Peak Bearishness? • Stocks Rebound • REIT Earnings

- U.S. equity markets ripped higher Tuesday with broad-based gains as a decent start to earnings season and signs of cooling price pressures sparked optimism amid a backdrop of historically bearish investor sentiment.

- Rebounding from 1% declines yesterday and posting its best day in three weeks, the S&P 500 rallied 2.8% today while the tech-heavy Nasdaq 100 advanced more than 3%.

- Real estate equities were broadly-higher today as well with the Equity REIT Index advancing 2.6% today with 17-of-18 property sectors in positive territory while the Mortgage REIT Index gained 3.4%.

- Not unusual during the lower-volume summer trading sessions, the significant intra-day market swings over the past two days have lacked a clearly identifiable catalyst. An investor sentiment survey by Bank of America showed historically bearish sentiment levels, which is typically viewed as a positive indicator for future returns.

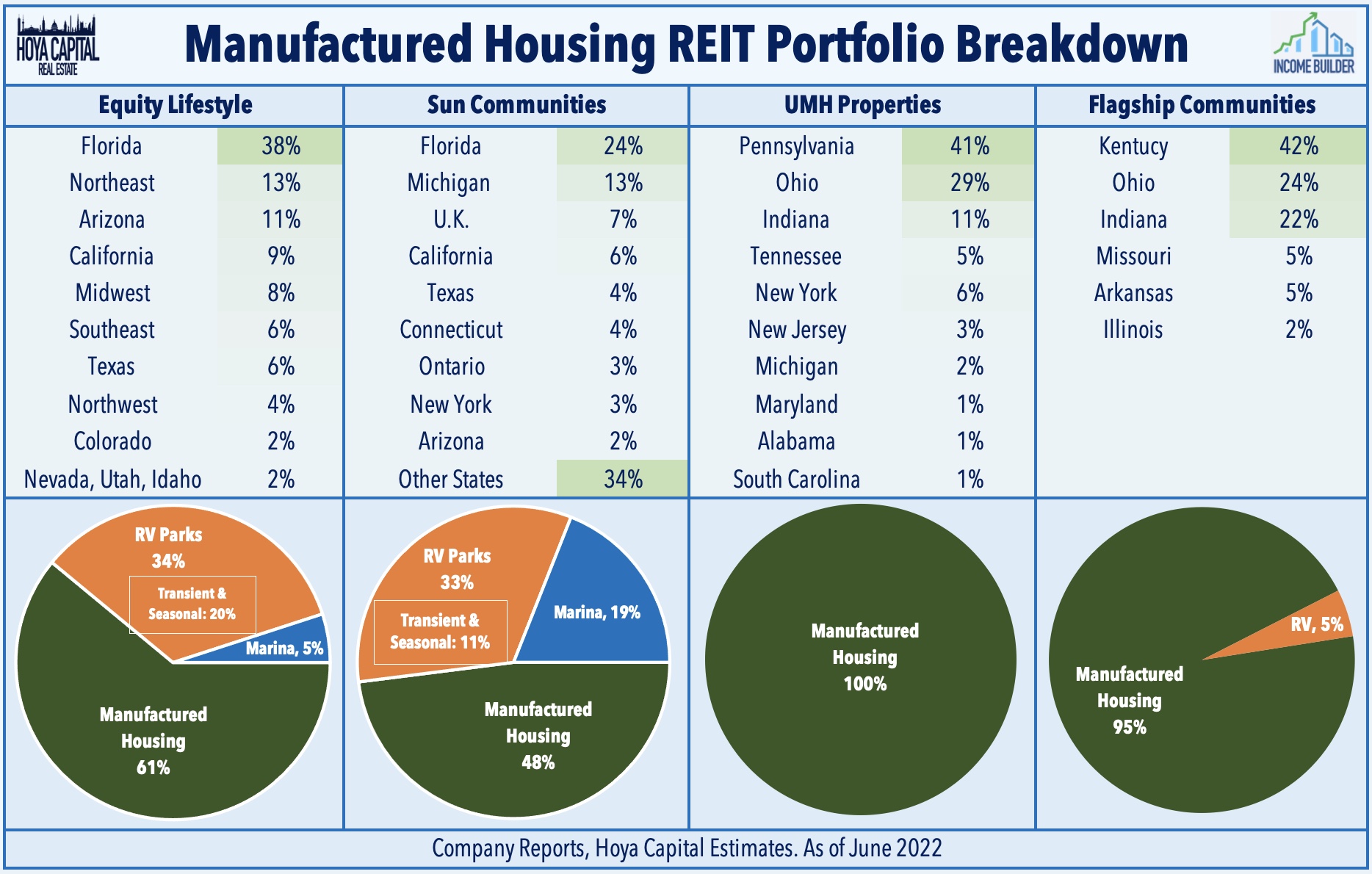

- Equity Lifestyle (ELS) was among the laggards today after reporting mildly disappointing results yesterday afternoon - a rare "miss" for a manufactured housing REIT. A slowdown in RV seasonal and transient demand amid surging gas prices was behind the weakness.

Income Builder Daily Recap

U.S. equity markets ripped higher Tuesday with broad-based gains as a decent start to corporate earnings season and signs of cooling price pressures sparked some optimism amid a period of historically bearish investor sentiment. Rebounding from 1% declines yesterday and posting its best day in three weeks, the S&P 500 rallied 2.8% today while the tech-heavy Nasdaq 100 advanced more than 3%. Real estate equities were broadly-higher today as well with the Equity REIT Index advancing 2.6% today with 17-of-18 property sectors in positive territory while the Mortgage REIT Index gained 3.4%.

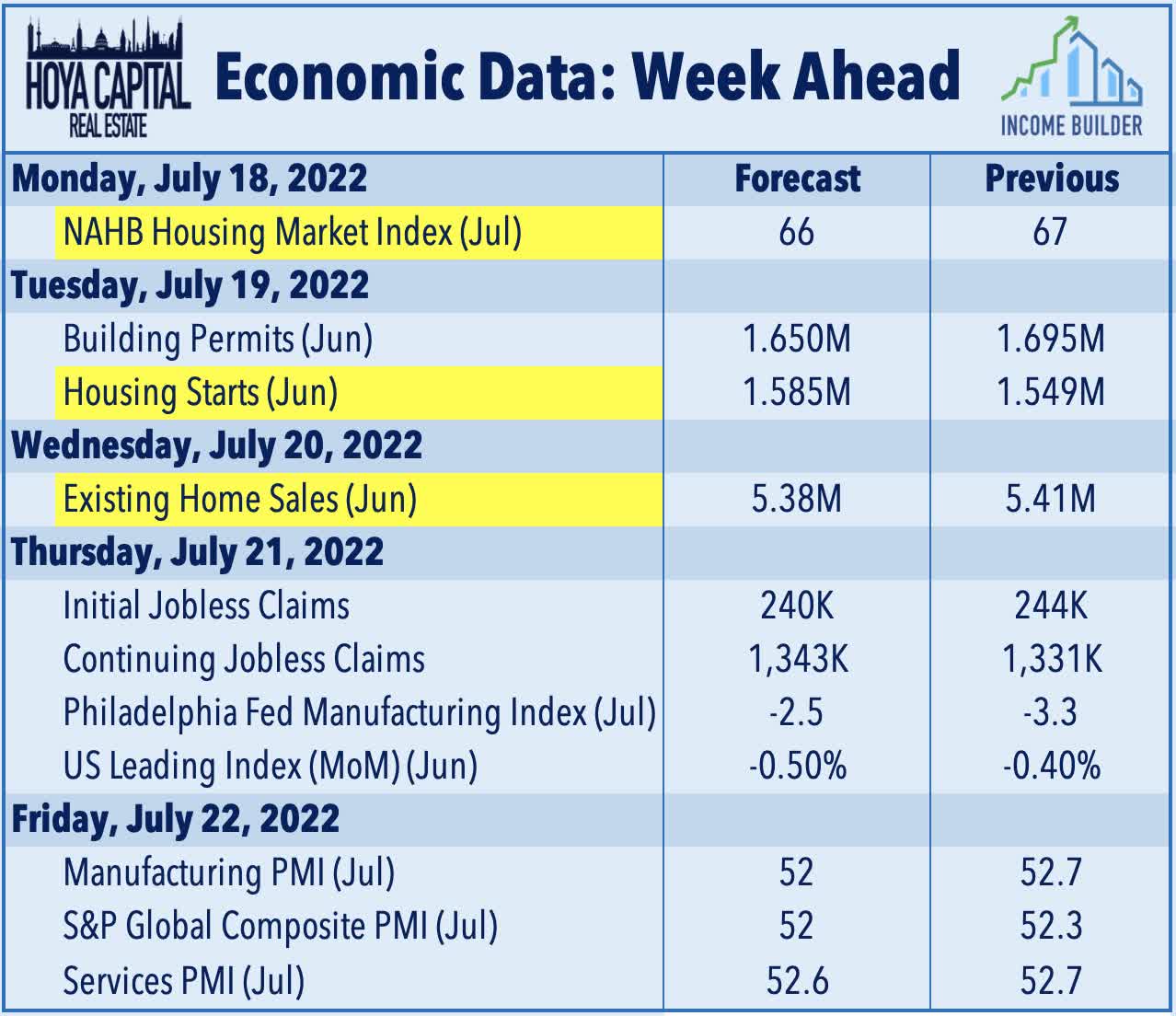

Not unusual during the lower-volume summer trading sessions, the significant intra-day market swings over the past two days have lacked a clearly identifiable catalyst. Perhaps sparking some of the optimism was an investor sentiment survey by Bank of America showing historically bearish sentiment levels, which is typically viewed as a positive indicator for future returns. Signs of considerable cooling in the previously-red hot housing market have also tempered inflation expectations and Fed rate hike expectations as Housing Starts dipped more than expected in June according to data this morning. All eleven GICS equity sectors were higher on the day, led to the upside by the Industrials (XLI) and Communications (XLC) sectors. Rate-senstive sectors lagged as the 10-Year Treasury Yield ticked higher by 6 basis points to close back above the 3.0% level today - still far shy of the 3.50% peak last month.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Real estate earnings season kicks off this week, and over the next month, we'll hear results from more than 175 equity REITs, 40 mortgage REITs, and dozens of housing industry companies. Today, we published our REIT Earnings Preview which discusses the major themes and metrics we'll be watching across each of the major property sectors this earnings season. Since the start of last earnings season, the Equity REIT Index has declined 16%, slightly lagging the 12% decline in the S&P 500 during this time while the 10-Year Yield is essentially after a brief surge to 3.50%. The past quarter has seen a reversal in property sector performance trends since early in 2022 with interest-rate-sensitive REITs catching a bid while pro-cyclical REITs have lagged on recession concerns.

Manufactured Housing: Equity Lifestyle (ELS) was among the laggards today after reporting mildly disappointing results yesterday afternoon - a rare "miss" for a manufactured housing REIT amid a record-10-year streak of outperformance over the REIT Index. While ELS maintained its FFO outlook of 7.9% growth, it downwardly revised its revenue and NOI outlook due to a slowdown in RV seasonal and transient demand citing "poorer weather, inflationary pressures, and a continued shift in demand for annual sites." The slowdown appears to be specific to the transient segment as ELS significantly increased its rent growth guidance on Annual RV rents to 6.5% from 6.0% and also raised its outlook for core MH rent growth to 5.3% from 5.2%. These issues appear to be somewhat ELS-specific - which has nearly 2x the amount of transient revenues as Sun Communities (SUI) - which is further along in a multi-year strategy to convert these slips into annual memberships.

Hotel & Cannabis: Elsewhere in the REIT sector today, hotel REIT Sunstone (SHO) rallied more than 8% today after S&P announced that it will be added to the S&P SmallCap 600 Index prior to the open of trading on Thursday, July 21st. Micro-cap cannabis REIT Power REIT (PW) - which has slid more than 75% this year on tenant rent payment concerns - rallied more than 25% after providing an update on the status of lease negotiations with its largest tenant Marengo Cannabis, noting that after a long delay that it has successfully secured a certificate of occupancy for the property which PW noted was a "significant hurdle" after the town initially refused to issue the CO. The annual straight-line rent based on the amended lease is $5,119,943 which translates to incremental Core FFO per share of approximately $0.38 per quarter and $1.52 per year on a per share basis.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were broadly higher today with residential mREITs gaining 3.1% while commercial mREITs rallied 3.0%. Ellington Financial (EFC) rallied more than 4% today after announcing that its estimated book value per share ("BVPS") was $16.22 as of June 30th, down about 4% during the month and 8% for the quarter as interest rates reached a recent peak in mid-June before retreating over the past several weeks. With mREIT earnings season kicking off next week - a period that included the sharp bond market sell-off from mid-April through mid-June - analysts expect that residential mREITs will report average BVPS declines of around 10% in the quarter while commercial mREIT BVPS are expected to be roughly flat.

REIT Preferreds & Capital Raising

Per the Income Builder Preferred Tracker available to Income Builder subscribers, REIT Preferred stocks finished higher by 0.82% today, on average. REIT Preferreds are lower by roughly 10% on a total return basis this year after ending 2021 with price returns of roughly 8.0% and total returns of roughly 14%. There are now roughly 180 REIT-issued exchange-listed preferred and debt securities with an average current yield of 6.97%.

Economic Data This Week

The state of the housing market will continue to be in focus throughout the week with a trio of reports expected to show a continued cool down in activity over the past month, reflecting the surge in mortgage rates which climbed to nearly 6% in late June before moderating in recent weeks. Following Homebuilder Sentiment data yesterday and Housing Starts and Building Permits data today, on Wednesday, we'll see Existing Home Sales data which is expected to slow to the lowest rate since June 2020. There are some early signs that the recent dip in mortgage rates, moderating home prices, and slightly higher inventory levels have pulled some potential buyers back into the fold in recent weeks, however, as the Redfin Homebuyer Demand Index has rebounded about 5% from its late-June lows.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.