Fed Defends Credibility • Home Prices Decline • Rent Updates

- U.S. equity and bond markets remained under pressure Tuesday following another slate of hawkish Fed commentary as officials cited the need to protect their "credibility" in defending their aggressive policy stance.

- Declining for the sixth-straight session, the S&P 500 dipped another 0.2% today but the Mid-Cap 400 and Small-Cap 600 along with the tech-heavy Nasdaq 100 each finished fractionally higher.

- Real estate equities were laggards as interest rates continued their relentless rise. The Equity REIT Index dipped 1.3% today with 13-of-18 property sectors in negative territory.

- Pressured by the historic surge in mortgage rates, the Case-Shiller US National Home Price Index declined 0.2% in July from the prior month, which was the first month-over-month decline since February 2012.

- Apartment List reported that multifamily rental rates continued a trend of moderation from the historically strong levels seen earlier this year - but are still on pace for one of the strongest years of rent growth on record.

Real Estate Daily Recap

U.S. equity and bond markets remained under pressure Tuesday following another slate of hawkish Federal Reserve commentary as officials defended their aggressive tightening course, citing the need to protect their "credibility." Declining for the sixth-straight session, the S&P 500 dipped another 0.2% today but the Mid-Cap 400 and Small-Cap 600 along with the tech-heavy Nasdaq 100 each finished fractionally higher. Real estate equities were laggards as interest rates continued their relentless rise. The Equity REIT Index dipped 1.3% today with 13-of-18 property sectors in negative territory while Mortgage REIT Index dipped another 2% as global interest rate volatility remained near the highest levels since March 2020.

A trio of Fed officials - Bullard, Evans, and Kashkari - refused to concede ground on their hawkish policy stance in their public commentary today despite a growing body of evidence that price pressures have cooled considerably in recent months amid a significant weakening of global economic conditions. The Case-Shiller US National Home Price Index declined 0.2% in July from the prior month, which was the first month-over-month decline since February 2012. The 10-Year Treasury Yield jumped another 9 basis points to 3.96% - its highest level since the end of the Financial Crisis. Crude Oil Prices rebounded 2% today as investors monitored Hurricane Ian which is expected to impact Florida as a major hurricane over the coming days.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Apartments: Apartment List released their National Rent Report today which showed that multifamily rental rates continued a trend of moderation from their historically strong levels seen earlier this year - but are still on pace for one of the strongest years of rent growth on record. On a month-over-month basis, national rents declined 0.2% in September, consistent with the seasonal trend that was typical in pre-pandemic years. Despite the monthly decline, rent growth in 2022 continues to outpace the pre-pandemic trend. In the first nine months, rents have increased by 6.8% compared to the 4.6% rate in 2018, 3.8% in 2019, and 0.3% in 2020. Apartment List noted that even if rents continue their seasonal dip for the remainder of the year, 2022 will still likely end up being the second fastest year of rent growth in its data. Elsewhere, Washington REIT (WRE) provided a business update today in which it noted that leasing spreads remained in double digits in August with 10.6% blended rent growth. WRE also reiterated its 2022 guidance while providing upbeat guidance for 2023 in which it expects Core FFO to increase 14% driven by multifamily NOI growth of 10% at the midpoint of its range.

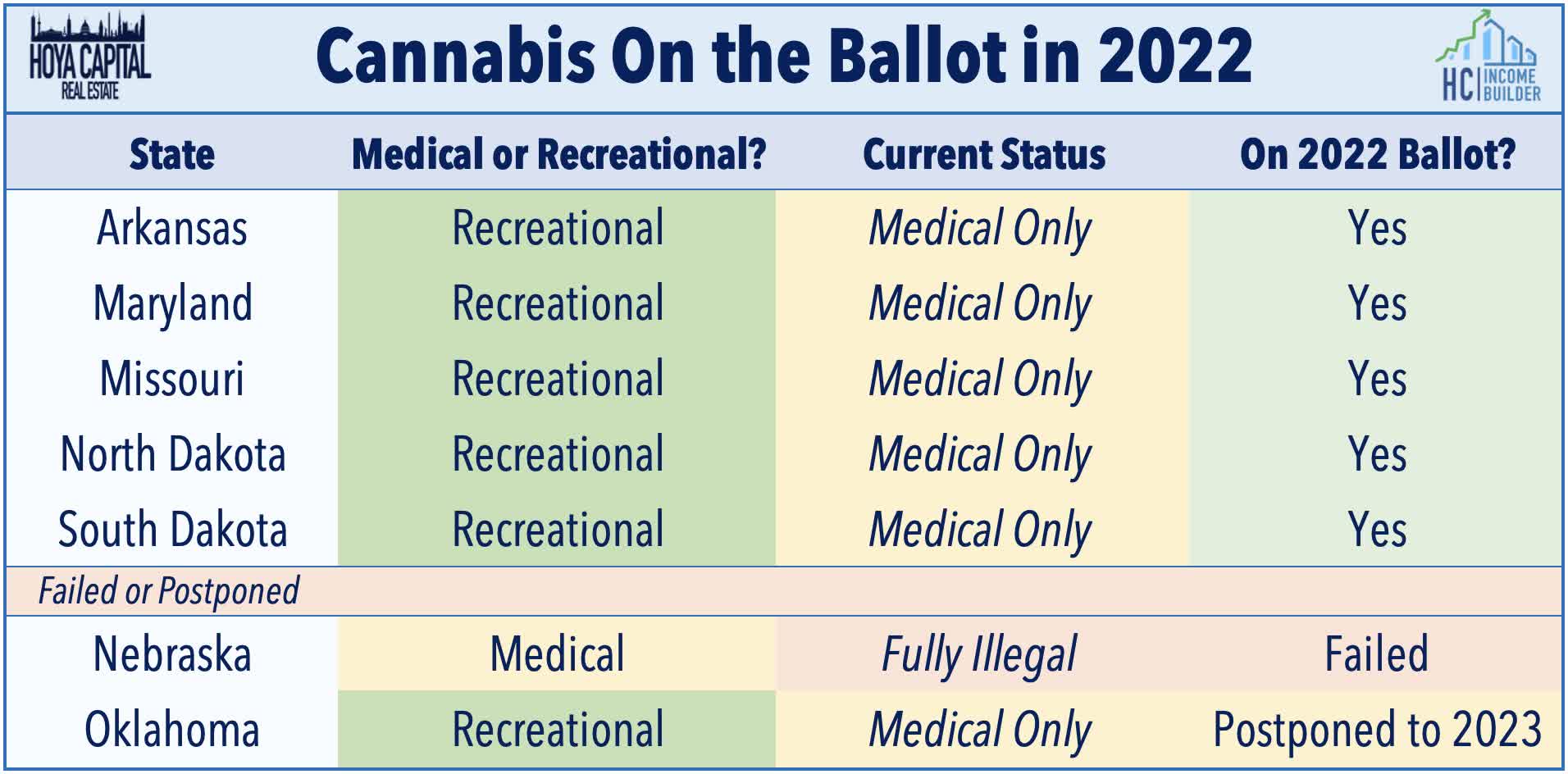

Cannabis: Today we published Cannabis REITs: Too Cheap To Get High. The previously-high-flying cannabis REITs have been slammed this year on concerns over rent payment from their cannabis cultivator tenants, which have been struggling amid a plunge in wholesale cannabis prices. The 30-50% plunge in pot prices comes amid a flood of new entrants to the cannabis retail and cultivation industry and as institutional capital to multi-state operators has driven production efficiencies. Tighter monetary policy and lack of progress in federal legalization have further stifled capital raising activity and led to a handful of defaults from smaller single-state operators, including several REIT tenants, but we've been encouraged by recent updates which suggest that nonpayment issues remain contained and isolated to a handful of smaller single-state operators. Of note, more than two-thirds of the U.S. population now support marijuana legalization, up from roughly 15% in the 1970s and 35% in the early 2000s while roughly 1-in-8 Americans consume cannabis regularly. In 2022, five more states will decide on marijuana legalization ballot measures: Arkansas, Missouri, Maryland, North Dakota, and South Dakota.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs remained under pressure today despite a bid for residential mortgage-backed bonds (MBB) as residential mREITs ended the day off by 2.1% while commercial mREITs declined by 1.5%. ARMOUR Residential REIT (ARR) was among the better performers today after holding its monthly dividend steady at 0.10/share. On an otherwise slow day of mREIT newsflow, New York Mortgage (NYMT) and Angel Oak (AOMR) were the upside standouts today while Sachem Capital (SACH) was the laggard.

Economic Data This Week

It'll be another busy week of housing data, inflation reports, and "Fed speak" in the week ahead. Today we saw New Home Sales data along with home price data on Tuesday with reports from Case Shiller and the FHFA. On Tuesday, we'll see Pending Home Sales data for August which is expected to echo the slowdown seen in Existing Sales and Housing Starts data last week. On Thursday we'll see the final revision of second-quarter Gross Domestic Product data which is expected to confirm that the U.S. was indeed in a technical recession in the first half of 2022. Finally, on Friday, we'll see another critical inflation report with the Core PCE Index - the Fed's preferred gauge of inflation - which has been one of the early indicators showing signs of peaking price pressures in recent months.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.