Yields Retreat • Home Sales Rebound • Happy Thanksgiving

- U.S. equity markets finished higher Wednesday while the benchmark 10-Year Yield fell to its lowest-level since early October following a mixed slate of economic data and Fed minutes hinting at a potential pivot.

- Closing at its highest level in two months, the S&P 500 advanced 0.6% today - extending its gains on the holiday-shortened week to 1.6%.

- Real estate equities were mixed today despite the retreat in interest rates as the Equity REIT Index gained 0.1% with 7-of-18 property sectors in positive territory. Mortgage REITs advanced 0.4%.

- Alongside Fed minutes showing that several officials backed the need to moderate the pace of rate hikes, disappointing jobless claims data and weaker-than-expected PMI data this morning kept downward pressure on long-term interest rates.

- There was a bit of good news on the economic data front, however, with New Home Sales topping estimates in the face of sharply higher mortgage rates. Sales in October rose 7.5% to a seasonally-adjusted annual rate of 632,000. Supply levels of newly-completed homes remained near record-lows in October at just 1.6 months.

Income Builder Daily Recap

U.S. equity markets finished mostly higher Wednesday while the benchmark 10-Year Yield fell to its lowest level since early October following a mixed slate of economic data and Fed minutes hinting at a potential pivot. Closing at its highest level in two months, the S&P 500 advanced 0.6% today - extending its gains on the holiday-shortened week to 1.6% - while the tech-heavy Nasdaq 100 finished higher by 1.0% today. Real estate equities were mixed today despite the retreat in interest rates as the Equity REIT Index gained 0.1% with 7-of-18 property sectors in positive territory while the Mortgage REIT Index gained 0.4%. Homebuilders rallied 2% after surprisingly solid New Home Sales data and another retreat in mortgage rates.

Alongside Fed minutes showing that several officials backed the need to moderate the pace of rate hikes, disappointing jobless claims data and weaker-than-expected PMI data this morning kept downward pressure on long-term interest rates with the 10-Year Treasury Yield slipping another 5 basis points to close at 3.71% - the lowest close since October 3rd - while the US Dollar Index fell nearly 1%. The Cboe Volatility Index (VIX) fell to its lowest level in more than three months. There was a bit of good news on the economic data front, however, with New Home Sales topping estimates in the face of sharply higher mortgage rates. Sales in October rose 7.5% to a seasonally-adjusted annual rate of 632,000. Supply levels of newly-completed homes remained near record-lows in October at just 1.6 months. Since peaking earlier this month above 7%, the 30-Year Mortgage Rate has receeded by 50 basis points, averaging 6.58% in the Freddie Mac Index this week.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Manufactured Housing: UMH Properties (UMH) - which we own in the REIT Focused Income Portfolio - announced that it closed on an acquisition of a manufactured home community in Canton, OH for $19.1 million. The community contains 321 developed homesites, of which 77% are occupied and is situated on approximately 170 acres. The acquisition brings UMH's full-year acquisition total to 1,226 sites for a total purchase price of $63 million. With just over a month to go in 2022, the record-breaking nine-year streak of outperformance for the Manufactured Housing REIT sector is in jeopardy with MH REITs training the broader REIT Index by about 4 percentage points.

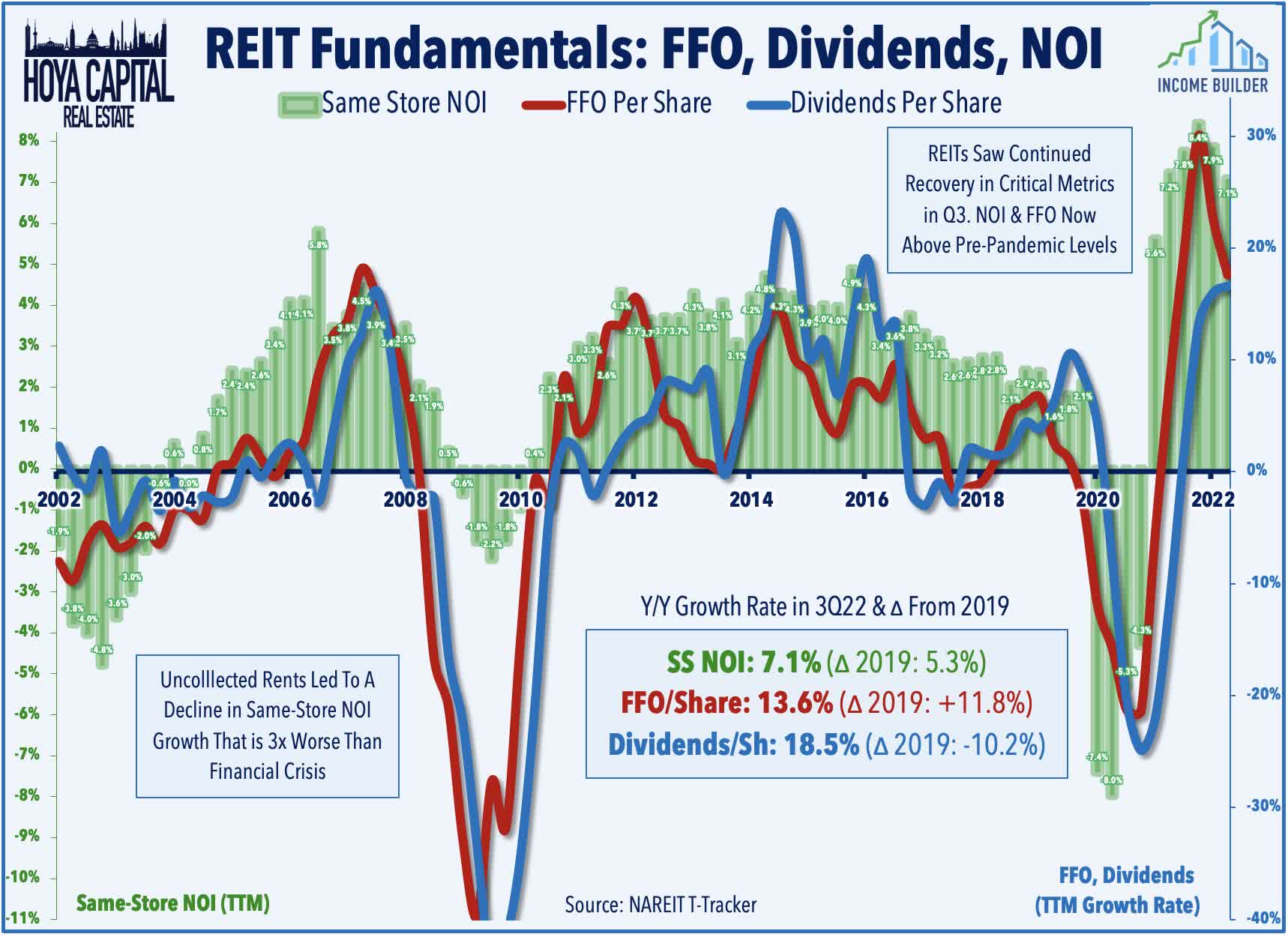

Yesterday we published our State of the REIT Nation Report, which analyzes high-level commercial real estate fundamentals. Of note, private real estate markets are finally "catching up" to the reality of sharply higher interest rates which have been reflected in public real estate markets for several quarters. Green Street Advisors' data shows that private-market values of commercial real estate properties have dipped nearly 13% over the past six months after a historically sharp 8% decline in October alone. Due to conservative balance sheet management over the past decade, REITs have been able to "hunker down" during this period of rising rates - avoiding the type of dilutive and high-cost capital raises that were necessary during the Financial Crisis. Obscured by the macro narrative, REIT property-level fundamentals have remained quite strong in recent quarters.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were mixed today with residential mREITs advancing 0.7% while commercial mREITs slipped 0.1%. On a slow day of newsflow before the Thanksgiving holiday, upside leaders included AGNC Investment (AGNC), ACRES Realty (ACRE), and Arlington Asset (AAIC) while Angel Oak (AOMR) and Hannon Armstrong (HASI) were the laggards.

Last week, we published Mortgage REITs: High Yields Are Fine, For Now. Mortgage REITs - which were left for dead amid a historically brutal year across fixed-income markets - have rebounded in recent weeks as earnings results were not as catastrophic as feared. Mortgage REITs are now outperforming Equity REITs for the year, and we continue to see value in a modest allocation towards higher-quality mREITs in a balanced income-focused real estate portfolio. Despite paying average dividend yields in the mid-teens, the majority of mREITs were able to cover their dividends as improved earnings power from wider investment spreads offset book value declines, but we flagged a handful of mREITs with payout ratios above 100% of EPS.

Economic Data This Week

We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook this weekend.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.