Hotel REIT Updates • Solid Jobs Data • Bonds Slump

- U.S. equity markets snapped a two-day skid Thursday while bonds remained under pressure as the 10-Year Treasury Yield climbed to its highest level in two years on expectations of aggressive monetary tightening.

- The S&P 500 advanced 0.5% today - but still remains lower by 1% on the week - while the tech-heavy Nasdaq 100 gained 0.4%. Mid-Caps and Small-Caps were roughly flat today.

- Real estate equities lagged today - but remain one of the better-performing sectors this week - as the Equity REIT Index declined 0.8% with 15-of-19 property sectors in negative territory.

- A pair of hotel REITs provided operational updates today. Resort operator Braemar Hotels (BHR) noted that its Revenue Per Room ("RevPar") was 20% above pre-pandemic levels in Q1, but Ashford (AHT) saw RevPar levels that were 23% below that of Q1 2019.

- Commercial mortgage REIT Hannon Armstrong (HASI) dipped over 7% after launching a $200M private placement of non-interest-bearing exchangeable bonds that can be converted into common stock.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets snapped a two-day skid Thursday while bonds remained under pressure as the 10-Year Treasury Yield climbed to its highest level in two years on expectations of aggressive monetary tightening. The S&P 500 advanced 0.5% today - but still remains lower by 1% on the week - while the tech-heavy Nasdaq 100 gained 0.4%. Mid-Caps and Small-Caps were roughly flat on the day. Real estate equities lagged today - but remain one of the better-performing sectors this week - as the Equity REIT Index declined 0.8% with 15-of-19 property sectors in negative territory while Mortgage REITs declined 1.6%.

Stronger-than-expected Initial Jobless Claims data - which showed the fewest number of initial unemployment filings since 1968 - eased some immediate concerns over economic slowing, but kept upward pressure on interests rates. The 10-Year Treasury Yield rose to its highest level since May 2019 at 2.65% while the 2-Year Treasury Yield decreased slightly to 2.46%. The U.S. Dollar Index strengthened once again to its highest level since May 2020 while Crude Oil (CL1:COM) rebounded by 1% and is roughly flat on the week. Seven of the eleven GICS equity sectors finished higher today, led to the upside by the Healthcare (XLV) and Energy (XLE) sectors.

Real Estate Daily RecapHotels: A pair of hotel REITs provided operational updates today. Braemar Hotels (BHR) - which focuses on luxury hotels and resorts - finished lower by 3% after announcing that it expects to report occupancy of 55% in Q1 with an Average Daily Rate of $597, resulting in RevPAR of $328, which was 20% above comparable levels in Q1 2019. BHR commented, "Leisure demand has held up much better than anticipated, as trends in corporate transient and group bookings continue to build." Ashford Hotels (AHT) tumbled 7% after announcing that it expects to report occupancy of 58% in Q1 with an ADR of $166 and RevPAR of $97, which represents a decrease of 23% compared to Q1 2019. TSA Checkpoint throughput data rebounded to 90% of pre-pandemic levels this week following a slow start to 2022.

Storage: Yesterday evening, we published an updated report on the self-storage REIT sector on the Income Builder Marketplace. Self-storage REITs - which delivered the most impressive rebound of any property sector throughout the pandemic - have built on their gains in early 2022 following a jaw-dropping 80% surge last year. Stumbling into the coronavirus pandemic with challenged fundamentals and an outlook for near-zero growth amid oversupply challenges, self-storage demand soared over the past year, powering record occupancy increases, and rent hikes. Storage demand is closely-correlated with housing market turnover: specifically home sales and rental turnover. The surge in mortgage rates this year appears likely to slow turnover and temper storage demand. In the report, we discussed how we're allocating to the sector and our updated Price Targets.

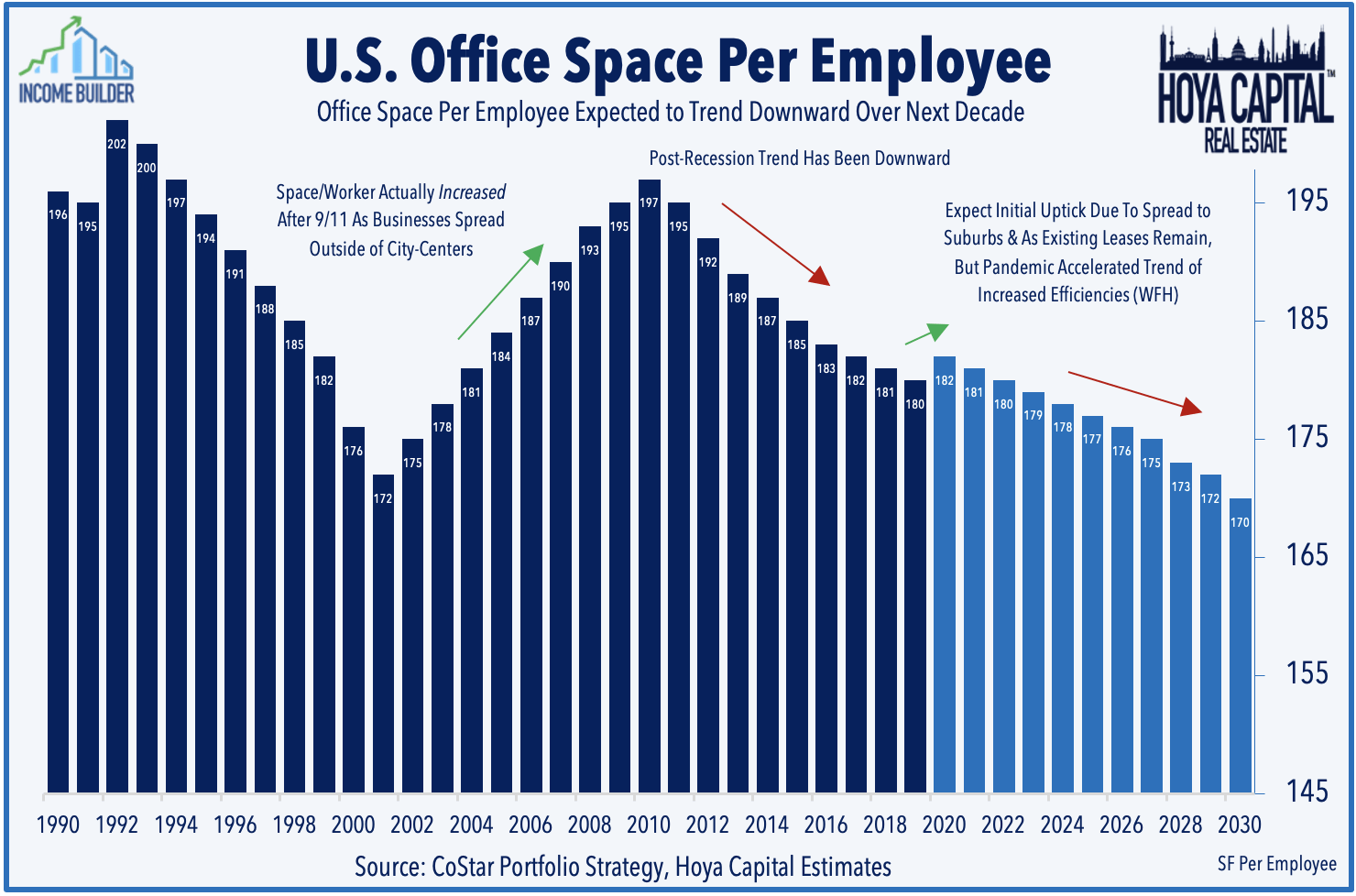

Office: Yesterday, we also published Office REITs: The New Normal? Office REITs - which lagged over the prior two years from persistent pandemic-related headwinds - have been the best-performing major property sector in early 2022. For many, Work-From-Home will transition to "hybrid" work environments over the next quarter, setting up a "now or never" dynamic for utilization rates that corporate decision-makers will be monitoring closely. Employees value hybrid WFH the same as a 10% pay rise, but most don't want to be fully remote either. With an increasingly tight labor market, employees - not employers - will chart the future of the workplace.

Mortgage REIT Daily RecapPer the REIT Rankings Tracker available to Income Builder subscribers, commercial mREITs declined 2.0% today while residential mREITs slipped 1.5%. Hannon Armstrong (HASI) dipped over 7% after launching a $200M private placement of non-interest-bearing exchangeable bonds that can be converted into common stock. The average residential mREIT pays a dividend yield of 10.91% while the average commercial mREIT pays a dividend yield of 7.50%.

REIT Preferreds & Capital RaisingPer the Income Builder Preferred Tracker available to Income Builder subscribers, the Hoya Capital REIT Preferred Index gained 0.09% today. REIT Preferreds ended 2021 with price returns of roughly 8.0% and total returns of roughly 14%. There are now 186 REIT-issued exchange-listed preferred and debt securities with an average current yield of 6.57%. In the capital markets today, AvalonBay (AVB) launched a secondary common stock offering of 2M shares, raising gross proceeds of $497.2M to fund future acquisitions or development. Yesterday, Moody Ratings affirmed Camden Property's (CPT) credit rating of “A3” with a stable outlook while Fitch Ratings assigned InvenTrust (IVT) a “BBB-“ credit rating with a stable outlook.

Economic Calendar This WeekWe'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook published this weekend.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.