Rout Deepens • Fed 'Resolute' • Ian Impacts

- U.S. equity markets continued to slide Friday- deepening the worst monthly rout since March 2020- as lukewarm inflation and PMI data weren't weak enough to force the Fed to blink.

- Closing the month and quarter at the lowest levels in over two years, the S&P 500 declined another 1.4% today, pushing its weekly decline to nearly 3%.

- Real estate equities caught a bid amid an otherwise brutal week of selling pressure. The Equity REIT Index advanced 1.1% today, trimming its weekly declines to under 4%.

- PCE Inflation - the Fed's preferred measure of inflation - came in hotter than expected in August as rising prices for food and services more-than-offset the decline in energy prices.

- Crude Oil dipped 2% to erase its weekly gains as global demand concerns negated the upward pressure from disruptions caused by Hurricane Ian and a worsening supply outlook in Europe.

Real Estate Daily Recap

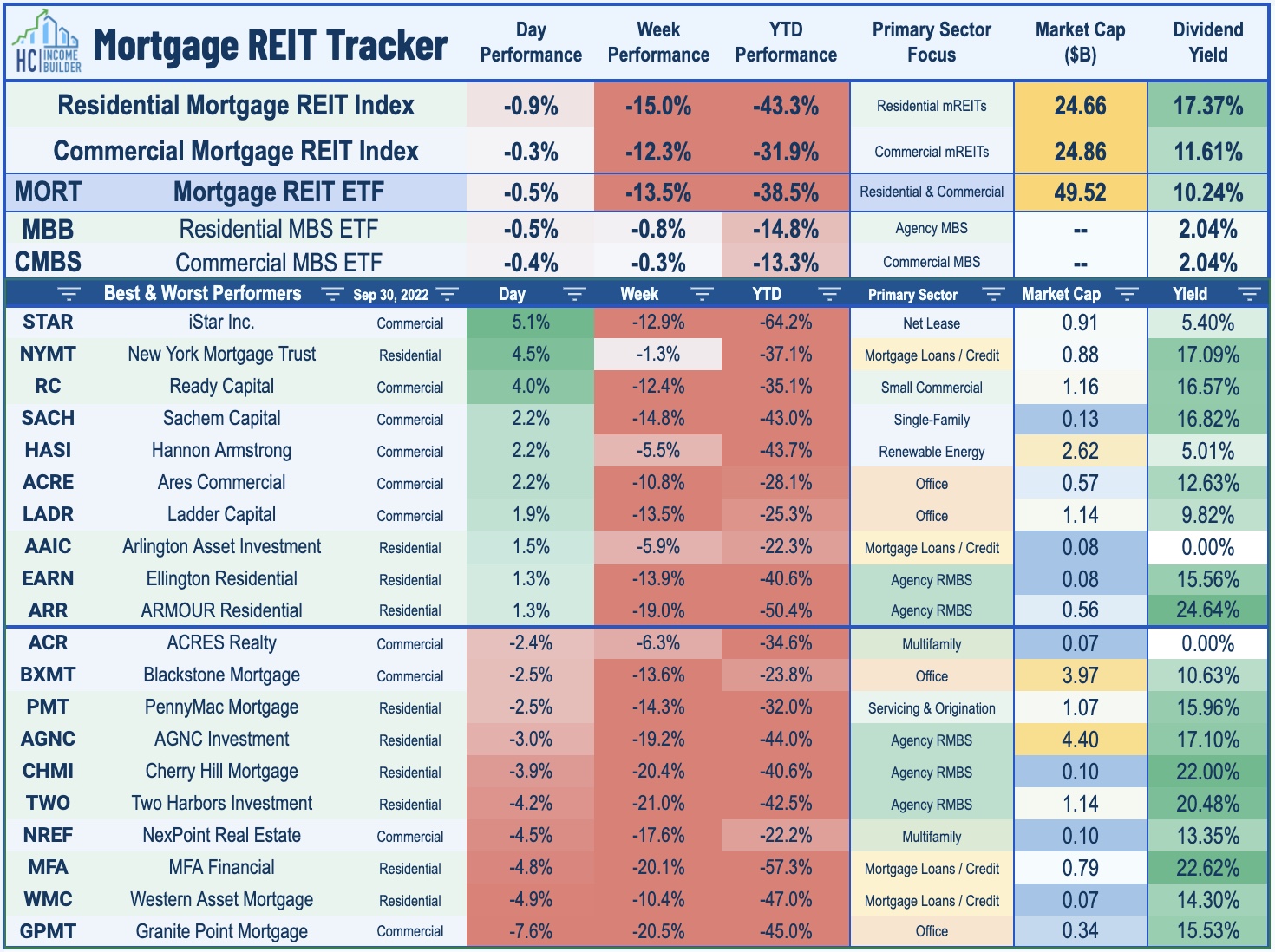

U.S. equity markets continued to slide Friday - deepening their worst monthly rout since March 2020 - as lukewarm inflation and PMI data likely wasn't weak enough to force the Fed to "blink" in its aggressive tightening course. Closing the month and quarter at the lowest levels in over two years, the S&P 500 declined another 1.4% today, pushing its weekly decline to nearly 3%. The Mid-Cap 400 and Small-Cap 600 posted more modest declines. Real estate equities caught a bid amid an otherwise brutal week of selling pressure. The Equity REIT Index advanced 1.1% today with 17-of-18 property sectors in positive territory - trimming the index's weekly declines to under 4%. The Mortgage REIT Index slipped another 0.5% today to push its weekly declines to over 12% amid a punishing week for bond markets.

Bond markets remained under pressure today as interest rate volatility remained at levels last seen during the COVID turmoil in March 2020. After posting its single-largest daily yield decline in a decade earlier in the week, the 10-Year Treasury Yield rebounded to close the week at 3.80% - up 10 basis points on the week to its highest end-of-week close in a decade. Crude Oil dipped 2% to erase its weekly gains as global demand concerns negated the upward pressure from disruptions caused by Hurricane Ian and a worsening supply outlook in Europe. Ten of the eleven GICS equity sectors finished lower on the day. The U.S. Dollar remained near two-decade highs after a mixed slate of economic data in the U.S. as all eyes turn to a critical slate of employment data in the week ahead.

Contributing to the continued selling pressure today was PCE inflation PCE Inflation - the Fed's preferred measure of inflation - came in hotter than expected in August as rising prices for food and services more-than-offset the decline in energy prices. Excluding food and energy, the Core PCE price index increased 0.6% in August after being flat in July. The same report from the BEA showed that Personal Incomes rose 0.3% in August - consistent with estimates - while Personal Spending rose 0.4% - also consistent with estimates adjusted for the downward revision in July. We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook this weekend.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Manufactured Housing: With Hurricane Ian making landfall this week as a destructive Category 4 storm on the Southwest Florida coast, today we published Manufactured Housing REITs: Impacts of Ian. The storm took a similar path as Hurricane Irma in 2017, but Ian's storm surge and wind impacts appear more significant. Florida is the largest market for MH REITs. ELS and SUI incurred a roughly 1% FFO hit from Irma, but damages will be higher given these REITs' recent marina investments. We expect updates from MH REITs early next week. Irrespective of the impacts, we continue to expect MH REITs to deliver impressive rent growth in the back half of the year and throughout 2023 despite the broader moderation in rental rates we're seeing in the multifamily and single-family markets as home price appreciation cools.

Cannabis: Earlier this week we published Cannabis REITs: Too Cheap To Get High. The previously-high-flying cannabis REITs have been slammed this year on concerns over rent payment from their cannabis cultivator tenants, which have been struggling amid a plunge in wholesale cannabis prices. The 30-50% plunge in pot prices comes amid a flood of new entrants to the cannabis retail and cultivation industry and as institutional capital to multi-state operators has driven production efficiencies. Tighter monetary policy and lack of progress in federal legalization have further stifled capital raising activity and led to a handful of defaults from smaller single-state operators, including several REIT tenants, but we've been encouraged by recent updates which suggest that nonpayment issues remain contained and isolated to a handful of smaller single-state operators. Of note, more than two-thirds of the U.S. population now support marijuana legalization, up from roughly 15% in the 1970s and 35% in the early 2000s while roughly 1-in-8 Americans consume cannabis regularly. In 2022, five more states will decide on marijuana legalization ballot measures: Arkansas, Missouri, Maryland, North Dakota, and South Dakota.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were mixed today amid an otherwise brutal week amid a surge in interest rate volatility and pressure on residential mortgage-backed bond (MBB) valuations. Ready Capital (RC) was among the upside leaders today after increasing the size of its stock buyback program while New York Mortgage Trust (NYMT) was also an upside standout. All 42 mortgage REITs finished lower on the week and 15 mREITs declined more than 15%.

Economic Data This Week

We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook this weekend.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.