Yields Jump • Global PMI Contraction • REITs Lead

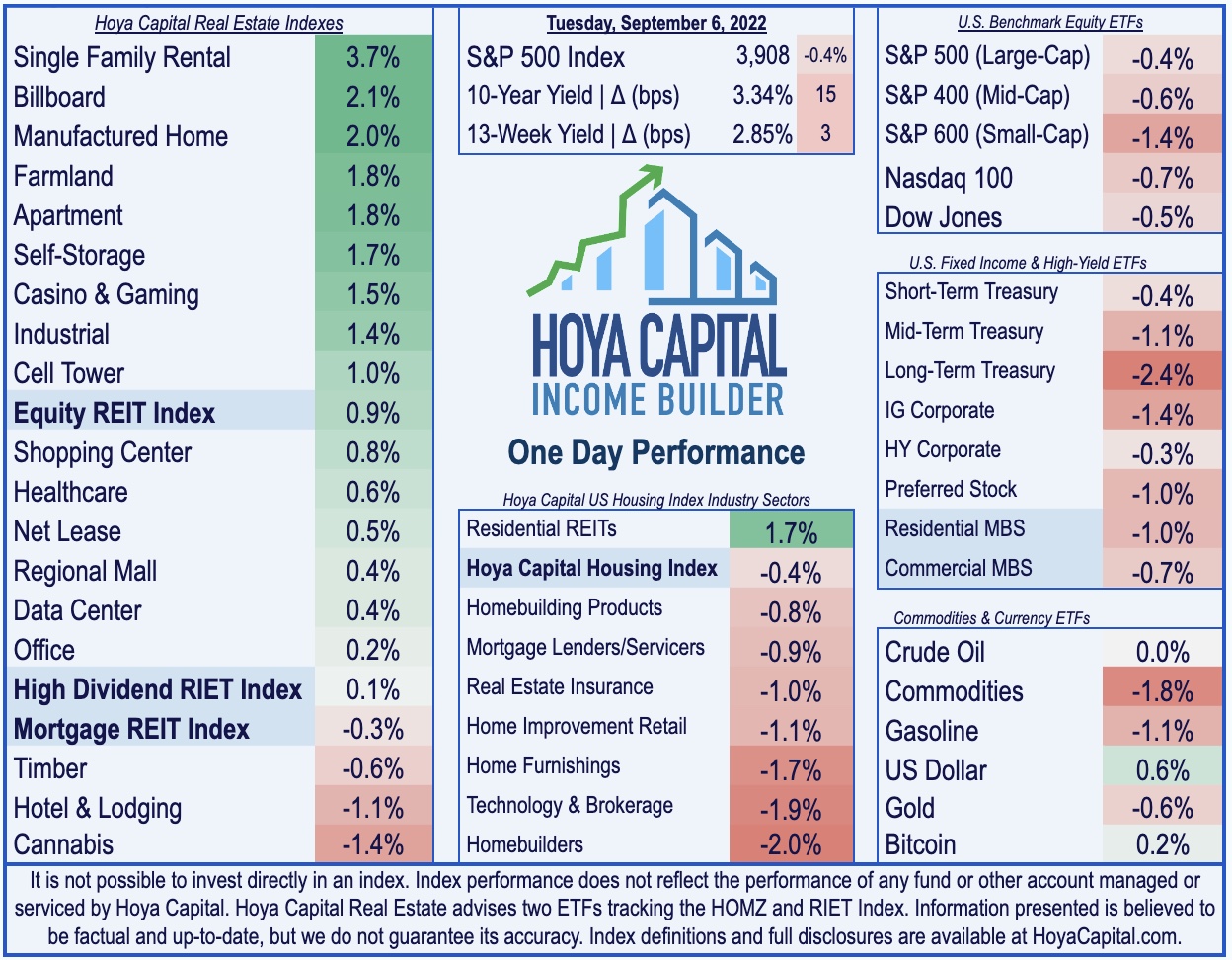

- U.S. equity markets slumped Tuesday - extending the broad-based selloff over the past month - as interest rates took a fresh leg higher on expectations of tightening international monetary policy.

- Entering the session on a three-week losing skid, the S&P 500 declined another 0.4% today while the tech-heavy Nasdaq 100 declined for the seventh-straight session.

- Despite the jump in long-term interest rates, real estate equities were among the few areas of strength today. the Equity REIT Index advancing 0.9% today with 15-of-18 property sectors higher.

- The benchmark 10-Year Treasury Yield jumped 15 basis points to 3.34% today - the third-highest daily close in the past decade while the US Dollar Index climbed to fresh 20-year highs.

- S&P Global reported this morning that August saw global economic activity contract for the first time since June 2020 while it revised lower its US Services PMI. Interestingly, a separate ISM survey showed surprising strength in Services activity in August.

Real Estate Daily Recap

U.S. equity markets slumped Tuesday - extending the broad-based selloff over the past month - as interest rates took a fresh leg higher on expectations of tightening international monetary policy despite fresh PMI data showing a global economic contraction in August. Entering the session on a three-week losing skid, the S&P 500 declined another 0.4% today while the tech-heavy Nasdaq 100 dipped another 0.7% to extend its streak of declines to seven-straight days. Despite the jump in long-term interest rates, real estate equities were among the few areas of strength with the Equity REIT Index advancing by 0.9% today with 15-of-18 property sectors in positive territory while the Mortgage REIT Index declined 0.3%.

As discussed in our Real Estate Weekly Outlook, investor sentiment has soured since mid-July after Fed officials initiated a hawkish pivot despite a mounting slate of economic data showing a significant slowdown in economic activity and cooling price pressures. Seven of the eleven GICS equity sectors were lower on the day with the Communications (XLC) and Technology (XLK) sectors among the downside laggards. The benchmark 10-Year Treasury Yield jumped 15 basis points to 3.34% today - the third-highest daily close in the past decade. The US Dollar Index, meanwhile, climbed to fresh 20-year highs while Commodities (DJP) prices slumped nearly 2%, each reflecting expectations of languishing economic growth conditions in Europe and Asia.

On that note, S&P Global reported this morning that August saw global economic activity contract for the first time since June 2020 "as new order inflows declined, international trade volumes fell and signs of excess capacity grew." It's JP Morgan Global Composite PMI fell to 49.3 in August, from 50.8 in July with output contracting in both the manufacturing and service sectors, the first time both categories have been in concurrent downturns since June 2020. S&P's U.S. PMI report, meanwhile, showed that U.S. Services PMI Business Activity Index fell to 43.7 in August, worse than the initial “flash” estimate of 44.1 and a reading of 47.3 in July. Interestingly, a separate survey from ISM - which tends to lag the S&P metrics by 2-3 months - showed that services sector activity rose in August to the highest level since April. Given that respondents reported higher diesel and gasoline prices in the month, however, the survey period appears to reflect conditions before early July.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

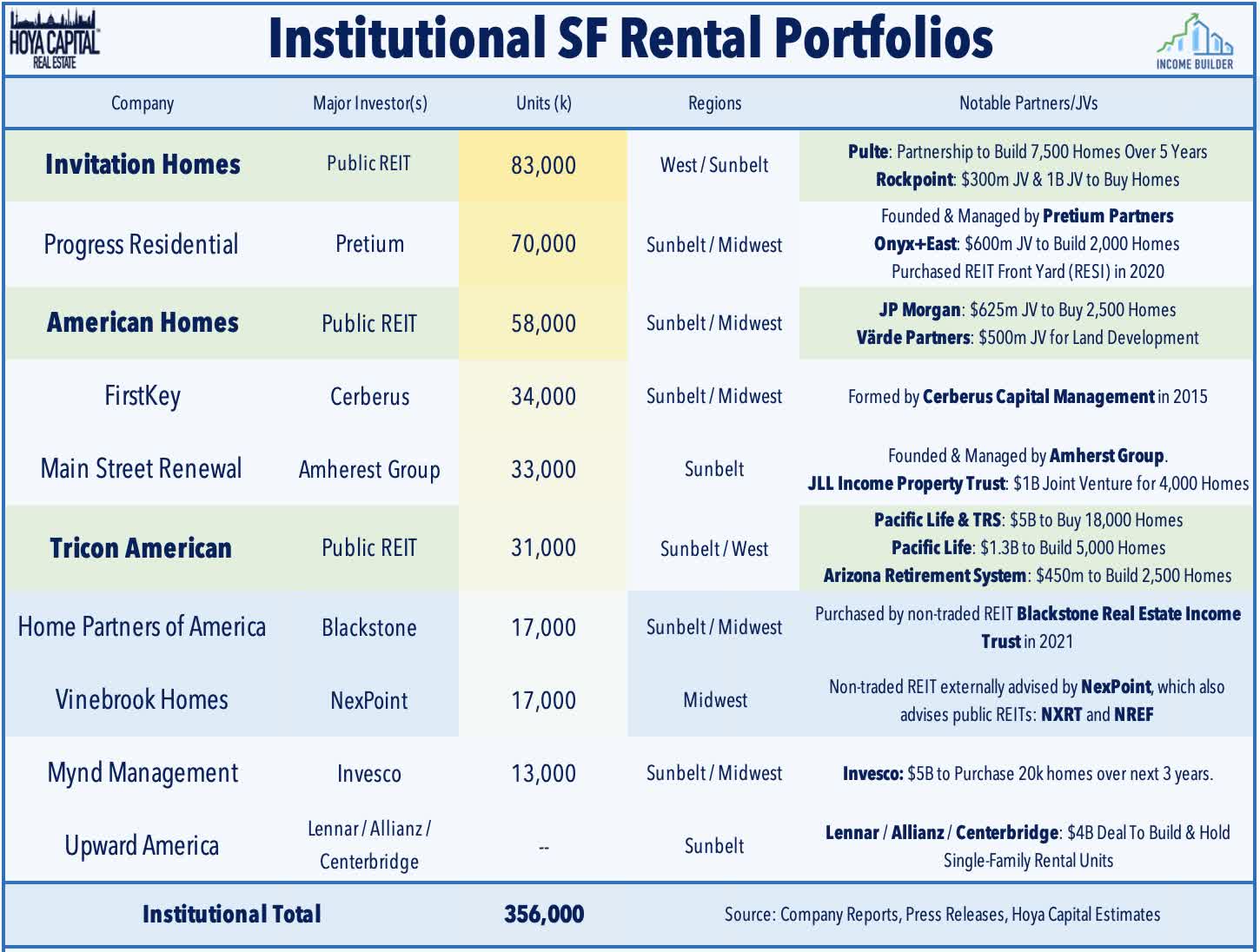

Single-Family Rental: Invitation Homes (INVH) - which is our largest holding in the REIT Dividend Growth Portfolio - rallied nearly 5% today after S&P announced that INVH will be added to the S&P 500 Index in its upcoming quarterly rebalance alongside real estate data firm CoStar Group (CSGP) - replacing PVH Corp. (PVH) and PENN Entertainment (PENN). INVH - which is the nation's largest owner of single-family rental homes - becomes the 30th REIT in the S&P 500 and the first single-family rental REIT.

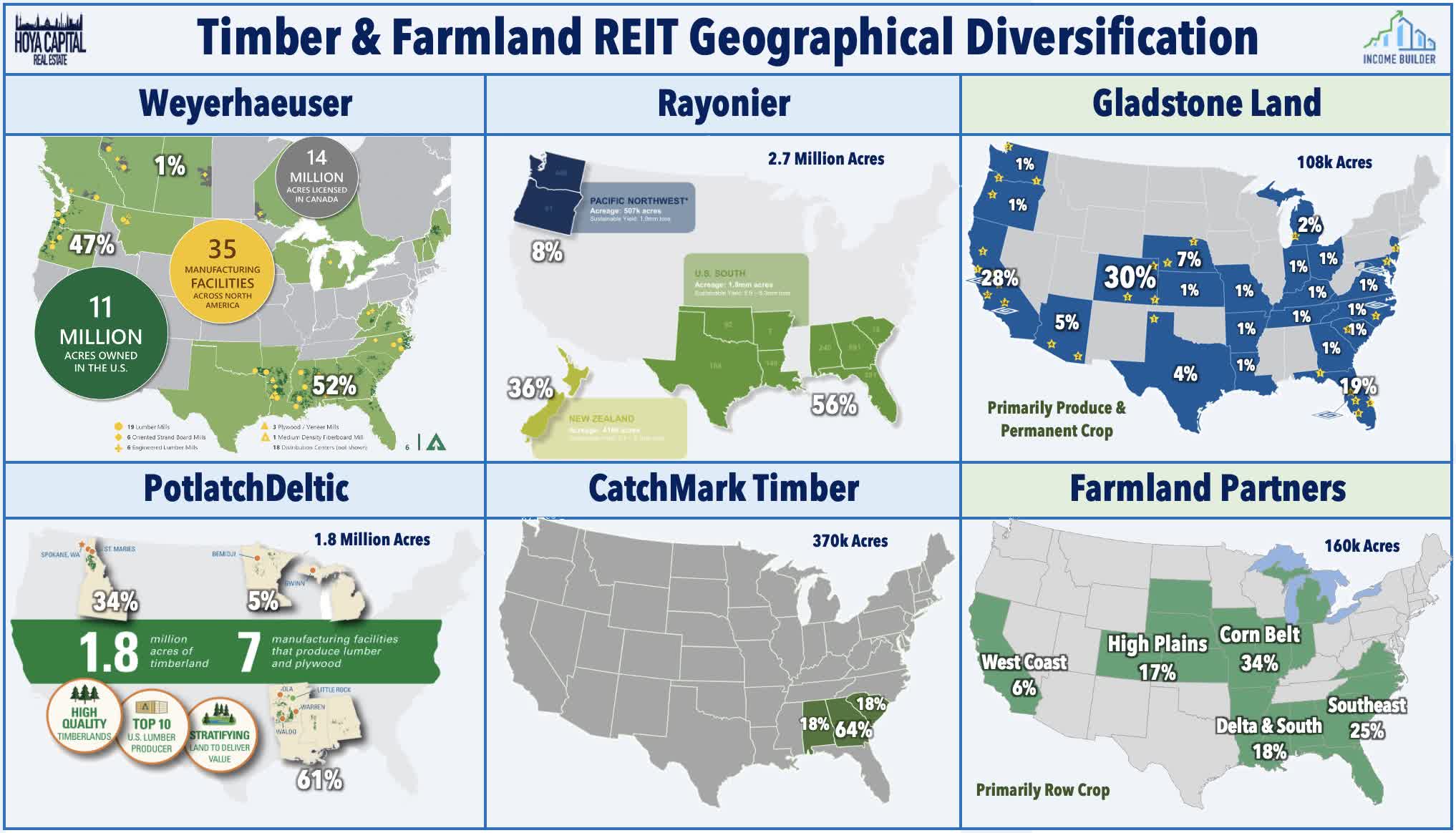

Land REITs: Today we published Timber & Farmland REITs: Buying Land At A Discount on the Income Builder Marketplace. While still outperforming the REIT Index this year, timber and farmland REITs have pulled back amid cooling inflation expectations, slumping global commodity demand, and regional weather complications. With indications that the Russia-Ukraine conflict may drag on indefinitely, we expect continued global market share gains for North American producers of the disrupted agricultural products– notably grains and lumber. In the new report, we discuss our updated outlook for the land REIT sectors and our recent portfolio allocations.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were mostly lower today with residential mREITs declining 0.7% while commercial mREITs slipped 0.3%. Annaly Capital (NLY) was among the leaders after S&P announced that it will be added to the S&P Mid-Cap 400 Index in its quarterly rebalance on September 19th - becoming the only mortgage REIT in the S&P Mid-Cap 400 Index.

Economic Data This Week

The economic calendar slows down in the Labor Day-shortened week ahead with U.S. equity and bond markets closed on Monday. Purchasing Managers' Index ("PMI") data will continue to be the major focus this week with a busy slate of reports released this morning with more to come throughout the week. We'll also be watching Jobless Claims data on Thursday. Investors should also expect another noisy week of Fed commentary as the "Blackout Period" before the September FOMC Meeting will begin at midnight on Friday

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.