M&A Monday • Yields Jump • REIT Dividend Hike

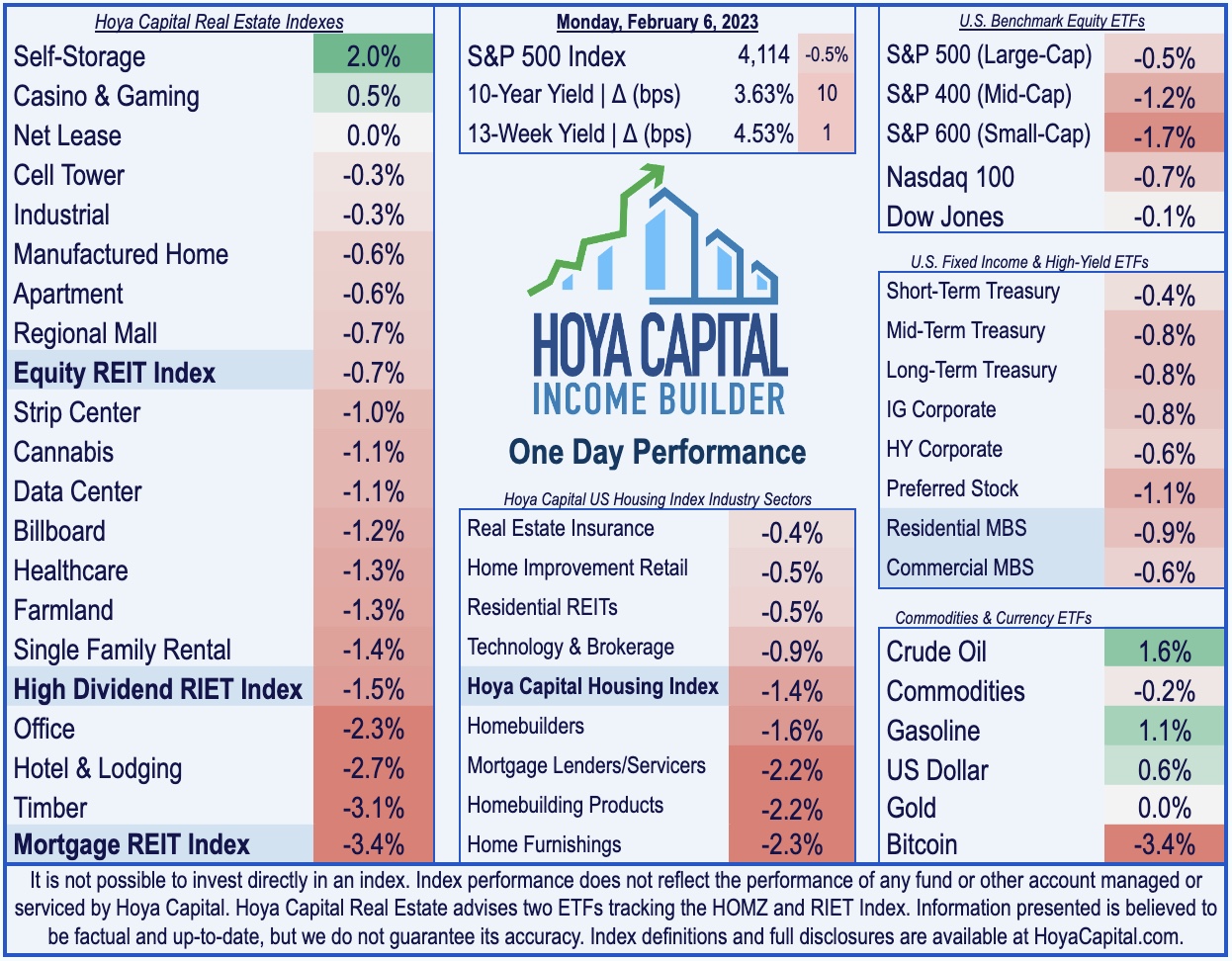

- U.S. equity markets declined Monday while Treasury yields jumped as investors deliberated the implications of strong employment data and geopolitical tensions ahead of another busy week of corporate earnings results.

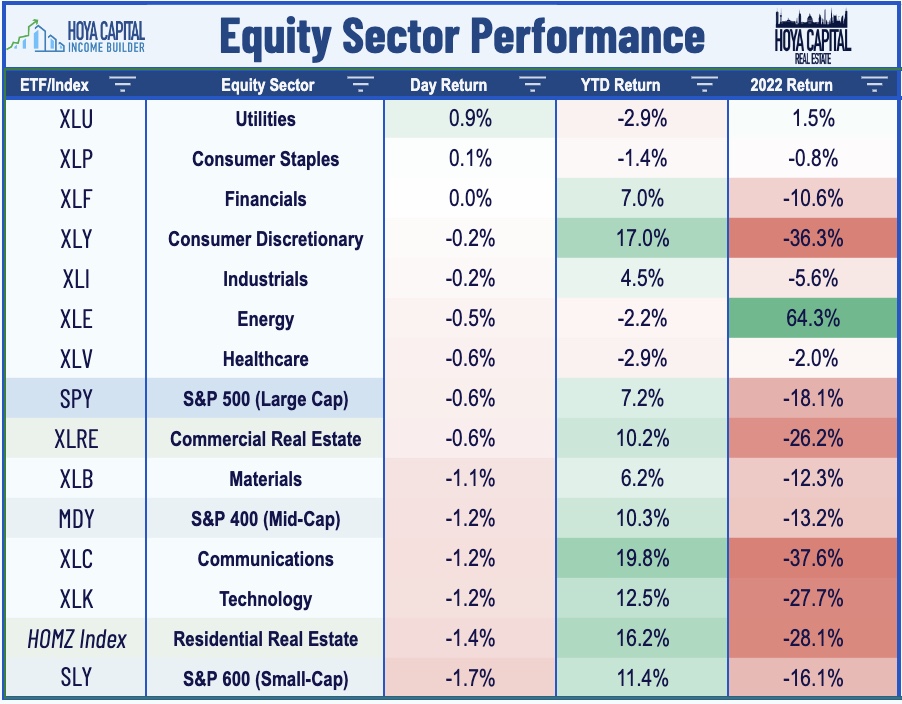

- Pausing after a strong start to the year with gains in four-of-five weeks, the S&P 500 slipped 0.5% today while the tech-heavy Nasdaq 100 declined 0.7%. Small-Caps dipped by nearly 2%.

- Real estate equities lagged ahead of a busy week of earnings reports as long-term interest rates jumped for a second-straight session. Equity REITs declined 0.7% while Mortgage REITs dipped 3.4%.

- Life Storage (LSI) surged more than 11% after it received an $11B takeover bid from its peer Public Storage (PSA) in a proposed all-stock deal worth $129 a share - a 17% premium to LSI's last closing price.

- Public Storage - which traded roughly flat today on the news - also announced that it will hike its quarterly dividend by 50% to $3.00/share - its first dividend hike since 2016.

Income Builder Daily Recap

U.S. equity markets declined Monday while Treasury yields jumped as investors deliberated the implications of strong employment data and geopolitical tensions ahead of another busy week of corporate earnings results. Pausing after a strong start to the year with gains in four-of-five weeks, the S&P 500 slipped 0.5% today while the tech-heavy Nasdaq 100 declined 0.7%. The Small-Cap 600 slid 1.7% after gaining over 5% last week. Real estate equities lagged ahead of a busy week of earnings reports as long-term interest rates jumped for a second-straight session. The Equity REIT Index declined 0.7% today with all 16-of-18 property sectors in negative territory while the Mortgage REIT Index dipped 3.4% and Homebuilders declined about 1.5%.

After dipping to four-month lows of around 3.40% last week before the blowout employment report, the 10-Year Treasury Yield jumped another 10 basis points today to 3.63%, sparking downward pressure on bonds across the credit and maturity curve. Hawkish comments from Atlanta Fed President Bostic and renewed geopolitical tensions with China further contributed to the risk-off sentiment as investors braced for the possibility that resilient labor markets may extend inflationary pressures. Commodities prices stabilized following a brutal week with Crude Oil rebounding 1.6% while Natural Gas prices rebounded about 3% from their lowest-levels since late 2019. Nine of the eleven GICS equity sectors finished lower on the session with Technology (XLK) and Communications (XLC) stocks among the laggards today.

As discussed in our Weekly Outlook, while earnings season kicks into high gear this week, the economic calendar slows down following a busy two-week stretch. We'll hear from a number of Federal Reserve officials throughout the week including Fed Chair Powell, who is slated to speak at the Economic Club of Washington on Tuesday. We'll be closely watching Jobless Claims data on Thursday as well for any signs of cracks in the seemingly unwavering labor market. On Friday, we'll get our first look at Michigan Consumer Sentiment data for February which includes a closely-watched consumer inflation expectations survey. Sentiment - which has tracked closely with consumer gasoline prices over the past two years - has rebounded in recent months since hitting its lowest-level on record in mid-2022.

Real Estate Daily Recap

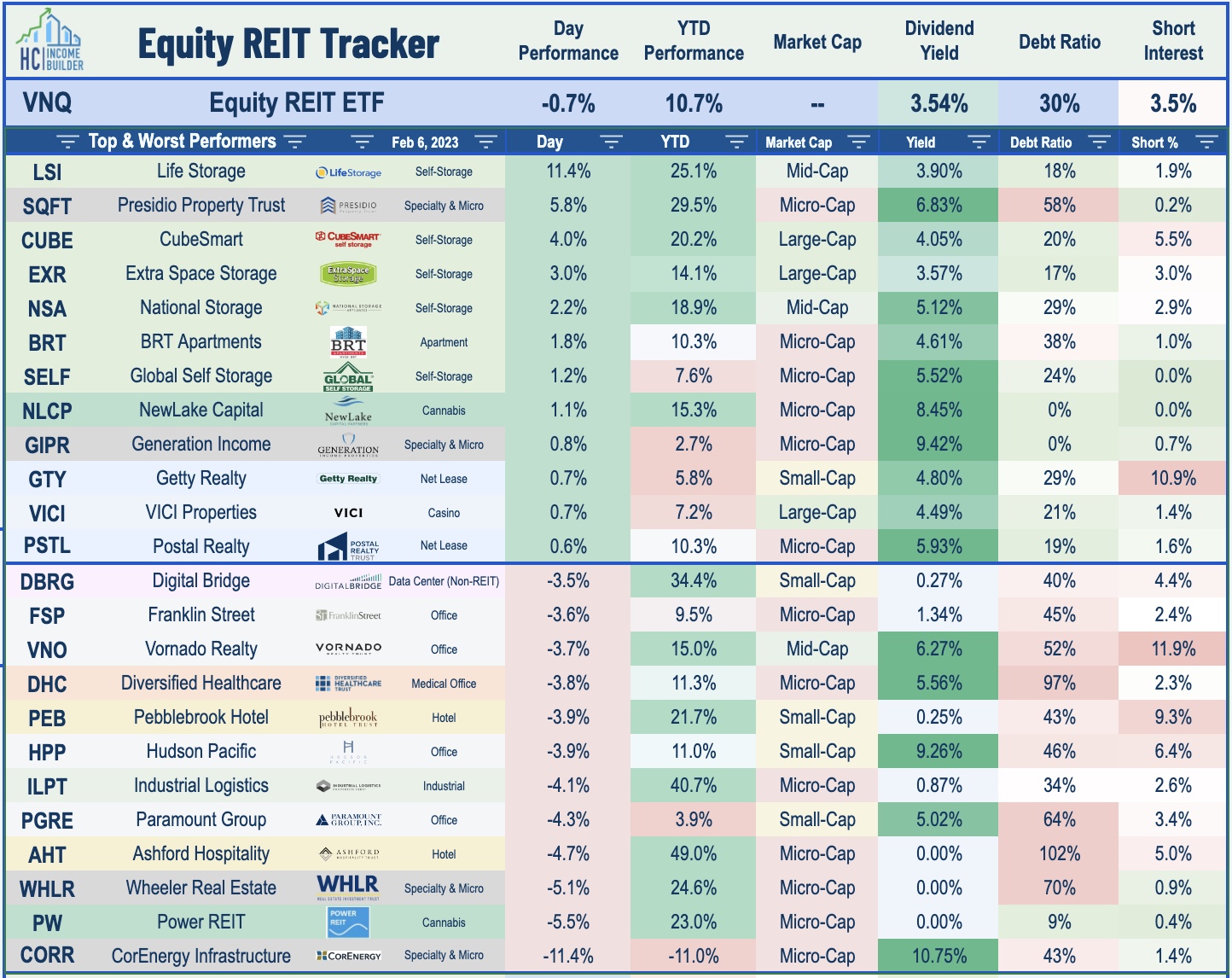

Best & Worst Performance Today Across the REIT Sector

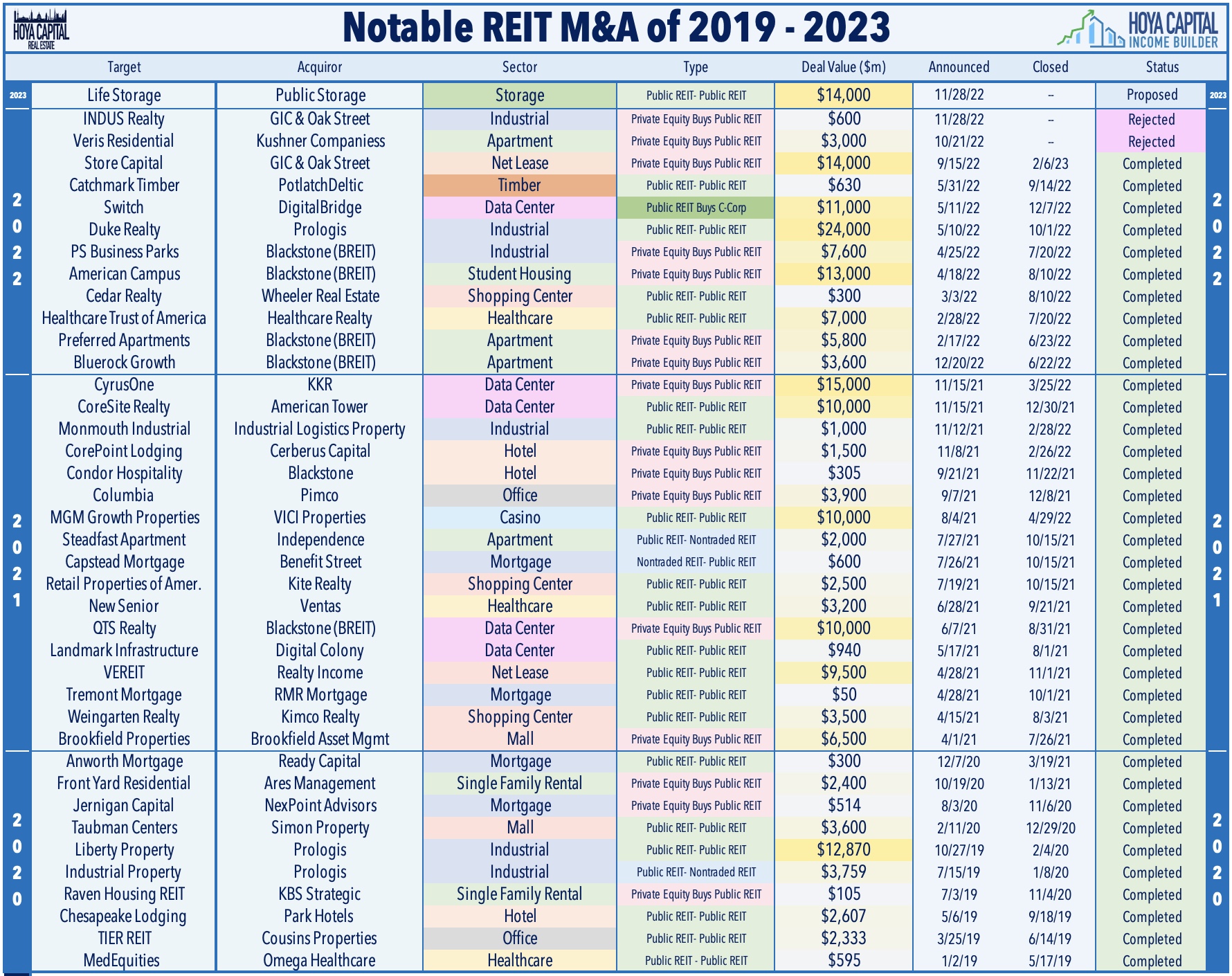

Storage: Life Storage (LSI) - which we recently added to the REIT Dividend Growth Portfolio - surged more than 11% after it received an $11B takeover bid from its peer Public Storage (PSA) in a proposed all-stock deal worth about $129 a share - a 17% premium to LSI's closing price last Friday, but about 15% below LSI's 52-week high at $152. LSI - the fourth-largest storage REIT with a market cap of $9.5B - noted in a release that PSA had privately made an earlier "substantially similar" offer that was rejected. PSA noted in its release that LSI was "not willing to engage in further dialogue" after the initial private offer. Public Storage - which traded roughly flat on the news - also announced that it will hike its quarterly dividend by 50% to $3.00/share - its first dividend hike since 2016. Last week in Storage REITs: Downsized Demand, we analyzed why storage REITs have stumbled of late amid a post-pandemic demand normalization and pressure from elevated supply growth.

After the close today, we'll hear from mall REIT Simon Property (SPG) and apartment REIT UDR (UDR), and tomorrow morning, we'll hear results from mall REIT Macerich (MAC). As discussed in our Earnings Preview, REITs entered earnings season with some positive momentum amid the recent moderation in interest rates and hopes of a 'softish' economic landing following a punishing year of stock price performance. How REITs are responding to this higher rate environment – both on the acquisitions and the financing side - will be closely watched. REITs hunkered down in 2022, but opportunities are becoming more plentiful and we see the non-traded REIT segment as one area that may be "ripe for the picking" if investor redemptions continue. Full-year FFO guidance will be the most closely watched metric, especially in the residential, retail, and office sectors given the wide range of expectations.

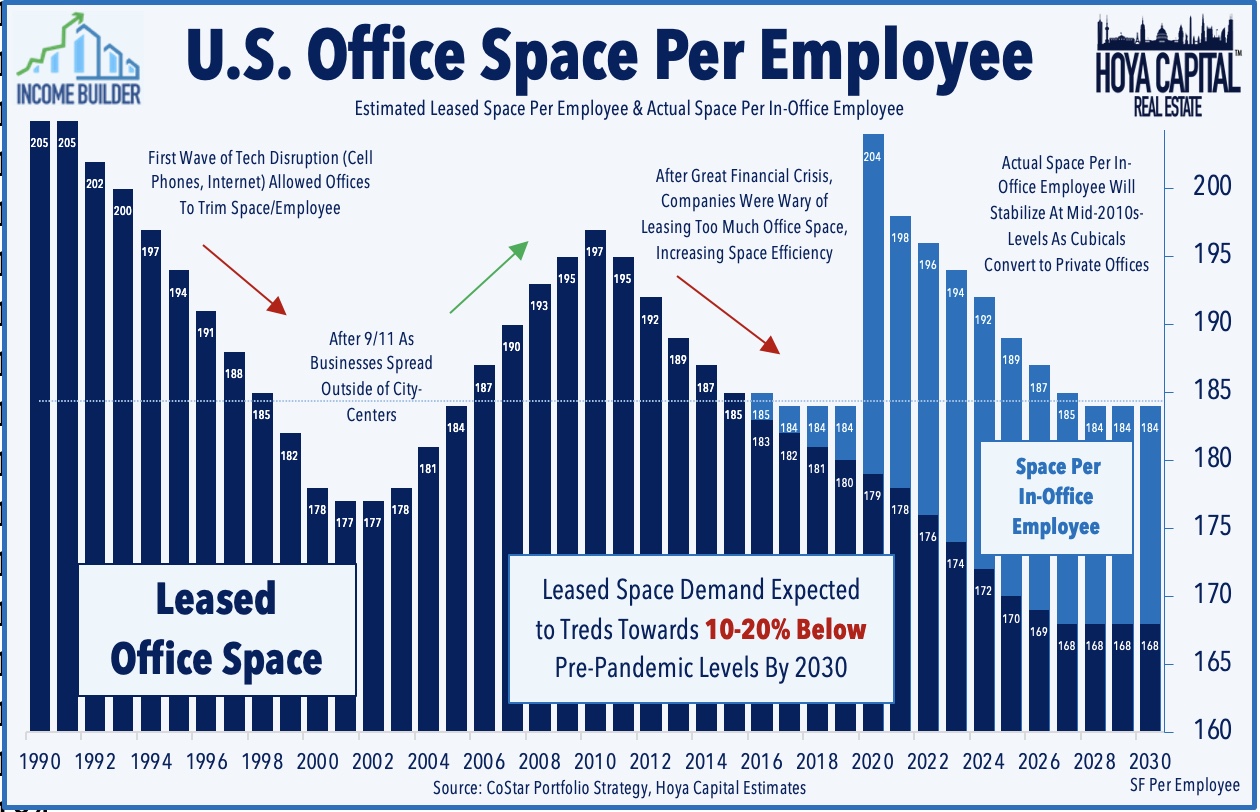

Office: Today, we published Office REITs: Plenty of Pain Priced In on the Income Builder Marketplace which discussed our updated outlook on the office sector and recent allocations. Office REITs have been far-and-away the worst-performing property sector since the start of the pandemic as depressed utilization rates and recession concerns have curbed office space demand. Occupiers due for renewal have been somewhat-reluctant to cut office space with leasing volumes still at 75% of pre-pandemic levels, but fundamentals softened more definitively in late 2022. As employment markets normalize from historic tightness, we believe that utilization rates should recover to around 60% in urban metros and 80% in secondary markets – up 20% from current levels - likely a more optimistic view than market consensus. With Office REITs trading at historically deep discounts to peers in public and private markets there appear to be some emerging pockets of value.

Additional Headlines from The Daily REITBeat on Income Builder

- Services Property (SVC) priced $610.2M of net lease mortgage notes in three classes to institutional buyers with an average coupon of 5.60%.

- Brixmor (BRX) announced that John G. Schreiber, the chair of the Company's board of directors will retire at the end of his current term.

- Store Capital (STOR) announced that GIC completed its previously announced acquisition of all outstanding shares of STORE for $32.25/share.

Mortgage REIT Daily Recap

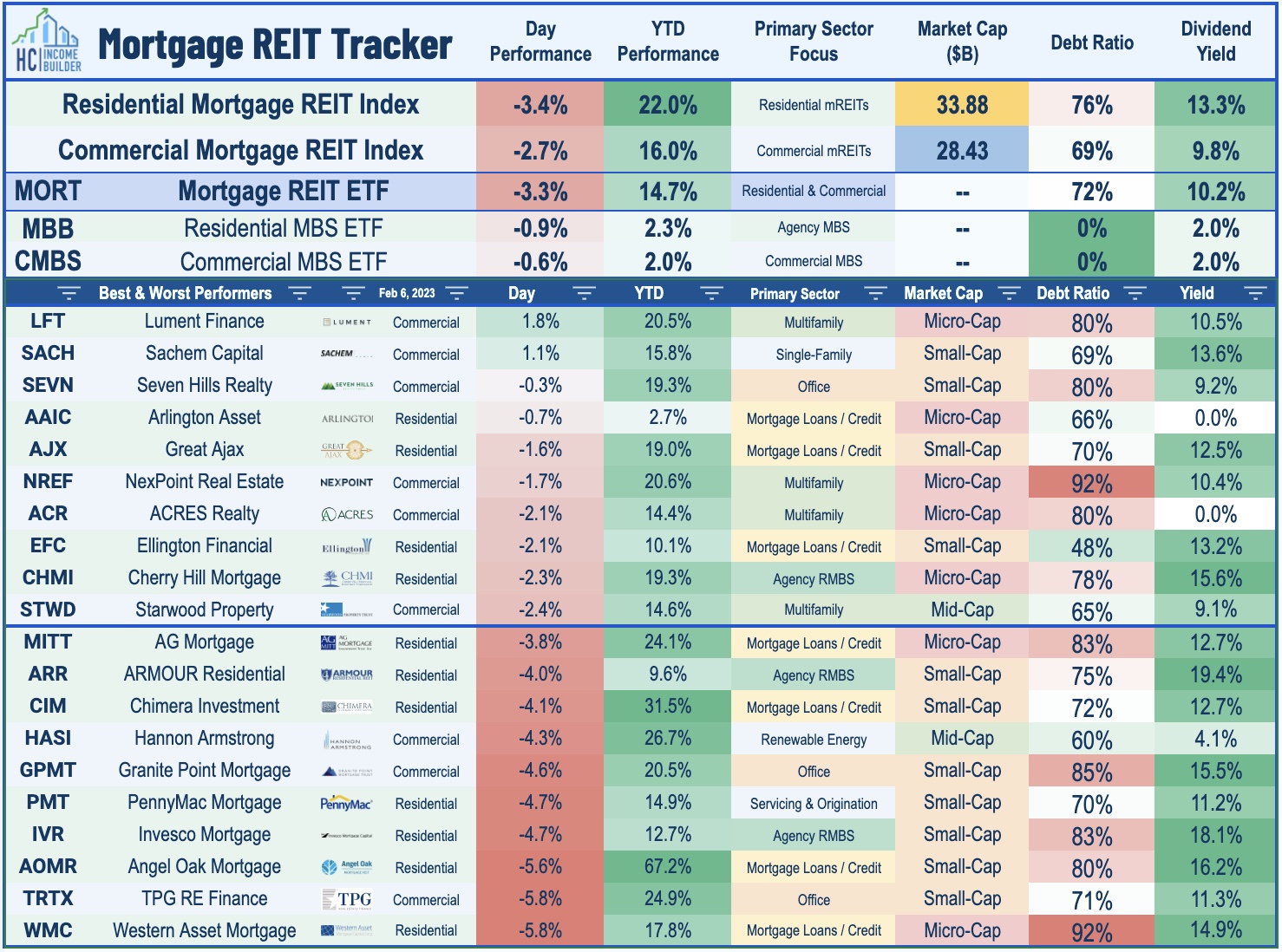

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs stumbled today - cutting into their strong gains thus far in 2023 - with residential mREITs sliding 3.4% today while commercial mREITs declined 2.7% amid broad selling pressure across fixed income-related securities. The mREIT earnings season kicks into gear this week with results from Seven Hills (SEVN) on Tuesday, Armour Residential (ARR), Ares Commercial (ACRE), and Chimera (CIM) on Wednesday, and Hannon Armstrong (HASI) on Thursday.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.