Red-Hot Inflation • REIT Dividend Hike • $1.5 Trillion Bill

- U.S. equity markets retreated Thursday in another choppy session after talks between Russia and Ukraine failed to yield a cease-fire agreement while CPI data showed the highest rate of consumer inflation in four decades.

- Retreating after its strongest day of gains since June 2020 and pushing its week-to-date declines to roughly 2%, the S&P 500 slipped 0.4% today while the tech-heavy Nasdaq 100 dipped 1.1%.

- Real estate equities were among the leaders today as the Equity REIT Index gained 0.3% with 13-of-19 property sectors in positive territory while Mortgage REITs advanced 0.2%.

- Consumer prices surged at the fastest pace in nearly four decades in February - even before the further surge in prices related to the Russia/Ukraine conflict - driven by surges in gasoline and food prices.

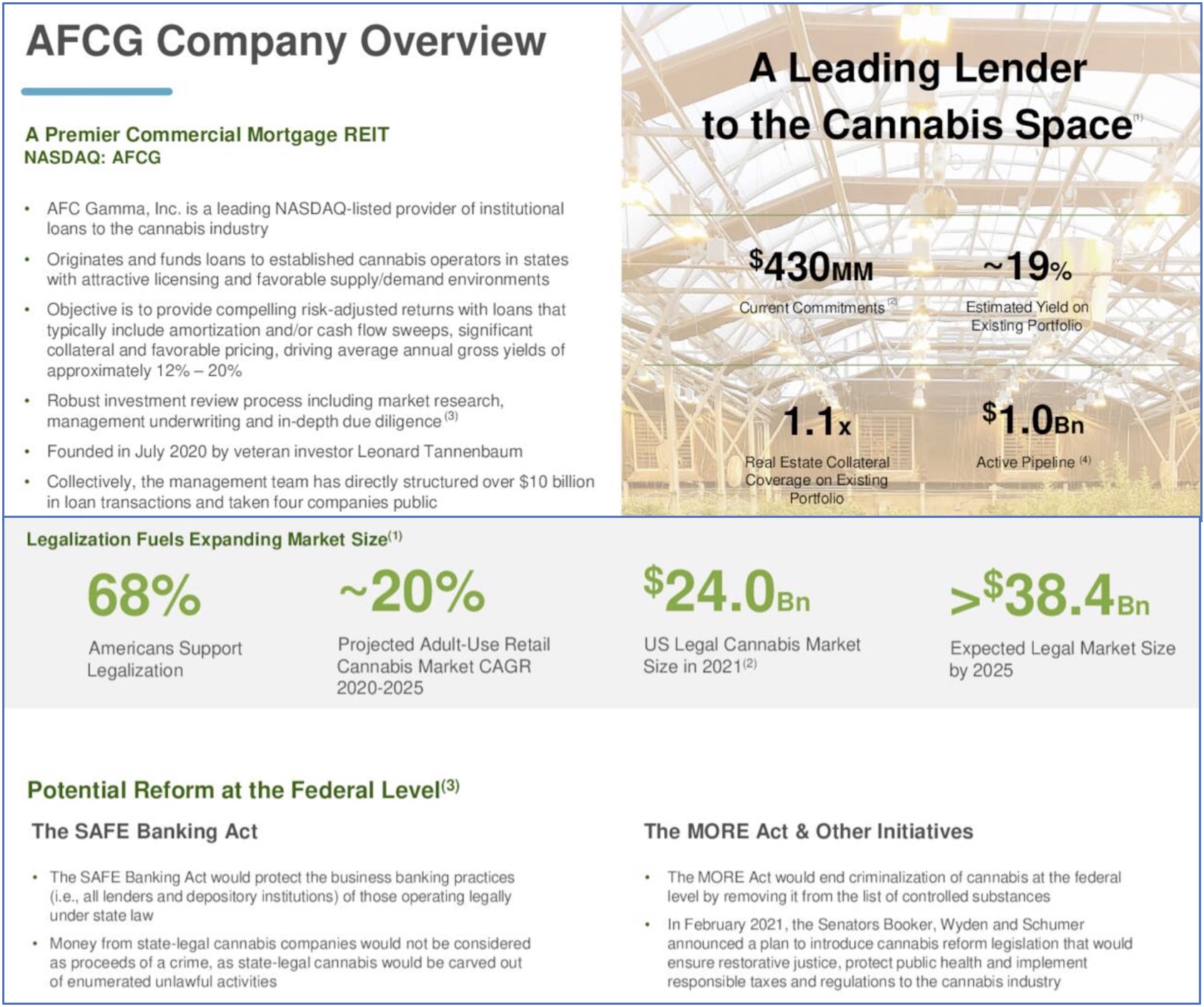

- AFC Gamma (AFCG) - a cannabis mortgage REIT that went public last February - was among the leaders today after reporting solid results and hiking its quarterly dividend by 10% to $0.55/share.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets finished lower Thursday in another choppy session after talks between Russia and Ukraine failed to yield a cease-fire agreement while CPI data showed the highest rate of consumer inflation in four decades. Retreating after its strongest day of gains since June 2020 and pushing its week-to-date declines to roughly 2%, the S&P 500 slipped 0.4% today while the tech-heavy Nasdaq 100 dipped 1.1%. Real estate equities were among the leaders today as the Equity REIT Index gained 0.3% with 13-of-19 property sectors in positive territory while Mortgage REITs advanced 0.2%.

While Gasoline (XB1:COM) and WTI Crude Oil (CL1:COM) futures each pulled back for a second straight day, consumer gasoline prices in the United States again hit fresh records today at $4.32/gallon, which comes as the U.S. House of Representatives passed a massive $1.5 trillion spending package that would fund the government for the rest of the year. Six of the eleven GICS equity sectors finished lower today, dragged on the downside by the Technology (XLK) sector as the 10-Year Treasury Yield climbed back above 2.0% today, but still below its mid-February highs of 2.05%.

The BLS reported this morning that consumer prices surged at the fastest pace in nearly four decades in February - before the further surge in prices related to the Russia/Ukraine conflict - as inflation has so far proven to be less "transitory" than many economists and politicians projected. The Consumer Price Index rose 7.9% year-over-year – roughly in line with consensus estimates - and the highest annual increase since February 1982. Core Consumer Prices - which excludes food and energy - rose 6.4% from last year - which was significantly hotter than estimates of 5.9%. Prices for food, rent, and gasoline were once again the largest contributors to inflation as the energy index rose 25.6% over the last year, and the food index increased 7.9% percent, the largest 12-month increase since July 1981.

As we've discussed for the last year, we continue to see persistent pressure on the headline inflation metrics due to the delayed impact of soaring rents and home values, which are just beginning to filter in the data. The cost of shelter increased 0.5% in February and accounted for over 40% of the monthly increase in the Core CPI Index. Private market rent data has shown that national rent inflation has been in the 10-15% range over the past quarter while home values have risen by 15-20%. The Dallas Fed published a report highlighting the data issues at the BLS, finding a 16-month lag between the BLS inflation series and real-time market pricing of home prices and rents which will add an estimated 0.6-1.2% to the Core CPI index in 2022 and 2023.

Real Estate Daily Recap

Cannabis: AFC Gamma (AFCG) - a cannabis mortgage REIT that went public last February - was among the leaders today after reporting solid results and hiking its quarterly dividend by 10% to $0.55/share. AFCG reported total loan commitments of $419.2M ($363.7 million of which has been funded) across 16 portfolio companies with a weighted average yield to maturity was of 19%. In its earnings release, the company noted that operating as a public REIT "has allowed us to accomplish several goals, including valuable access to public debt and equity markets, which provides AFCG with an attractive cost of capital relative to its peers.” The largest cannabis REIT Innovative Industrial (IIPR) has been the best-performing REIT since the start of 2017.

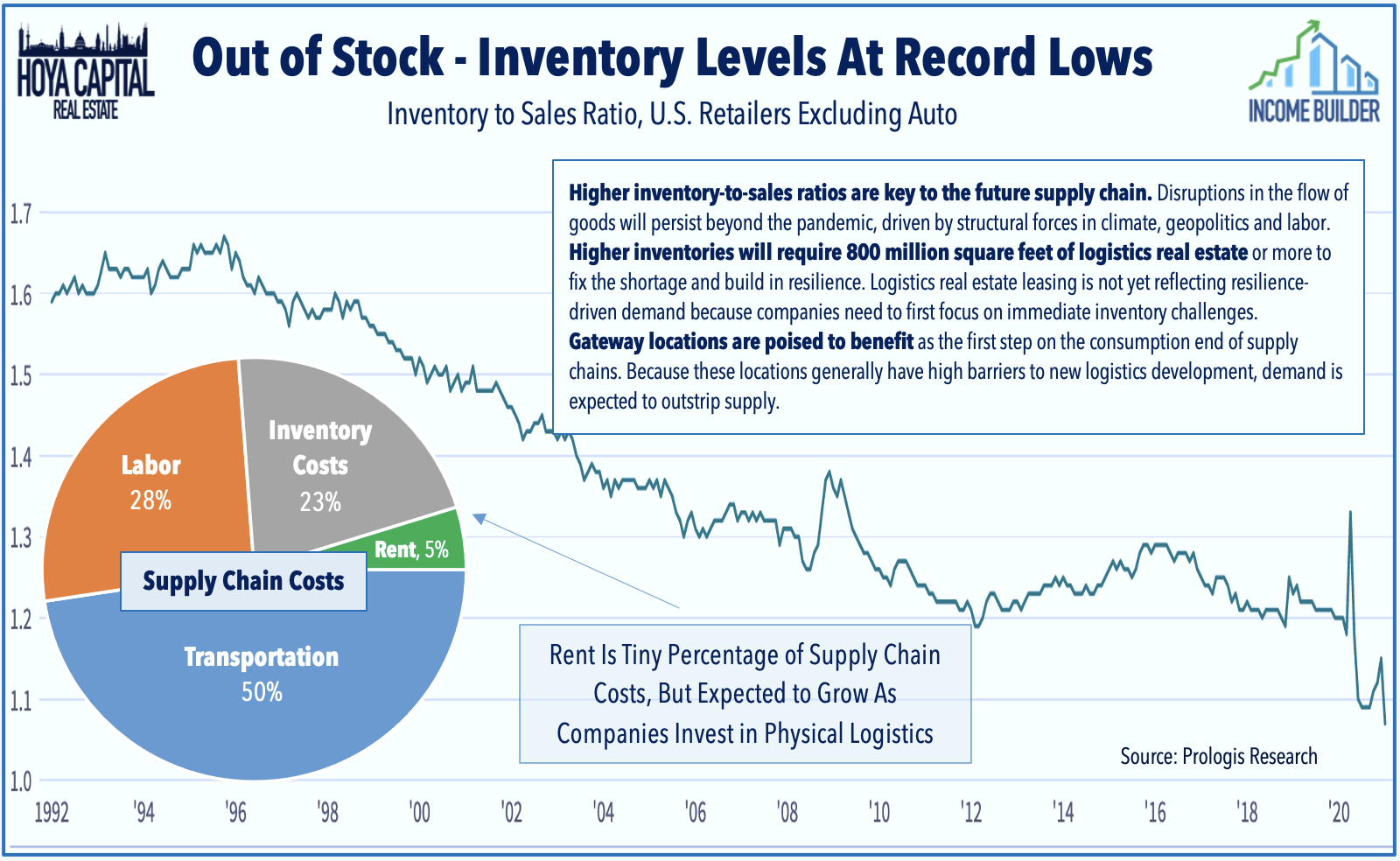

Industrial: Rexford Industrial (REXR) was also among the leaders today after announcing an acquisition of eight industrial properties for $205.2M in its home Southern California market and noted that it has over $500M of additional investments under contract. Yesterday we published Supply Chains At Breaking Point, which discussed our updated outlook on the industrial REIT sector. On the front-lines of the historic supply-chain shortages, Industrial REITs outperformed the broad-based REIT Index for the sixth consecutive year in 2021, but have uncharacteristically lagged in early 2022. Industrial vacancy rates declined to record-lows below 4% despite robust levels of new development, driving rent growth of nearly 20% in North America with some markets seeing 50% year-over-year increases. Industrial REITs are never "cheap" but much like the residential sector, supply-demand fundamentals are likely to remain favorable into the late 2020s.

Yesterday we also published Shopping Center REITs: Outlook Remains Upbeat as an exclusive report for Income Builder members. Unlike their mall REIT peers, Shopping Center REITs entered 2022 with fundamentals that are as strong - or possibly even stronger - than before the pandemic with a full recovery completed. Occupancy rate trends and leasing spreads have been especially impressive with rents rising by double-digit rates in Q4, indicating clear signs of pricing power for the first time since the mid-2010s. Shopping Center REIT valuations were becoming rich in late-2021, but the combination of Omicron and the Russia conflict have pulled valuations of several higher-quality REITs back toward "bargain" territory. We discussed our favorite names in the sector in the report.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, residential mREITs finished flat today while commercial mREITs finished higher by 0.3%. After the close today, AGNC Investment (AGNC) announced that its estimated tangible Book Value Per Share ("BVPS") was $13.48 at the end of February, down from $14.91 at the end of January as the yield curve continued to flatten into early March. AGNC also held its monthly dividend steady at $0.12/share. The average residential mREIT pays a dividend yield of 11.14% while the average commercial mREIT pays a dividend yield of 7.58%.

Economic Data This Week

The economic calendar wraps up tomorrow with Michigan Consumer Sentiment data, which sunk to the lowest level in ten years in February amid intensifying concerns over inflation. We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook report published this weekend.

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.