Fed Not Done • Stocks Slide • REIT Earnings

- U.S. equity markets declined for a third-day Wednesday after the Federal Reserve hiked rates by another 75 basis points while Chair Powell noted that rates will head "higher than previously expected."

- Pulling back for a third day following its best week since November 2020, the S&P 500 declined 2.5% today while the tech-heavy Nasdaq 100 dipped 3.4%.

- Real estate equities were under similar pressure amid the busiest stretch of earnings season. Equity REITs finished lower by 2.8% today while Mortgage REITs pulled-back 2.4%. Homebuilders declined 2.9%.

- Net Lease REIT National Retail (NNN) was among the better-performers today after it reported better-than-expected results and raised its full-year FFO growth outlook to 9.4% - up 120 basis points from its prior outlook. Brixmor (BRX) also reported impressive results and hiked its dividend by 8%.

- Storage REIT ExtraSpace (EXR) dipped after lowering its full-year FFO and NOI growth outlook by 70 basis points each, citing a combination of expense pressures and slower demand. Public Storage (PSA) was also under pressure despite raising its full-year outlook.

Income Builder Daily Recap

U.S. equity markets declined for a third-day Wednesday after the Federal Reserve hiked rates by another 75 basis points while Chair Powell noted that the "ultimate level" of rates will be "higher than previously expected.” Pulling back for a third day following its best week since November 2020, the S&P 500 declined 2.5% today while the tech-heavy Nasdaq 100 dipped 3.4%. The Mid-Cap 400 and Small-Cap 600 each finished off by 3%. Despite the rate hike and hawkish rhetoric, the 10-Year Treasury Yield was little-changed today. Real estate equities were under similar pressure amid the busiest stretch of earnings season. The Equity REIT Index finished lower by 2.8% today with all 18 property sectors in negative territory while the Mortgage REIT Index declined 2.4%.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Net Lease: National Retail (NNN) - the second-largest net lease REIT - was among the better-performers today after it reported better-than-expected results and raised its full-year FFO growth outlook to 9.4% - up 120 basis points from its prior outlook. Of note, while NNN continued to plow ahead with acquisitions, it noted some upward "velocity" in cap rate since the last Fed rate hike remaking that cap rates have risen about 25-40 basis points "in the last month or so." Agree Realty (ADC) slipped about 3% after reporting mixed results while slightly raising the midpoint of its acquisitions guidance. Four Corners (FCPT) and Postal Realty (PSTL) were each roughly flat after reporting in-line results. We'll hear results this afternoon from Realty Income (O), EPR Properties (EPR), Broadstone (BNL).

Storage: Following a strong start to storage REIT earnings season last week with a "beat and raise" report from CubeSmart (CUBE), results yesterday from ExtraSpace (EXR) raised concern that storage demand in some markets may be moderating faster than previously expected. EXR dipped nearly 10% after lowering its full-year FFO and NOI growth outlook by 70 basis points each, citing a combination of expense pressures and slower demand. Public Storage (PSA) also dipped 7% despite reporting strong results and raising its full-year growth outlook. PSA now sees FFO growth of 20.5% this year - up 150 basis points from its prior outlook. We'll hear results this afternoon from Life Storage (LSI) and National Storage (NSA).

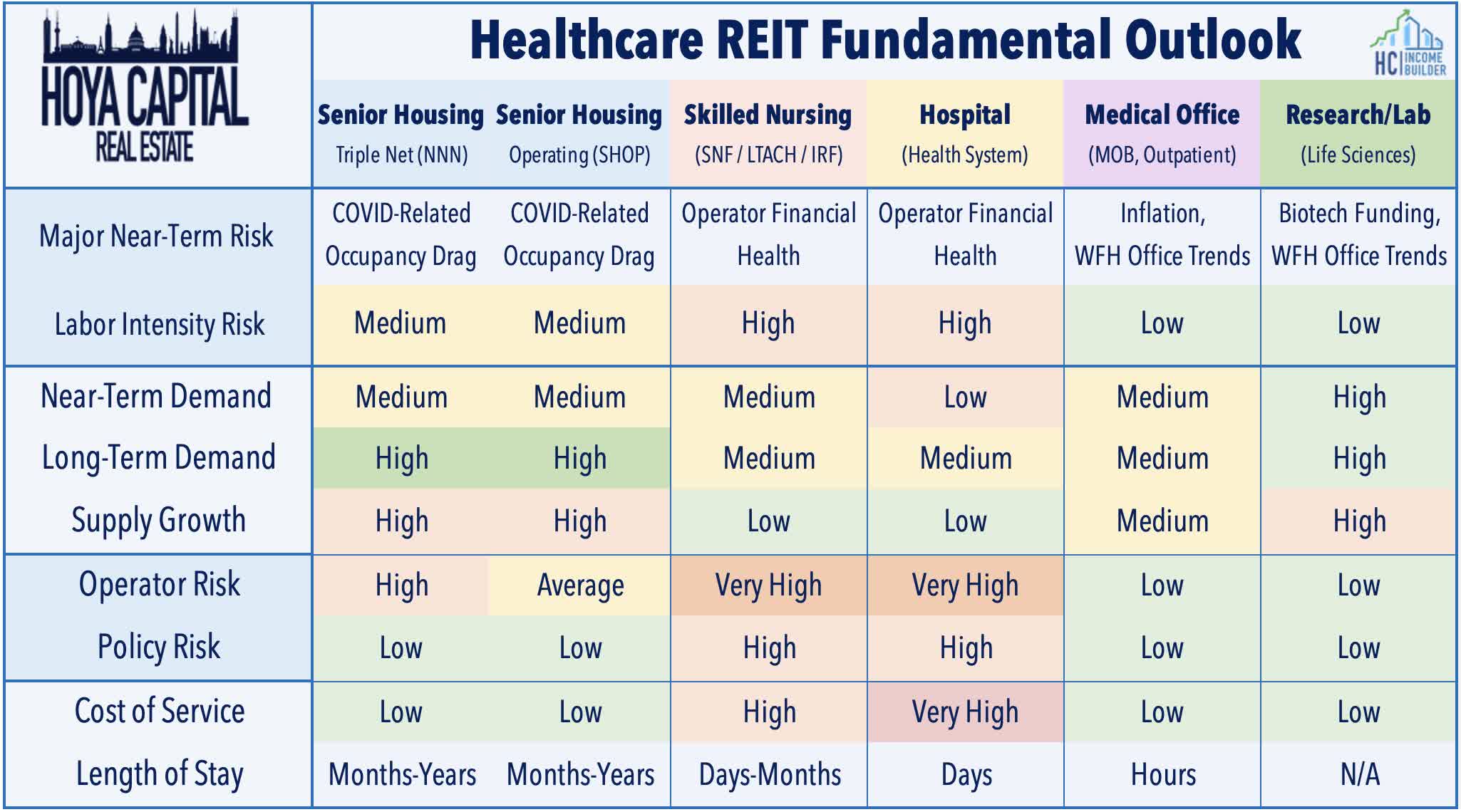

Healthcare: HealthPeak (PEAK) was among the leaders today after reporting solid results and raising its full-year FFO and NOI growth outlook, driven by strong performance in its Medical Office and Life Science sub-segments, but offset by weakness in its senior housing portfolio. Community Healthcare (CHCT) was the top-performing REIT today with gains of 2.1% after reporting better-than-expected results driven by an improvement in occupancy rates and a "continued pickup" in leasing activity. We'll hear results this afternoon from Omega Healthcare (OHI), Global Medical (GMRE), and Diversified Healthcare (DHC).

Shopping Center: We heard results from four shopping center REITs yesterday afternoon - Brixmor (BRX), Whitestone (WSR), InvenTrust (IVT), and Acadia (AKR) - each of which raised their full-year FFO growth target as the strong earning season for the shopping center sector continued. Results from BRX were the strongest of the group, highlighted by an acceleration in leasing spreads to 14.2% - its strongest since 2019 and record portfolio-wide occupancy driven by a 110 basis point small-shop occupancy gain. BRX also raised its quarterly dividend by 8.3% to $0.26 per share. We'll hear results this afternoon from Kite Realty (KRG), RPT Realty (RPT).

Office: Today we published Office REITs: Power to the Workers on the Income Builder Marketplace. Pressured by the painfully slow “return to the office” with daily utilization rates still 50% below pre-pandemic norms, Office REITs are the among worst-performing property sectors this year. Office leasing activity and REIT earnings results have been surprisingly resilient, but corporations won't pay for half-empty space indefinitely and have been leveraging softening market conditions to extract generous concessions. With labor markets still historically tight, employees are still dictating the terms of the "Work from Home" dynamic, especially in coastal markets with long commutes where WFH benefits outweigh costs. Counterintuitively, a recession could be a net positive for the typically pro-cyclical office sector as firms increasingly utilize office mandates as part of a workforce reduction strategy, driving utilization rates closer to pre-pandemic levels.

We'll hear results this afternoon from Hudson Pacific (HPP), Piedmont (PDM), and Orion (ONL).Last Friday we published REIT Earnings Halftime Report. At the halfway point of earnings season, of the 41 REITs that have provided full-year Funds From Operations ("FFO") guidance, 28 REITs (67%) raised their outlook while just 4 REITs (10%) have lowered their outlook. Solid results from REITs come amid an otherwise disappointing earnings season for the broader equity market as, per FactSet, just 48% of S&P 500 companies have boosted their outlook. In addition to the aforementioned reports, we'll hear results from nearly two dozen REITs this afternoon including apartment REIT Veris Residential (VRE), mall REIT Tanger Outlets (SKT) hotel REITs Park Hotels (PK), Braemar Hotels (BHR), and RLJ Lodging (RLJ), along with cannabis REIT Innovative Industrial (IIPR).

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were under pressure today after the FOMC press conference. Rithm Capital (RITM) was among the better-performers today after reporting decent results, noting that its Book Value Per Share ("BVPS") declined just 1% to $12.10 - the most muted decline among residential mREITs so far this earnings season. TPG Real Estate (TRTX) slumped more than 14% today after reporting that its BVPS dipped more than 10% in Q3, the steepest decline among commercial mREITs thus far. Brightspire (BRSP) and Ares Commercial (ACRE) each declined about 3% after reporting that their BVPS declined about 3% and 2%, respectively, during the quarter. We'll hear results this afternoon from Invesco Mortgage (IVR), Cherry Hill Mortgage (CHMI), and New York Mortgage (NYMT).

Economic Data This Week

The jam-packed week of economic data and corporate earnings continues with Jobless Claims data on Thursday and the BLS Nonfarm Payrolls report on Friday. Economists are looking for job growth of roughly 200k in October - which would be the smallest gain since December 2020 - and for the unemployment rate to tick higher to 3.60%. 'Good news is bad news' will likely be the theme of these reports as investors and the Fed look for signs of the long-awaited cooldown in job growth which has yet to fully materialize. Purchasing Managers' Index ("PMI") data will continue to be a major market focus - particularly in Europe and Asia - as recent reports have dipped below the breakeven 50-level.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.