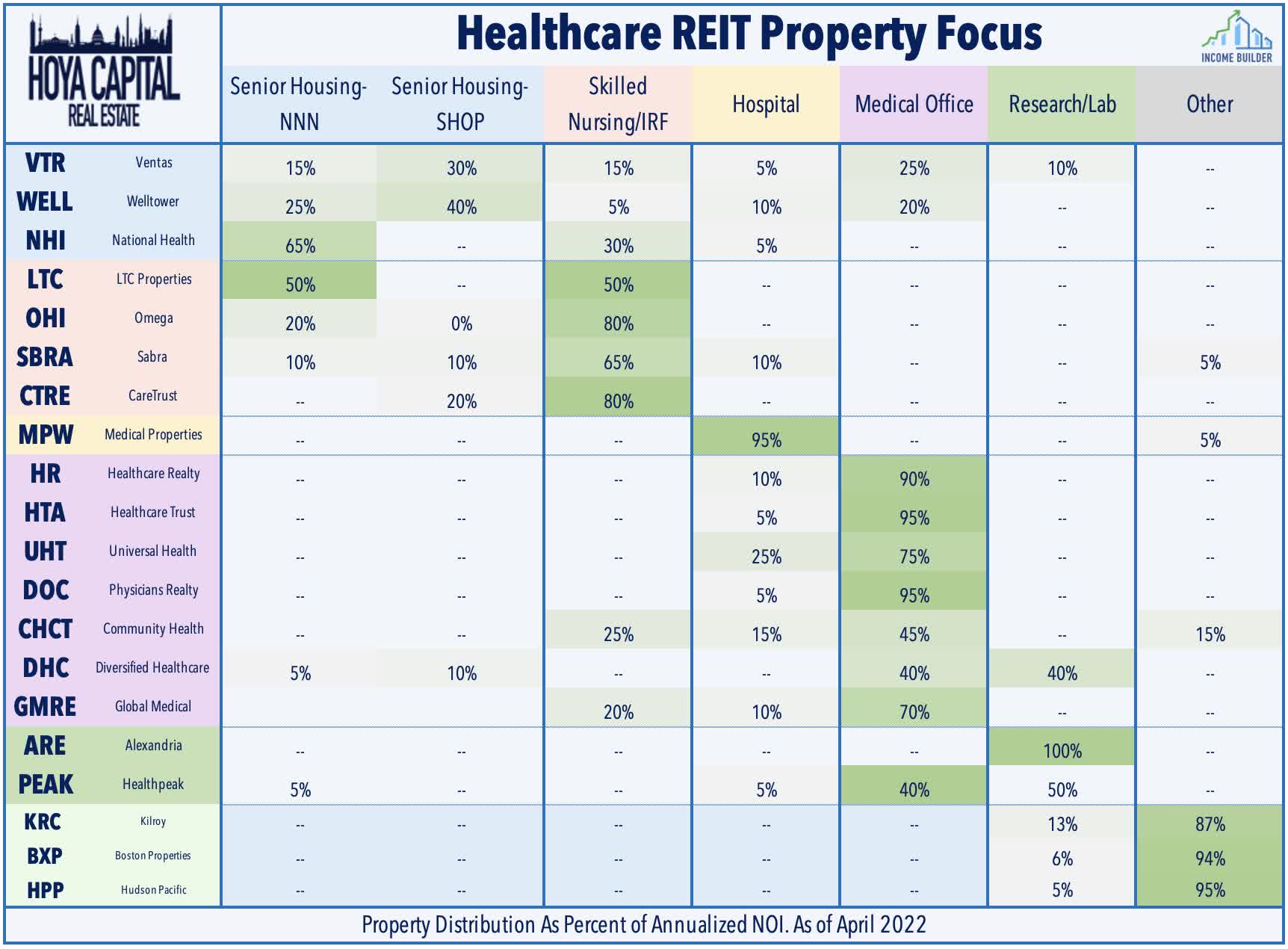

Healthcare: Healthcare Realty (HR) and Healthcare Trust of America (HTA) provided details on financing plans for their upcoming merger. HR expects to fund the $1.1 billion special cash dividend - $4.82 per share - to HTA shareholders through a combination of asset sales and joint venture transactions at a blended cap rate of 4.8%. Proceeds are expected to be derived from properties under contract for $807 million and properties under letter-of-intent for $295 million. HR is also in active discussions with multiple counterparties regarding the sale of additional properties valued at more than $600 million at similar cap rates. HR also expects to form a new joint venture with CBRE Investment Management (“CBRE IM”), contributing four HTA properties while retaining a 20% interest in the joint venture.

Hotels: Today we published Hotel REITs: Summer of Revenge Travel. Despite recession-like levels of consumer confidence and surging transportation costs, U.S. consumers have continued to travel this summer at rates approaching pre-pandemic levels, powering Hotel RevPAR to fresh record highs. Skepticism over the sustainability of this momentum, however, has dragged hotel REITs lower by nearly 25% over the past month after being the top-performing property sector for much of 2022. Ashford (AHT) jumped 6% today after announcing yesterday afternoon that it expects its Q2 RevPAR to be 6% below that of the comparable pre-pandemic quarter in 2019. Braemar (BHR) advanced 3% after announcing that it expects its RevPAR to be 28% above its comparable 2019 level as surging nightly room rates on luxury hotels have offset lagging occupancy rates.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were little-changed today with residential mREITs finishing lower by 0.1% while commercial mREITs gained 0.3%. Ellington Financial (EFC) and Ellington Residential (EARN) were among the leaders today after holding their monthly dividends steady with dividend yields of 11.8% and 12.4%, respectively. On another quiet day of newsflow, upside standouts included Angel Oak (AOMR) and AG Mortgage (MITT) while Invesco Mortgage (IVR) lagged after posting 20% gains in each of the past two weeks. The average residential mREIT now pays a dividend yield of roughly 13.3% while the average commercial mREIT pays a dividend yield of 9.2%.

REIT Preferreds & Capital Raising

Per the Income Builder Preferred Tracker available to Income Builder subscribers, REIT Preferred stocks finished higher by 1.11% today, on average. REIT Preferreds are lower by roughly 13% on a total return basis this year after ending 2021 with price returns of roughly 8.0% and total returns of roughly 14%. There are now roughly 180 REIT-issued exchange-listed preferred and debt securities with an average current yield of 6.97%.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.