REIT Dividend Hikes • Jobs Day Ahead • Cannabis Comeback?

- U.S. equity markets were mixed Thursday ahead of the critical nonfarm payrolls report as disappointing jobless claims data and a downbeat BOE economic forecast sent benchmark rates back towards three-month lows.

- Still holding onto week-to-date gains of 0.5%, the S&P 500 retreated 0.1% today while Mid-Caps and Small-Caps posted steeper 1% declines, but the tech-heavy Nasdaq 100 finished higher by 0.3%.

- Real estate equities were among the better-performers today following a strong slate of earnings reports and a trio of dividend hikes. The Equity REIT Index finished lower by 0.1% today.

- A trio of REITs hiked their dividends over the past 24 hours including shopping center REIT Federal Realty (FRT), which raised its quarterly dividend for the 55th consecutive year - the longest record of consecutive annual dividend increases in the REIT sector.

- Innovative Industrial (IIPR) - a perennial outperformer that has been slammed this year on concerns over tenant credit issues - was among the leaders today after reporting solid results and providing updates on several troubled tenant operators.

Real Estate Daily Recap

U.S. equity markets were mixed Thursday ahead of the critical nonfarm payrolls report as disappointing jobless claims data and a downbeat BOE economic forecast sent benchmark rates back towards three-month lows. Still holding onto week-to-date gains of 0.5%, the S&P 500 retreated 0.1% today while Mid-Caps and Small-Caps posted steeper 1% declines, but the tech-heavy Nasdaq 100 finished higher by 0.3%. The 10-Year Treasury Yield dipped seven basis points to 2.68% - its second lowest closing year since early April as Crude Oil prices dipped to the lowest-level since January. Real estate equities were among the better-performers today following a strong slate of earnings reports and a trio of dividend hikes. The Equity REIT Index finished lower by 0.1% today with 9-of-18 property sectors in positive territory while the Mortgage REIT Index slipped 1.1%.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

A trio of REITs hiked their dividends over the past 24 hours. Shopping center REIT Federal Realty (FRT) raised its quarterly dividend by 1% to $1.08 per share, which marked the 55th consecutive year that FRT has raised its dividend - the longest record of consecutive annual dividend increases in the REIT sector. Elsewhere, industrial REIT Terreno Realty (TRNO) raised its quarterly dividend by 18% to $0.40 per share while hotel REIT Host Hotels (HST) doubled its quarterly dividend to $0.12 per share. We've now seen 73 equity REITs raise their dividends this year compared to 2 dividend cuts. On the mortgage REIT side, we've seen 12 dividend increases offset by 4 cuts.

Shopping Center: Federal Realty (FRT) was among the leaders today after reporting very strong results and raising its full-year outlook. Citing "record levels of leasing," FRT now sees FFO growth of 10.9% - up 410 basis points from its prior outlook - which would bring its FFO back in line with its pre-pandemic level in full-year 2019. RPT Realty (RPT) slumped about 2% despite also reporting very strong leasing demand with its highest leasing volume signed in the first six months of a year since 2016 while maintaining its full-year outlook which calls for FFO growth of 8.4%. We'll hear results this afternoon from Regency Centers (REG) and Philips Edison (PECO).

Net Lease: Realty Income (O) was among the upside standouts of a busy 24-hours of net lease REIT reports after reporting better-than-expected results and raising its full-year normalized FFO guidance by 220 basis points and reporting its highest occupancy rate in over 10 years. Store Capital (STOR) finished lower by about 2% despite reporting solid results and raising its full-year FFO growth target to 10.2% - up 220 basis points from last quarter. Spirit Realty (SRC) also declined about 2% after maintaining its full-year outlook which calls for FFO growth of 7.3%. Broadstone (BNL) lagged after narrowing the range on its full-year FFO outlook lower while Postal Realty (PSTL) finished roughly flat after reporting in-line results.

Cannabis: Innovative Industrial (IIPR) - a perennial outperformer that has been slammed this year on concerns over tenant credit issues and coming into the crosshairs of short-sellers - was among the leaders today after reporting solid results with its second-quarter FFO growing more than 30% from last year while noting that it collected 99% of rents through the first six months of 2022, pushing back on concerns over struggling tenants' rent-paying capacity. These concerns peaked in early July when IIPR reported that one of its tenants, Kings Garden, defaulted on its rent and property management fees for July while another tenant, Parallel, is named in a lawsuit. On its earnings call, IIPR noted that it has commenced legal proceedings against Kings Garden - which represented about 8% of its revenues last year - but noted that Parallel has "continued to pay rent in full." The ten largest publicly-traded cannabis REIT tenant operators have plunged between 50% and 80% over the past year, hurt in part by a slowdown in stimulus-fueled sales growth and a far more-difficult capital raising environment.

Storage: Life Storage (LSI) was among the best-performers today after reporting very strong results and raising its full-year outlook, matching results earlier in the week from ExtraSpace (EXR). Citing robust rent growth of 20%, Life Storage raised its full-year NOI outlook by 350 basis points to 17.5% while boosting its FFO growth target by 410 basis points to 24.3%. National Storage (NSA) slumped about 2% after maintaining its full-year outlook while announcing a new share repurchase program. We'll hear results this afternoon from CubeSmart (CUBE) and Public Storage (PSA).

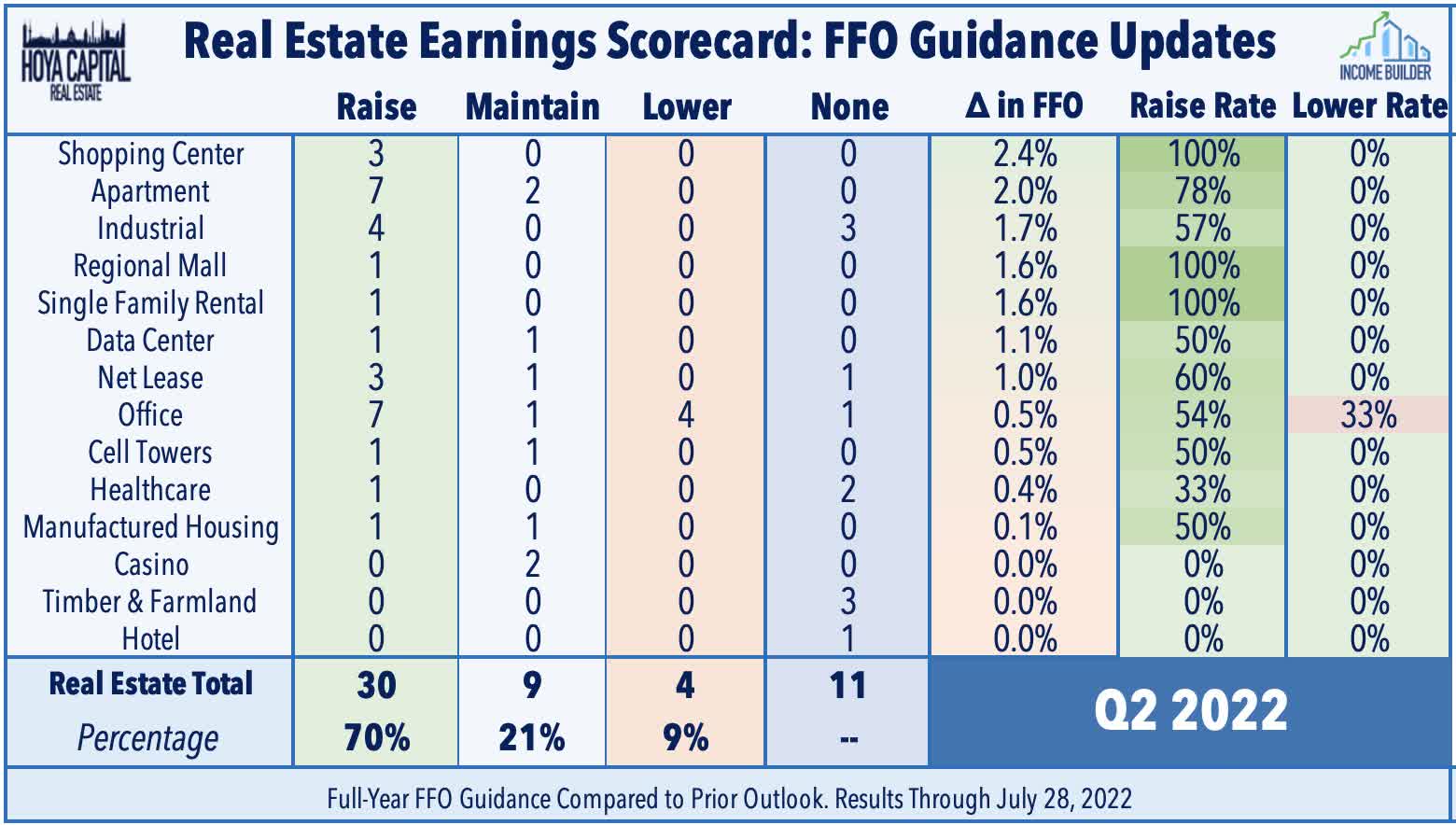

Earlier this week we published our Real Estate Earnings Halftime Report. Equity REIT earnings have been quite impressive thus far with upside standouts being Apartment, Shopping Center, and Industrial REITs. In addition to the aforementioned REITs, we'll also hear earnings reports this afternoon from single-family rental REIT American Homes (AMH), healthcare REIT Ventas (VTR), industrial REIT Americold (COLD), and hotel REITs Apple Hospitality (APLE), RLJ Lodging (RLJ), and Services Property (SVC). We'll continue to provide real-time coverage for Hoya Capital Income Builder members and will publish follow-up articles summarizing our thoughts and analysis throughout earnings season.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were mixed today amid a busy slate of earnings reports as commercial mREITs advanced 0.3% while residential mREITs slipped 2.2%. Starwood Capital (STWD) - which we own in the REIT Focused Income Portfolio - was among the leaders today after reporting solid results with its book value per share ("BVPS") rising 1.2% in the quarter. Laggards included AG Mortgage (MITT), which dipped 9% after reporting that its BVPS declined 16.1% in Q2 - the steepest decline reported thus far in the mREIT sector. With mREIT earnings season now past the half-way mark, residential mREITs have reported an average BVPS decline of 9.9% while commercial mREITs have reported a 1.0% increase in their BVPS.

REIT Preferreds & Capital Raising

Per the Income Builder Preferred Tracker available to Income Builder subscribers, REIT Preferred stocks finished lower by 0.14% today, on average. REIT Preferreds are lower by roughly 5% on a total return basis this year after ending 2021 with price returns of roughly 8.0% and total returns of roughly 14%. There are now roughly 180 REIT-issued exchange-listed preferred and debt securities with an average current yield of 6.89%.

Economic Data This Week

The closely-watched BLS Nonfarm Payrolls report will be released on Friday morning. Economists are looking for job growth of roughly 250k in July which would be the lowest month-over-month increase since the start of the pandemic as the U.S. has now recovered 95% of the 22 million jobs lost from the COVID-related economic shutdowns. The unemployment rate, meanwhile, is expected to stay steady at 3.6%. Purchasing Managers' Index ("PMI") data will continue to be a major market focus - particularly in Europe and Asia - as recent reports have barely managed to hold on to the breakeven 50-level.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.