M&A Monday • Twitter Takeover • REIT Earnings

- U.S. equity markets rebounded Monday while bonds caught a bid amid COVID concerns in China and a wave of major M&A news ahead of the busiest week of corporate earnings.

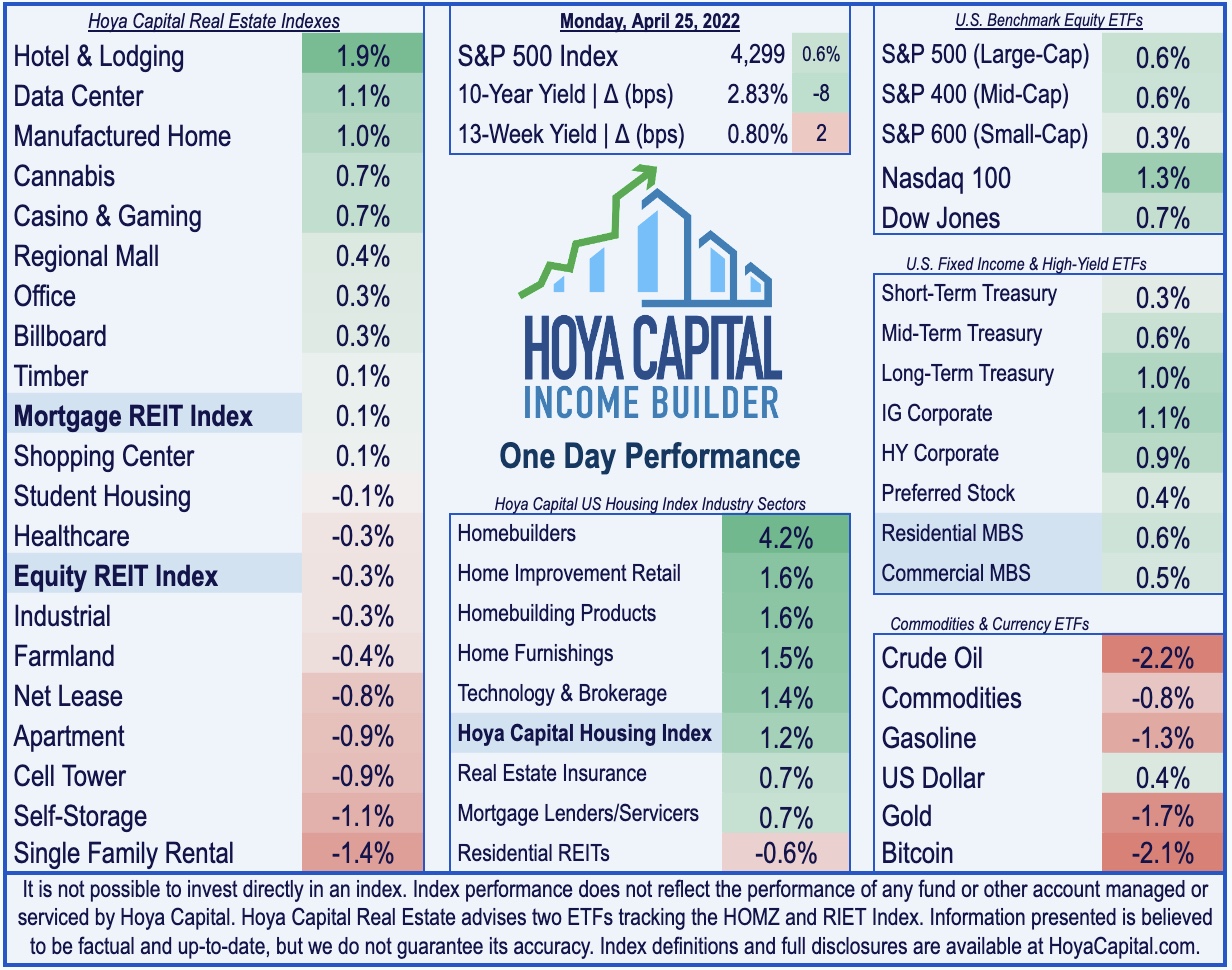

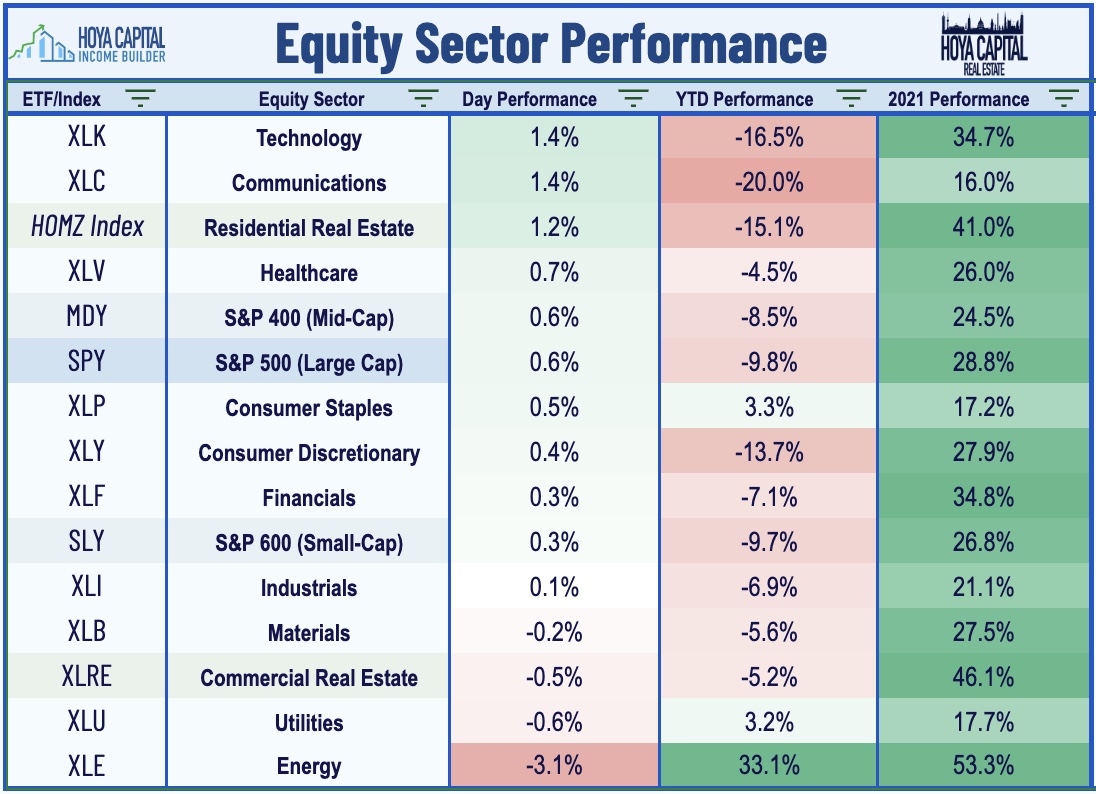

- Emerging back out of "correction" territory, the S&P 500 rebounded by 0.6% today while the tech-heavy Nasdaq 100 gained 1.3% after entering the sesion on the cusp of "bear market" territory.

- Real estate equities were mixed today following several strong weeks of outperformance as the Equity REIT Index slipped 0.3% today with 10-of-19 property sectors in positive-territory. Mortgage REITs gained 0.1%.

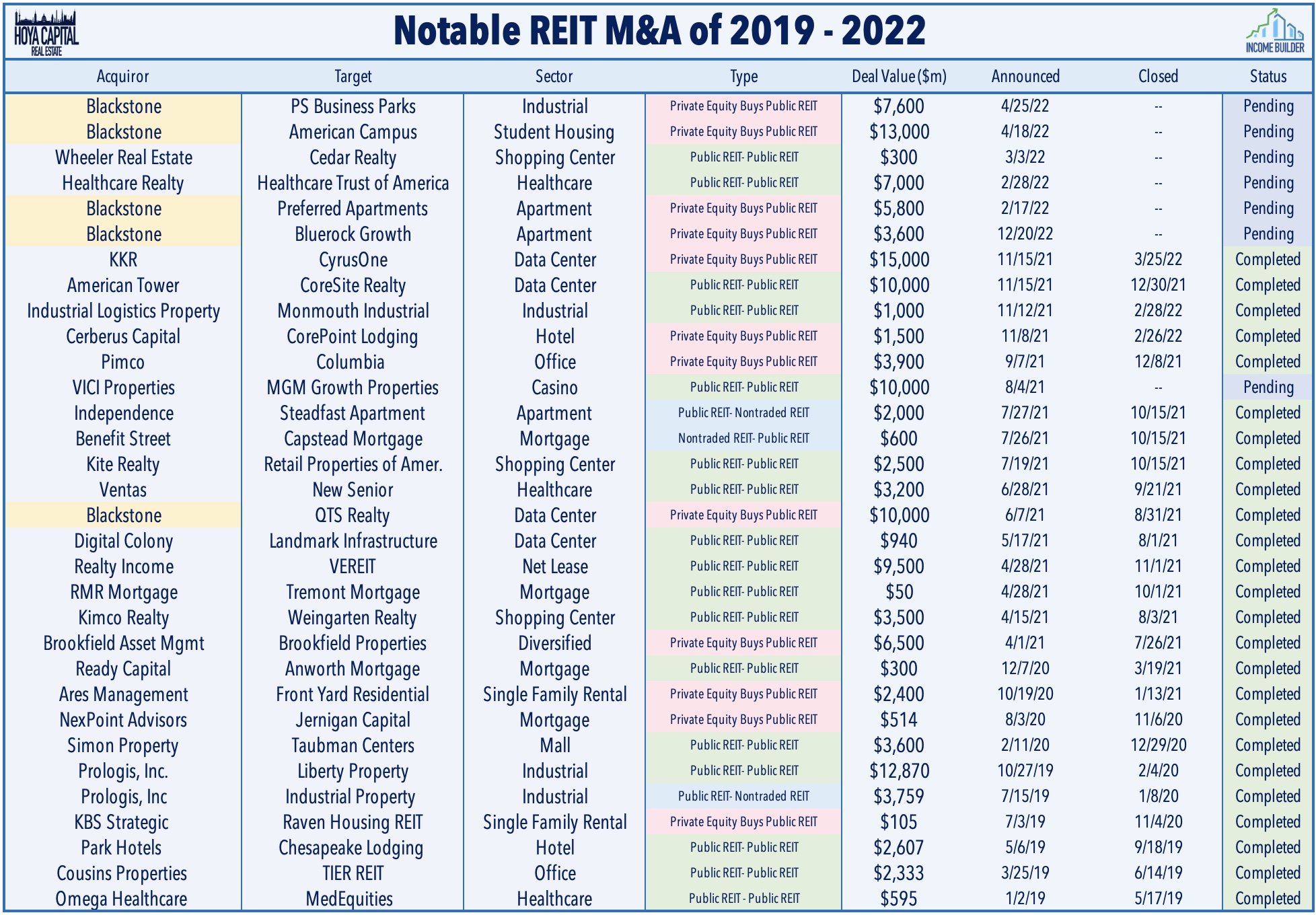

- PS Business Parks (PSB) surged 12% today after it agreed to be acquired by asset manager Blackstone (BX) at $187.50 - a 12% premium to Friday's close. For Blackstone, the deal is the second major REIT acquisition in two weeks and the fifth over the past twelve months.

- Mall REIT Simon Property Group (SPG) and asset manager Brookfield (BAM) plan to partner on a bid for department store brand Kohl's (KSS) for $68/share in a deal valued at $8.6B. SPG has seen decent success of late in its strategy of purchasing distressed retailers.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets rebounded Monday while bonds caught a bid amid COVID concerns in China and a wave of major M&A news ahead of the busiest week of corporate earnings season. Emerging back out of "correction" territory, the S&P 500 rebounded by 0.6% today while the tech-heavy Nasdaq 100 gained 1.3% after entering the session on the cusp of "bear market" territory. Real estate equities were mixed today following several strong weeks of outperformance as the Equity REIT Index slipped 0.3% today with 10-of-19 property sectors in positive territory while Mortgage REITs gained 0.1%.

As discussed in our Real Estate Weekly Outlook, equity markets entered the session on a three-week skid while bonds are in the midst of the steepest sell-off in decades. Both equities and bonds caught a bid today as ongoing COVID lockdown concerns in China and expectations of moderating inflation pulled the 10-Year Treasury Yield lower by 8 basis points to 2.83% while the 2-Year Treasury Yield dipped 9 basis points to 2.63%. The Technology (XLK) and Communications (XLC) sectors led to the upside today after Twitter (TWTR) accepted Elon Musk's cash bid for the social media platform. Homebuilders and the broader Hoya Capital Housing Index were also among the leaders today as mortgage rates pulled-back from post-GFC highs ahead of a busy slate of housing data in the week ahead.

We'll see another jam-packed week of economic data in the week ahead, along with the busiest week of corporate earnings season. The state of the housing market will be the focus early in the week with New Home Sales and the Case Shiller Home Price Index on Tuesday and Pending Home Sales on Wednesday, each of which are expected to show signs of moderating housing market activity amid the historic surge in mortgage rates over the past quarter. On Thursday, we'll get our first look at first-quarter Gross Domestic Product, which is expected to show a slowdown to 1.0% growth in Q1. Then on Friday, we'll get another look at inflation with the PCE Price Index for March which is expected to show another month of multi-decade-high rates of consumer price increases. Also on Friday, we'll also see Personal Income and Spending data and the revised look at Consumer Sentiment.

Real Estate Daily Recap

Industrial: PS Business Parks (PSB) surged 12% today after it agreed to be acquired by asset manager Blackstone (BX) at $187.50 - a 12% premium to Friday's close in a deal that is expected to close in the third quarter. For Blackstone, the deal is the second major REIT acquisition in two weeks and the fifth over the past twelve months, a list that includes residential REITs American Campus (ACC), Preferred Apartments (APTS), Bluerock Growth (BRG), and data center REIT QTS Realty (QTS). PSB - which was initially formed as a subsidiary of Public Storage (PSA) back in 1990 - owns 27M square feet of industrial and flex office space in California, Miami, Texas, and Northern Virginia. PSA currently holds 41% of the common equity interest in PSB and announced that it will vote in favor of the acquisition and plans to distribute to its shareholders the $2.3B tax gain from the sale.

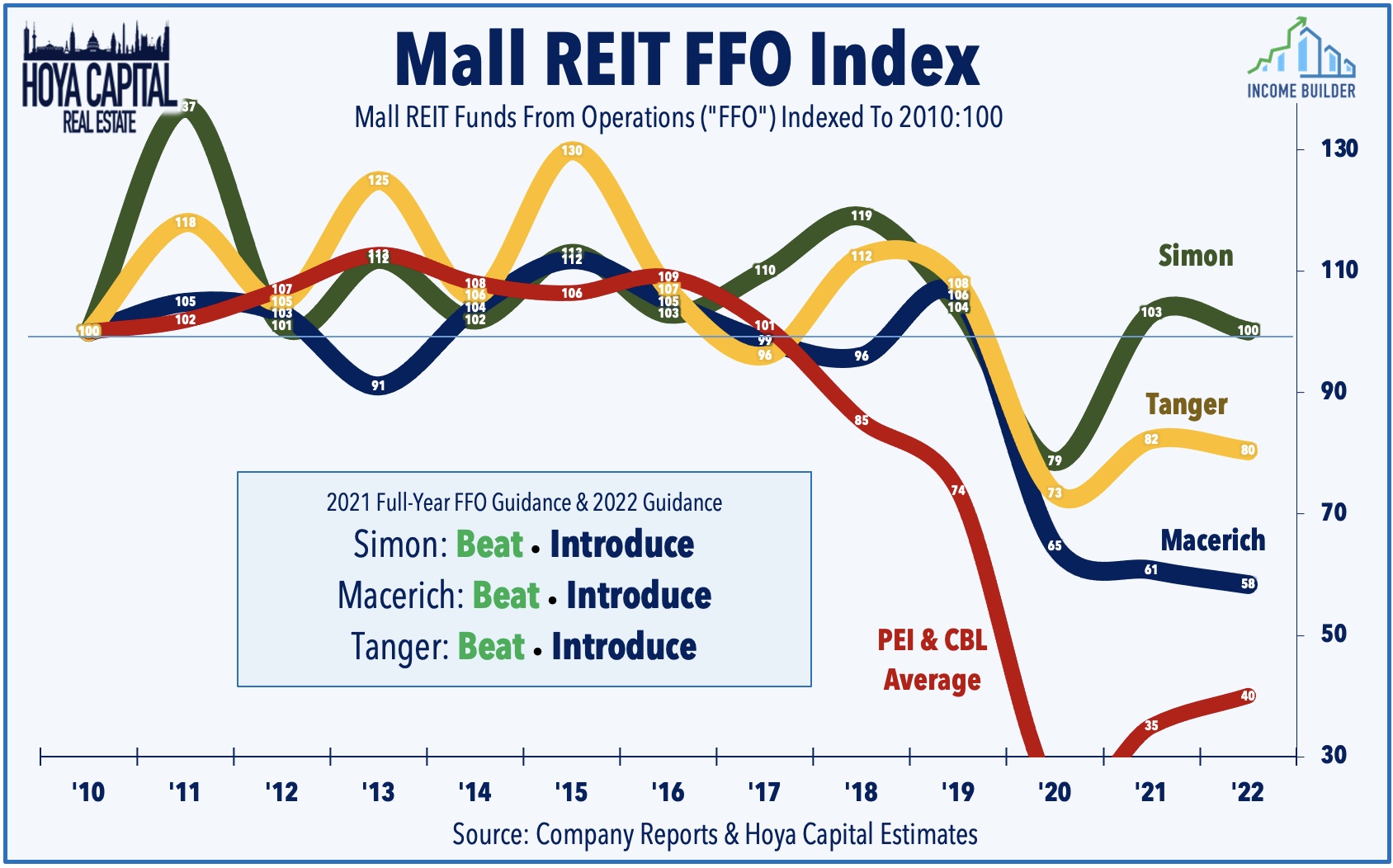

Mall: Consistent with reports last week, mall REIT Simon Property Group (SPG) and asset manager Brookfield (BAM) plan to partner on a bid for department store brand Kohl's (KSS) for $68/share in a deal valued at $8.6B. Buying struggling retailers has become the M.O. of Simon in recent years as SPG and BAM had previously partnered on the acquisition of JCPenny out of bankruptcy in December 2020 and Simon partnered with Authentic Brands to purchase interests in Brooks Brothers, Lucky Brand, Aeropostale, and Forever 21 - a strategy that has we believe has been moderately successful, as Simon is the lone mall REIT that has seen a full recovery to its pre-pandemic FFO.

This afternoon, we'll hear results from American Campus (ACC), Alexandria (ARE), PotlatchDeltic (PCH), SBA Communications (SBAC), and Sun Communities (SUI). Last week, we published our Real Estate Earnings Preview which discussed the major themes and metrics we'll be watching across each of the real estate property sectors this earnings season. Despite the historic surge in interest rates over the past quarter driven by expectations of Fed monetary tightening, REITs enter the first-quarter earnings season with some momentum at their backs. Having lagged for most of this year, the broad-based Equity REIT Index jumped ahead of the S&P 500 on a year-to-date performance basis in early April following several weeks of outperformance. REITs with better inflation-hedging characteristics have led the gains in 2022 while large-cap technology REITs have continued to lag.

Last week, we launched our newly-developed Landowner Portfolio - a custom strategy we've developed exclusively for Income Builder members. The strategy targets exposure to publicly-traded companies that own or control significant acreage of land across North America, diversified across regions and across distinct productive uses. This portfolio is comprised of 18 companies that collectively own or control over 50 million acres of land across the United States- larger than the entire landmass of New England. Holdings include Timber REITs, Farmland REITs, Ground Lease REITs, Triple Net Lease REITs, and substantially land-owning companies across the homebuilding, land development, agriculture, mining, and energy sectors.

Mortgage REIT Daily Recap

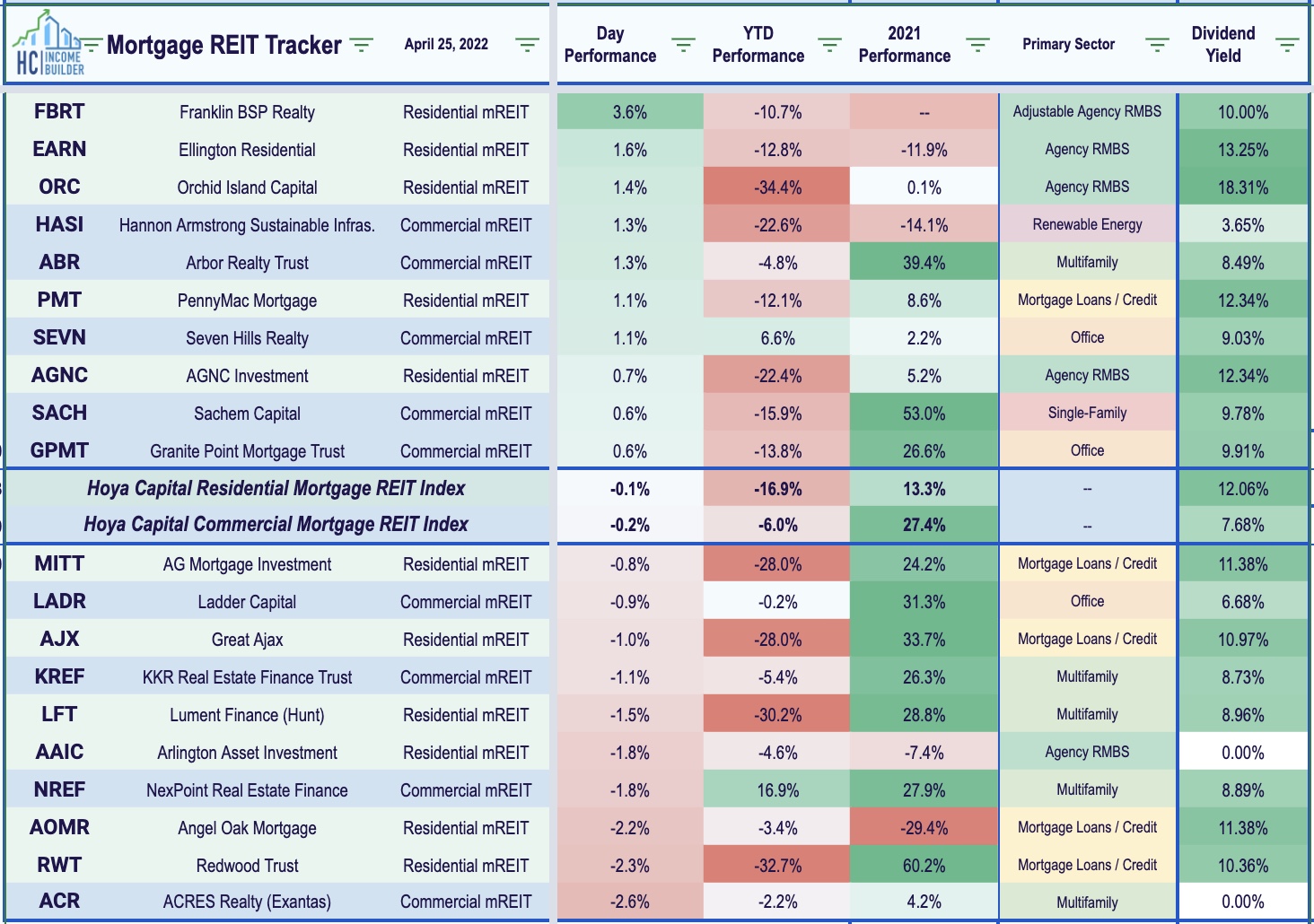

Per the REIT Rankings Tracker available to Income Builder subscribers, mREITs were roughly flat today as commercial mREITs slipped 0.2% while residential mREITs declined 0.1%. Mortgage REIT earnings season officially kicks off this afternoon with results from KKR Real Estate (KREF) and Apollo Commercial (ARI). With MBS pricing down considerably over the last quarter, the effectiveness of these mREITs rate-hedging strategies will become apparent in Q1. Analysts are expecting average BVPS declines of 8-15% in Q1, but several more highly-levered mREITs may see 20%+ declines.

REIT Preferreds & Capital Raising

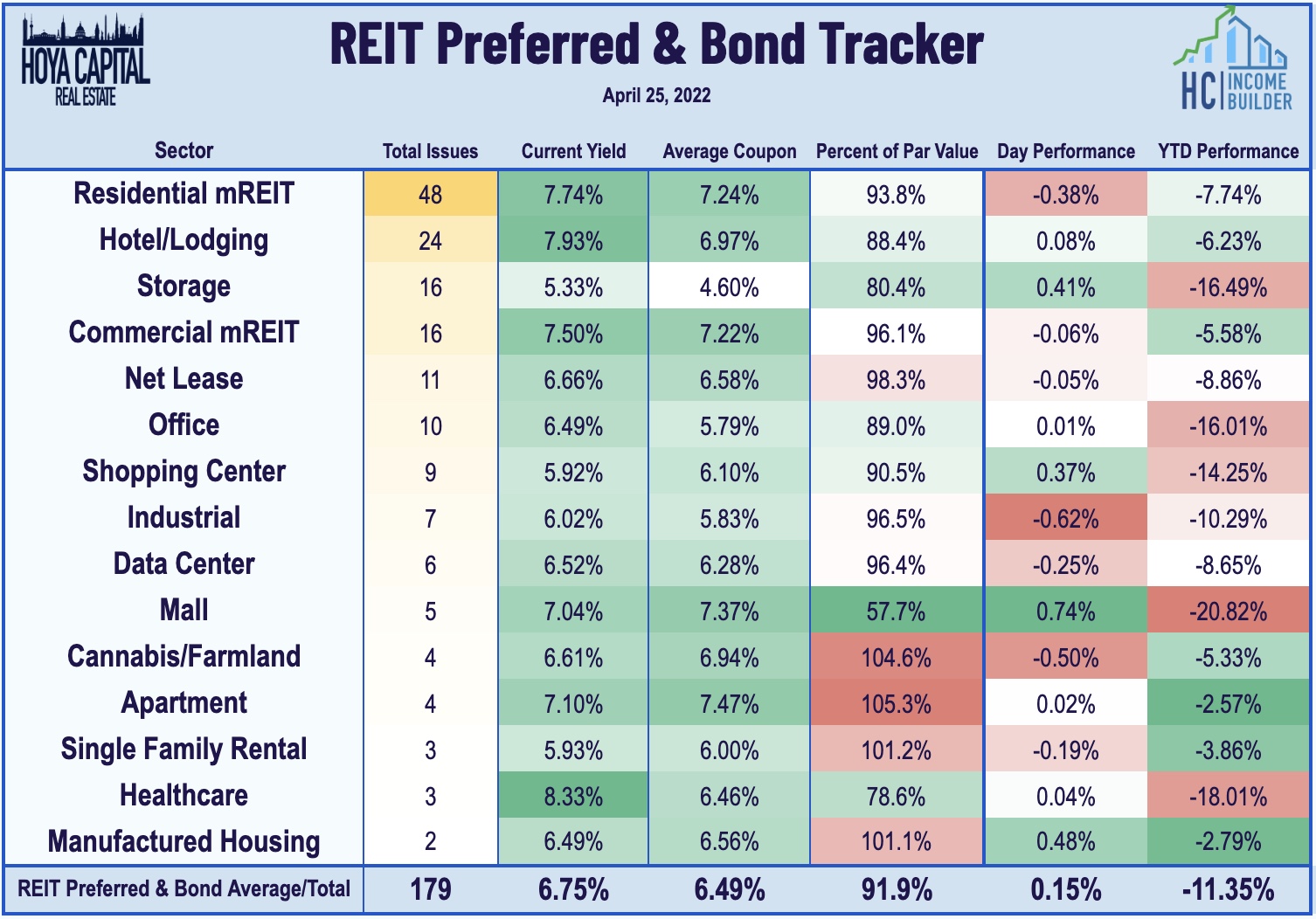

Per the Income Builder Preferred Tracker available to Income Builder subscribers, the Hoya Capital REIT Preferred Index finished higher by 0.15% today. REIT Preferreds ended 2021 with price returns of roughly 8.0% and total returns of roughly 14%. There are now 186 REIT-issued exchange-listed preferred and debt securities with an average current yield of 6.73%. As part of its aforementioned acquisition announcement, PS Business Parks (PSB) noted that it plans to keep public its three outstanding NYSE-listed series of preferred stock (PSB.PX, PSB.Y, PSB.PZ) so long as there is at least $75 million aggregate liquidation value of preferred stock outstanding.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.