Dovish Hike? • Markets Rally • REIT Earnings

- U.S. equity markets rallied Wednesday after the Fed indicated that the path of future hikes may be less aggressive amid recent signs of slowing economic growth and cooling price pressures.

- Rebounding from yesterday's declines, the S&P 500 advanced 2.6% today while earnings beats from several mega-cap tech firms helped to propel the tech-heavy Nasdaq 100 to gains of more than 4%.

- Real estate equities and other more-defensive market segments were generally laggards today despite a strong slate of REIT earnings results and a continued retreat in long-term interest rates.

- A trio of Coastal apartment REITs reported very strong "beat-and-raise" results yesterday afternoon, each of which reporting rent growth on new leases of around 20% in Q2 as rents have shown few signs of cooling despite the slowdown in the homeownership markets.

- Results from a handful of office REITs were also surprisingly solid with Boston Properties and Paramount each raising their full-year outlook. Shopping center REIT Retail Opportunity also reported very strong results.

Real Estate Daily Recap

U.S. equity markets rallied Wednesday after the Fed indicated that the path of future hikes may be less aggressive than the "unusually large" increases in the past two months amid signs of slowing economic growth and cooling price pressures. Rebounding from yesterday's declines, the S&P 500 advanced 2.6% today while earnings beats from several mega-cap tech firms helped to propel the tech-heavy Nasdaq 100 to gains of more than 4%. Real estate equities and other more-defensive market segments were generally laggards today despite a strong slate of REIT earnings results and a continued retreat in long-term interest rates. The Equity REIT Index advanced 0.6% today with 13-of-18 property sectors in positive territory while the Mortgage REIT Index gained 2.6%.

The post-Fed rally was broad-based with stocks, bonds, and commodities rallying in synchrony, a notable departure from the correlations seen over the past several months. The 10 Year Treasury Yield dipped to the lowest level since May, retreating by 5 basis points to close at 2.73%. All eleven GICS equity sectors were higher today led on the upside by Technology (XLK) stocks following better-than-expected results from Microsoft (MSFT) and Alphabet (GOOG). Crude Oil prices rallied nearly 4% on the day while the U.S. Dollar weakened by 1% after flirting with fresh 20-year highs earlier in the week.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Apartment: A trio of Coastal apartment REITs reported very strong "beat-and-raise" results yesterday afternoon, each of which reporting rent growth on new leases of around 20% in Q2 as rents have shown few signs of cooling despite the slowdown in the homeownership markets. Equity Residential (EQR) rallied 3% today after revising its full-year FFO growth target to 18.1% - up 270 basis points from its prior outlook - citing "favorable supply-and-demand dynamics and a healthy labor market bolstering employment and wages." Essex Properties (ESS) advanced 1.2% after raising its full-year FFO outlook by 400 basis points to 15.7% while UDR Properties (UDR) gained 0.6% after hiking its FFO growth target by 160 basis points to 15.9%. After the close today, we'll hear results from AvalonBay (AVB), Mid-America (MAA), and Independence Realty (IRT).

Office: Boston Properties (BXP) was among the leaders today with 2% gains after reporting better-than-expected results and boosting its full-year outlook, citing resilient demand for high-quality assets amid signs of softening in other segments. Paramount Group (PGRE) also gained after boosting its outlook and reporting similar trends of better-than-expected leasing trends in its core NYC market. West coast-focused Hudson Pacific (HPP) also advanced more than 2% today despite slightly lowered its full-year FFO targets. Earlier this week, we published Office REITs: Workers Hate The Commute, Not The Office which discussed how - despite persistently low utilization rates at offices across most major markets - corporate decision makers have been reluctant to make permanent decisions to reduce square footage. After the close today, we'll hear results from Empire State Realty (ESRT), Kilroy (KRC), and Piedmont (PDM).

Industrial: Eastgroup (EGP) slumped by 1% today despite posting better-than-expected results and significantly raising its full-year FFO and NOI growth outlooks. Citing "buoyant market conditions with strong tenant demand and rising rents," EGP raised it full-year FFO growth outlook by 250 basis points to 13.3% while recording 37.2% rent growth on new and renewed leases. Industrial Logistics (ILPT) - which has been among the worst-performing REITs this year after cutting its dividend - finished roughly flat today after reporting strong property-level metrics but showed little progress at the corporate level in bringing down its extreme debt-load resulting from its ill-timed acquisition of Monmouth. After the close today, we'll hear results from STAG Industrial (STAG).

Shopping Centers: Retail Opportunities (ROIC) was among the leaders today with nearly 3% gains after reporting strong results and raising its full-year NOI and FFO targets. Citing “strong demand for space across our portfolio," ROIC now sees FFO growth of 10.0% this year - up 300 basis points from its prior outlook - which would bring its FFO back even with its pre-pandemic rate in full-year 2019. Shopping center REITs continue to exhibit renewed pricing power as occupancy rates and leasing spreads are at their highest levels since 2017. Consistent with this recent strength, ROIC reported another quarter of double-digit rent growth on same-space new leases and renewals while same-center occupancy rates improved 60 basis points from last year to 97.6%.

Last week, we published our REIT Earnings Preview which discusses the major themes and metrics we'll be watching across each of the major property sectors this earnings season. In addition to the aforementioned REITs, we'll also hear results this afternoon from single-family rental REIT Invitation Homes (INVH), casino REIT VICI Properties (VICI), and data center REIT Equinix (EQIX).

Mortgage REIT Daily Recap

Mortgage REITs were broadly higher today with residential mREITs and commercial mREITs each advancing 2.6%. Blackstone Mortgage (BXMT) rallied nearly 3% today after posting better-than-expected results with Q2 distributable EPS of $0.67, topping the $0.63 consensus and rising from $0.62 in Q1 2022. Citing its "floating-rate portfolio and strong liquidity position," BXMT's book value per share ("BVPS") was essentially unchanged at $27.17 despite the historically brutal quarter for fixed-income securities. Apollo Commercial (ARI) rallied more than 5% today after also topping consensus EPS estimates while recording a modest 1% decline in its BVPS. Tomorrow, we'll hear results from Annaly Capital (NLY), Armour Residential (ARR), and Seven Hills (SEVN).

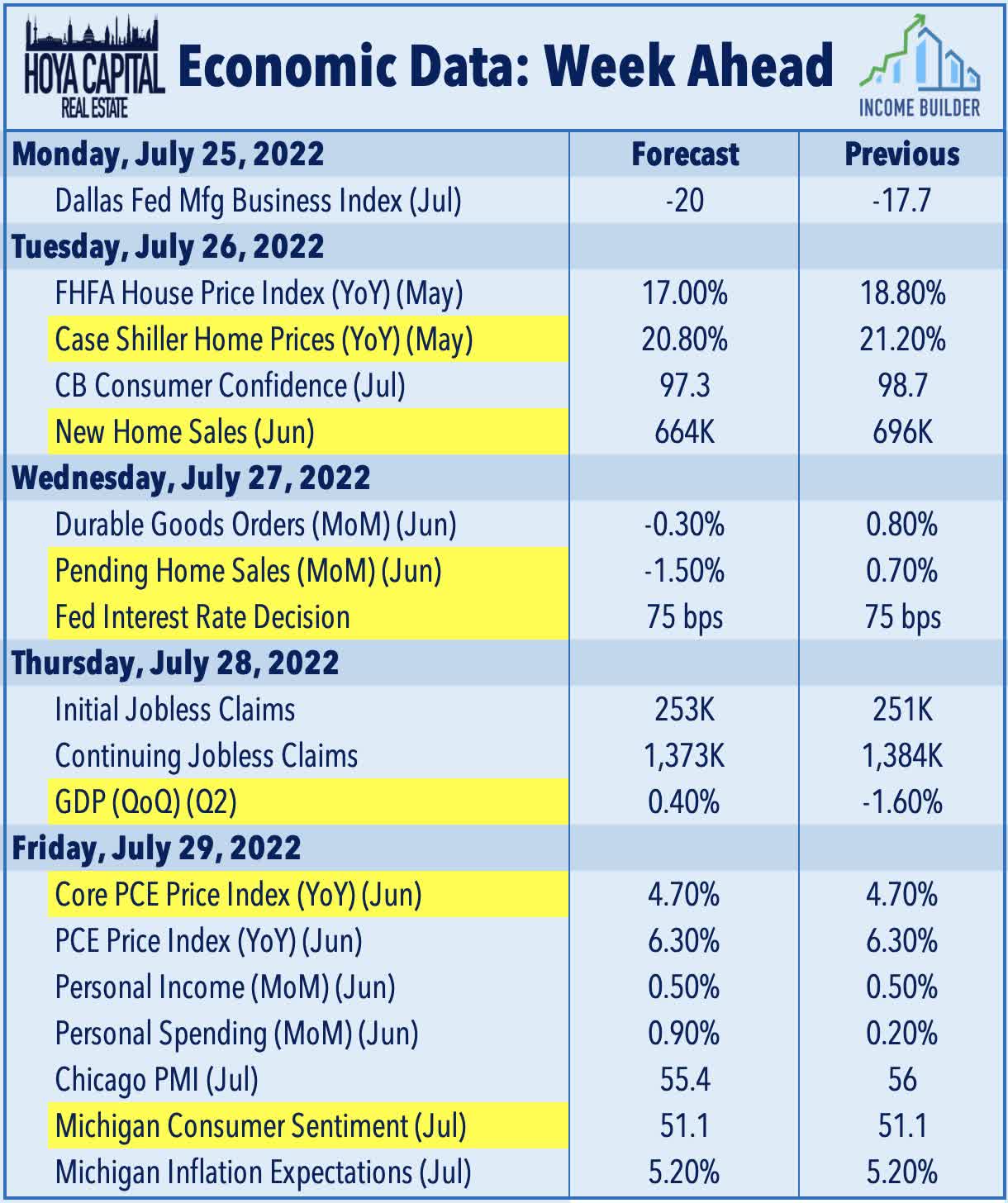

Economic Data This Week

The jam-packed week of economic data continues on Thursday with Gross Domestic Product data. While the Atlanta Fed's GDPNow Forecast sees -1.6% growth in Q2, analysts still expect the economy to record a 0.4% increase in growth and narrowly avoid a technical recession. On Friday, we'll see another critical inflation report with the Core PCE Index - the Fed's preferred gauge of inflation - which has been one of the early indicators showing signs of peaking price pressures in recent months.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.