Red Ripple • Stocks Dip • REIT Earnings Wrap

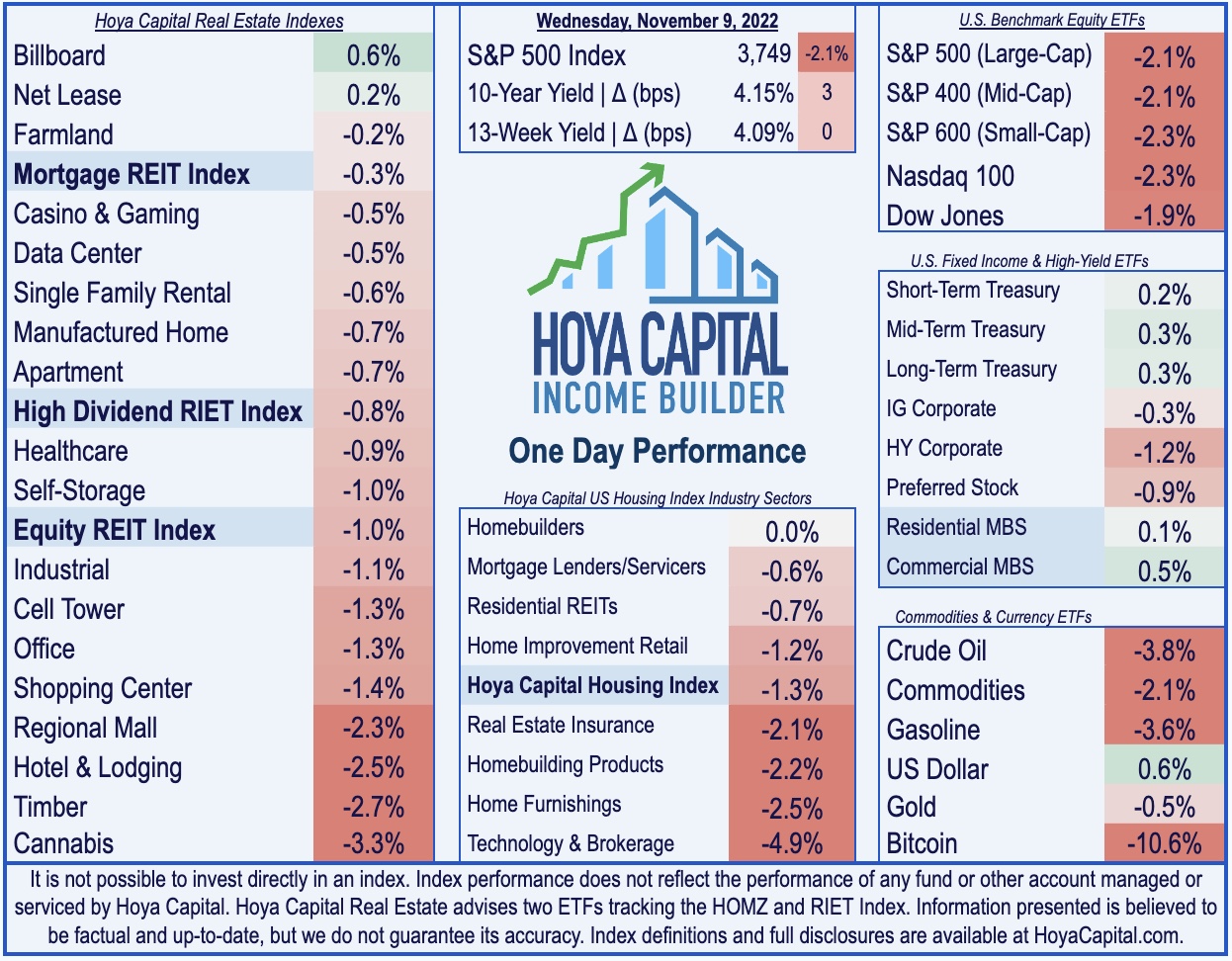

- U.S. equity markets fell sharply Wednesday as investors parsed Election Day that failed to show the forecasted "Red Wave" with ultimate control of the Senate and House still undeclared.

- Snapping a three-day winning streak and erasing its weekly gains, the S&P 500 dipped by 2.1% today while the tech-heavy Nasdaq 100 declined 2.3%.

- Real estate equities were among the stronger performers amid the final stretch of earnings season. Equity REITs slipped 1.0% while Mortgage REITs declined 0.3%.

- Bitcoin dipped more than 10% today -extending its weekly plunge to over 25% - as the largest crypto exchange FTX remains on the brink of insolvency following a dropped bailout bid from its rival Binance.

- Single-family rental REIT Tricon Residential (TCN) and net lease REIT Spirit Realty (SRC) were among the best performers today after raising their full-year earnings outlook.

Income Builder Daily Recap

U.S. equity markets fell sharply Wednesday as investors parsed Election Day that failed to show the forecasted "Red Wave" with ultimate control of the Senate and House still undeclared. Snapping a three-day winning streak and erasing its weekly gains, the S&P 500 dipped by 2.1% today while the tech-heavy Nasdaq 100 declined 2.3%. Bitcoin dipped more than 10% today -extending its weekly plunge to over 25% - as the largest crypto exchange FTX remains on the brink of insolvency following a dropped bailout bid from its rival Binance. Real estate equities were among the stronger performers amid the final stretch of earnings season with a handful of strong reports. The Equity REIT Index finished lower by 1.0% today with 2-of-18 property sectors in positive territory while the Mortgage REIT Index slipped 0.3%.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Net Lease: Spirit Realty (SRC) rallied more than 2% after rounding-out net lease REIT earnings season with a strong report and raising its full-year outlook. Spirit raised its full-year FFO growth outlook by 30 basis points to 7.6% - one of eight net lease REITs to raise their full-year outlook this earnings season. Of note, Spirit commented that it's seeing cap rates that are 150 basis points higher than a year ago - but seeing more "spread widening" among industrial assets than on retail assets.

Single-Family Rental: Tricon Residential (TCN) was among the best performers today with gains of over 2% after reporting strong results and raising its full-year FFO and NOI outlook. Following a pair of fairly downbeat results from its larger peers - American Homes (AMH) and Invitation Homes (INVH) - TCN significantly boosted its full-year FFO outlook by 880 basis points to 17.5% driven in part by performance fee earned from the sale of its U.S. multi-family portfolio. Providing further color, TCN commented, “the fundamentals of our SFR business are rock solid.. underscoring the resilience of the single-family rental business in a much higher rate environment where it’s never been more compelling to rent versus own a home."

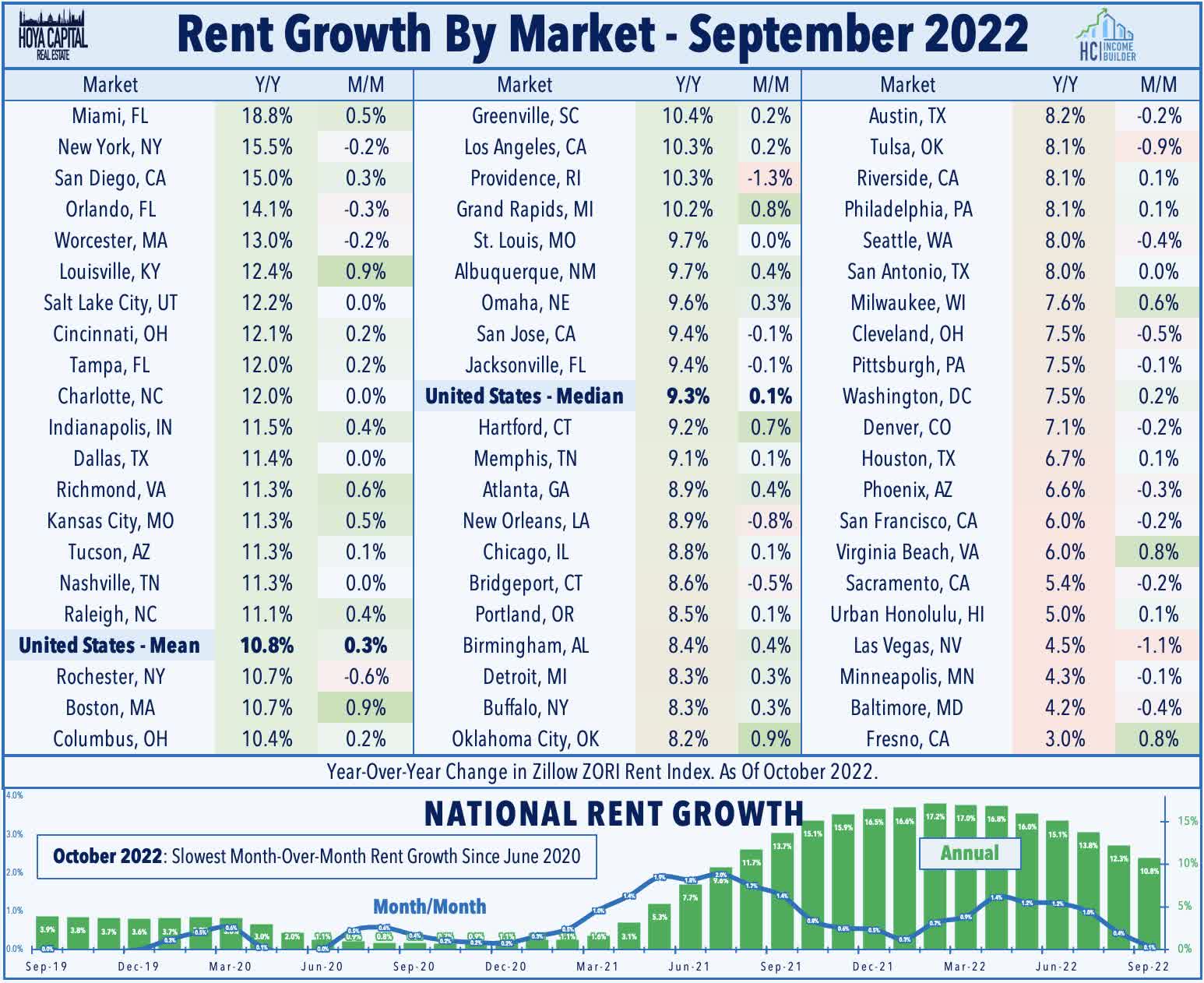

Apartments: Today, we published Apartment REITs: Roaring Rents Begin To Ease. Pressured by the broader housing cooldown, Apartment REITs have been among the weaker-performing property sectors over the past quarter despite achieving record-setting rent growth throughout the summer. While the era of 20% rent increases on new leases is over, there remains significant “embedded” rent growth in below-market renewals that should power another year of impressive growth in 2023. The importance of regional selectivity is again becoming a key factor, and we’re seeing a return to the “Sunbelt outperformance” theme with all four Sunbelt-focused REITs raising their outlook this earnings season. In the report, we discussed our updated outlook and new apartment REIT position.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs finished lower today as earnings season wrapped-up with a handful of reports. Two Harbors (TWO) rallied more than 5% after reporting that its Book Value Per Share ("BVPS") declined by roughly 19% in Q3 to $16.42 - consistent with preliminary results provided in early October. Starwood Property (STWD) finished roughly flat after reporting in-line results and noting that its BVPS increased about 1% during the quarter to $21.69. Granite Point (GPMT) dipped more than 14% after reporting an uptick in credit losses and noting that its BVPS declined 5% to $15.24 - among the steeper declines among commercial mREITs this quarter. Lument Finance (LFT) was also a laggard today after reporting disappointing results. Ellington Residential (EARN) and Franklin BSP (FBRT) report results this afternoon.

Economic Data This Week

Inflation data highlights this week's economic calendar with the Consumer Price Index report on Thursday which investors - and the Fed - are hoping to show that the fastest pace of year-over-year increases is finally behind us. The headline CPI is expected to moderate to an 8.0% year-over-year rate while the Core CPI is expected to decelerate slightly to 6.5%. Consumer gas prices were, on average, 3% higher in October compared to the prior month and 15.9% above the prior month. The other major market-moving event of the week comes on Tuesday with Election Day in the United States. On Friday, we'll get our first look at Michigan Consumer Sentiment for September. The Fed is particularly interested in the 5-Year Inflation Expectations survey, looking for signs of a potential "wage-price inflation spiral" through elevated consumer wage expectations.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.