Pain At The Pump • Stocks Dip • Week Ahead

- U.S. equity markets finished sharply lower Monday while global commodities prices soared as Russia continued its invasion of Ukraine, fueling concern that price shocks could derail the post-pandemic economic recovery.

- Adding to declines of 2.3% last week and finishing at the lowest level since last June, the S&P 500 dipped 2.9% today while the tech-heavy Nasdaq 100 declined more than 3.5%.

- Real estate equities - along with other domestic-focused and yield-sensitive sectors - were among the outperformers as the Equity REIT Index finished lower by 2.0% today while the Mortgage REIT Index declined by 1.5%.

- Gasoline prices jumped above $4/gallon for the first time since 2008 and recorded the largest one-day increase in prices since Hurricane Katrina as questions remain over Western leaders' ability or willingness to increase domestic energy production.

- The economic calendar slows down a bit in the week ahead with the major report of the week coming on Thursday when the BLS will report the Consumer Price Index for February which is expected to show the highest rate of inflation since 1982 at 7.9%.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets finished sharply lower Monday while global commodities prices soared as Russia continued its invasion of Ukraine, fueling concern that price shocks could derail the post-pandemic economic recovery. Adding to declines of 2.3% last week and finishing at the lowest level since last June, the S&P 500 dipped 2.9% today while the tech-heavy Nasdaq 100 declined more than 3.5%. Real estate equities - along with other domestic-focused and yield-sensitive sectors - were among the outperformers as the Equity REIT Index finished lower by 2.0% today while Mortgage REITs declined 1.5%.

As discussed in our Real Estate Weekly Outlook, the Russian invasion of Ukraine has triggered a historic surge in commodities prices and sparked a bid for domestic safe-haven assets, trends that intensified today as Brent Crude Oil Futures briefly topped $130/barrel before paring some of its gains while the U.S. Dollar (USDU) rallied another 1%. Gasoline prices jumped above $4/gallon for the first time since 2008 and recorded the largest one-day increase in prices since Hurricane Katrina as questions remain over Western leaders' ability or willingness to increase domestic energy production.

The economic calendar slows down a bit in the week ahead with the major report of the week coming on Thursday when the BLS will report the Consumer Price Index for February which is expected to show the highest rate of inflation since 1982 at 7.9%. While most economists expected the inflation rate to peak in early 2022, soaring commodities prices in recent weeks amid the Russian invasion of Ukraine - which together are major global suppliers of oil, gas, wheat, iron, and fertilizer - will keep significant upward pressure on inflation metrics over the next several months. We'll also be watching JOLTS Jobs Openings data on Wednesday and Michigan Consumer Sentiment data on Friday which sunk to the lowest level in ten years in February amid intensifying concerns over inflation.

Real Estate Daily Recap

Today, we published our State of the REIT Nation. The "REIT Recovery" from the pandemic is essentially complete as FFO levels are back to pre-pandemic levels. Dividend payouts have lagged, however, setting the stage for significant growth in 2022. While REITs have pulled back into "cheap" territory in early 2022, REITs benefited from premium valuations over the past year which helped to jump-start external growth and awaken animal spirits. We highlighted how REIT balance sheets look far more like a typical operating company than the highly leveraged holding companies of yesteryear, which served them well during the pandemic-related volatility and should be a cushion to buffer the impact from the geopolitical issues in early 2022.

Industrial: Indus Realty (INDT) was under pressure today after reporting mixed results this morning and announcing that it intends to sell its remaining office/flex buildings and fully exit its legacy investment in office properties. INDT - formerly branded as Griffin Industrial - converted to a REIT in early 2021 and currently owns 36 industrial/logistics buildings aggregating approximately 5.4 million square feet in Connecticut, Pennsylvania, North Carolina, South Carolina, and Florida. The Office/Flex Portfolio is comprised of seven buildings located in Windsor and Bloomfield Connecticut totaling 175k sq. ft. Today, we also published Industrial REITs: Shortages Everywhere as an exclusive report for Income Builder Members which discussed our updated outlook and recommendations within the red-hot industrial sector.

Apartment: A pair of apartment REITs provided business updates ahead of the Citi 2022 Global Property Conference this week. AvalonBay (AVB) was among the outperformers today after announcing last Friday that it continues to see accelerating rent growth across nearly all of its markets as effective rent growth rose 12.7% in February, up from 12.4% in January and 11.0% in Q4. AVB noted that its currently running about 60 basis points above its full-year guidance provided last month. Camden (CPT) was also among the outperformers today after reporting last Friday that its blended lease rates rose 14.3% year-over-year in February, its strongest ever for February, but a slight moderation from its record-high Q4 increase of 15.6%.

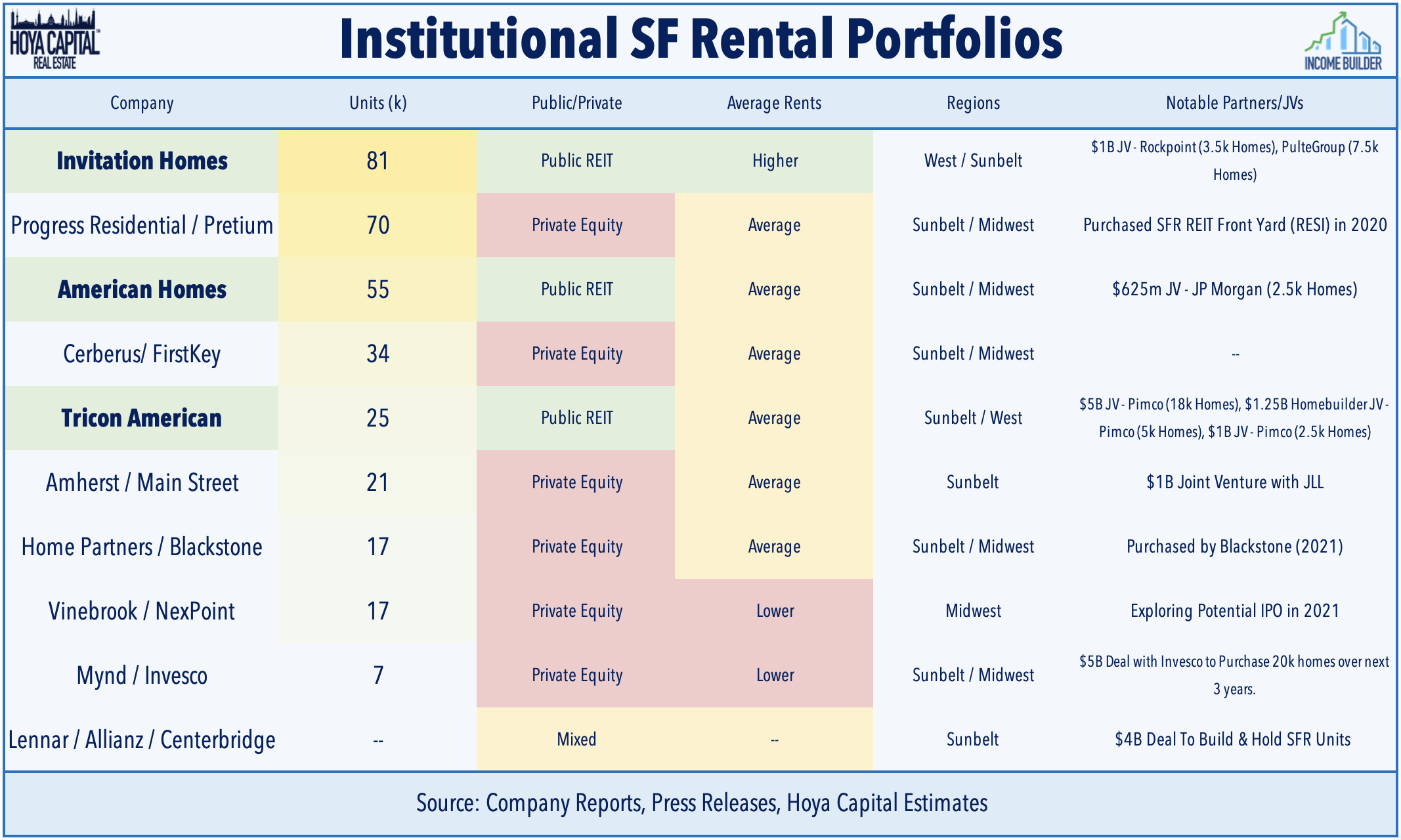

Single-Family Rental: Invitation Homes (INVH) announced a new joint-venture with Rockpoint Group that will acquire and renovate higher-priced homes in premium markets relative to its current strategy which targets homes with rents typically in the $1,500-2,500 per month range. The JV will be capitalized with a total equity commitment of $300 million, with 17% from INVH and 83% from Rockpoint. The companies plan to focus on "top-quality submarkets within the Western US, Southeastern US, Florida, and Texas." INVH will provide investment, asset management, and property management services to the JV, for which it will earn asset management and property management fees and have the opportunity to earn a promoted interest subject to certain performance thresholds.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, residential mREITs declined 0.7% today while commercial mREITs finished lower by 2.5%. Mortgage REIT earnings season wraps up this week with Ellington Residential (EARN) reporting results this afternoon and cannabis REIT AFC Gamma (AFCG) reporting on Tuesday. The average residential mREIT pays a dividend yield of 11.51% while the average commercial mREIT pays a dividend yield of 7.73%.

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.