Bank Rescue • Stocks Stabilize • REIT Dividend Hikes

- U.S. equity markets rebounded Thursday after a consortium of U.S. banks collaborated on a rescue package for regional lender First Republic in a bid to stave off further financial contagion.

- Continuing the seesaw action of the past week, the S&P 500 rebounded by 1.8% today, while the tech-heavy Nasdaq 100 rallied by 2.6%. The Dow gained 372 points.

- Real estate equities lagged today as benchmark interest rates rebounded following a 50 basis point rate hike from the European Central Bank. Equity REITs declined 0.2%, but Mortgage REITs advanced.

- Another day, another handful of REIT dividend hikes. Park Hotels (PK) boosted its quarterly dividend to $0.15/share, a 25% boost from its prior rate of $0.12/share and apartment REIT Equity Residential (EQR) hiked its dividend by 6% to $0.66/share.

- Mortgage REIT New York Mortgage (NYMT) surged more than 6% after announcing an upside stock buyback program to repurchase up to $250M in common stock and $100M in preferred stock.

Income Builder Daily Recap

U.S. equity markets rebounded Thursday after a consortium of U.S. banks collaborated on a rescue package for regional lender First Republic in a bid to stave off further financial contagion. Continuing the seesaw action of the past week, the S&P 500 rebounded by 1.8% today, while the tech-heavy Nasdaq 100 rallied by 2.6%. The Dow gained 372 points. Real estate equities lagged today as benchmark interest rates rebounded following a 50 basis point rate hike from the European Central Bank. The Equity REIT Index declined 0.2% today with 13-of-18 property sectors in negative territory, but the Mortgage REIT Index gained 0.2%. Homebuilders rallied following better-than-expected home construction data and a retreat in mortgage rates.

Despite having one of the continent's largest banks on the brink, the European Central Bank went forward with its telegraphed 50 basis point rate hike, which sparked a rebound in global benchmark interest rates. After experiencing its sharpest three-day decline in history earlier this week, the policy-sensitive 2-Year Treasury Yield jumped 25 basis points today to close back above 4.15% while the 10-Year Treasury Yield rebounded to 3.59%. Stronger-than-expected jobless claims data also contributed to the "risk-on" action as both initial and continuing claims eased after a bounce in the prior week. The Crude Oil benchmark stabilized around its lowest levels since 2021 while ten of the eleven GICS equity sectors finished higher on the day, with Technology (XLK) and Financials (XLF) stocks leading on the upside.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Apartment: Midwest-focused Centerspace (CSR) slumped about 2% after it announced a $144.3M deal to sell nine communities totaling 1,567 homes located in Minnesota and Nebraska, representing about 10% of its portfolio. CSR - which has a Debt Ratio of around 45% which is well above the apartment REIT average of 28% - plans to use the proceeds to pay down outstanding debt and extend maturities. CEO Mark Decker commented, "This is another step in our strategy to boost the quality of our homes, earnings power of the company, and flexibility of our balance sheet." CSR has underperformed its peers this year after reporting downbeat Q4 results and providing guidance calling for a 1% decline in FFO in 2023, which came amid an otherwise impressive earnings season across the apartment sector.

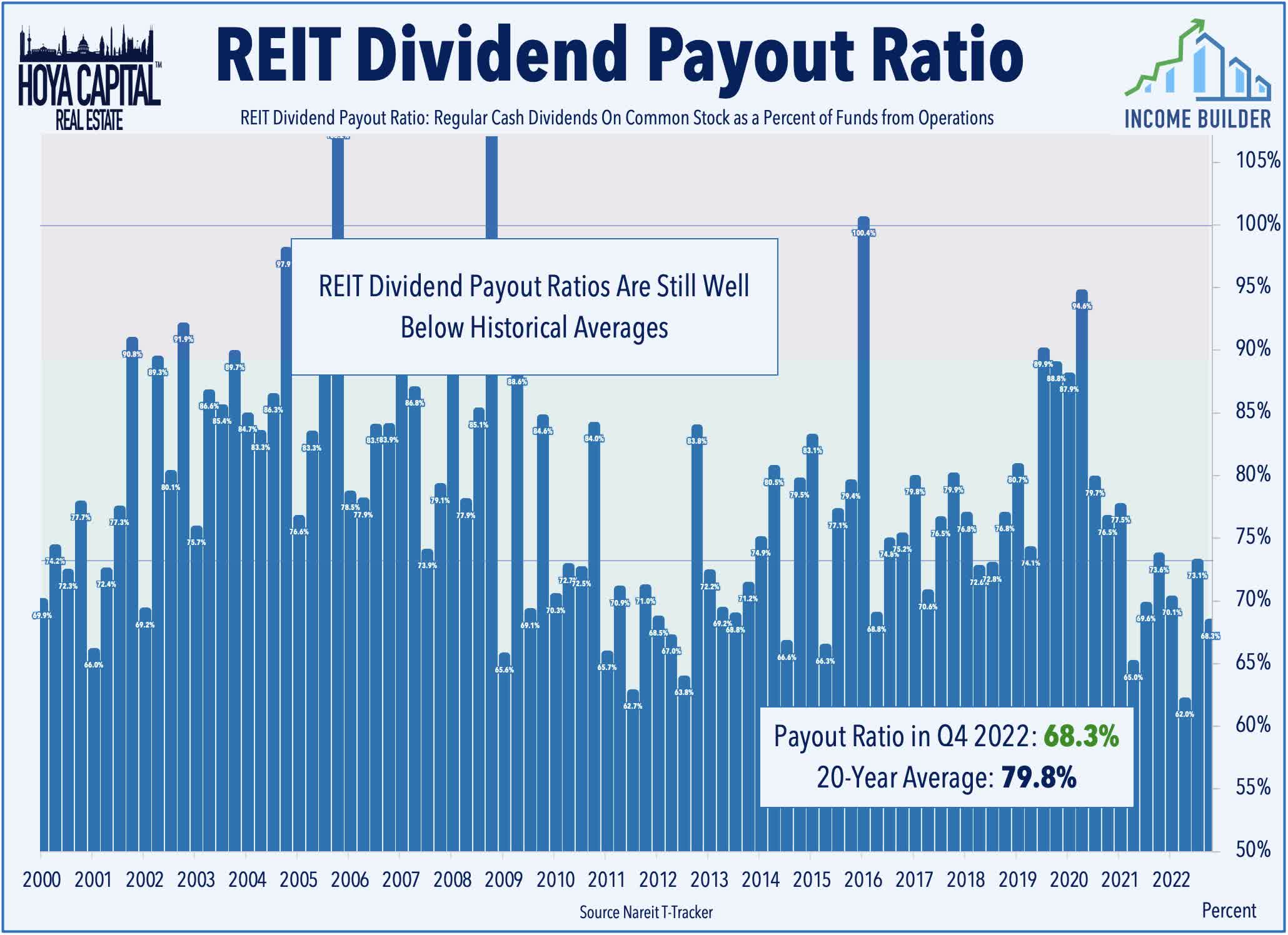

Another day, another handful of REIT dividend hikes. Park Hotels (PK) boosted its quarterly dividend to $0.15/share, a 25% boost from its prior rate of $0.12/share. After the close today, apartment REIT Equity Residential (EQR) hiked its dividend by 6% to $0.6625/share. We've now seen 40 REITs hike their dividends this year, while eight REITs have lowered their payouts. Earlier this week, we published our State of the REIT Nation examined high-level REIT fundamentals to chart the likely path forward for the real estate industry amid the recent turmoil. Owing to the harsh lessons from the Great Financial Crisis, most REITs have been exceedingly conservative with their balance sheet and strategic decisions, ceding ground to higher-levered private-market players. With the exception of office, malls, and some sub-sectors of healthcare and mortgage REITs, fundamentals across the REIT industry are stronger than before the pandemic. REIT FFO is 10% above pre-pandemic-levels while dividend coverage remains historically strong.

Additional Headlines from The Daily REITBeat on Income Builder

- Cousins Properties (CUZ) announced that SVB Financial is current on its lease through March 2023, which is projected to generate approximately $700,000 in straight-line revenue.

- BA/ML downgraded hospital-focused Medical Properties Trust (MPW) to Neutral from Buy

- Morningstar upgraded timber REITs Rayonier (RYN) and Weyerhauser (WY) to Buy from Hold

Mortgage REIT Daily Recap

Today we published Mortgage REITs: High-Yield Opportunities on the Income Builder marketplace, which discussed our updated outlook on the sector and recent allocations in our Focused Income Portfolio. Mortgage REITs have been slammed by the fallout of the ongoing regional banking crisis amid a resurgence of interest rate volatility and credit concerns, erasing their once-robust gains for 2023. Commercial mREIT exposure to the troubled office sector has come into focus following a wave of mega-sized loan defaults from over-levered private owners. For Residential mREITs, Book Values remain in decent-shape as MBS spread-widening has been more-than-offset by a decline in benchmark rates, but sharp changes in rates heighten the hedge-related risk. Despite paying average dividend yields in the low-teens, the majority of mortgage REITs are still able to cover their dividends, but we identified several mREITs that are most at-risk of dividend reductions and broader risk factors.

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs finished broadly lower today with residential mREITs slipping 2.1% while commercial mREITs dipped 4.1%. New York Mortgage (NYMT) surged more than 6% after announcing an upside stock buyback program to repurchase up to $250M in common stock and $100M in preferred stock. The three mREITs that declared dividends over the past 24 hours have held their dividends steady: Ladder Capital (LADR) held its quarterly dividend steady at $0.23/share, representing a yield of 10.0%. Elsewhere, AG Mortgage (MITT) held its quarterly dividend steady at $0.18/share, representing a yield of 14.1% while Broadmark Realty (BRMK) held its monthly dividend consistent at $0.035/share, representing a yield of 9.43%.

Economic Data This Week

The busy week of inflation, retail, and the U.S. housing market data continues on Thursday with Housing Starts and Building Permits as well as the closely-watched weekly Jobless Claims report. On Friday, we'll get the first look at March Consumer Confidence data from the University of Michigan.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.