Recession Watch • REITs Rally • Earnings Beats

- U.S. equity markets continued their post-Fed rally Thursday as data showing that the U.S. entered a technical recession in the first half of 2022 sent long-term benchmark interest rates to four-month-lows.

- Adding to gains of 2.6% yesterday and pushing its week-to-date gains to nearly 3%, the S&P 500 advanced another 1.2% today while the tech-heavy Nasdaq 100 gained 1%.

- Real estate equities led the gains today after a very strong slate of earnings reports from residential and technology REITs- segments that had seen an influx of bears and short-sellers.

- Equinix (EQIX) rallied more than 8% today after reporting better-than-expected results driven by record-high levels of gross bookings in the first-half of the year. EQIX raised its full-year FFO outlook to 9.5% on a constant-currency basis.

- Invitation Homes (INVH) - the nation's largest housing owner - rallied 4.5% today after reporting strong results with an acceleration in rent growth in Q2 to an 11.8% blended rate - its strongest quarter on record while occupancy and turnover trends remain favorable.

Real Estate Daily Recap

U.S. equity markets continued their post-Fed rally Thursday as data showing that the U.S. entered a technical recession in the first-half of 2022 sent long-term benchmark interest rates to their lowest levels since April. Adding to gains of 2.6% yesterday and pushing its week-to-date gains to nearly 3%, the S&P 500 advanced another 1.2% today while the tech-heavy Nasdaq 100 pushed its two-day rally to over 5%. Real estate equities led the gains today after a very strong slate of earnings reports from residential and technology REITs - segments that had seen an influx of bears and short-sellers. The Equity REIT Index rallied 3.3% today with all 18 property sectors in positive territory while the Mortgage REIT Index gained 3.1%.

The "bad news is good news" dynamic has been the theme over the past several days as a stretch of weaker-than-expected employment, housing, and sentiment data climaxed today in a closely-watched GDP report that showed that the U.S. economy shrank at a 0.9% annual rate last quarter, marking a second straight quarterly decline in gross domestic product. The 10 Year Treasury Yield dipped to the lowest level since April, retreating by 5 basis points to close at 2.68%. The weak economic data this week has coincided with a generally stronger-than-expected slate of corporate earnings results following a lukewarm start to earnings season. Ten of the eleven GICS equity sectors were higher on the day led to the upside by the more defensive and yield-senstive segments including Real Estate (XLRE) and Utilities (XLU).

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Data Center: Equinix (EQIX) rallied more than 8% today after reporting better-than-expected results. Driven by record-high levels of gross bookings in the first-half of the year, EQIX raised its full-year FFO outlook to 9.5% on a constant-currency basis, up 220 basis points from its prior outlook. Data center REITs have become "battleground" stocks in recent months after short-selling firm Chanos & Company launched a $200m fund that will bet against US-listed REITs with a particular focus on data centers. In a Financial Times interview, Jim Chanos described the position as the firm's "big short" based on the thesis that "value is accruing to cloud companies, not the bricks and mortar legacy data centers." We see a significant underestimation of the pricing power of the network-dense data centers, in particular, the major focus of EQIX. After the close today, we'll hear results from Digital Realty (DLR).

Single-Family Rental: Invitation Homes (INVH) - the nation's largest housing owner - rallied 4.5% today after reporting strong results and raising its full-year NOI and FFO guidance. Citing "favorable supply and demand fundamentals" in its markets, INVH saw an acceleration in rent growth in Q2 to an 11.8% blended rate - its strongest quarter on record. The SFR REIT now expects FFO growth of 12.5% this year - up 160 bps from its prior outlook - while also raising its NOI growth outlook by 100 basis points to 10.8%.

Apartment: Apartment REIT results continue to be highly impressive as another trio of REITs reported "beat and raise" quarters in the past 24 hours. AvalonBay (AVB) rallied more than 5% after raising its full-year FFO growth target to 19.4% - up 340 basis points from its prior outlook with a similar boost to its same-store NOI. Mid-America (MAA) gained more than 4% after reporting similarly impressive results with an acceleration in rent growth in Q2. Independence Realty (IRT) gained about 4% after raising its full-year FFO growth outlook by 240 basis points to a sector-leading 27%. After the close today, we'll hear results from Camden Property (CPT), Apartment Income (AIRC), and Washington REIT (WRE).

Shopping Centers: A pair of shopping center REITs reported strong "beat and raise" results yesterday afternoon. Kimco (KIM) gained after boosting its full-year FFO growth outlook to 12.3% - up 250 basis points from its prior outlook. Of note, KIM commented that one of the key drivers is their focus on "last mile locations" which are seeing positive traffic patterns at 101.3% relative to the same period last year, consistent with the trends discussed in our recent report Shopping Center REITs: Winning The Last Mile. Site Centers (SITC) gained after boosting its FFO growth outlook by 170 basis points while recording its highest quarterly new leasing volume since early 2017.

Mall: Macerich (MAC) advanced 2.5% after posting in-line earnings results. MAC slightly raised the midpoint of its full-year adjusted FFO outlook, but that level would still be more than 40% below its pre-pandemic 2019 full-year FFO. Occupancy rates in its consolidated centers improved a bit to 90.9% - 230 basis points higher than the prior year - but still well below the 94% occupancy rate in 2018 before the pandemic. Rents remain under pressure, however, as MAC newly-signed leases were more than 6% below its expiring leases with potentially more downside to come as new lease rates are roughly 14% below its overall Average Base Rent rate.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs continued their strong week with residential mREITs and commercial mREITs pushing their weekly gains to nearly 6%. Annaly Capital (NLY) gained nearly 4% after reporting decent results in Q2 with its distributable EPS beating consensus estimates despite a 12.9% decline in its book value per share ("BVPS") driven by "persistent spread widening and rate volatility." Like its peer AGNC earlier in the week, NLY provided an upbeat outlook on recent conditions, noting the "historically attractive new investment returns" on Agency MBS. Armour Residential (ARR) also rallied 6% after reporting similar results of better-than-expected EPS despite a 14.5% decline in its BVPS. On the commercial mREIT side, Seven Hills (SEVN) was roughly flat after reporting that its BVPS rose by 0.3% in Q2 while NexPoint Real Estate (NREF) slid more than 7% after missing EPS expectations. We'll hear from Ladder Capital (LADR), Redwood Trust (RWT), and Ares Commercial (ACRE) over the next 24 hours.

REIT Preferreds & Capital Raising

Per the Income Builder Preferred Tracker available to Income Builder subscribers, REIT Preferred stocks finished higher by 1.47% today, on average. REIT Preferreds are lower by roughly 10% on a total return basis this year after ending 2021 with price returns of roughly 8.0% and total returns of roughly 14%. There are now roughly 180 REIT-issued exchange-listed preferred and debt securities with an average current yield of 6.89%.

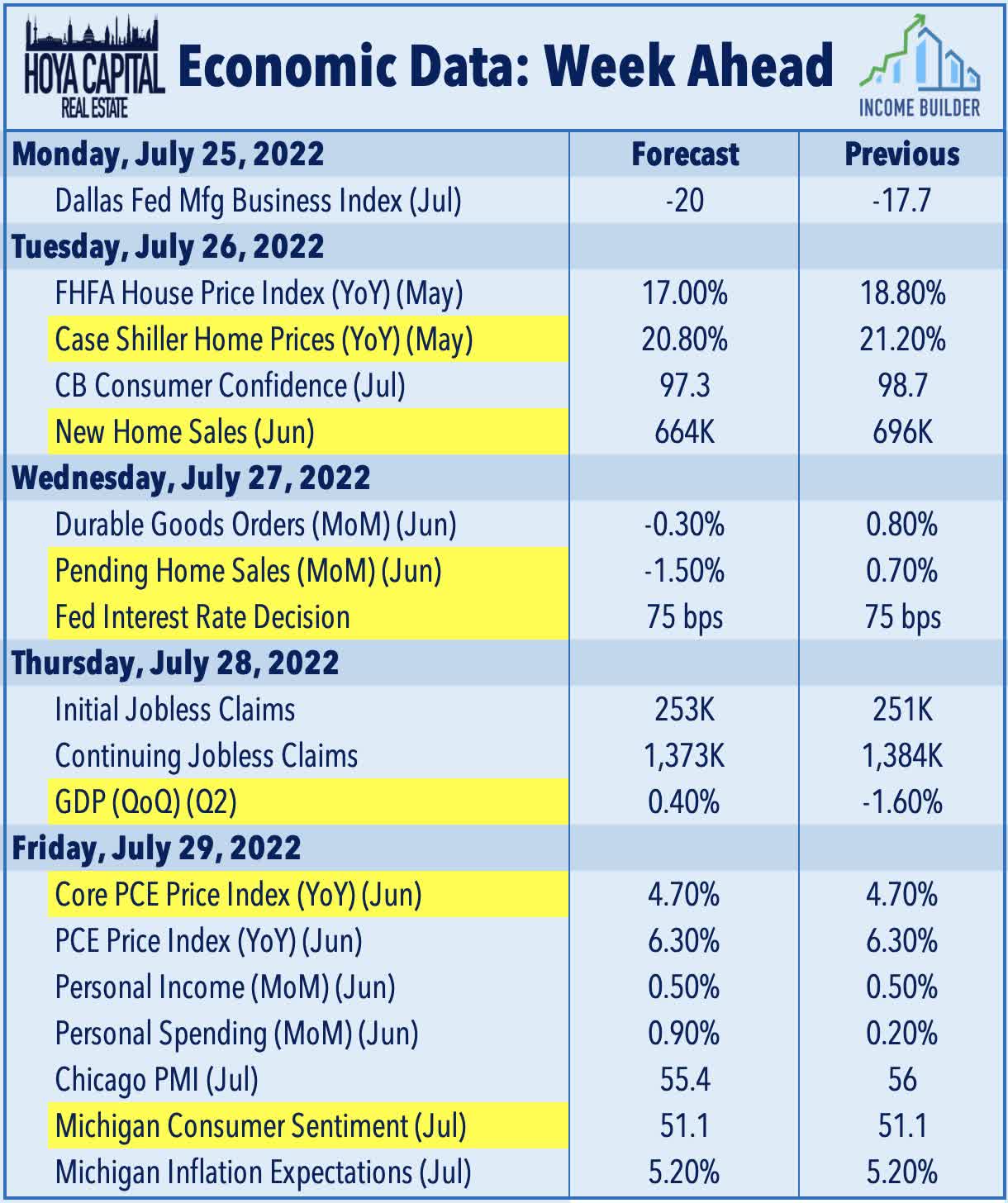

Economic Data This Week

The jam-packed week of economic data concludes on Friday, with the Core PCE Index - the Fed's preferred gauge of inflation - which has been one of the early indicators showing signs of peaking price pressures in recent months. We'll also get a second look at Michigan Consumer Sentiment data which includes the Inflation Expectations survey which is closely watched by the Fed.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.