REIT Rebound • Tanger Hikes Dividend • Recession Warnings

- U.S. equity markets remained under pressure Tuesday as benchmark interest rates continued to march higher ahead of a critical slate of inflation data and the start of corporate earnings season.

- Declining for the fifth straight session, the S&P 500 declined another 0.7% today while the tech-heavy Nasdaq 100 dipped 1.4% to the lowest level since July 2020.

- Real estate equities finally caught a bid after several days of relentless selling pressure underperformance. The Equity REIT Index advanced 1.1% today with 15-of-18 property sectors in positive territory.

- The Mortgage REIT Index surged nearly 7% following a slate of updates from Annaly, AGNC, and Dynex that showed that book value declines were less catastrophic than feared in the third quarter.

- Tanger Outlets (SKT) rallied 5% after it hiked its quarterly dividend by 20% to $0.22/share, representing a forward yield of roughly 5.95%. For Tanger, it's the second dividend hike this year, but its payout remains well below the pre-pandemic quarterly rate of $0.36 paid in 2019.

Income Builder Daily Recap

U.S. equity markets remained under pressure Tuesday as benchmark interest rates continued to march higher ahead of a critical slate of inflation data and the start of corporate earnings season. Declining for the fifth straight session and erasing what was left of its two-day JOLTs rally last week, the S&P 500 declined another 0.7% today while the tech-heavy Nasdaq 100 dipped 1.4% to the lowest level since July 2020. The more-domestically-focused Mid-Cap 400 and Small-Cap 600, however, finished higher on the day. Real estate equities finally caught a bid after several days of relentless selling pressure underperformance. The Equity REIT Index advanced 1.1% today with 15-of-18 property sectors in positive territory while the Mortgage REIT Index surged nearly 7% following a slate of updates that showed that book value declines were less catastrophic than feared in the third quarter.

Equity and bond markets sold off late in the session after the Bank of England was forced into expanding its emergency bond-buying operation while warning of "material risk" to financial stability, but noted that the central bank will halt its bond-buying as planned at the end of this week. Swelling alongside UK interest rates, the U.S. 10-Year Treasury Yield flirted with a 4-handle before ending the day at 3.94% - up 5 basis points on the day and the second-highest closing level since 2010. The U.S. Dollar remained near two-decade highs while Crude Oil slipped for the second session on concerns over the demand outlook as the International Monetary Fund again downgraded its forecast for the global economy and warned of the possibility for a deep global recession, commenting that “the worst is yet to come." Citing the Russia-Ukraine war, high inflation, and slowing growth in China, the IMF downgraded global growth by another 0.2 percentage points since July while it expects the U.S. to grow by just 1.6% this year and 1% in 2023.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Mall: Tanger Outlets (SKT) rallied 5% after it hiked its quarterly dividend by 20% to $0.22/share, representing a forward yield of roughly 5.95%. For Tanger, it's the second dividend hike this year, but its payout remains well below the pre-pandemic quarterly rate of $0.36 paid in 2019. Elsewhere, Simon Property (SPG) advanced roughly 2% today after it announced a strategic partnership with Jamestown, a global real estate investment and management firm whereby Simon will acquire a 50% interest in Jamestown from founding partners Christoph and Ute Kahl, and the firm will continue to operate independently. Simon - which has looked outside the traditional mall sector for its investments over the past several years - commented that the partnership "will unlock new value creation opportunities and create a platform for future growth in the investment management sector."

Single-Family Rental & Apartments: Invitation Homes (INVH) advanced more than 2% today after reporting that it identified "limited damage" from Hurricane Ian on its homes and communities in Florida. Elsewhere, Camden Property (CPT) advanced about 1% after it announced that it expects to incur approximately $1.0 million in expenses during the third quarter of 2022 as a result of Hurricane Ian as these projected expenses relate primarily to cleanup and repairs for water intrusion, roofing, and landscaping at the company’s apartment communities in Florida and North Carolina. Relevant to the inflation outlook, the Bureau of Labor Statistics published a report this week which confirmed the significant lag in shelter inflation reporting in the CPI metrics - an issue that we've highlighted for several years. The BLS confirmed that rent inflation for new tenants leads the official BLS rent inflation by 4 quarters and noted, "As rent is the largest component of the CPI, this has implications for our understanding of inflation dynamics and guiding monetary policy."

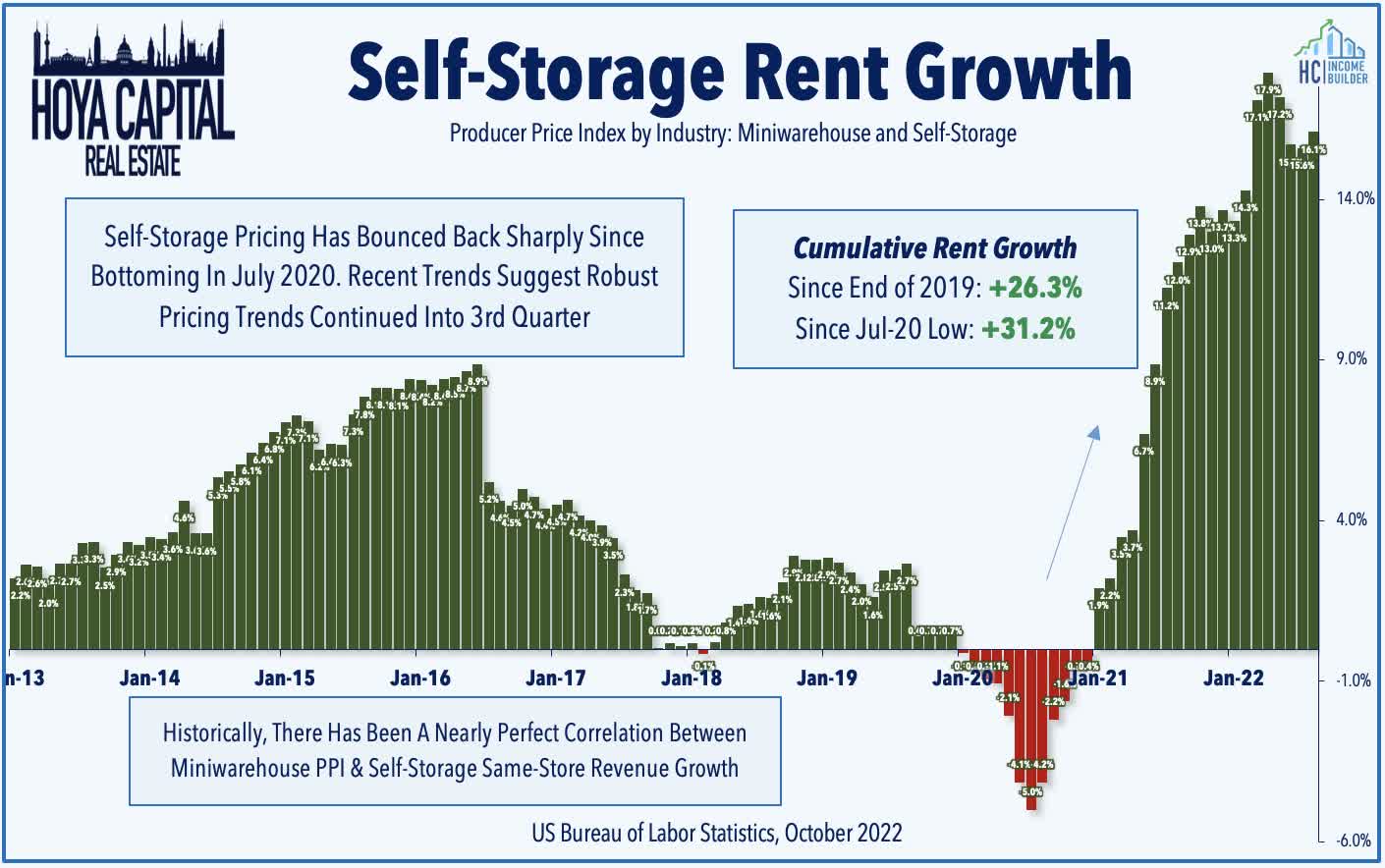

Storage: Yesterday we published Self-Storage REITs: Locked-In and Sticky which discussed how storage REITs have defied expectations to the upside as comprehensively as any real estate sector since the start of the pandemic, delivering earnings growth of over 50% since 2019. Incremental storage demand is driven by change - particularly home moving rates and household formations. Surging mortgage rates have had a "lock-in" effect among existing homeowners while also pricing-out new formations. While the rate-driven slowdown in housing market activity is expected to temper incremental storage demand, recent data and interim REIT updates have indicated "sticky" demand trends continued deep into the third quarter. Given the deeply discounted valuations, we like the risk/reward at these levels, given the strong balance sheets, low cap-ex needs, and operational track record.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, the sharp volatility continued for mortgage REITs as residential mREITs rallied nearly 8% while commercial mREITs gained 4%. Annaly Capital (NLY) surged nearly 12% after reporting that its Book Value Per Share "BVPS" was estimated at $19.85-$20.05 per share as of Sept. 30th - lower by roughly 15% in Q3 - which was "less bad" than the 40% decline in its stock price during that period. AGNC Investment (AGNC) rallied 11% after holding its dividend steady and reporting that its BVPS stood at $9.06-$9.10 on September 30 - lower by roughly 20% in Q3 compared to a 40% decline in its stock price. Dynex Capital (DX) advanced 6% after estimating its BVPS at $14.15-$14.45 at the end of Q3, down roughly 15% during the quarter.

Economic Data This Week

Inflation data highlight a busy week of economic data in the coming week ahead of the Fed's November meeting the first week of November. On Thursday, the BLS will report the Consumer Price Index which investors - and the Fed - are hoping to show that the fastest pace of year-over-year increases is finally behind us. The headline CPI is expected to moderate to an 8.1% year-over-year rate but the Core CPI is expected to accelerate slightly to 6.5% as the effects of the delayed recognition of housing inflation from 2021 continue to add upward pressure to the metrics. Consumer gas prices were, on average, 7% lower in September compared to the prior month but have since jumped by 8% from their bottom on September 18th. Earlier in the week on Wednesday, we'll see the Producer Price Index for September which is expected to exhibit similar trends of peaking price pressures. On Friday, we'll see Retail Sales data and get our first look at Michigan Consumer Sentiment for September. The Fed is particularly interested in the 5-Year Inflation Expectations survey, looking for signs of a potential "wage-price inflation spiral" through elevated consumer wage expectations.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.