Walmart Woes • Fed Ahead • REIT Earnings

- U.S. equity markets declined Tuesday after downbeat economic data and weak results from Walmart raised questions about the health of the U.S. consumer ahead of the Fed rate hike decision.

- Following fractional gains on Monday, the S&P 500 declined by 1.2% today while the tech-heavy Nasdaq 100 dipped 2%, but declines were more muted among small and mid-cap equities.

- Real estate equities were among the outperformers today following a relatively solid slate of earnings reports from residential and healthcare REITs and moderation in long-term interest rates.

- Lab space-focused Alexandria Real Estate (ARE) rallied more than 4% after reporting better-than-expected results and raising its full-year outlook as red-hot lab space demand showed few signs of cooling.

- Manufactured housing REIT Sun Communities (SUI) was also among the better performers today after reporting solid results and raising its full-year Core FFO growth outlook despite the anticipated slowdown in transient RV demand.

Real Estate Daily Recap

U.S. equity markets declined Tuesday after downbeat economic data and weak results from Walmart raised questions about the health of the U.S. consumer ahead of the Fed rate hike decision on Wednesday afternoon. Following fractional gains on Monday, the S&P 500 declined by 1.2% today while the tech-heavy Nasdaq 100 dipped 2%, but declines were more muted among small and mid-cap equities. Real estate equities were among the outperformers today following a relatively solid slate of earnings reports from residential and healthcare REITs and moderation in long-term interest rates. The Equity REIT Index gained 0.1% today with 8-of-18 property sectors in positive territory while the Mortgage REIT Index finished lower by 0.1%.

Ahead of the FOMC rate decision tomorrow afternoon, the potential inflation-dampening effects of slowing consumer demand were a focus today after Walmart (WMT) - the nation's largest retailer - warned of weakening spending and noted that it has been aggressively slashing prices across several categories to reduce elevated inventory levels. Disappointing consumer confidence data and home sales data further contributed to the "risk-off" trade as the 10-Year Treasury Yield declined 3 basis points to 2.79% today - trading back near the lowest level since May. Crude Oil prices declined 1.4% on the day while the U.S. Dollar strengthened back to within 1% of 20-year highs. The defensive-focused Utilities (XLU), Healthcare (XLV), and Real Estate (XLRE) sectors were the lone GICS sector in positive territory today.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Healthcare: Lab space-focused Alexandria Real Estate (ARE) rallied more than 4% after reporting better-than-expected results and raising its full-year outlook. Lab space demand showed few signs of cooling as ARE's beat was driven by a record rental rate increase - 45.4% GAAP and 33.9% cash - and a historically high leasing volume of 2.3M square feet, the third-highest quarter of leasing volume in the company's history. ARE now sees FFO growth of 8.4% this year - up 40 basis points from its prior outlook - and raised its same-store NOI growth outlook by 30 basis points to 7.8% at the midpoint.

Manufactured Housing: Sun Communities (SUI) was among the better performers today after reporting solid results and raising its full-year outlook despite the anticipated slowdown in transient RV demand. Following a rare "miss" from Equity Lifestyle (ELS) last week, SUI slightly raised the midpoint of its Core FFO outlook based on its newly-reported constant-currency convention - which it began reporting following the acquisition of Park Holidays in the UK - but slightly lowered the midpoint of its same-store NOI growth outlook due to the drag from transient RV demand moderation. SUI expects FFO growth of 11.7% this year following growth of nearly 30% in 2021, but manufactured housing REITs will need a strong back-half of the year to deliver a remarkable tenth consecutive year of outperformance over the REIT Index.

Apartment: Sunbelt-focused NexPoint Residential (NXRT) finished modestly lower today despite reporting solid earnings results and commenting that it hasn't yet seen any leading demand slowdown in its portfolio. NXRT raised the midpoint of its same-store NOI guidance by 150 basis points to 15.8% as rental rate increases on renewals continue to average more than 20%. NXRT commented that it is "expecting to see further strength in fundamentals for middle-market rental housing, particularly in our Sunbelt markets, and we maintain optimism that 2022 will be one of our best internal growth years ever. Student housing REIT American Campus (ACC) also reported its final earnings results before its pending acquisition by Blackstone (BX). This afternoon, we'll see results from Equity Residential (EQR), Essex Properties (ESS), and UDR Properties (UDR).

Office: Brandywine Realty (BDN) dipped more than 3% after reporting mixed results and lowering its full-year FFO outlook. Citing the impact from rising interest rates, BDN lowered its FFO growth target to 0.7% this year, down from 2.9% growth in its prior outlook. BDN maintained its full-year same-store NOI and occupancy targets, however. Yesterday we published Office REITs: Workers Hate The Commute, Not The Office which discussed our updated outlook and recent allocations in the office REIT sector. The 'Return to the Office' is here - but it's underwhelming. Despite 80% of employees currently in post-pandemic work arrangements, office utilization rates have remained 40-60% below pre-pandemic levels. As projected, commute times have been the key variable explaining significant differences in WFH adoption across regions. Workers don't necessarily dislike the office, but long commutes more than offset any productivity gains. This afternoon, we'll hear results from Boston Properties (BXP), Paramount Group (PGRE), and American Assets (AAT).

Last week, we published our REIT Earnings Preview which discusses the major themes and metrics we'll be watching across each of the major property sectors this earnings season. In addition to the aforementioned REITs, we'll also hear results this afternoon from data center REIT Equinix (EQIX), net lease REIT Four Corners (FCPT), industrial REITs Eastgroup (EGP) and Industrial Logistics (ILPT), shopping center REIT Retail Opportunities (ROIC), and hotel REIT Pebblebrook (PEB).

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker, mortgage REITs finished modestly higher today with residential mREITs advancing 0.1% while commercial mREITs gained 0.9%. AGNC Investment (AGNC) finished modestly lower after reporting that its Book Value Per Share ("BVPS") declined by 12.9% in the quarter amid the "challenging monetary policy and macro-economic environment" but provided an upbeat outlook for Agency MBS, citing favorable returns associated with wider spreads and an improving technical outlook for MBS supply/demand conditions. KKR Real Estate (KREF) was among the outperformers after reporting that its BVPS was roughly flat during the quarter and noted that with 100% of its activity in Q2 was in multifamily or industrial property types. This afternoon, we'll see results from Apollo Commercial (ARI).

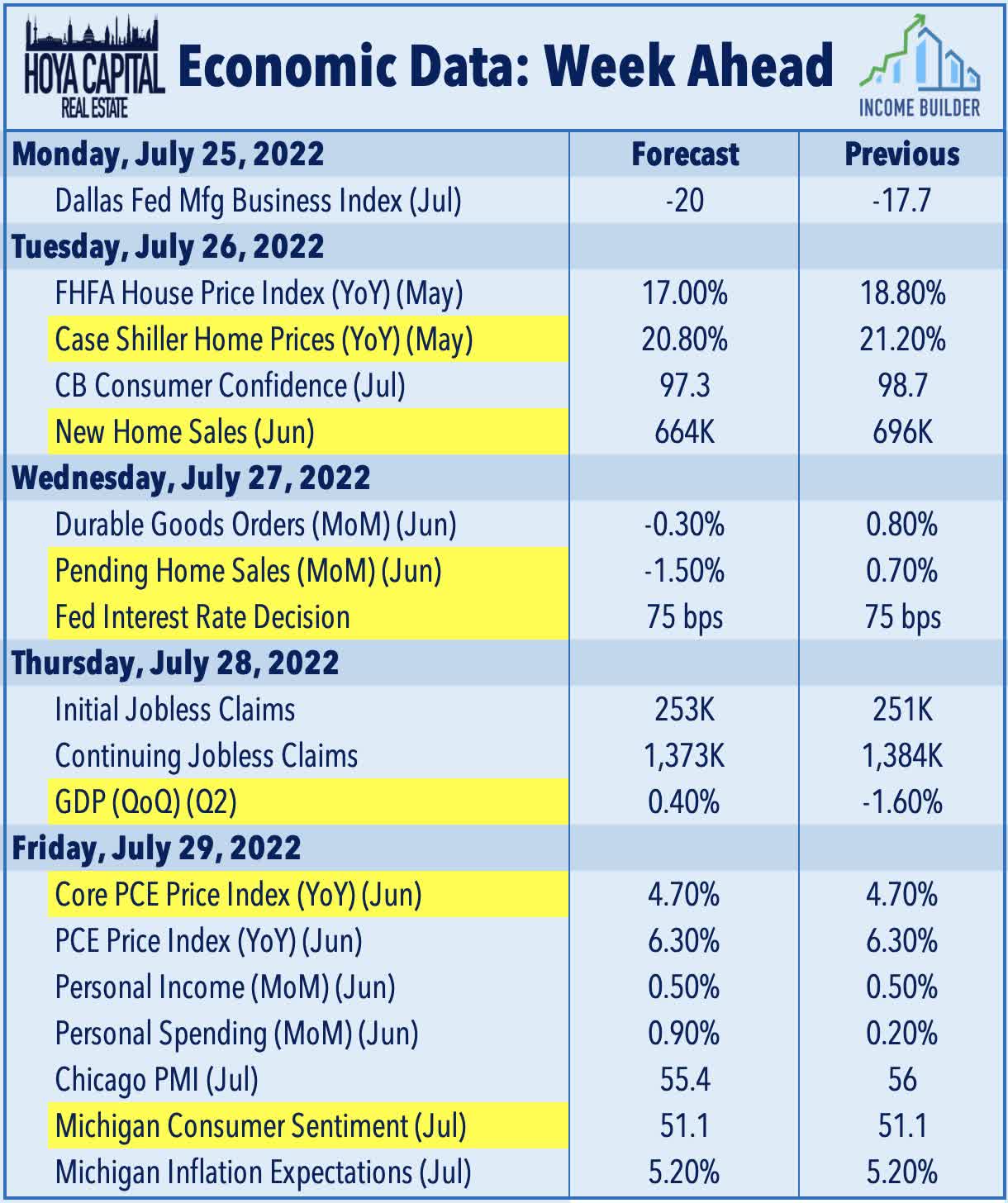

Economic Data This Week

The jam-packed week of economic data continues on Wednesday afternoon when we'll see the FOMC Interest Rate Decision in which the Fed is expected to hike rates by 75 basis points, but could signal a "wait and see" approach to future hikes given the recent deterioration in global economic growth conditions. Whether or not we're truly in a recession will be determined on Thursday with Gross Domestic Product data. While the Atlanta Fed's GDPNow Forecast sees -1.6% growth in Q2, analysts still expect the economy to record a 0.4% increase in growth and narrowly avoid a technical recession. On Friday, we'll see another critical inflation report with the Core PCE Index - the Fed's preferred gauge of inflation - which has been one of the early indicators showing signs of peaking price pressures in recent months.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.