Credit Suisse Turmoil • OPEC Cuts • Ian Updates

- U.S. equity markets rebounded Monday following their worst September in two decades as signs of financial market stress at major banks and weakening PMI-data called into question the Fed's tightening-course.

- Rebounding from its lowest close in over two years, the S&P 500 rallied 2.6% today- cutting its year-to-date declines back below 25%- while the Mid-Cap 400 and Small-Cap 600 posted similar gains.

- Real estate equities were broadly higher as well as long-term interest rates pulled-back from their highest levels since the Financial Crisis. The Equity REIT Index advanced 1.8%. Homebuilders rallied 4%.

- The faint quivers of financial market instability became more widely-felt tremors over the weekend following a series of updates from Credit Suisse - the seventh largest financial institution in the world - that raised questions over the bank's solvency amid pressure from a historic pace of central bank monetary tightening.

- Manufactured Housing REIT Equity LifeStyle (ELS) gained 2% after providing a Hurricane Ian update today, commenting: "At this time, we do not believe that Hurricane Ian will significantly impact our results of operations or our financial condition."

Income Builder Daily Recap

U.S. equity markets rebounded Monday following their worst September in two decades as signs of financial market stress at major banks and weakening economic data called into question the Fed's aggressive rate-hike course. Rebounding from its lowest close in over two years, the S&P 500 rallied 2.6% today - cutting its year-to-date declines back below 25% - while the Mid-Cap 400 and Small-Cap 600 posted similar advances. Real estate equities were broadly higher as well as long-term interest rates pulled back from their highest levels since the Financial Crisis. The Equity REIT Index advanced 1.8% today with 17-of-18 property sectors in positive territory while the Mortgage REIT Index gained 1.3%. Homebuilders and the broader Hoya Capital Housing Index were among the upside gainers in hopes of some relief from the historic surge in mortgage rates.

The faint quivers of financial market instability became more widely-felt tremors over the weekend following a series of updates from Credit Suisse (CS) - the seventh largest financial institution in the world - that raised questions over the bank's solvency amid pressure from a historic pace of central bank monetary tightening. Internal memos noted that the firm is at a "critical moment" with CDS market prices reflecting a one-in-four probability that the bank defaults on its bonds within the next five years. The 10-Year Treasury Yield retreated 15 basis points to 3.65% - well below its recent highs above 4% as investors started to scale-back expectations for the pace and magnitude of future Fed rate hikes. The U.S. Dollar Index retreated from two-decade highs following weaker-than-expected PMI data in the U.S. while Crude Oil prices rallied on reports that the OPEC+ group of oil producers is discussing output cuts of more than 1 million barrels per day amid a backdrop of falling oil prices and months of severe market volatility.

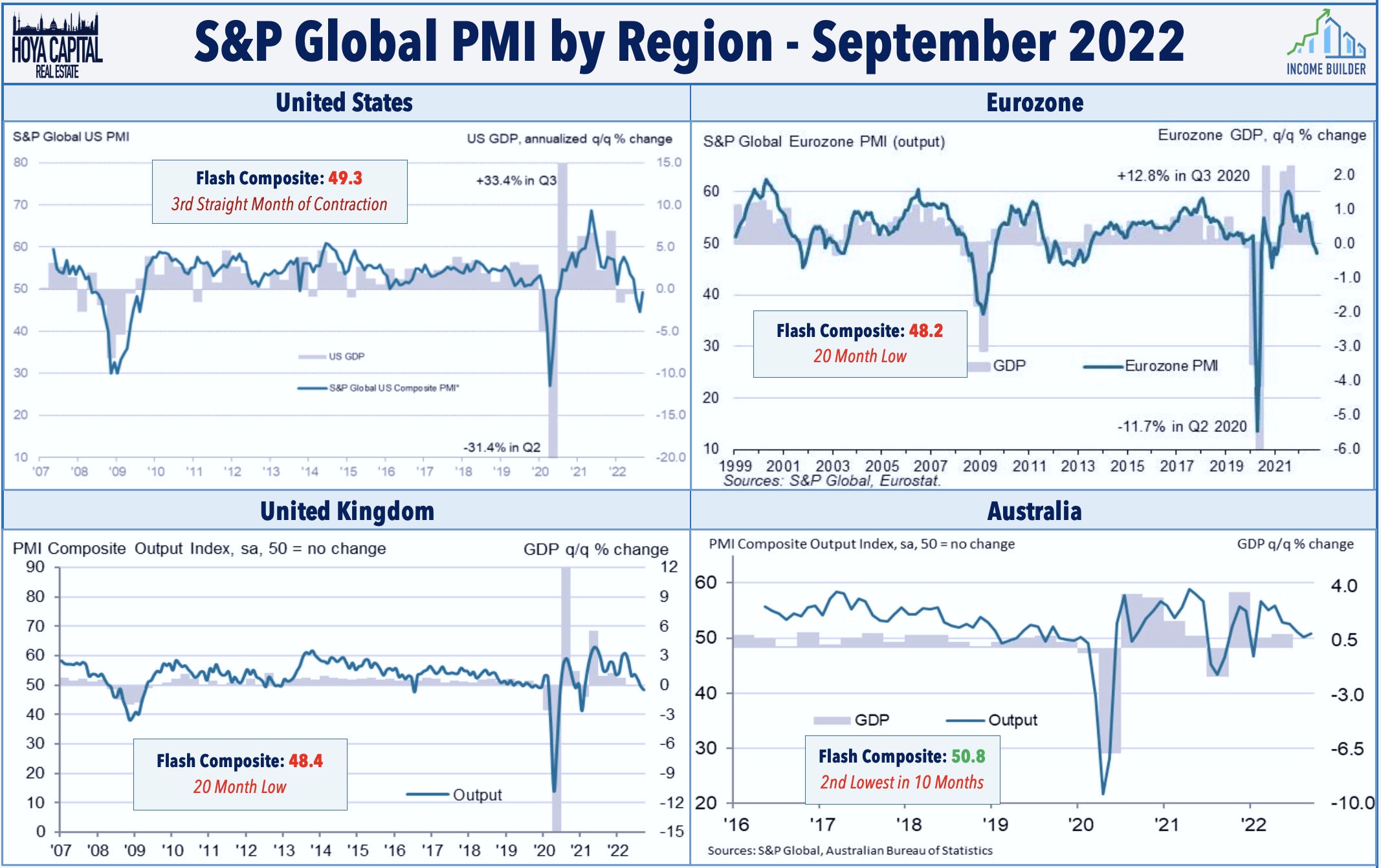

Consistent with the "bad news is good news" theme, a disappointing PMI report from the ISM contributed to the bid across equity and bond markets. The report from the Institute for Supply Management today showed that U.S. manufacturing activity slowed by the most since the depths of the pandemic in September as new orders contracted amid aggressive interest rate increases from the Federal Reserve to cool demand and tame inflation. The ISM's manufacturing PMI dropped to 50.9 this month, the lowest reading since May 2020, from 52.8 in August. ISM said the fall in the index "reflects companies adjusting to potential future lower demand." The S&P Global Composite PMI Index released in mid-September showed that the economy was in contraction in all three months of Q3 in the United States, Eurozone, and United Kingdom.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Manufactured Housing: Equity LifeStyle (ELS) provided a Hurricane Ian update today, commenting: "At this time, we do not believe that Hurricane Ian will significantly impact our results of operations or our financial condition." Based on its initial assessments, "wind-related structural damage to common areas appears limited... and consistent with prior storm events, newer homes appear to have held up well during the hurricane." ELS specifically cited five properties that did "suffer significant flooding and wind-related damage" which included three RV properties near Fort Myers - Gulf Air RV, Fort Myers Beach RV, and Pine Island RV - and two marinas in the area - Palm Harbour Marina and Fish Tale Marina. ELS noted that the impact on its North and South Carolina properties was "minimal" and believes that it has adequate insurance including business interruption coverage to avoid a "significant impact" on its operations or financial condition. Last week we published Manufactured Housing REITs: Impacts of Ian which discussed the expected FFO impact on ELS and Sun Communities (SUI) from the hurricane.

Net Lease: Realty Income (O) provided a business update today noting that its acquisition activity totaled $1.8B in Q3 - bringing its full-year year-to-date investment to $5.0B - pushing back on concern that the higher-rate environment may have significantly slowed the net lease acquisition pipeline. In its second-quarter earnings report back in early August, Realty Income raised its full-year acquisition target to "Over $6.0B" from its prior target of "Over $5B." In today's update, Realty Income also noted that it raised $700M in proceeds from common stock sales through its at-the-market ("ATM") issuance program and that it has another 20M shares in potential future ATM issuance representing $1.3B in gross proceeds. In an Income Builder report last week, we discussed why net lease REITs - typically thought to be one of the more "bond-like" sectors - have surprisingly been one of the best-performing sectors this year despite the challenging rising-rate environment.

Cannabis: Innovative Industrial (IIPR) gained today after one of its tenants - TILT Holdings - announced that it signed a third amendment to its sale-leaseback deal with IIPR for its White Haven, PA facility to accommodate second-round testing to satisfy requests from the Pennsylvania Department of Environmental Protection, but commented that both parties believe the extension to November 1 will "provide sufficient time to resolve all outstanding issues and complete the necessary paperwork allowing the transaction to close." TILT currently operates one facility in MA leased from IIPR. The deal for the new facility was initially signed alongside the lease for the existing MA facility this past May. TILT has operated the PA facility since early 2019 - a 40k square-foot building that includes cultivation, processing, and manufacturing.

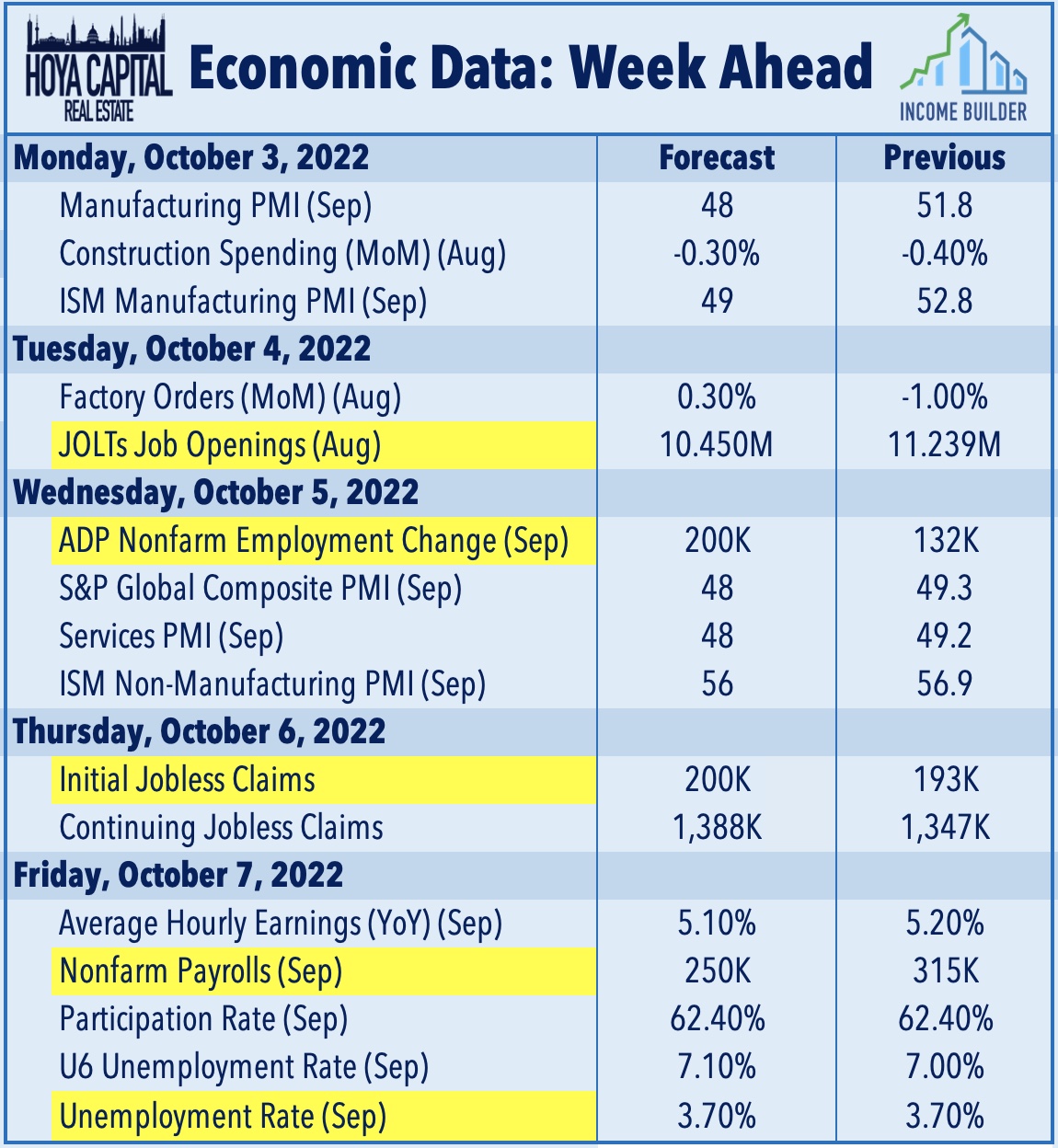

Economic Data This WeekEmployment data highlights another critical week of economic data in the week ahead headlined by JOLTS data on Tuesday, ADP Payrolls on Wednesday, Jobless Claims data on Thursday, and the BLS Nonfarm Payrolls report on Friday. Economists are looking for job growth of roughly 250k in September - which would be the smallest gain since December 2020 - and for the unemployment rate to stay steady at 3.70%. 'Good news is bad news' will likely be the theme of these reports as investors and the Fed look for signs of the long-awaited cooldown in job growth which has yet to materialize. Purchasing Managers' Index ("PMI") data will continue to be a major market focus - particularly in Europe and Asia - as recent reports have dipped below the breakeven 50-level.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.