Jobs Market Cools • Gas Prices Rise • REIT Rebound

- U.S. equity markets rallied for a second-straight day Tuesday as investors bet that JOLTS data showing a sharp plunge in job openings may temper the Fed's aggressive tightening course.

- Posting the best two-day gain in two years following its worst September in decades, the S&P 500 rallied 2.9% today while the Mid-Cap 400 and Small-Cap 600 rallied nearly 4%.

- Real estate equities were also broadly-higher as long-term interest rates continued to moderate from recent highs. The Equity REIT Index gained 2% while the Mortgage REIT Index soared 7.3%.

- The number of job openings plunged by more than a million in August - one of the most significant one-month declines in the history of the JOLTS survey - providing a potential early sign that labor market conditions may finally be easing.

- Consumer gasoline prices have risen by roughly 4%, on average, since bottoming in mid-September but noted a wide regional difference with several states on the West Coast again seeing prices above $6 per gallon.

Income Builder Daily Recap

U.S. equity markets rallied for a second-straight day Tuesday as investors bet that JOLTS data showing a sharp plunge in job openings to 14-month lows may force the Fed to temper its aggressive tightening course. Posting the best two-day gain in two years following its worst September in decades, the S&P 500 rallied 2.9% today while the Mid-Cap 400 and Small-Cap 600 each rallied nearly 4%. Real estate equities were broadly higher as well as long-term interest rates continued to moderate from recent highs. The Equity REIT Index advanced 2.0% today with all 18 property sectors in positive territory while the Mortgage REIT Index soared 7.3%. Homebuilders and the broader Hoya Capital Housing Index were again among the upside gainers.

The 10-Year Treasury Yield retreated by another 3 basis points to 3.62% as one of the largest single-month declines in job openings on record in August prompted investors to further scale-back expectations for the pace and magnitude of future Fed rate hikes. The U.S. Dollar Index dipped for a fifth straight session. Crude Oil rallied for a second-straight day - pushing its rebound to more than 12% since its lows last week - on amplified supply concerns in Europe following reports that OPEC is discussing even larger production cuts than initially reported. AAA reported that consumer Gasoline prices have risen by roughly 4%, on average, since bottoming in mid-September, but noted a wide regional difference with several states on the West Coast again seeing prices above $6 per gallon while Texas and Gulf Coast states are seeing prices below $3 in some areas.

The number of job openings plunged by more than a million in August - one of the most significant one-month declines in the history of the Job Openings and Labor Turnover Survey - providing a potential early sign that labor market conditions may finally be easing. Reflecting conditions in the same month that Fed Chair Powell commented that the U.S. economy "continues to show strong underlying momentum" and "the labor market is particularly strong," data today showed that the number of available positions totaled 10.05 million for the month, a 10% drop from the 11.17 million reported in July and well below the 11.1 million consensus estimate. Health care and social assistance saw the biggest drop in vacancies, falling by 236,000. The number and rate of layoffs and discharges were little changed at 1.5 million and 1.0 percent, respectively.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

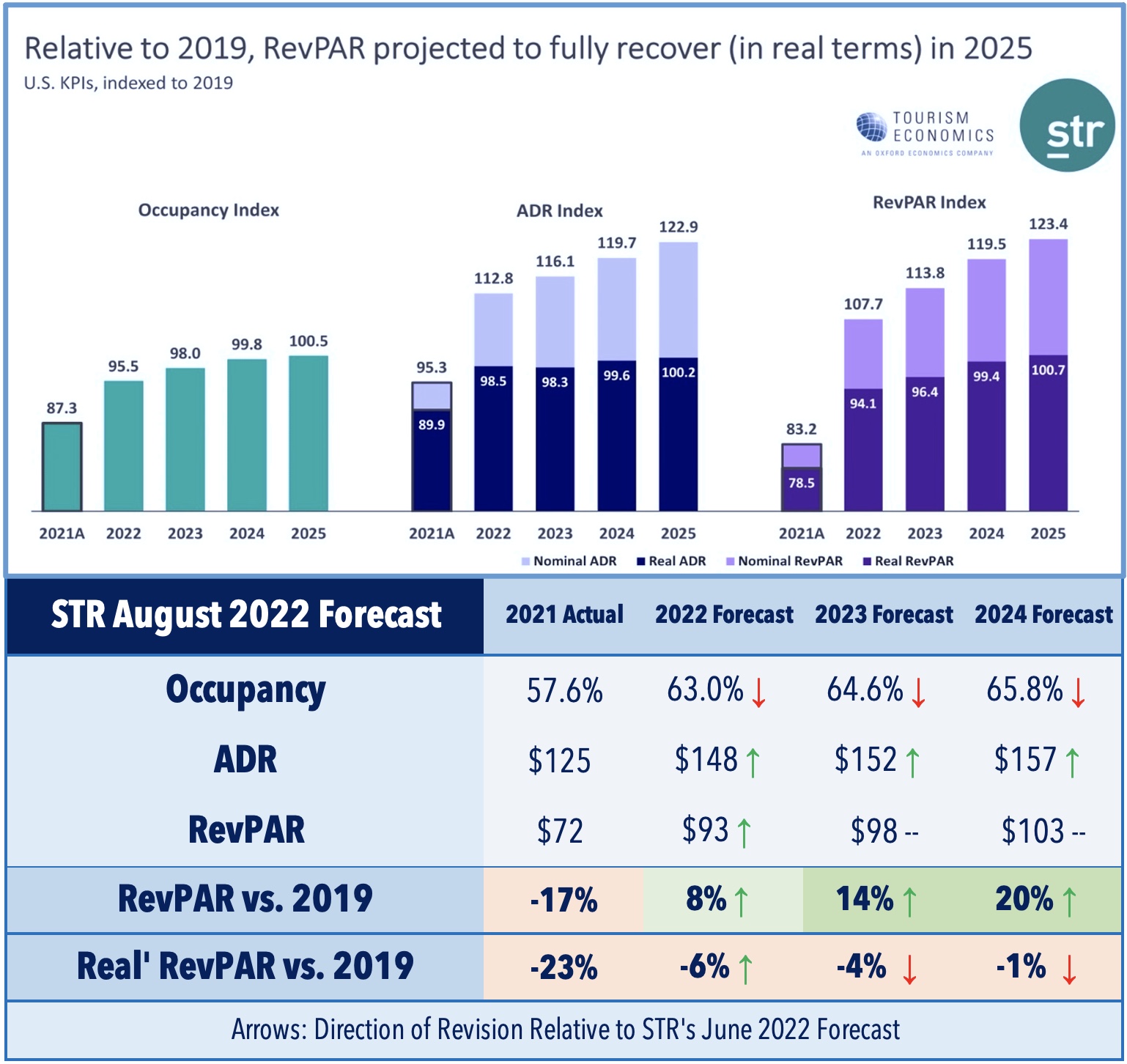

Hotels: Today we published Hotel REITs: A Summer to Remember on the Income Builder Marketplace. Hotel REITs have held up surprisingly well throughout the recent market turmoil and remain one of the top-performing property sectors this year following a solid summer of operating performance. Several years of pent-up leisure demand from COVID delays helped to offset a slow business travel recovery and STR recently reported that profitability levels were above 2019-levels throughout the summer. Solid operating performance and improved balance sheet health have fueled the long-awaited return of dividend distributions. Ten of 16 hotel REITs have either reinstated or raised their dividends this year. That said, we remain skeptical over the sustainability of the recovery in the upscale urban markets given the complexion of the RevPAR recovery, - driven by pent-up domestic leisure travel and surging room rates rather than an underlying occupancy recovery.

Healthcare: Welltower (WELL) was among the laggards today after it provided a business update noting that it now expects Q3 normalized FFO per share trending below the midpoint of its previous guidance of $0.82-$0.87/share due to the delayed disbursement of funds from the U.S. Department of Health and Human Services. WELL also commented that occupancy growth in its Senior Housing segment is expected to be in line with previous guidance while "pricing power remains robust as evidenced by strong realized renewal rate growth and interim price increases contemplated by several operators." For Q4, the company expects an additional ~$0.03 per share headwind compared with Q3 2022 resulting from higher interest rates (~$0.02 per share) and the stronger U.S. dollar (~$0.01 per share), assuming the forward interest rate curve and exchange rates remain at current levels.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were sharply higher today - rebounding from a punishing decline over the prior two weeks - as a bid for mortgage-backed bond (MBB) and a moderation in interest rate volatility sparked a double-digit rally across many of the most beaten-down names. All 42 mortgage REITs advanced on the day while Chimera Investment (CIM) and AG Mortgage (MITT) led the rally on the upside with gains of more than 13% today while heavyweights Annaly Capital (NLY) and AGNC Investment (AGNC) rallied 7%.

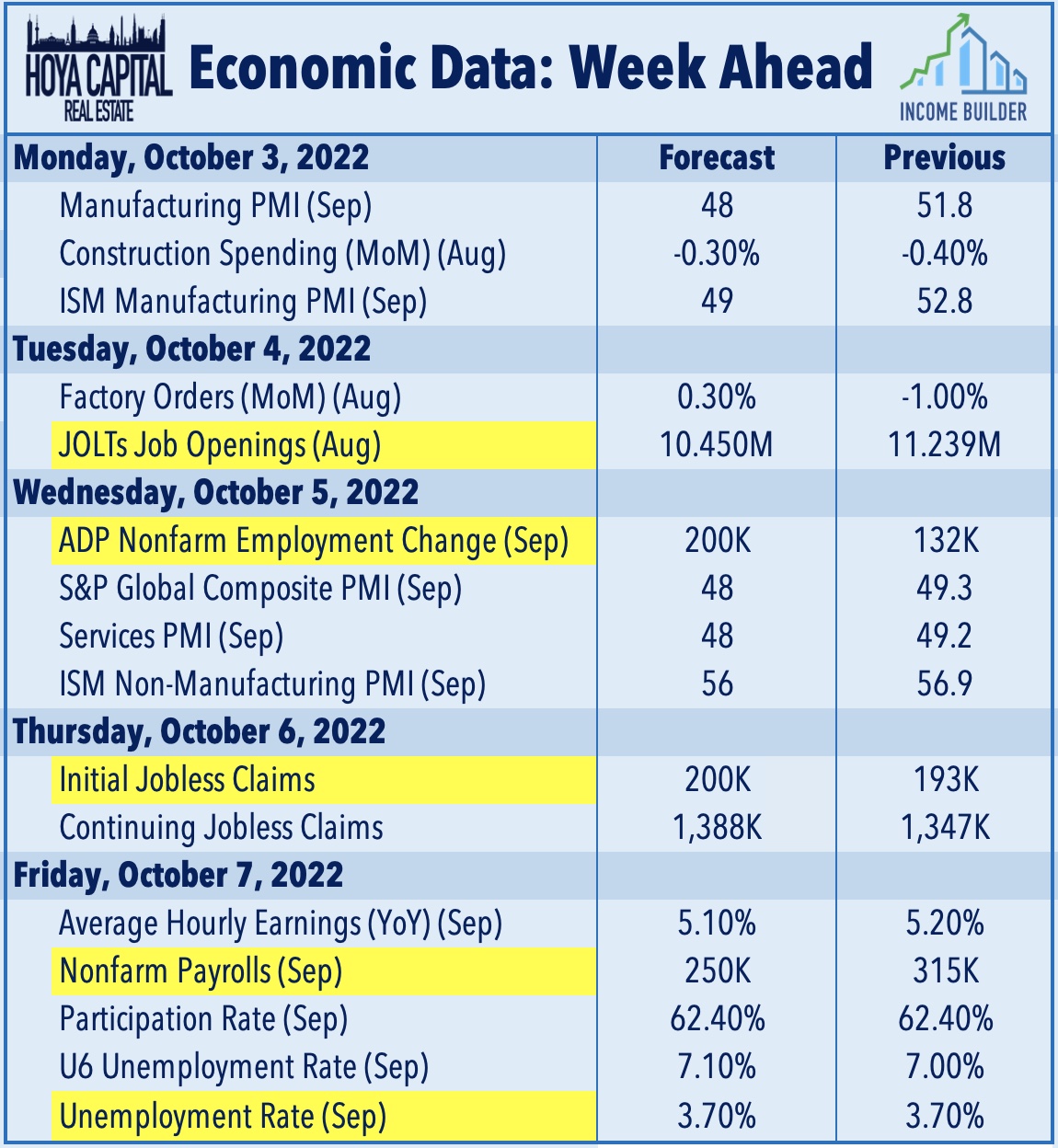

Economic Data This WeekEmployment data highlights another critical week of economic data in the week ahead headlined by JOLTS data on Tuesday, ADP Payrolls on Wednesday, Jobless Claims data on Thursday, and the BLS Nonfarm Payrolls report on Friday. Economists are looking for job growth of roughly 250k in September - which would be the smallest gain since December 2020 - and for the unemployment rate to stay steady at 3.70%. 'Good news is bad news' will likely be the theme of these reports as investors and the Fed look for signs of the long-awaited cooldown in job growth which has yet to materialize. Purchasing Managers' Index ("PMI") data will continue to be a major market focus - particularly in Europe and Asia - as recent reports have dipped below the breakeven 50-level.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.