Stocks Slide • Super Merger • Inflation Engrained?

- U.S. equity markets finished sharply lower Friday- giving back all of yesterday's rally - as another slate of disappointing economic data indicated that the window for a "soft landing" may be closing.

- Sliding back towards two-year lows after a late-session rally on Thursday, the S&P 500 declined 2.4% today while the tech-heavy Nasdaq 100 dipped 3.0%.

- Real estate equities remained under pressure today as the 10-Year Treasury Yield closed above 4% for the first time since 2008. The Equity and Mortgage REIT Index each dipped about 2.5%.

- A week of disappointingly-hot inflation data continued on Friday with the University of Michigan's consumer sentiment showing that inflation expectations accelerated in early October - reversing an encouraging trend of easing over the prior five months.

- Supermarket chain Kroger (KR) - the second-largest grocery chain - announced an agreement to merge with Albertsons (ACI)- the fourth-largest grocery chain in a $24.6 billion all-cash merger agreement. Kimco Realty (KIM) announced that it raised $300 million in a partial sale of its stake in Albertsons.

Income Builder Daily Recap

U.S. equity markets finished sharply lower Friday - giving back all of yesterday's seemingly unexplained rally - as another slate of disappointing economic data indicated that the potential window for an economic "soft landing" may be closing. Sliding back towards two-year lows after a late-session rally on Thursday, the S&P 500 declined 2.4% today - and roughly 1.5% for the week - while the tech-heavy Nasdaq 100 dipped 3.0%. Real estate equities remained under pressure today amid a continued rise in long-term interest rates with the 10-Year Treasury Yield closing above 4% for the first time since October 2008. The Equity REIT Index dipped 2.5% today with all 18 property sectors in negative territory while the Mortgage REIT Index slipped 2.7%. Homebuilders declined another 3.8%.

A week of disappointingly-hot inflation data continued on Friday with the University of Michigan's consumer sentiment showing that inflation expectations accelerated in early October - reversing an encouraging trend of easing over the prior five months. The Michigan Consumer Sentiment survey showed that one-year inflation expectations accelerated to 5.1% from 4.7% last month while the five-year inflation expectations metric drifted higher to 2.9% - but still below the 3.3% peak in June. The Fed is particularly interested in the 5-Year Inflation Expectations survey, looking for signs of a potential "wage-price inflation spiral" through elevated consumer wage expectations. The hotter-than-expected survey data follows similarly hot Consumer Price Index and Producer Price index data earlier in the week.

Also this morning, the Census Bureau reported that retail sales activity was flat in September - and slightly below estimates - as consumers pulled back spending on "big ticket" items amid the Fed-driven surge in financing costs and broader concerns over slowing economic growth. On a year-over-year basis, total retail sales were higher by 8.2% - below the 8.3% forecast - as lower spending at the gasoline station and on electronics and appliances was partially offset by an uptick in spending at department stores, restaurants, and the grocery store. We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook this weekend.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

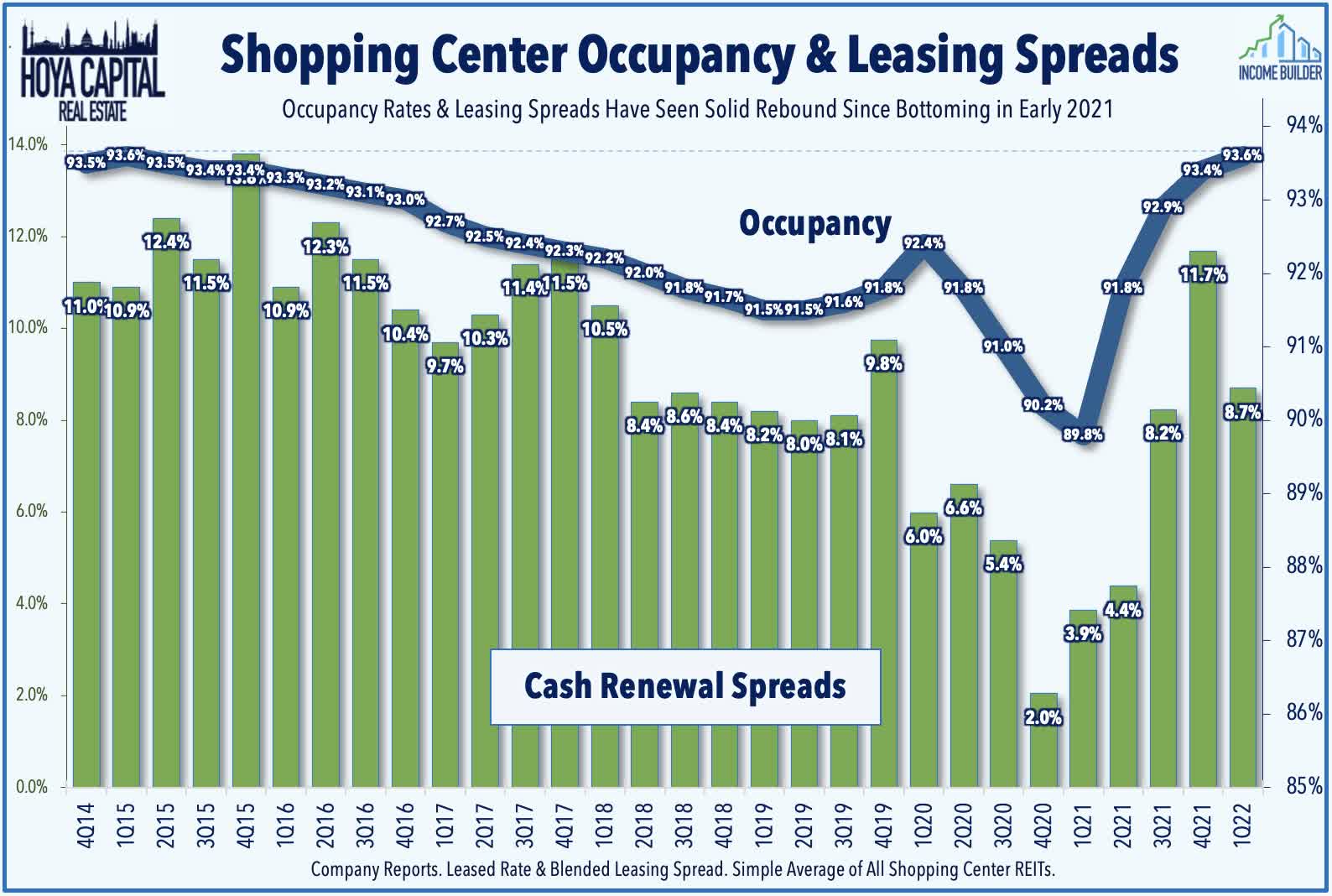

Shopping Center: Supermarket chain Kroger (KR) - the second-largest grocery chain - announced an agreement to merge with Albertsons (ACI)- the fourth-largest grocery chain in a $24.6 billion all-cash merger agreement. Following the deal announcement - which some analysts doubt will survive scrutiny from antitrust regulators - Kimco Realty (KIM) announced that it raised $300 million in a partial sale of its stake in Albertsons, selling 11.5 million of its 39.8 million shares in Albertsons, generating net proceeds of $301.1 million. Kimco still retains 28.3 million shares of Albertsons and agreed not to sell its shares in Albertsons for a period of up to seven months. After the lock-up expires, Kimco will have "full flexibility" over its Albertsons holdings, including the ability to further sell down its stake. Kimco now expects to pay a special dividend from its Albertsons investment. Unlike their mall REIT peers, Shopping Center REITs have enjoyed fundamentals that are as strong - or possibly even stronger - than before the pandemic.

Net Lease: Another day, another REIT dividend hike. Net Lease REIT Agree Realty (ADC) hiked its dividend for the second time this year, declaring a monthly cash dividend of $0.240 per common share, representing a 2.6% increase over its previous monthly dividend. Elsewhere, Service Properties Trust (SVC) continued yesterday's rally after it resumed its previously-suspended dividend at $0.20/share quarterly dividend, representing a dividend yield of 14.47%. We've now seen 111 REIT dividend hikes this year compared to 7 REIT dividend reductions.

Cell Tower: Yesterday we published Cell Tower REITs: 5G's Killer App. Cell Tower REITs have been slammed harder than any property sector over the past three months, weighed down by tech-related weakness and disruptive threats to the long-term competitive positioning. Concerns over emerging - and potentially competing - satellite technologies came to a head when Apple announced that its new iPhone lineup would be capable of sending text messages over satellite networks. Awed by impressive rocket launches, the market has overlooked more meaningful industry dynamics - the accelerated rollout of fixed wireless access ("FWA") - which have further solidified the competitive positioning of land-based wireless networks - a market that is effectively "cornered" by the three cell tower REITs.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were broadly-lower today, but held onto weekly gains after a flurry of preliminary Q3 results showed that conditions aren't quite as dire as some feared amid the worst year of returns for credit markets in history. Redwood Trust (RWT) gained 0.5% after it reported that its estimated Book Value Per Share ("BVPS") was $10.20 as of the end of Q3 - down just 5% during the quarter. Earlier in the week, Orchid Island (ORC) noted that its BVPS was lower by 21%, AGNC Investment's (AGNC) BVPS declined 20%, Two Harbors' (TWO) BVPS declined 19%, while Annaly Capital's (NLY) and Dynex Capital's (DX) BVPS each declined 15% in the quarter.

Economic Data This Week

We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook this weekend.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.