Earnings Ahead • U.K. Stability • China Consolidation

- U.S. equity markets rebounded Monday following a busy weekend of international political developments with hopes of U.K. economic stability and expectations of continued 'COVID-zero' policies in China after Xi's power consolidation.

- Ahead of a busy week of earnings reports and economic data, the S&P 500 advanced 1.2% today- adding to last week's rebound of nearly 5%-while the tech-heavy Nasdaq advanced 1.1%.

- Real estate equities were mixed today ahead of a busy two weeks of REIT earnings reports. The Equity REIT Index finished fractionally higher today with 10-of-18 property sectors in positive territory.

- Political instability in Europe and Asia has loomed over markets in recent weeks, and while the U.K. appears to be headed in the right direction with Rishi Sunak set to become Britain’s next PM, questions loom over China as Xi Jinping consolidated power with a third term.

- It'll be another jam-packed week of housing data, inflation reports, and corporate earnings results in the week ahead. The main event of the week comes on Thursday with third-quarter Gross Domestic Product. We'll hear reports from over 50 REITs this week as well.

Income Builder Daily Recap

U.S. equity markets rebounded Monday on a busy weekend of international political developments with hopes of U.K. economic stability and expectations of continued 'COVID-zero' policies in China after Xi's power consolidation. Adding to last week's rebound of nearly 5% ahead of a busy week of earnings reports and economic data, the S&P 500 advanced 1.2% today while the tech-heavy Nasdaq 100 advanced 1.1%. Real estate equities were mixed today as investors looked ahead to a busy two weeks of REIT earnings reports. Again led by the more 'pro-cyclical' property sectors, the Equity REIT Index finished fractionally higher today with 10-of-18 property sectors in positive territory while the Mortgage REIT Index advanced 0.2%.

As discussed in our Real Estate Weekly Outlook, political instability in Europe and Asia has loomed over markets in recent weeks, and while the U.K. appears to be headed in the right direction with former Treasury chief Rishi Sunak set to become Britain’s next prime minister, questions loom over China as Xi Jinping consolidated power with a third term as China's leader. Domestic politics may explain some of the recent market rebound amid recent polling that points towards a divided government in Washington. The 10-Year Treasury Yield climbed 2 basis points today to its highest close since 2007 while the US Dollar Index advanced 0.6% to near-two-decade highs. Nine of the eleven GICS equity sectors finished higher today with Healthcare (XLV) and Consumer Staples (XLP) stocks leading on the upside.

It'll be another jam-packed week of housing data, inflation reports, and corporate earnings results in the week ahead. The main event of the week comes on Thursday with third-quarter Gross Domestic Product data which is expected to show that the U.S. economy just barely returned to expansion during the summer after a first-half recession. The Atlanta Fed's GDPNow model forecasts growth of 2.9% from the prior quarter as the significant drag from residential fixed investment is expected to be offset by a short-term boost from higher net exports - a boost driven primarily by lower imports. On Wednesday and Friday, we'll see New Home Sales and Pending Home Sales data for September which are expected to echo the continued slowdown seen in Existing Sales and Housing Starts data this past week. We'll also see home price data on Tuesday with reports from Case Shiller and the FHFA which last month showed the first monthly decline in home prices since 2012. Finally, on Friday, we'll see another critical inflation report with the Core PCE Index - the Fed's preferred gauge of inflation - which has been one of the early indicators showing signs of peaking price pressures in recent months.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

As discussed in our Real Estate Earnings Preview, REIT earnings season kicks into gear this week with more than 50 REITs reporting results. Slammed by the historic surge in interest rates over the past six months, REITs enter third-quarter earnings season with the lowest valuations - and highest dividend yields - since the Financial Crisis. How REITs are responding to this higher rate environment – both on the acquisitions and the financing side - will be closely watched, as will commentary on movement in asset prices. We'll hear results this afternoon from Alexandria Real Estate (ARE), Sun Communities (SUI), PotlatchDeltic (PCH), and Universal Health (UHT).

Healthcare: This afternoon, we'll also publish an updated report on the Healthcare REIT sector to the Income Builder marketplace. The combination of sharply higher labor costs, a slow post-COVID recovery in patient volumes, and the waning of government fiscal support has pressured healthcare operators in recent months - particularly in the hospital and skilled nursing segments. Several REITs with high exposure to potentially troubled operators have been slammed in recent months - notably hospital owner Medical Properties Trust (MPW) - and has come into the cross-hairs of short-selling firms that believe rents may need to be reduced to keep several troubled operators alive. In the report, we'll analyze recent labor market and survey data which suggest that the worst of the labor pressures may be easing and provide our updated outlook and top ideas within the sector.

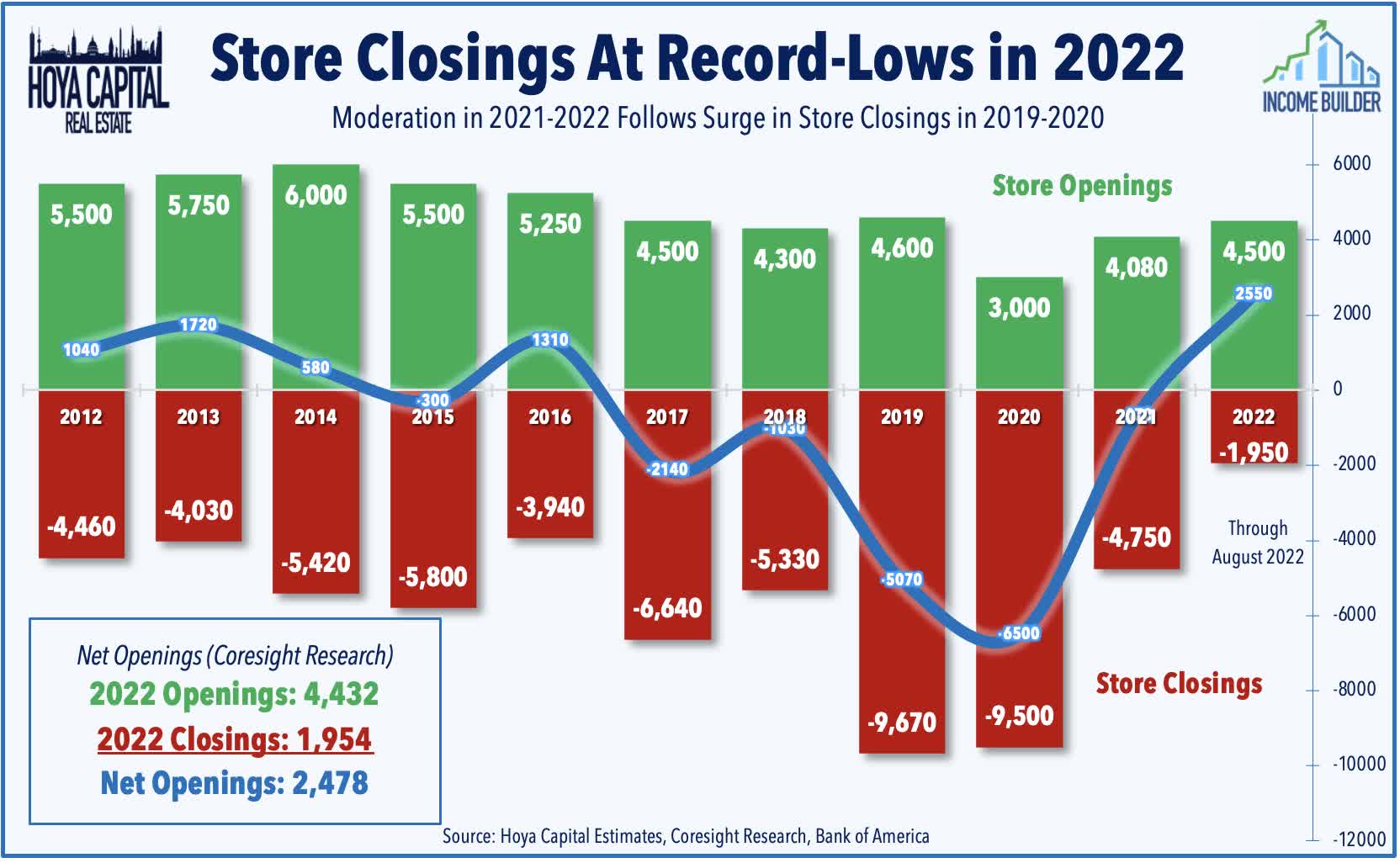

Shopping Centers: Last Friday afternoon, we published Shopping Center REITs: Bargain Hunting. Shopping Center REITs are one of the better-performing property sectors this year - significantly outpacing their mall REIT peers - as impressive earnings results and record-low store closings have offset looming recession concerns. The versatility and larger footprint of the strip center format have been a winning formula as retailers have increasingly utilized their brick-and-mortar properties as hybrid "distribution centers" in last-mile delivery networks. Critically, after a surge in store closings during the pandemic, the number of store openings has outpaced closings by nearly 2x since 2021 with particular strength in well-located strip centers. Results across the shopping center REIT sector have been as impressive as any property sector over the past three quarters with fundamentals that are stronger than before the pandemic.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were mixed today ahead of the start of earnings season this week with residential mREITs slipping 0.2% today while commercial mREITs gained 0.5%. As noted in our REIT Earnings Preview, over the past two weeks, we've heard preliminary results from ten mREITs which showed BVPS declines ranging from 4-20% in Q3, but BVPS declines have been more muted for credit-focused mREITs compared to pure-play agency-focused mREITs. We'll hear results from 15 mortgage REITs next week including AGNC Mortgage (AGNC) this afternoon, Rithm Capital (RITM) on Tuesday, Annaly (NLY) and Blackstone Mortgage (BXMT) on Wednesday, and Arbor Realty (ABR) on Friday.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.