Fed Hikes • Peace Talks • Retail Sales

- U.S. equity markets rallied Wednesday after the Federal Reserve hiked interest rates for the first time since 2018 and indicated an aggressive stance to combat inflation while conveying an optimistic outlook.

- Adding to yesterday's gains of more than 2%, the S&P 500 rallied another 2.0% today while the tech-heavy Nasdaq 100 gained 3.7%, posting its strongest two-day rally since November 2020.

- Real estate equities were broadly higher today with the Equity REIT Index gaining 1.2% with 18-of-19 property sectors in positive territory while Mortgage REITs advanced 1.0%.

- Retail sales rose at a slower pace than expected in February but estimates for January were revised sharply higher as the year-over-year growth remained impressive at nearly 18%.

- Net lease REIT Realty Income (O) advanced today after becoming the 51st equity REIT to raise its dividend this year. Angel Oak (AOMR) - the newest mortgage REIT that went public last year - soared 15% after reporting strong results.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets rallied Wednesday after the Federal Reserve hiked interest rates for the first time since 2018 and indicated an aggressive stance to combat inflation while conveying an optimistic outlook for economic growth. Adding to yesterday's gains of more than 2%, the S&P 500 rallied another 2.0% today while the tech-heavy Nasdaq 100 gained 3.7% - posting its strongest two-day rally since November 2020. Real estate equities were broadly higher today with the Equity REIT Index gaining 1.2% with 18-of-19 property sectors in positive territory while Mortgage REITs advanced 1.0%.

Hopes of a potential resolution to the Russia/Ukraine conflict following a reportedly productive round of cease-fire talks prompted a rotation back into many of the beaten-down assets classes and kept downward pressure on WTI Crude Oil (CL1:COM) prices, which remained below $95/barrel after soaring above $130 last week. Updated FOMC "dot plot" projections signal expectations of an additional six rate hikes this year, bringing the short-term rate up to 2.0% while the Fed also indicated forthcoming plans to shrink its balance sheet. The 10-Year Treasury Yield climbed to its highest level since late 2019, briefly topping 2.25% before closing the trading day at 2.19%.

The Census Bureau reported this morning that retail sales rose at a slower pace than expected in February but estimates for January were revised sharply higher as the year-over-year growth remained impressive at nearly 18%. Data for February showed the first clear signs that soaring gasoline and energy prices are taking a bite out of consumer spending as sales were actually lower by 0.4% in February excluding auto and gasoline sales. Areas of strength in February included restaurants, department stores, and home improvement retailers. Notably, the February data included a 3.7% dip in nonstore (e-commerce) sales following a 20.5% surge in the prior month.

Real Estate Daily Recap

Timber & Farmland: Today we published Land REITs: Ultimate Inflation Hedges. Publicly-traded landowners - specifically timber and farmland REITs - have been among the best-performing real estate sectors this year amid concerns over persistent inflation and soaring commodities prices. Amid the ongoing conflict with Russia- which is among the world's largest exporters of agriculture, gasoline, and timber products- the importance and value of North American production will become evident. Buying land has been a "hot trade" over the past year, and valuations appear extremely rich for farmland REITs with implied cap rates in the 2-3% range, but valuations of higher-quality timber REITs including PotlatchDeltic (PCH) and Weyerhaeuser (WY) remain quite attractive.

Net Lease: Realty Income (O) gained about 1% today after becoming the 51st equity REIT to raise its dividend this year, announcing a 0.2% dividend hike to $0.247/month, representing a forward yield of roughly 4.5%. This evening, we'll publish an updated report on the Net Lease sector on Income Builder which will examine risks to these REITs - which utilize long lease terms with mostly-fixed rate annual escalators - from rising interest rates and inflation. Despite their reputation as bond-substitutes, net lease REITs have historically delivered above-average earnings growth as accretive external growth has more than offset the drag from muted property-level growth.

Mortgage REIT Daily Recap

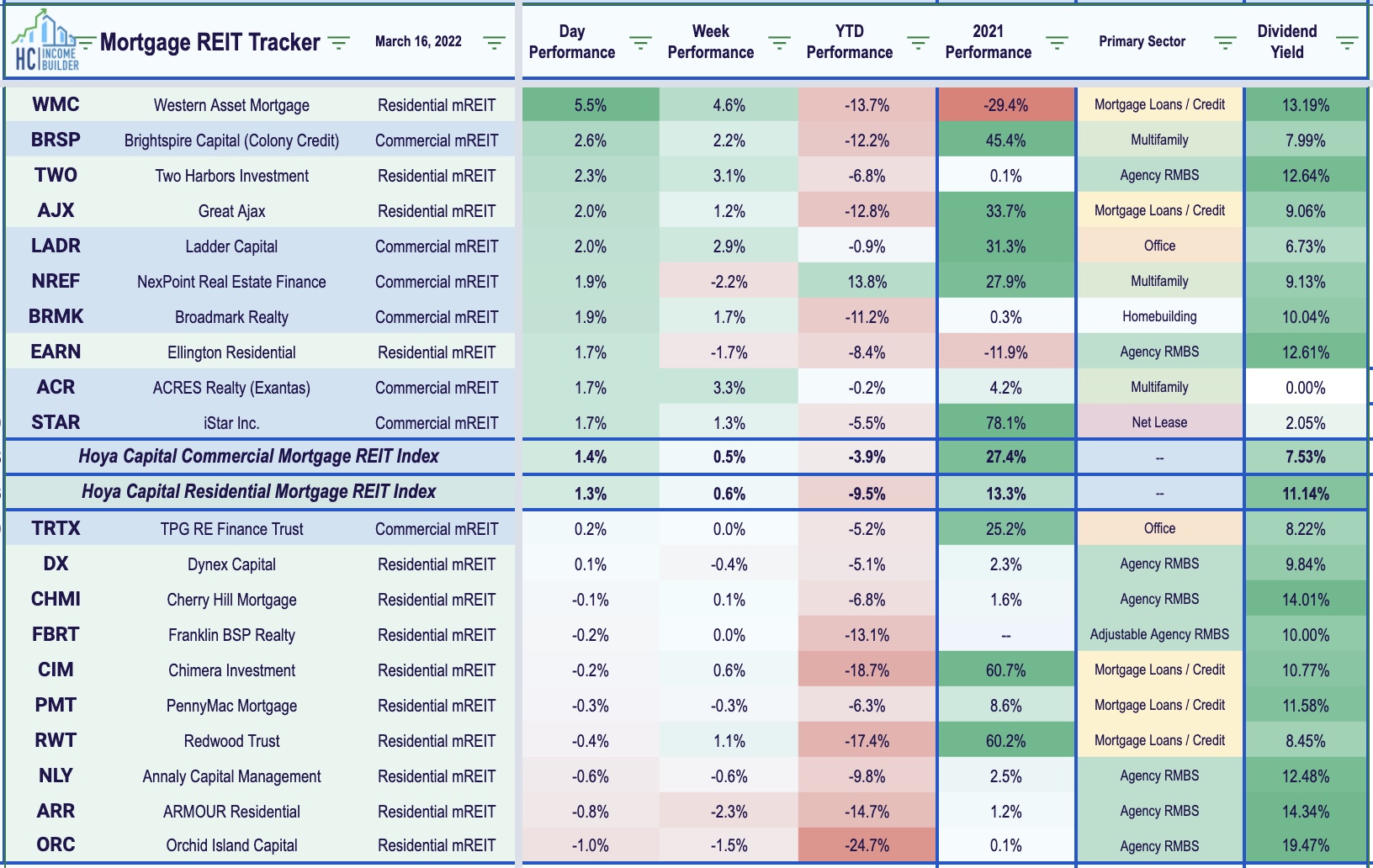

Per the REIT Rankings Tracker available to Income Builder subscribers, residential mREITs finished higher by 1.3% today while commercial mREITs gained 1.5%. Angel Oak (AOMR) - the newest mREIT that went public last year - soared 15% after reporting strong results, noting that its Book Value Per Share ("BVPS") was essentially flat in Q4 at $19.47. Cherry Hill (CHMI) traded flat today after reporting Q4 results that were roughly in line with expectations with its BVPS declining 5.6% to $8.56 Lument Finance (LFT) gained 1% despite reporting that its Book Value Per Share ("BVPS") dipped 16% in Q4 and reducing its quarterly dividend by a third to $0.06 - the second mREIT to reduce its dividend this year versus seven increases.

Economic Data This Week

The jam-packed week of economic data continues on Thursday with Housing Starts and Building Permits along with Jobless Claims and Industrial Production data. Then on Friday, we'll see Existing Home Sales data which are each expected to show steady strength behind the housing industry despite the jump in mortgage rates.

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.