Tech Wreck • REIT Earnings • Soft GDP Report

- U.S. equity markets finished mostly-lower Thursday, repeating a pattern from the prior session as disappointing results from mega-cap tech names were partially offset by a retreat in interest rates.

- Declining for a second-session but clinging to week-to-date gains of 1.5%, the S&P 500 retreated 0.6% today. The tech-heavy Nasdaq 100 dipped nearly 2% but Mid-Caps and Small-Caps finished higher.

- Real estate equities were upside leaders for a third day, lifted by a solid slate of earnings results and the retreat in longer-term interest rates with equity REITs advancing 0.1%.

- Hospital owner Medical Properties Trust (MPW) - a "battleground" REIT that has come into the cross-hairs of short-selling firms - rallied more than 7% today after reporting better-than-expected results and raising its full-year FFO growth target.

- Invitation Homes (INVH) slumped after reporting mixed results and trimming its full-year outlook, citing a hit from higher-than-expected property taxes and higher bad debt expense from renters who have fallen behind on their rent.

Income Builder Daily Recap

U.S. equity markets finished mostly lower Thursday, repeating a pattern from the prior session as disappointing results from mega-cap tech names were partially offset by a retreat in interest rates and bid for bonds. Declining for a second session but clinging to week-to-date gains of 1.5%, the S&P 500 retreated 0.6% today. The tech-heavy Nasdaq 100 dipped nearly 2% but the Mid-Cap 400 and Small-Cap 600 each finished higher. Real estate equities were upside leaders for a third day, driven by a solid slate of earnings results from healthcare, apartment, and retail REITs and lifted by the continued retreat in longer-term interest rates from multi-decade highs. The Equity REIT Index finished higher by 0.1% today with 10-of-18 property sectors in positive territory while the Mortgage REIT Index gained 0.8%.

Consistent with the "Bad News is Good News" theme, bonds caught a bid after a generally downbeat slate of economic data this morning, headlined by a GDP report that showed that the U.S. economy barely avoided a third-straight quarter of contraction - but the positive 2.6% growth was driven almost entirely by volatile balance-of-trade effects. The 10 Year Treasury Yield finished lower by another 8 basis points today to close at 3.94% - well below its recent intra-day highs of 4.30% last week - while the US Dollar Index rebounded after a two-day skid. Homebuilders rebounded as decent earning results offset GDP data showing a substantial drag on overall economic growth from the sharp slowdown in Residential Fixed Investment.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

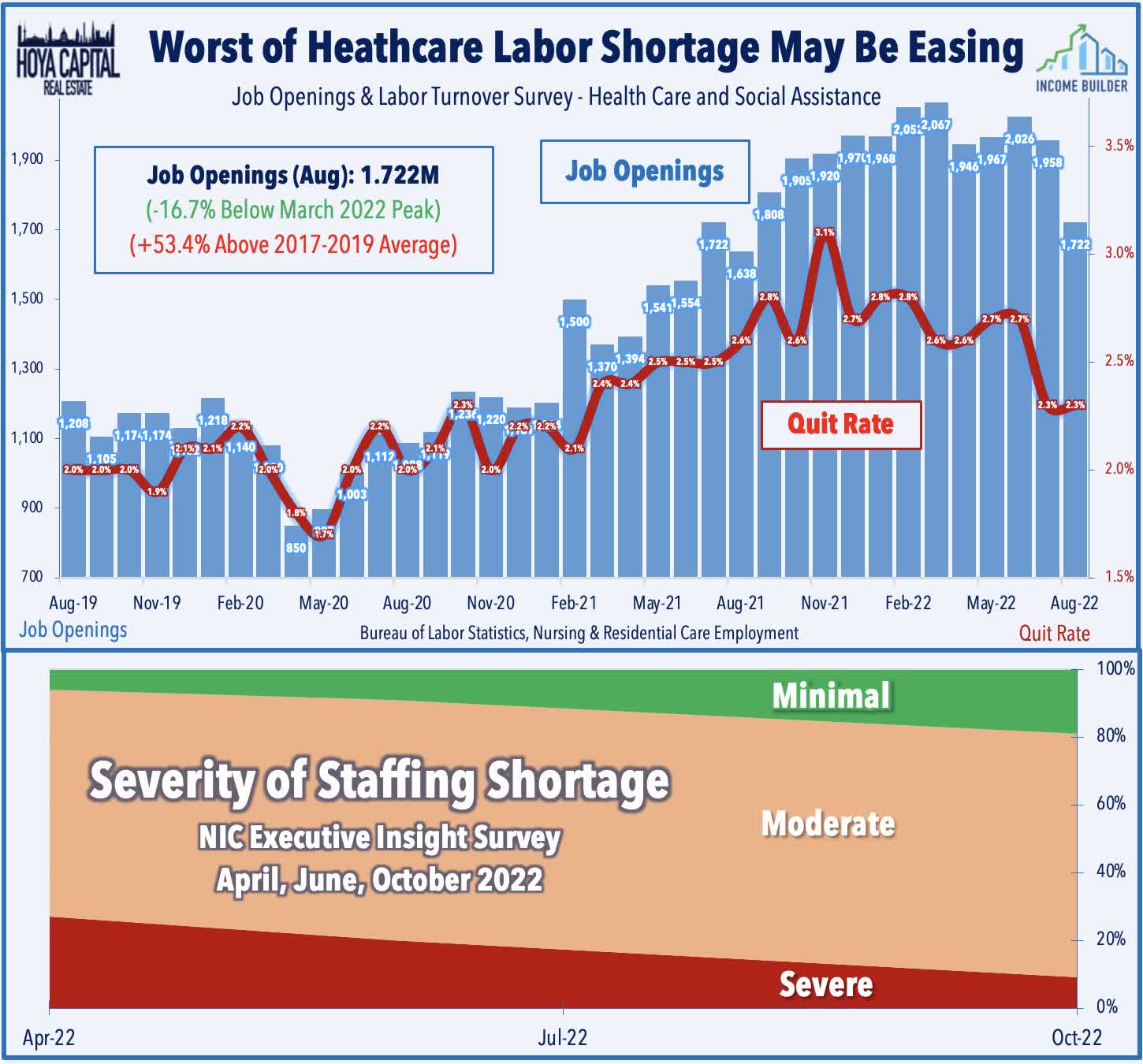

Healthcare: Hospital owner Medical Properties Trust (MPW) - which we own in the REIT Focused Income Portfolio - rallied more than 7% today after reporting better-than-expected results and raising its full-year FFO growth target. Citing improvement in operating performance at its hospital facilities and forecasted escalations in its CPI-linked leases, MPW raised its full-year FFO growth target to 3.4% - up 50 basis points from last quarter. In Healthcare REITs: Staffing Shortage Stumble, we analyzed why the sector has lagged over the past quarter as sharply higher labor costs, a sluggish post-COVID recovery in patient volumes, and the waning of government fiscal support have pressured operators. Hospital operators have been slammed particularly hard as elective surgeries continue to be either delayed or pushed to outpatient facilities, amplifying a broader industry shift towards low-cost healthcare settings - but noted that recent data suggests that the worst of the staffing shortage headwinds may be easing. We'll hear results this afternoon from LTC Properties (LTC).

Net Lease: Getty Realty (GTY) - which we also own in the REIT Focused Income Portfolio - was an upside standout with gains of more than 2% after reporting better-than-expected results and raising its full-year FFO outlook. GTY - which owns gas stations and adjacent convenience facilities - now sees FFO growth of 7.9% this year - up 80 basis points from its prior outlook. Getty also boosted its quarterly dividend by 4.9% to $0.43/share - the 120th REIT to raise its dividend this year. We'll hear results this afternoon from Netstreit (NTST) and Essentials Properties (EPRT) and we'll see results from WP Carey (WPC) tomorrow morning.

Apartments: Sunbelt-focused Mid-America (MAA) rallied nearly 2% today after reporting impressive results and raising its full-year FFO growth target higher by 330 basis points to 21.4%. Independence Realty (IRT) rallied more than 4% after reporting similarly strong results and boosting its full-year FFO target by 30 basis points to a sector-high 28.0%. Coastal-focused REITs, however, have delivered a more challenging quarter thus far with rent growth showing a more material deceleration. Essex Properties (ESS) slipped 3% after maintaining its full-year FFO outlook, but noting that blended spreads slowed to just 4.7% in October - down from 9.6% in Q3 and 15.4% in Q2. UDR Inc (UDR) finished roughly flat despite raising its full-year NOI and FFO growth targets. We'll hear results this afternoon from Camden Property (CPT) and Elme Communities (ELME).

Shopping Centers: Kimco Realty (KIM) advanced 1% after it raised its full-year FFO growth outlook to 14.5% - up 220 basis points from last quarter - driven by by an acceleration in blended leasing spreads to 7.5% and a 20 basis point sequential rise in occupancy to 95.3% KIM also hiked its quarterly dividend by another 4.5% to $0.23/share - its second dividend hike this year. Last Friday afternoon, we published Shopping Center REITs: Bargain Hunting which discussed why the versatility and larger footprint of the strip center format has been a winning formula as retailers have increasingly utilized their brick-and-mortar properties as hybrid "distribution centers" in last-mile delivery networks. Results across the shopping center REIT sector have been as impressive as any property sector over the past three quarters with fundamentals that are stronger than before the pandemic.

Single-Family Rental: Invitation Homes (INVH) slumped 7% today after reporting mixed results and trimming its full-year outlook, citing a hit from higher-than-expected property taxes and higher bad debt expense from renters who have fallen behind on their rent. While INVH reported impressive leasing spreads of nearly 12% in Q3, its rent collection rate dipped to 97% in Q3 - down 200 basis points from last quarter and its pre-COVID average of 99% - consistent with signs of stress across the broader economy amid historically high levels of inflation. We'll see results from American Homes (AMH) next Thursday and Tricon Residential (TCN) the following week.

Data Center: Digital Realty (DLR) finished roughly flat today after reporting mixed results - highlighted on the upside by a record-level of leasing volume - but offset by softer renewal rent growth. During the quarter, DLR signed total bookings expected to generate $176M of annualized GAAP rental revenue - its strongest quarter of bookings on record. Rental rates on renewal leases signed during the quarter rolled down 0.5% on a cash basis - down from the 3.3% average in the first half of 2022. Foreign currency headwinds prompted a downward revision to its full-year FFO growth target, which is now expected to rise 3.0% this year - down from the 4.1% outlook last quarter. We'll hear results from Equinix (EQIX) next Wednesday.

Homebuilders: MDC Holdings (MDC) finished slightly higher today after reporting better-than-expected top-line revenue growth of 12% in the quarter, but noting a considerable slowdown in new order demand amid the historic surge in mortgage rates. Results from the ten homebuilders that have reported results over the past month have shown that while the existing pipeline of previous orders has kept homebuilding revenues and EPS near record-high levels, the surge in mortgage rates has led to a sharp drop-off in new orders - lower by over 35% year-over-year in Q3 - and a surge in cancellation rates, which jumped to nearly 25% during the quarter. Positively, builders still have more than six months worth of backlog to work through at the current sales pace - which should help to buffer the immediate downside pressure on revenues and earnings metrics.

Cell Tower: American Tower (AMT) advanced 1% today after reporting decent results, but revising down its full-year FFO target, citing negative FX effects and a drag from deferred rent payments from Vodafone India - which is undergoing a government-backed restructuring. AMT noted that it expects Vodafone to "revert back to 100% payment at the start of 2023 and repay outstanding pass-through balances." AMT did revise its full-year revenue growth target higher by 80 basis points, however, driven by strong "organic" rent growth in the U.S. and in its Latin America and Africa markets. Of note, AMT did not provide 2023 guidance but did comment that it expects 2023 to be a "challenging year" given the headwind from rising interest rates which will "certainly will take us off of our target AFFO growth" but noted that property-level fundamentals - rent growth and leasing volumes - should continue to "accelerate" into 2024. SBA Communications (SBAC) will round out earnings results for the sector next Wednesday.

As discussed in our Real Estate Earnings Preview, earnings season kicked into gear this week with more than 50 REITs reporting results. Slammed by the historic surge in interest rates over the past six months, REITs enter third-quarter earnings season with the lowest valuations - and highest dividend yields - since the Financial Crisis. In addition to the aforementioned reports, we'll hear results this afternoon from office REITs Corporate Office (OFC) and Office Properties Income (OPI); casino REITs VICI Properties (VICI) and Gaming & Leisure Properties (GLPI); self-storage REIT CubeSmart (CUBE), and industrial REIT STAG Industrial (STAG). Timber REIT Weyerhaeuser (WY) will report results on Friday morning.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs continued to rally today as earnings results thus far have been significantly better than expected. Annaly Capital (NLY) - the largest mortgage REIT - rallied 1.5% after reporting better-than-expected EPS results and reducing its economic leverage while confirming that its preliminary Book Value Per Share ("BVPS") declined 15% in the quarter - consistent with its update in early October. Armour Residential (ARR) surged nearly 4% after reporting a similar beat on the bottom line with adjusted EPS of $0.32 - covering its $0.30 quarterly dividend - while confirming that its BVPS dipped 19% in Q3. Seven Hills (SEVN) - a commercial mREIT that lends at floating rates - advanced after reporting that its BVPS increased 0.1% in Q3. We'll hear results over the next 24 hours from Ladder Capital (LADR), Orchid Island (ORC), PennyMac (PMT), and Redwoood Trust (RWT).

Economic Data This Week

The busy week of economic data wraps up on Friday with another critical inflation report. The Core PCE Index - the Fed's preferred gauge of inflation - which has been one of the early indicators showing signs of peaking price pressures in recent months, but is expected to reacelerate to a 5.2% year-over-year rate, up from 4.9% last month. We'll also see Pending Home Sales data and a second look at Michigan Consumer Sentiment for October.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.