REIT Dividend Hikes • Inflation Ahead • Healthcare Update

Summary

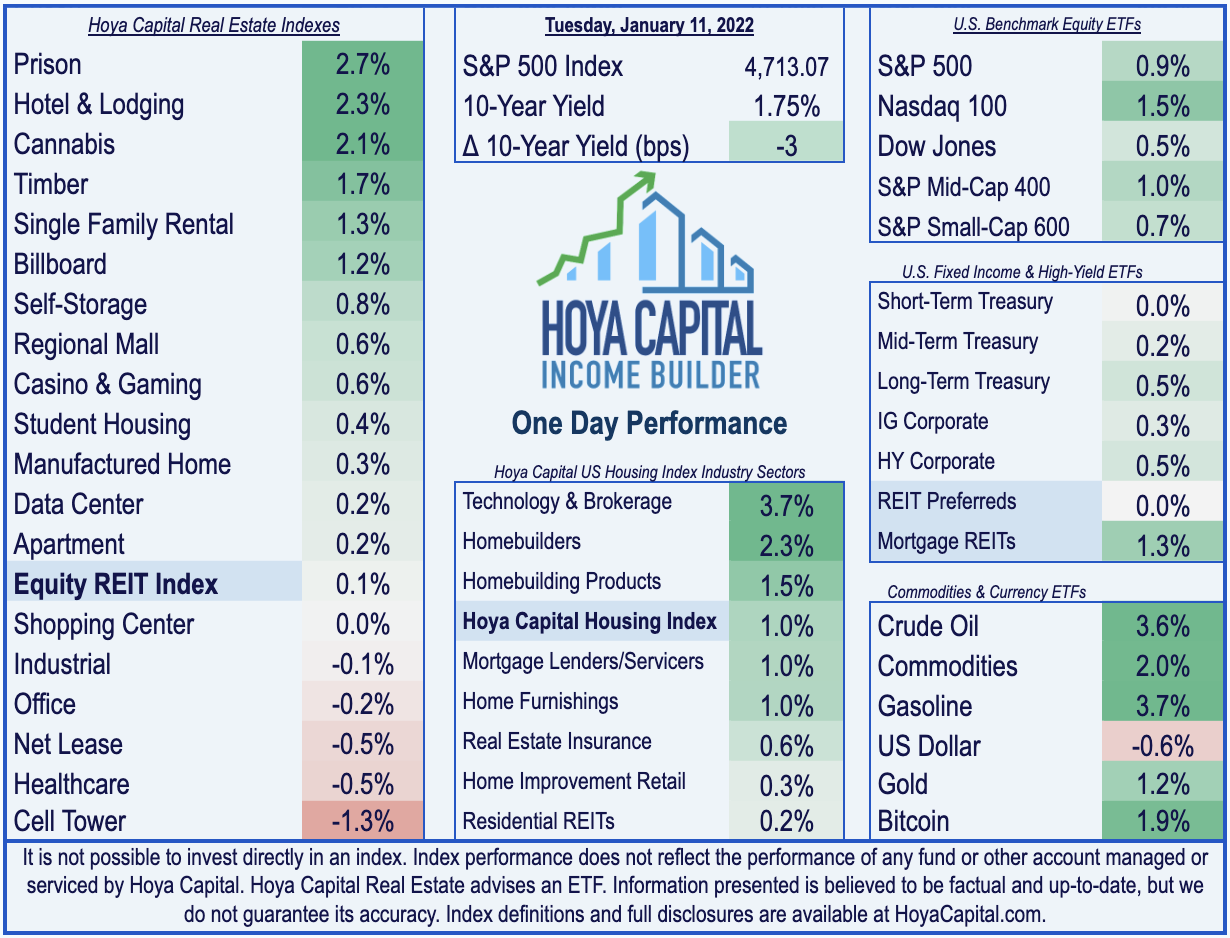

- U.S. equity markets finished broadly higher Tuesday after Fed Chair Powell struck a less hawkish tone in his confirmation hearing, sparking a bid for longer-duration assets ahead of CPI inflation data tomorrow.

- Snapping a five-day losing streak, the S&P 500 rallied 0.9% today while the tech-heavy Nasdaq 100 gained 1.5% and the Mid-Cap 400 gained 1.0%.

- Real estate equities were mostly higher today, but have lagged in the early-goings of 2022 as the Equity REIT Index gained 0.1% with 14-of-19 property sectors in positive-territory while Mortgage REITs advanced 1.3%.

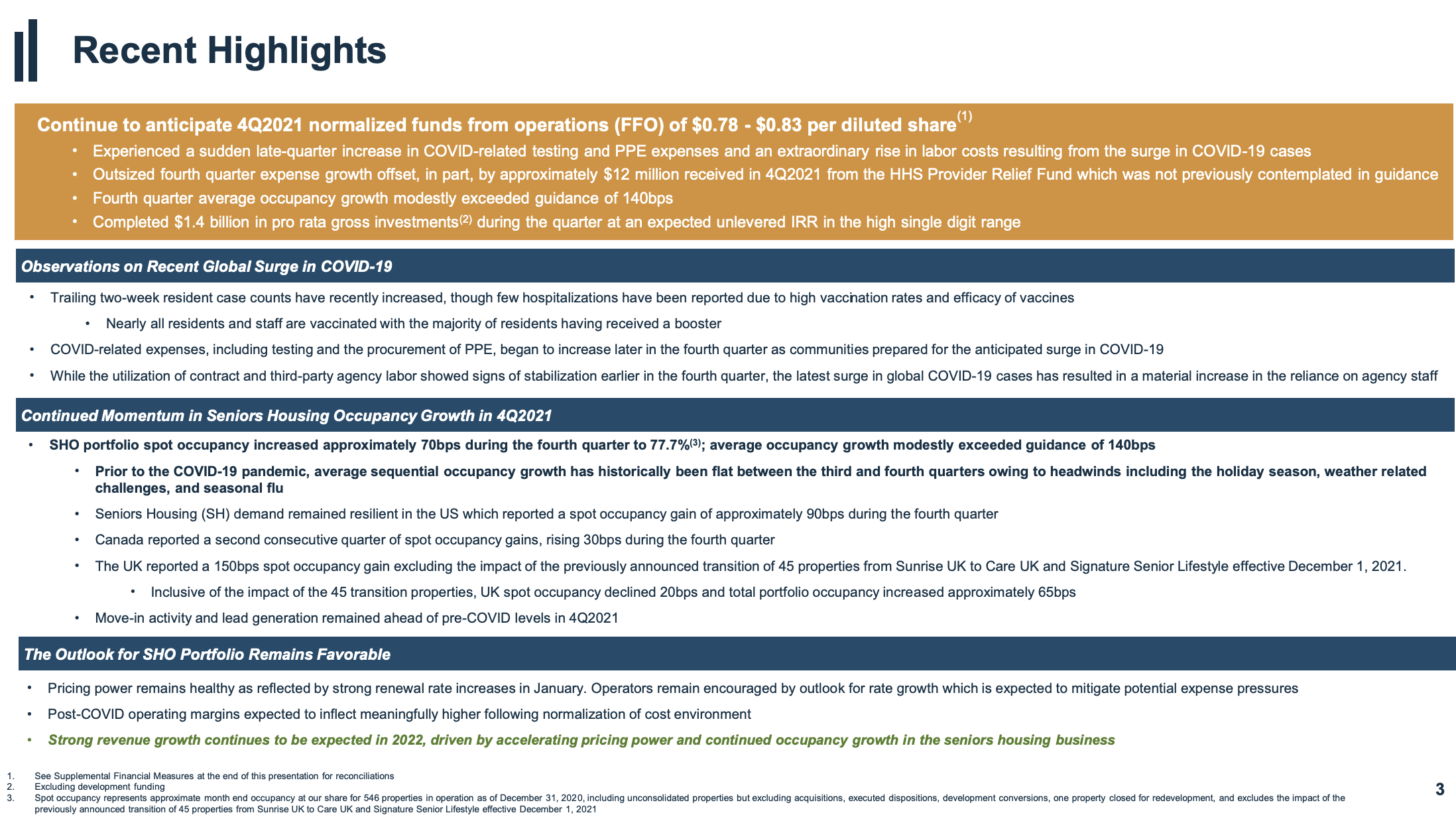

- Senior Housing REIT Welltower (WELL) reiterated its Q4 FFO guidance as "outsized" fourth-quarter expenses were offset by HHS Provider Relief Fund. WELL noted that occupancy modestly exceeded its guidance and commented that it expects "strong revenue growth in 2022."

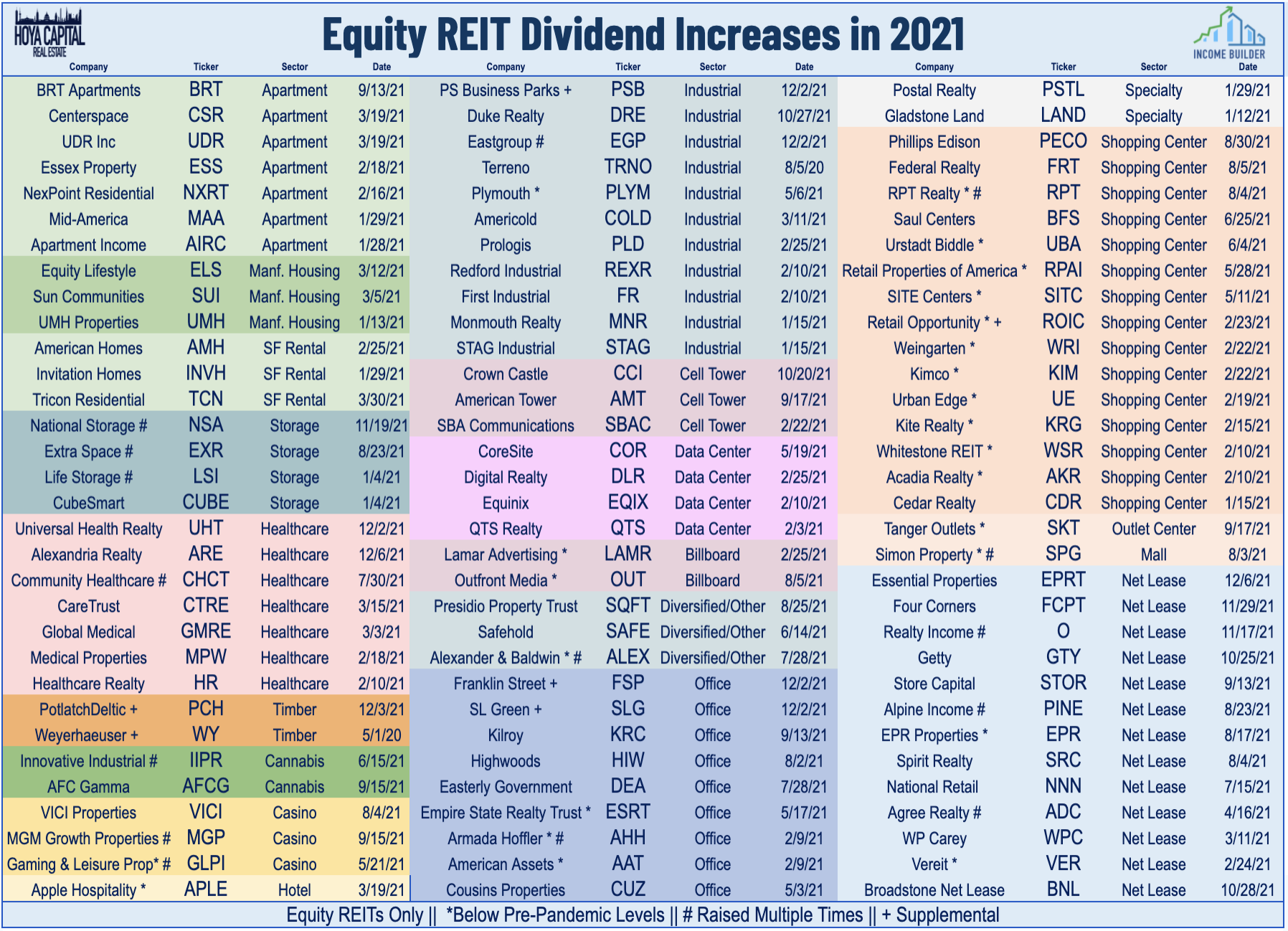

- Following a wave of more than 130 REIT dividend hikes in 2021, we saw our second REIT dividend increase of 2022 today with STAG Industrial (STAG) hiking its monthly dividend.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

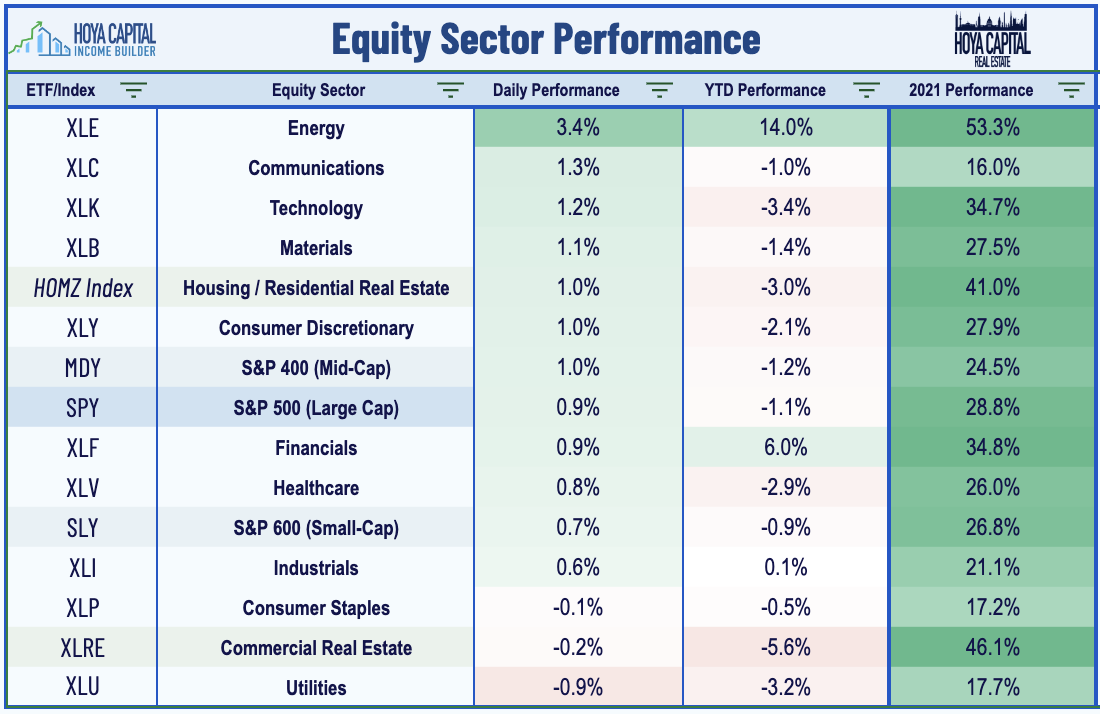

U.S. equity markets finished broadly higher Tuesday after Fed Chair Powell struck a less-hawkish tone in his confirmation hearing, sparking a bid for longer-duration assets ahead of a key CPI inflation report tomorrow. Snapping a five-day losing streak, the S&P 500 rallied 0.9% today while the tech-heavy Nasdaq 100 gained 1.5% and the Mid-Cap 400 gained 1.0%. Real estate equities were mostly higher today, but have lagged in the early-goings of 2022 as the Equity REIT Index gained 0.1% with 14-of-19 property sectors in positive territory while Mortgage REITs advanced 1.3%.

After eclipsing the highest level since the start of the pandemic, the 10-Year Treasury Yield pulled back 5 basis points today following comments from Fed Chair Powell and data showing that hospitalizations in the U.S. hit fresh record-highs on Tuesday. Eight of the eleven GICS equity sectors were higher today with the Energy (XLE) sector continuing its strong start to 2022. Homebuilders and the broader Hoya Capital Housing Index were among the leaders today following several analyst upgrades and positive industry commentary suggesting that demand remains robust into early winter.

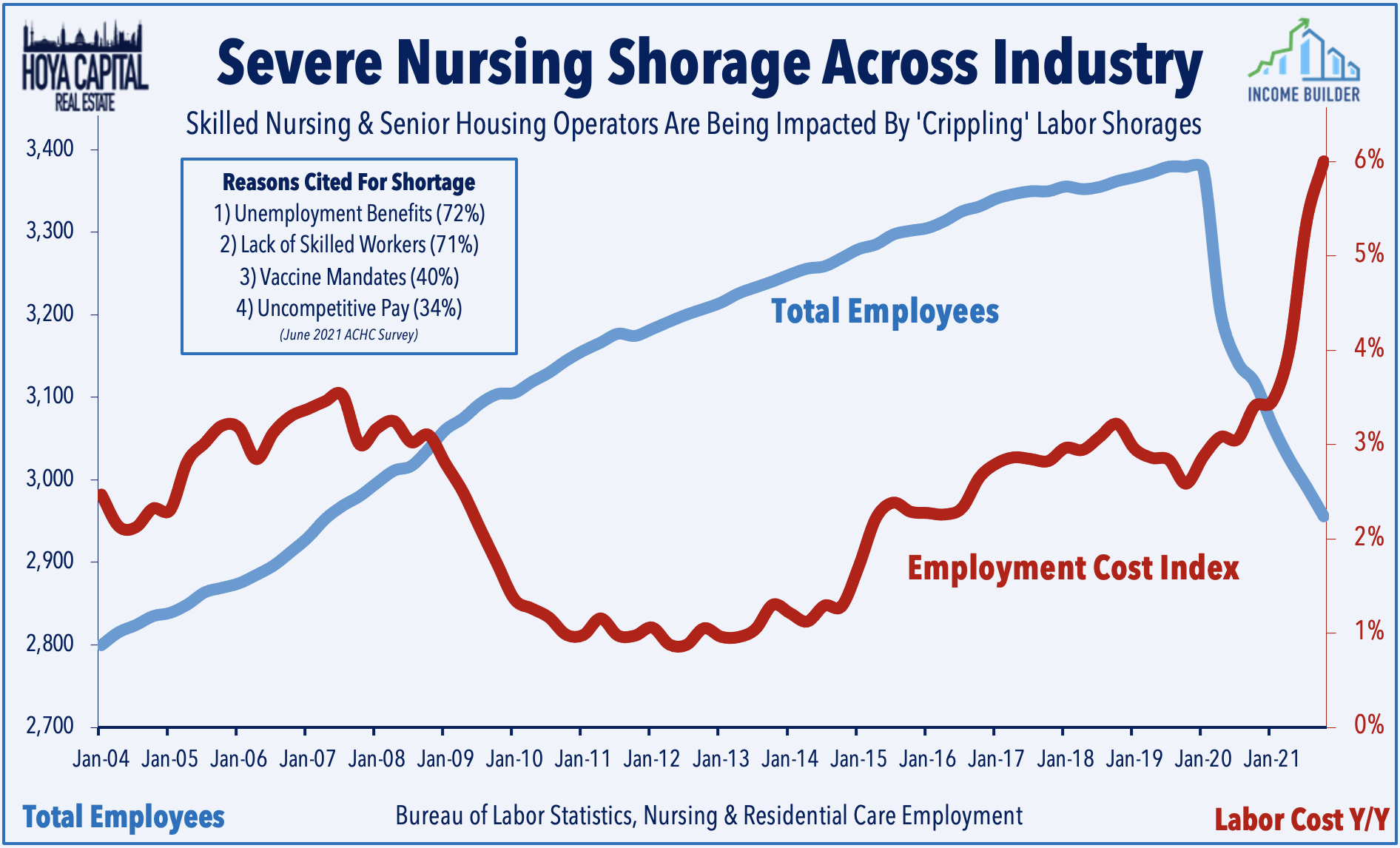

Equity REIT & Homebuilder Daily RecapHealthcare: Today, we published Healthcare REITs: Vaccine Hesitancy. After a vaccine-driven revival, Healthcare REITs were the weakest-performing property sector in 2021 as the promising recovery in skilled nursing and senior housing has suffered Omicron-driven setbacks. Staffing shortages have become critical issues at skilled nursing and senior housing facilities, which operators attribute to a combination of COVID-related sick days, vaccine mandates, unemployment benefits, and uncompetitive wages. While near-term headwinds will persist until the pandemic abates, we remain optimistic on the longer-term outlook for healthcare REITs. Baby Boomers are substantially larger and wealthier than any prior generation.

On cue, senior housing REIT Welltower (WELL) issued a business update this morning in which it reiterated its Q4 FFO guidance as outsized fourth-quarter expenses were offset by $12M received in HHS Provider Relief Fund. Encouragingly, WELL noted that occupancy modestly exceeded its guidance and commented that it expects "strong revenue growth in 2022 driven by accelerating pricing power and continued occupancy growth in the seniors housing business." On the labor shortage issues, WELL commented that "while the utilization of contract and third-party agency labor showed signs of stabilization earlier in the fourth quarter, the latest surge in global COVID-19 cases has resulted in a material increase in the reliance on agency staff."

Industrial: Following a wave of more than 130 REIT dividend hikes in 2021, we saw our second REIT dividend increase of 2022 today as STAG Industrial (STAG) declared a $0.1217/share quarterly dividend, a 0.7% increase from its prior dividend of $0.1208. Last week, Life Storage (LSI) declared a $1.00/share quarterly dividend, a 16.3% increase from its prior dividend of $0.86. As discussed in our State of the REIT Nation report, FFO growth significantly outpaced dividend growth in 2021, pushing REIT dividend payout ratios to just 67% in Q3 - well below the 20-year average of 75% - indicating that REITs are well equipped to continue to raise their payouts in the quarters ahead.

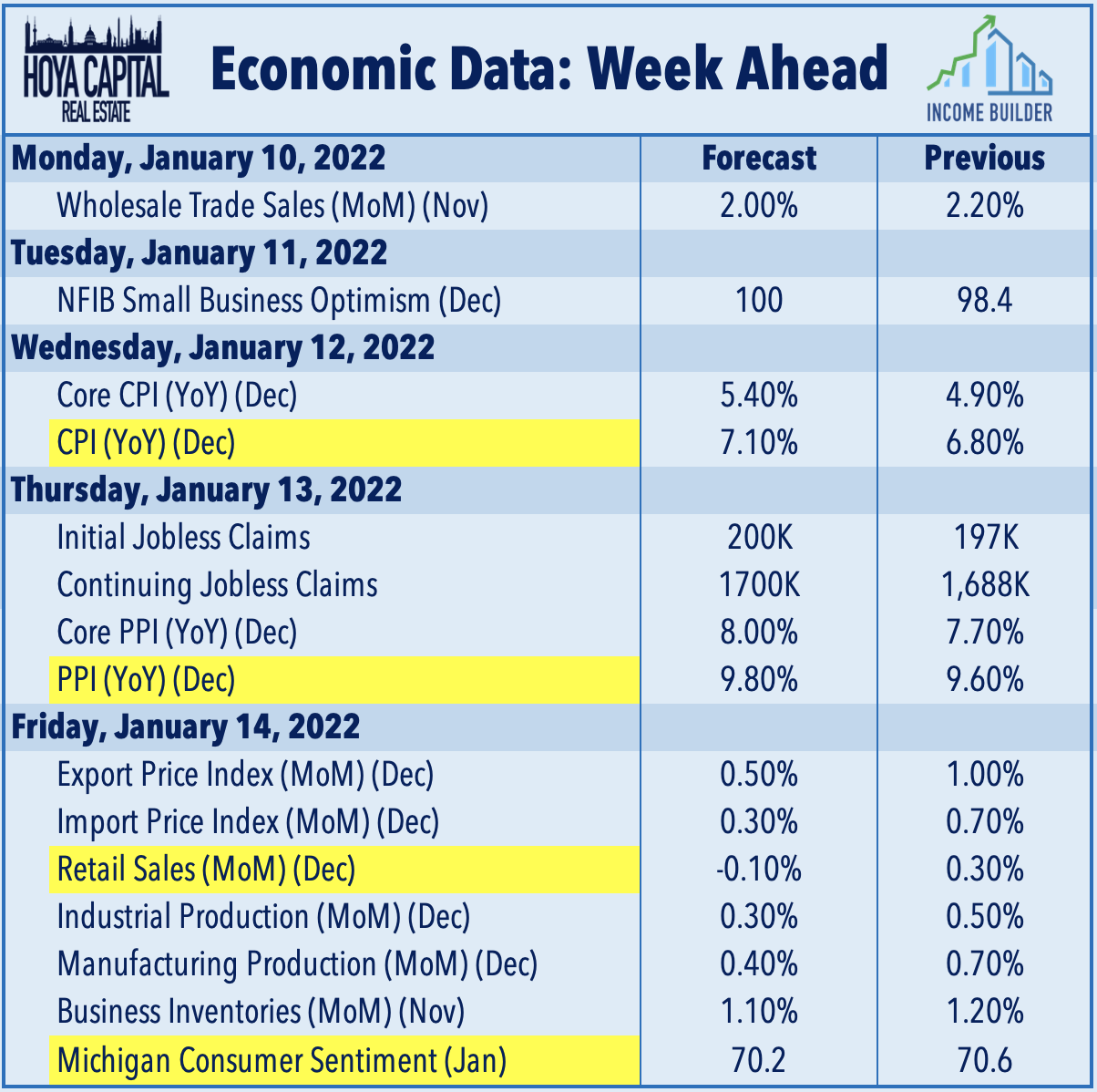

Economic Data This WeekInflation and retail sales data highlight the busy week of economic data in the week ahead, kicking off on Wednesday with the Consumer Price Index report for December which is expected to show the highest rate of consumer price inflation in 40 years. On Thursday, we'll see the Producer Price Index report which is expected to show the highest rate of producer price inflation on record nearly 10%. On Friday, we'll see Retail Sales data for the critical holiday month of December which is expected to show a modest decline from the prior month and we'll also get our first look at Consumer Sentiment data for January.

We're excited to announce the launch of our new investment research service here on Seeking Alpha - Hoya Capital Income Builder. We've put together a great team of contributors from across the REIT, dividend, and ETF industry, so whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.