REIT Dividend Hikes • Yields Rise • Earnings Recap

- U.S. equity markets rebounded Friday- trimming the weekly declines on the major benchmarks- as investors analyzed another busy slate of corporate earnings results, consumer sentiment data, and Fed commentary.

- Real estate equities were among the leaders today following a very strong slate of earnings results over the past 24-hours. Equity REITs advanced 0.4% today while Mortgage REITs gained 0.9%.

- A trio of REITs hiked their dividends over the past 24 hours, one of nearly a dozen REITs to hike their dividend this week: American Homes, RPT Realty, and Weyerhaeuser.

- Net lease REIT WP Carey (WPC) rallied more than 4% after reporting very strong results and issued 2023 guidance that exceeded analyst estimates. WPC forecasts that same-store rent growth will increase to around 4% for full-year 2023 as the effects of its CPI-linked escalators take full effect.

- Sunbelt-focused office REIT Cousins Properties (CUZ) rallied nearly 3% today after reporting better-than-expected results highlighted by an acceleration in rent spreads to 7.3% and total leasing volume that was essentially in-line with its pre-pandemic levels from 2019.

Income Builder Daily Recap

U.S. equity markets rebounded Friday- trimming the weekly declines on the major benchmarks- as investors analyzed another busy slate of corporate earnings results, consumer sentiment data, and Fed commentary. Shaving its weekly decline to 1.0%, the S&P 500 advanced 0.2% today. The tech-heavy Nasdaq 100 dipped 0.7%, however, posting its first weekly decline of the year. Bonds remained under pressure with the 10-Year Treasury Yield climbing another 6 basis points today to 3.74% - rebounding from four-month lows around 3.40% last week. Real estate equities were among the leaders today following a very strong slate of earnings results over the past 24 hours. The Equity REIT Index advanced 0.4% today with 13-of-18 property sectors in positive territory while the Mortgage REIT Index advanced 0.9%.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

A trio of REITs hiked their dividends over the past 24 hours, one of nearly a dozen REITs to hike their dividend this week. RPT Realty (RPT) hiked its quarterly dividend by 8% to $0.14/share, Weyerhaeuser (WY) increased its quarterly dividend by 6% to $0.19/share, and American Homes (AMH) hiked its quarterly dividend by 22% to $0.22/share. Today we published our REIT Halftime Report on the Income Builder Marketplace. We're approaching the halfway point of another consequential real estate earnings season with roughly 40 equity REITs and 15 mortgage REITs representing 50% of the total market capitalization having reported results thus far. REIT earnings results to this point have modestly exceeded expectations. Of the 36 REITs that provide guidance, 20 (56%) reported 2022 Funds From Operations ("FFO") above their prior guidance while 3 (8%) missed. Industrial and Residential REITs have been upside standouts - forecasting mid-single-digit FFO growth in 2023. Strip center, net lease, and healthcare REIT FFO is expected to be roughly flat in 2023 while office and mall REITs forecast FFO declines for the year.

Apartment: Apartment Income (AIRC) - which we own in the REIT Focused Income Portfolio - gained about 1% after reporting strong results yesterday afternoon, noting that it achieved a sector-leading blended leasing spread of 11% blended spreads in both Q4 and January - far exceeding the sector average of 6.1% and 4.8% for those periods. Equity Residential (EQR) also advanced 1% after reporting solid results, noting that its full-year FFO rose 18.1% in 2022 - in-line with its prior guidance - and forecasts that its FFO will grow another 6.2 % for full-year 2023 - above the apartment REIT average of roughly 4%. Income Builder contributor Amada Advisors published an extended commentary on apartment REIT results linked here. Of note, the report highlights that Camden (CPT) assigns letter grades to its markets based on fundamental trends its observing. Top-ranked markets include Orlando, Southeast Florida, Tampa, Charlotte, Raleigh and Nashville, all ranked A+ or A. The lowest ranked markets are Houston, Los Angeles and Orange County with ratings of B/B-.

Net Lease: WP Carey (WPC) - which we own in the REIT Focused Income Portfolio - rallied more than 4% after reporting very strong results this morning and issued 2023 guidance that exceeded analyst estimates. WPC forecasts that same-store rent growth will increase to around 4% for full-year 2023 as the effects of its CPI-linked escalators take full effect. Of note, while National Retail (NNN) reported muted cap rate movement in its report earlier this week, WPC observed more material widening with acquisition cap rates averaging 6.8% in Q4 - up 80 basis points from Q4 of 2021 and noted that the majority of the opportunities that its evaluating have cap rates "high 6s and into the 7s." WPC noted that it has seen bid-ask spread tighten of late as initially-reluctant sellers adjust pricing to reflect the higher-rate environment.

Office: Sunbelt-focused Cousins Properties (CUZ) - which we added to the REIT Dividend Growth Portfolio this week - rallied nearly 3% today after reporting better-than-expected results highlighted by an acceleration in rent spreads to 7.3% and total leasing volume that was essentially in-line with its pre-pandemic levels from 2019. Corporate Office (OFC) advanced 1% after reporting similarly solid leasing trends with a sequential increase in rent spreads and occupancy rates. In our REIT Halftime Report, we noted that fourth-quarter results have been better than expected across much of the sector, the FFO outlook for 2023 has been notably soft across the sector with all 9 REITs projecting a decline in FFO of at least 5%. We've observed a continued outperformance from REITs focused on Sunbelt and secondary markets with all four of these REITs - Cousins, Corporate Office, Highwoods (HIW), and Piedmont (PDM) - all forecasting 2023 FFO that will remain above their pre-pandemic level from 2019.

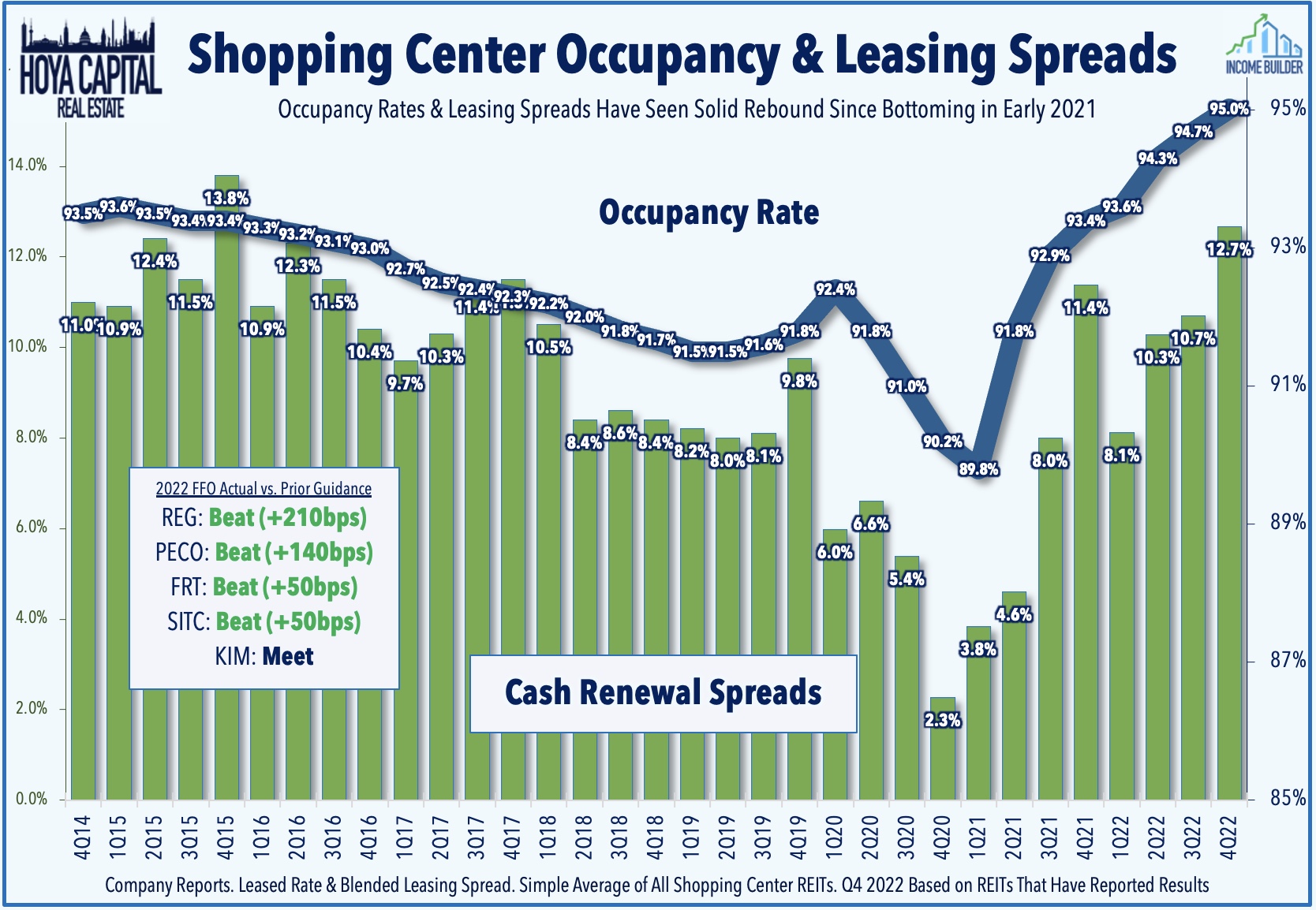

Strip Centers: A pair of grocery-focused shopping center REITs - Regency Centers (REG) and Philips Edison (PECO) - each rallied more than 3% today after reporting strong fourth-quarter results. We've heard results from five of the 16 shopping center REITs - four of which have reported full-year FFO that was above their prior guidance. Importantly, all five REITs have reported a sequential acceleration in rent growth - which is on-pace for the second-best quarter in a decade - and an improvement in occupancy rates to the highest on record. Same-store occupancy rates among these five REITs climbed by an average of 35 basis points from last quarter and 140 from last year while rent growth is on-pace to be in the double-digits for a third-straight quarter. These five shopping center REITs see muted FFO growth in 2023, however, due in part to expectations of near-term vacancies from several bankrupt or near-bankrupt retailers including Party City and Bed Bath (BBBY), but expressed a high degree of confidence in their ability to quickly re-lease the space.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were mostly-higher today with residential mREITs finishing fractionally higher while commercial mREITs advanced 1.3%. Ladder Capital (LADR) rallied 6% today after reporting strong results, noting that its Book Value Per Share ("BVPS") increased 2.1% while no major issues with loan performance. Redwood Trust (RWT) was among the laggards today after reporting mixed results, noting that its BVPS declined 6.2% in Q4 - the weakest among the residential REITs to report thus far. In our REIT Halftime Report, we noted that residential mREITs have reported an average 2% increase in BVPS in Q4 from the prior quarter - led by a rebound in agency-focused mREITs - while commercial mREITs have reported a 1% decline.

Economic Data This Week

We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook this weekend.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.