Blackstone Infusion • Jobs Week • REIT Dividend Hike

- U.S. equity markets declined Tuesday- a choppy start to 2023 following the worst year for markets in a decade- while benchmark interest rates retreated ahead of a critical slate of employment data.

- Coming off declines of nearly 20% last year, the S&P 500 slipped by 0.4% today while the tech-heavy Nasdaq 100 dipped 0.7% after plunging by over 30% in 2022.

- Real estate equities started the year on the right foot, however, with the Equity REIT Index finishing higher by 0.1% today with 10-of-18 property sectors in positive territory.

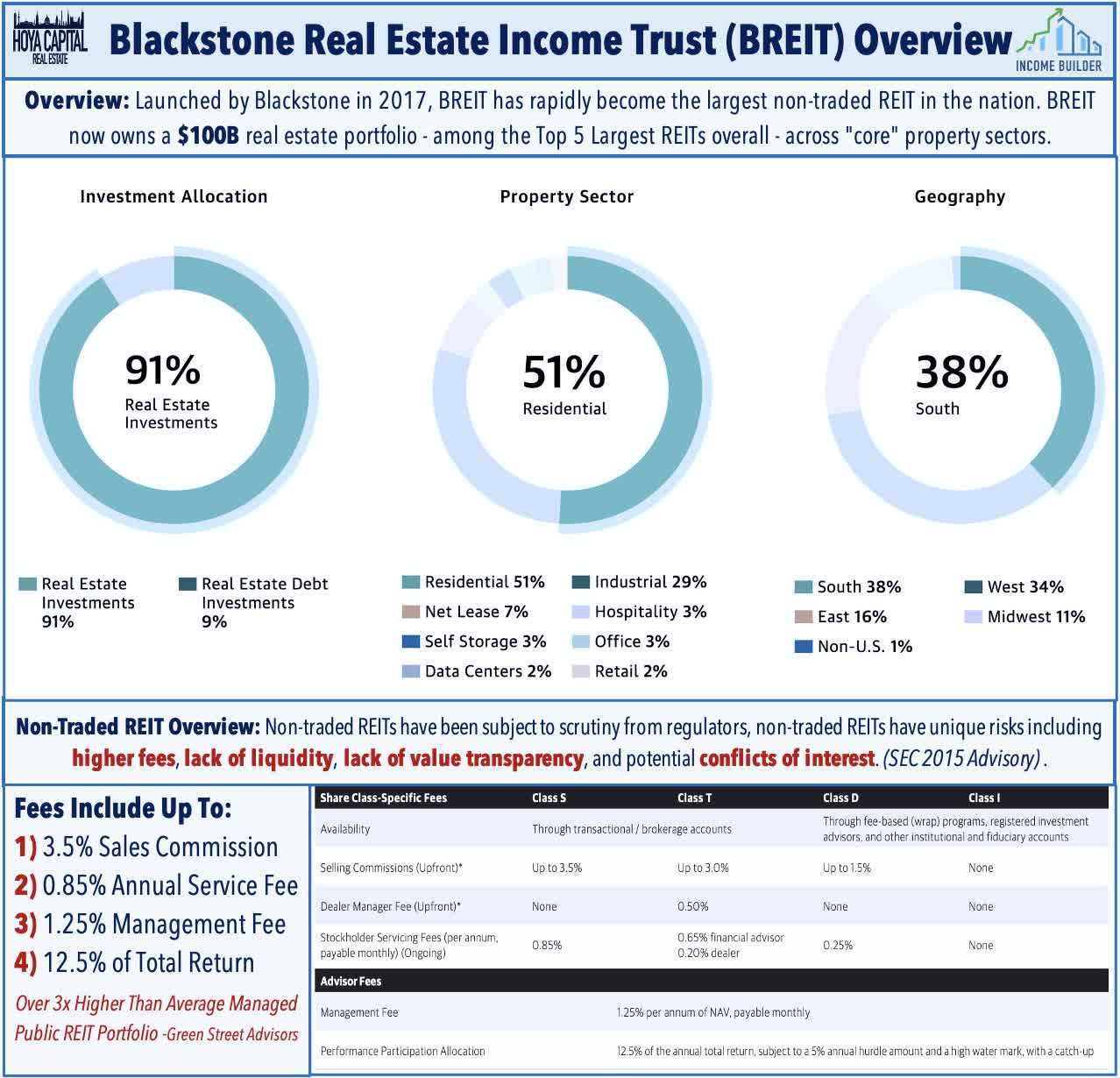

- Blackstone (BX) announced this morning that it received a $4B cash infusion from the University of California for its privately-traded real estate fund BREIT, which was forced in December to limit investor redemptions after receiving a wave of withdrawals that exceeded its quarterly limits.

- After more than 125 REITs raised their dividends in 2022, it didn't take long to see the first REIT dividend hike of 2023. Life Storage (LSI) - which hiked its dividend twice last year - boosted its quarterly payout by 11.1%.

Income Builder Daily Recap

U.S. equity markets declined Tuesday - a choppy start to 2023 following the worst year for financial markets in a decade - while benchmark interest rates retreated ahead of a critical slate of employment data. Coming off declines of nearly 20% last year, the S&P 500 slipped by 0.4% today while the tech-heavy Nasdaq 100 dipped 0.7%. Real estate equities started the year on the right foot, however, with the Equity REIT Index finishing higher by 0.1% today with 10-of-18 property sectors in positive territory, while the Mortgage REIT Index rallied 1.9% and the Homebuilders Index advanced 1.6%.

A departure from the "inflation trade" that dominated last year, performance patterns on the first trading session were more consistent with a "risk off" theme with the 10-Year Treasury Yield (US10Y) dipping 9 basis points today while Crude Oil prices dipped more than 3% - each retreating from their highest levels in two months last week. The U.S. Dollar Index rebounded by nearly 1% after dipping to six-month lows last week. Technology stocks were among the laggards today after Apple (AAPL) told suppliers to make fewer components for some of its products because of withering demand while Tesla (TSLA) dipped after fourth-quarter deliveries missed estimates.

As noted in our Real Estate Weekly Outlook, employment data highlights a critical holiday-shortened week of economic data in the week ahead headlined by JOLTS data on Wednesday, ADP Payrolls and Jobless Claims data on Thursday and the BLS Nonfarm Payrolls report on Friday. Economists are looking for job growth of roughly 200k in December - which would be the smallest gain since December 2020 - and for the unemployment rate to stay steady at 3.7%. 'Good news is bad news' will likely be the theme of these reports as investors and the Fed await the long-awaited cooldown in labor markets which has yet to fully materialize. Strong job gains observed in the BLS' nonfarm establishment survey, however, have been at odds with most other employment metrics showing a more material slowdown in hiring including the BLS' household survey in the same report which showed a second-straight month of net job declines last month.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Blackstone (BX) announced this morning that it received a $4B cash infusion from the University of California for its privately-traded real estate fund BREIT, which was forced in December to limit investor redemptions after receiving a wave of withdrawals that exceeded its quarterly limits. The strategic venture will be formed through a two-part deal, in which UC Investments will acquire $4B of BREIT class I stock at the January 1 public offering price. In exchange, the agreement ensures that the University of California receives a minimum annualized net return of 11.25% over the six-year holding period of its investment via a $1B backstop by Blackstone, which in turn will receive a 5% cash promote payment from UC Investments on any returns received in excess of the specified minimum, in addition to the existing management and incentive fees borne by all holders of Class I shares of BREIT.

Storage: After more than 125 REITs raised their dividends in 2022, it didn't take long to see the first REIT dividend hike of 2023. Life Storage (LSI) - which hiked its dividend twice last year - boosted its quarterly payout by 11.1% to $1.20/share, representing a forward yield of roughly 4.90%. In our State of the REIT Nation report last month, we noted that REIT payout ratio ratios - currently averaging below 70% of FFO - remain below the long-term historical averages, implying that REITs have significant 'embedded' dividend growth that should be unlocked over the coming quarters.

Additional Headlines from The Daily REITBeat on Income Builder

- We're excited to announce that Armada ETF Advisors is a new contributing author on Income Builder. Members now receive access to Armada's insights and analysis focused on residential REITs. Read their recent reports and follow their Seeking Alpha page here.

- Digital Realty (DLR) announced Matt Mercier has been named Chief Financial Officer effective January 1, 2023 as he succeeds Andrew Power who was recently named Chief Executive Officer

- Jefferies upgraded National Retail (NNN) and Healthpeak (PEAK) to Buy from Hold. SMBC Nikko upgraded Terreno (TRNO) and Ventas (VTR) to Outperform from Neutral.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were broadly higher today with residential mREITs advancing 2.8% while commercial mREITs gained 1.3%. On a quiet day of mREIT newsflow, Angel Oak (AOMR) and Chimera (CIM) - each among the laggards last year - led the gains to the upside today while Sachem Capital (SACH) and Hannon Armstrong (HASI) lagged today. Last month, we published Mortgage REITs: High Yields Are Fine, For Now, which noted that despite paying average dividend yields in the mid-teens, the majority of mREITs have been able to cover their dividends, but we flagged a handful of mREITs with payout ratios above 100% of EPS.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.