Double-Digit Inflation • Stocks Rebound China COVID Lockdowns

- U.S. equity markets rebounded Tuesday ahead of the closely-watched Fed decision tomorrow as energy prices pulled back sharply after China announced a new set of sweeping COVID lockdowns.

- Bouncing back from declines of 0.7% on Monday which was the lowest close since June 2021, the S&P 500 rallied 2.1% today while the tech-heavy Nasdaq 100 gained 3.1%.

- Real estate equities were broadly higher today as well with the Equity REIT Index gaining 0.7% with 17-of-19 property sectors in positive territory while Mortgage REITs gained 0.7%.

- The BLS reported this morning that Producer Prices soared at a 10.0% annual rate in March - the highest annual inflation rate on record. The monthly increase of 0.8% in March and an upwardly revised 1.2% in February were the largest month-over-month increases since 2009.

- Another day, another wave of REIT dividend hikes. Three more equity REITs and two more mortgage REITs hiked their dividends over the last 24 hours including office REIT Paramount, healthcare REIT CareTrust, and casino REIT MGM Growth Properties.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets rebounded Tuesday ahead of the closely-watched Fed decision tomorrow as energy prices pulled back sharply after China announced a new set of sweeping COVID lockdowns. Bouncing back from declines of 0.7% on Monday which was the lowest close since June 2021, the S&P 500 rallied 2.1% today while the tech-heavy Nasdaq 100 gained 3.1% after dipping into "bear market" territory yesterday. Real estate equities were broadly higher today as well with the Equity REIT Index gaining 0.7% with 17-of-19 property sectors in positive territory while Mortgage REITs gained 0.7%.

Renewed COVID concerns in China amid a surge in new cases weighed on the energy demand outlook, pulling WTI Crude Oil (CL1:COM) lower by another 8% today back below $95/barrel - a nearly 30% plunge from its highs last week above $130. Ten of the eleven GICS equity sectors were higher today, led to the upside by Technology (XLK) and Consumer Discretionary (XLK) while homebuilders and the broader Hoya Capital Housing Index also delivered a strong day ahead of a busy slate of housing data over the next three days.

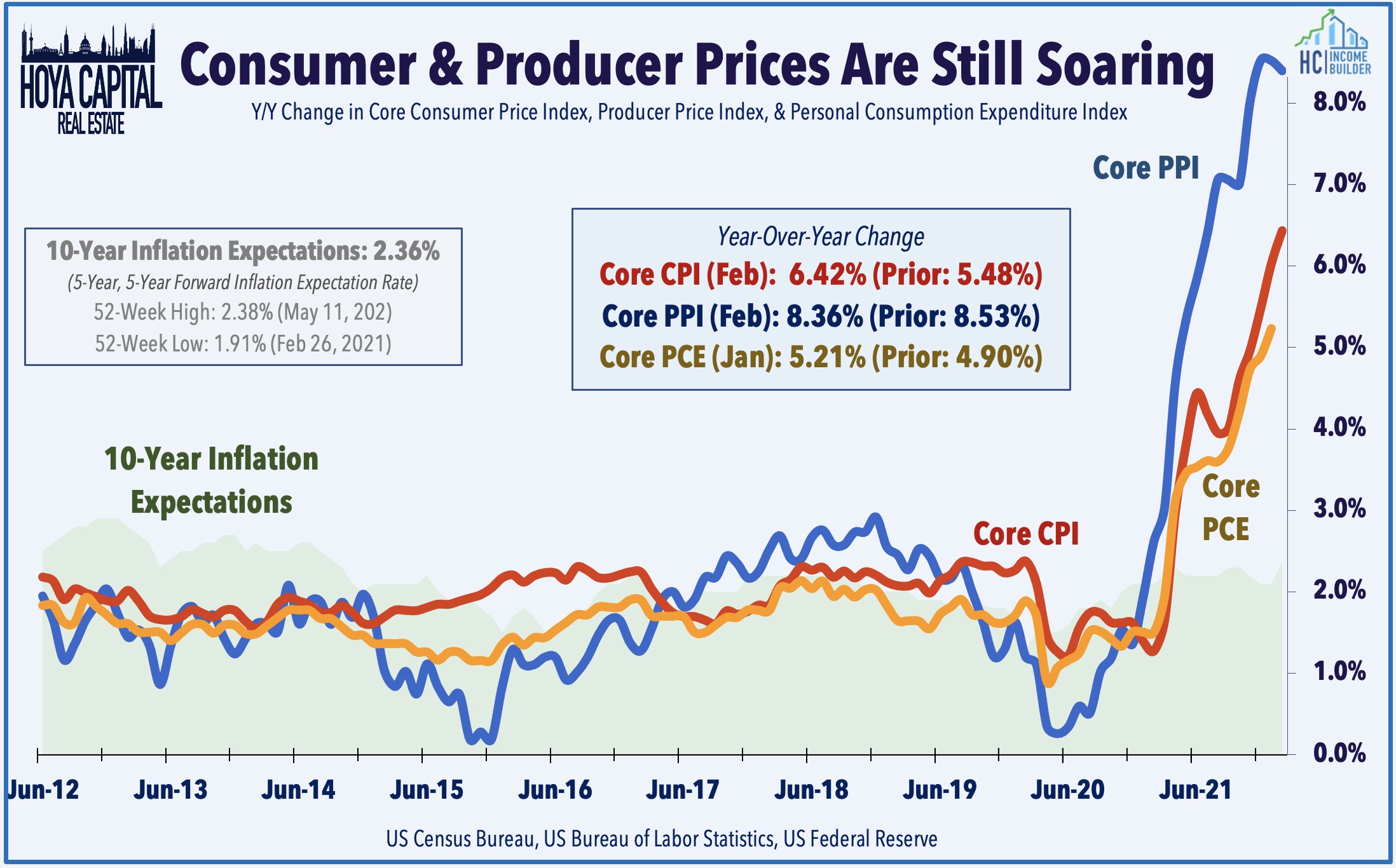

Inflation remains relentless ahead of the Fed's rate hike decision on Wednesday afternoon. The BLS reported this morning that Producer Prices soared at a 10.0% annual rate in March - the highest annual inflation rate on record. The monthly increase of 0.8% in March and an upwardly revised 1.2% in February were the largest month-over-month increases since 2009 with two-thirds of the increase due to the cost of energy. Amid the red-hot headline number, there were some pockets of cooling as Core PPI - which excludes food and energy - came in below estimates at 8.4% on an annual basis with just an 0.2% month-over-month increase, its smallest in six months.

Real Estate Daily Recap

Another day, another wave of REIT dividend hikes. Three more equity REITs and two more mortgage REITs hiked their dividends over the last 24 hours. Office REIT Paramount (PGRE) hiked its dividend by 10.7% to $0.0775, healthcare REIT CareTrust (CTRE) increased its payout by 3.8% to $0.275, and casino REIT MGM Growth Properties (MGP) increased its dividend by 1% to $0.53. We've now seen 50 equity REITs and 7 mortgage REITs hike their dividends so far in 2022, a faster pace than the record year in 2021.

Mall: Pennsylvania REIT (PEI) dipped more than 10% after reporting Q4 results yesterday afternoon. PREIT recorded its first quarter of positive FFO since before the pandemic, but its full-year FFO remained negative for a second-straight year. While the company noted improving portfolio metrics with a solid 290 basis point sequential rise in occupancy to 93.2% and flat renewal pricing after nearly four straight years of negative spreads, investors wonder if it's "too little too late" as interest expenses on debt service accounted for 43% of revenues in 2021, up from 32% in 2020 and the firm reiterated that its credit facility prevents the payment of dividends with the exception of those needed to maintain its REIT status.

Timber & Farmland: Yesterday, we published an updated report on the Timber & Farmland REIT sector on Hoya Capital Income Builder. Amid the ongoing conflict with Russia - which is among the world's largest exporters of agriculture, gasoline, and timber products - the importance and value of North American production in these key commodities will become especially evident. While the significance of Russian oil and natural gas production has been the key focus of politicians and consumers alike as gasoline prices soared to record-highs, Russia is also the world’s largest exporter of lumber - primarily softwoods - and the seventh-largest exporter of forestry products. Meanwhile, earning its name as the "Breadbasket of Europe," more than a quarter of the world’s wheat exports come from Russia and Ukraine. We'll discuss key themes, recent earnings results, and our updated outlook.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, residential mREITs finished higher by 0.5% today while commercial mREITs gained 0.8%. Redwood Trust (RWT) rallied more than 2% after it announced a 9.5% dividend hike to $0.23/share. BrightSpire Capital (BRSP) gained 1.5% after raising its dividend by 5.6% to $0.19/share. The average residential mREIT pays a dividend yield of 11.34% while the average commercial mREIT pays a dividend yield of 7.67%. We'll hear results this afternoon from Cherry Hill (CHMI), Lument Finance (LFT), and Angel Oak (AOMR).

Economic Data This Week

The jam-packed week of economic data continues on Wednesday with Retail Sales data, which is expected to show an uptick in February, buoyed by rising prices. The busy slate of housing data also kicks off on Wednesday with the Homebuilder Sentiment. On Thursday, we'll see Housing Starts and Building Permits and on Friday we'll see Existing Home Sales data which are each expected to show steady strength behind the housing industry despite the jump in mortgage rates. The most closely-watched event of the week, however, comes on Wednesday with the Federal Reserve's FOMC Meeting in which the committee is widely expected to announce a 25 basis point rate hike, but investors will be parsing the Fed's comments to evaluate the updated pace of tightening.

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.