Home Prices Decline • Casino M&A • Weed Woes

- U.S. equity markets slipped Tuesday in a relatively quiet post-Christmas session as benchmark interest rates jumped to one-month highs amid concern over the impact of China's reversal of COVID-zero policies.

- Seeking to avoid a third-straight week of losses in the final stretch of 2022, the S&P 500 slipped 0.4% today while the tech-heavy Nasdaq 100 declined 1.4%.

- Real estate equities were among the better performers today with the Equity REIT Index finishing essentially unchanged with 9-of-18 property sectors in positive territory, while Mortgage REITs slipped 0.2%.

- The Case-Shiller US National Home Price Index declined 0.5% in October from the prior month - the fourth-straight month-over-month decline - but the dip in October was less steep than the prior two months.

- The busy month continued for VICI Properties (VICI), which announced this morning that it will provide up to $350M in mezzanine loan financing to complete the construction of Fontainebleau Las Vegas, a 67-story hotel and casino at the north end of the Las Vegas Strip.

Income Builder Daily Recap

U.S. equity markets slipped Tuesday in a relatively quiet post-Christmas session as benchmark long-term interest rates jumped to one-month highs amid concern over the impact of China's reversal of COVID-zero policies. Seeking to avoid a third-straight week of losses in the final stretch of 2022, the S&P 500 slipped 0.4% today while the tech-heavy Nasdaq 100 declined 1.4%. The benchmark 10-Year Treasury Yield (US10Y) jumped another 11 basis points today the highest levels since early November. Despite the jump in rates, real estate equities were among the better performers today with the Equity REIT Index finishing essentially unchanged with 9-of-18 property sectors in positive territory, while the Mortgage REIT Index slipped 0.2%.

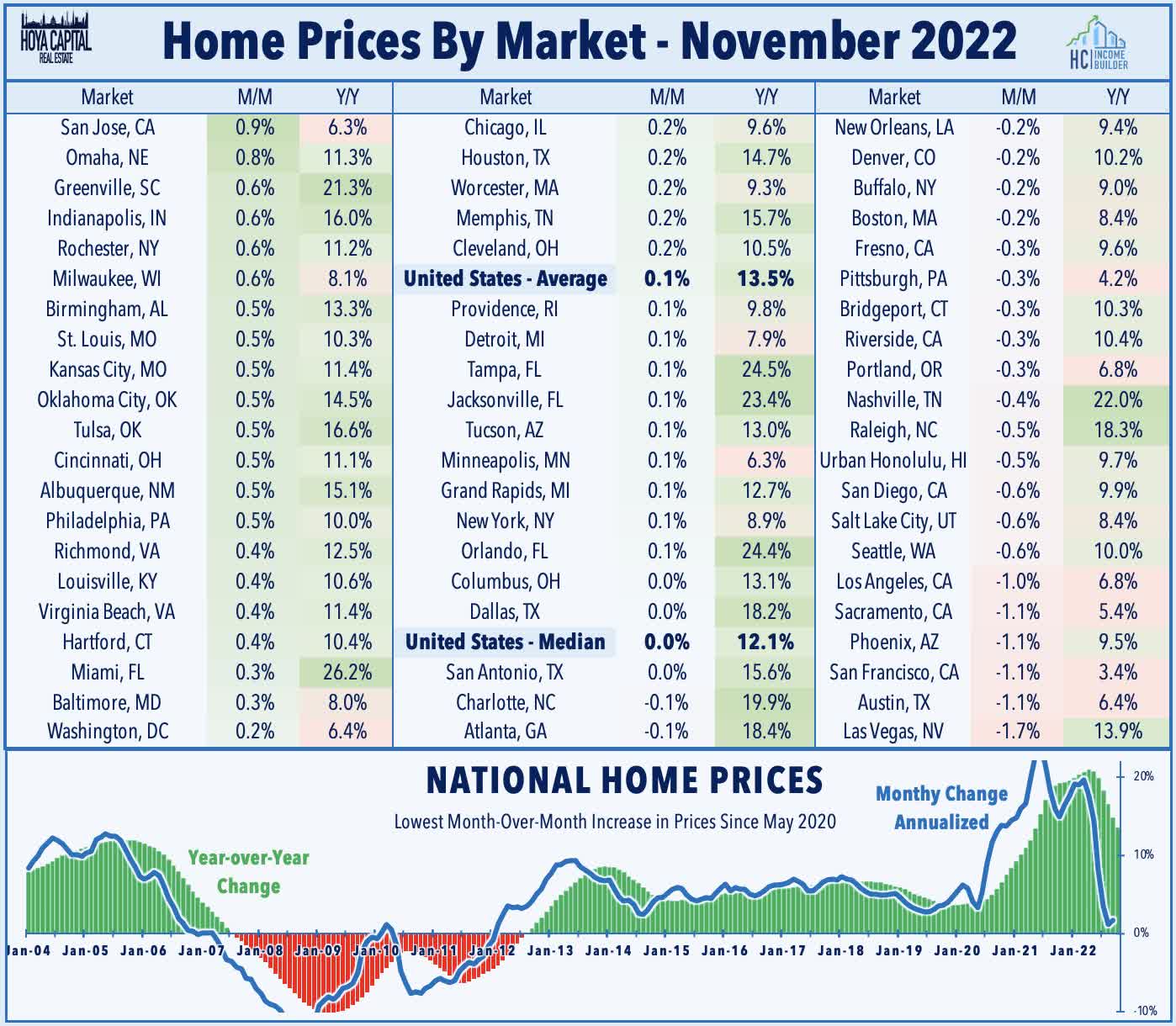

The beaten-down Homebuilders were among the upside standouts today, however, after Case Shiller and FHFA data showed that home prices declined were "less bad" than expected as historically low inventory levels and a relatively strong labor market has helped to contain the downside in home values. The Case-Shiller US National Home Price Index declined 0.5% in October from the prior month - the fourth-straight month-over-month decline - but the dip in October was less steep than the prior two months which saw the largest single-month decline since November 2011. Home values are now about 3% below their recent peaks in June 2022 but some home price metrics - including the NAR's Median Price of Existing Homes - are now showing double-digit price declines from their early 2022 peak in some regions and markets. Recent data from Zillow (Z) showed that roughly half of the Top 60 markets recorded negative month-over-month growth in October with particularly sharp slowdowns in West Coast markets.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Casino: The busy month continued for VICI Properties (VICI), which announced this morning that it will provide up to $350M in mezzanine loan financing to complete the construction of Fontainebleau Las Vegas, a 67-story hotel and casino at the north end of the Las Vegas Strip owned by an investment group that includes Koch Industries. The long-delayed project - which originally broke ground in 2007 and has changed hands several times during its $3.7B development - is finally expected to open in the fourth quarter of 2023. The casino will feature 3,700 hotel rooms along with 550,000 square feet of convention space. The loan is the third major deal of the past month for VICI, which announced in November a $5.5B deal to acquire the MGM Grand and Mandalay Bay from Blackstone and announced a $300M deal last week to acquire two hotel-and-casino properties in Mississippi.

Cannabis: The pressure on cannabis stocks continued today on reports that the U.S. FDA is reportedly planning to make recommendations on how to regulate cannabis compound CBD in food and supplements and is considering new rules including safety standards and/or disclosures on products. As we'll analyze in our updated Cannabis REIT report published to Income Builder this evening, the previously-high-flying cannabis sector has been slammed this year on concerns over rent payment from their cannabis cultivator tenants, which have been struggling amid a plunge in wholesale cannabis prices and continued setbacks on the federal legalization outlook. The exclusion of the SAFE Banking Act from the omnibus federal spending package dimmed hopes that any major federal marijuana legislation will be passed during the Biden Presidency. Cannabis REITs - which entered 2022 with the strongest five-year total returns, dividend growth, and FFO growth of any property sector - have been unable to escape the cannabis industry's struggles this year amid amplified concerns over tenant rent-paying capacity. The ten public-traded REIT tenants have plunged between 60-00% over the past year.

Additional Headlines from The Daily REITBeat on Income Builder

- UMH Properties (UMH) announced that it closed on the acquisition of a newly developed all-age, manufactured home community located in Sebring, FL for $15.1M.

- Four Corners Property (FCPT) announced the acquisition of four Buffalo Wild Wings properties in Illinois for $14.3M at a 7.3% cap rate.

- Income Builder Members receive access to The Daily REITBeat, an institutional-quality daily note that keeps subscribers apprised of pertinent news, data, and trends specifically within the REIT industry

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were mostly-lower today with residential mREITs slipping 0.1% while commercial mREITs declined 0.5%. On a quiet day of mREIT newsflow, Sachem Capital (SACH) and ACRES Realty (ACR) led the gains to the upside today while Seven Hills (SEVN) and Hannon Armstrong (HASI) were laggards. Last month, we published Mortgage REITs: High Yields Are Fine, For Now, which noted that despite paying average dividend yields in the mid-teens, the majority of mREITs have been able to cover their dividends, but we flagged a handful of mREITs with payout ratios above 100% of EPS.

Economic Data This Week

The economic calendar slows down in the holiday-shortened week ahead. On Tuesday, we saw the Case Shiller Home Price Index and the FHFA Home Price Index. On Wednesday, we'll see Pending Home Sales data for November which is expected to decline for a sixth-straight month to the lowest levels since 2012 as the 30-Year Fixed Rate Mortgage peaked during the week of November 10th at 7.08% before pulling back to 6.27% this past week.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.