REIT M&A • Earnings Updates • Dividend Hikes

- U.S. equity markets remained under pressure Wednesday with the major benchmarks extending their longest losing-streak of the year amid lingering uncertainty over the path of inflation and Fed rate hikes.

- Following its worst decline since December, the S&P 500 declined 0.2% today - its fourth-straight session of losses - while the Dow declined 85 points following a nearly 700 skid yesterday.

- Indus Realty (INDT) rallied 5% after announcing that it reached an agreement with Centerbridge Partners and GIC Real Estate to be acquired in an all-cash $868M transaction at $67.00/share.

- Tanger Outlets (SKT) rallied 4% after reporting better-than-expected results highlighted by strong leasing volume and a positive inflection in rental rate trends. Tanger recorded rent spreads of 10.1%- its strongest rent growth since 2016.

- SBA Communications (SBAC) dipped more than 5% after reporting mixed results and announcing that its CEO will retire at the end of 2023, overshadowing a 20% hike to its quarterly dividend to $0.85/share - becoming the 26th REIT to raise its dividend this year.

Income Builder Daily Recap

U.S. equity markets remained under pressure Wednesday with the major benchmarks extending their longest losing streak of the year amid lingering uncertainty over the path of inflation and Fed rate hikes. Following its worst decline since December, the S&P 500 declined 0.2% today - its fourth-straight session of losses - while the Dow declined 85 points following a nearly 700 skid on Tuesday. Other major benchmarks eked out gains on the session, however, with the tech-heavy Nasdaq 100 clinging to 0.1% gains while the Mid-Cap 400 advanced 0.2%. Bonds stabilized following a sharp sell-off on Tuesday as the 10-Year Treasury Yield retreated by 3 basis points to 3.92% today. Real estate equities were mixed amid the busiest 48-hour stretch of earnings season. The Equity REIT Index declined 0.9% today with 5-of-18 property sectors in positive territory. The Mortgage REIT Index gained 0.6% while Homebuilders rebounded by 0.9%.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Industrial: The busy slate of earnings news was overshadowed by some major M&A news. Small-cap Indus Realty (INDT) rallied more than 5% today after announcing that it reached an agreement with Centerbridge Partners and GIC Real Estate to be acquired in an all-cash $868M transaction at $67.00/share - up from the initial $65/share offer that the private equity pair initially proposed in late November. Previously known as Griffin Industrial Realty before its REIT conversion back in 2021 - Indus is a small-cap REIT that owns 42 industrial/logistics buildings aggregating 6.1 million square feet in Connecticut, Pennsylvania, North Carolina, South Carolina, and Florida. Per the merger terms, INDUS will be allowed to declare and pay its regular Q1 and Q2 2023 cash dividends but will suspend subsequent dividends until the closing of its merger, which is expected to occur by mid-2023. For GIC, the deal is its second major acquisition of the past year following its $14B takeover of net lease REIT Store Capital last September.

Mall: Tanger Outlets (SKT) rallied 4% after reporting better-than-expected results highlighted by strong leasing volume and a positive inflection in rental rate trends. Tanger recorded rent spreads of 10.1% on new and renewed leases on a trailing twelve-month basis - its strongest rent growth since 2016 and marking the fourth-straight quarter of positive spreads following a dismal stretch of rent declines from mid-2019 to late 2021. The outlet-focused retail operator commented that "traffic remained steady and total gross sales were in line with last year's levels in spite of a far more promotional retail environment this holiday selling season. Tanger recorded 4.0% FFO growth in 2022 - above its prior guidance - and expects growth of 0.5% in 2023 at the midpoint of its range, which would bring its FFO to within 20% of pre-pandemic levels from full-year 2019.

Net Lease: Realty Income (O) - the largest net lease REIT - gained after reporting better-than-expected results, noting that its full-year FFO rose 13.1% in 2022 - 80 basis points above its prior guidance. Like most of its net lease REIT peers, it's been "business as usual" for the company despite the surge in benchmark interest rates as Realty Income acquired $3.9 billion in assets in Q4 across 578 properties at a weighted average cap rate of 6.1% - up 70 basis points from Q4 2021 during which time the benchmark 10-Year Treasury Yield increased roughly 230 basis points. Realty Income expects relatively muted FFO growth in 2023 at 0.2% - roughly in-line with its net lease peers National Retail (NNN) and WP Carey (WPC) - as higher interest rate expenses and muted property-level rent growth are expected to offset the effects of "at least $5B" in acquisition volume.

Storage: Public Storage (PSA) slumped about 2.5% after kicking-off storage REIT earnings with a solid report, but provided a relatively soft outlook for 2023. PSA recorded full-year FFO growth of 23.1% in 2022 - 290 basis points above its prior guidance - while also delivering same-store NOI growth that exceeded its prior expectations with 17.1% growth in 2022. PSA expects its FFO growth and same-store NOI growth to each moderate to roughly 3% this year at the midpoint of its range. Earlier this month, PSA hiked its dividend by 50% - its first dividend hike since 2016 - alongside a proposal to acquire Life Storage (LSI). On the earnings call, PSA reiterated its view that the "combination is poised to unlock superior growth and value creation for shareholders," highlighting PSA's higher operating margins, value in combining their ancillary business lines - including storage insurance, third-party property management, business customer offerings and lending - and the benefits of scale related to new development opportunities and balance sheet strength.

Apartments: A pair of REITs concluded a strong earnings season for apartment REITs. NYC-focused Veris (VRE) reported a sector-high same-store NOI growth of over 20% in 2022 and strong leasing trends in Q4 and into early Q1 with blended spreads of over 11% across both periods. Centerspace (CSR) reported full-year FFO growth of 11.0% in 2022 - slightly below its prior guidance - but provided a fairly upbeat forecast calling for blended rent growth of 4.5% for full-year 2023. This afternoon, we'll publish our updated Apartment REIT report to the Income Builder Marketplace which will analyze recent earnings results and discuss our recent allocations in the sector. Notably, apartment REIT earnings results and guidance have pushed back on the "hard landing" narrative. Apartment REITs forecast NOI growth of 7% and FFO growth of 4% in 2023 - among the strongest in the real estate sector.

Cell Tower: Last but not least, SBA Communications (SBAC) dipped more than 5% after reporting mixed results and announcing that its president and CEO, Jeff Stoops, will retire at the end of 2023 at which time current CFO Brendan Cavanagh will become the new CEO. SBAC recorded FFO growth of 14.1% in 2022 - above its prior guidance - but forecasts a moderation in 2023 with expectations of 3.2%, slightly below its peer Crown Castle (CCI). SBAC announced that it will hike its quarterly dividend by 20% to $0.85/share - becoming the 26th REIT to raise its dividend this year.

Additional Headlines from The Daily REITBeat on Income Builder

- BHR, BNL, EPR, EXR, FPI, GOOD, GTY, OUT, RTL, SUI are scheduled to report after the close of trading

- AMT, CIO, CLDT, GNL, IRM, MPW, and PLYM will announce tomorrow morning before the open

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs rebounded today with residential mREITs advancing 0.7% while commercial mREITs gained 1.1%. TPG Real Estate (TRTX) soared more than 15% after reporting strong fourth-quarter results, noting that its distributable earnings per share rose to $0.30 in Q4 - up 53% from last quarter - and covering its $0.24/share dividend. Invesco Mortgage (IVR) traded flat today after reporting that its Book value Per Share ("BVPS") was roughly unchanged in Q4 at $12.79, but noted that its BVPS has improved by approximately 4% since year-end through February 17. IVR reported earnings available for distribution of $1.46 - up from $1.39 in Q3 - which covers its $0.65/share dividend. We'll hear results from New York Mortgage (NYMT) and Franklin BSP (FBRT) this afternoon.

Economic Data This Week

Housing and inflation data headline the busy slate of economic data this week. The most closely-watched report of the week will be the PCE Price Index on Friday - the Fed's preferred gauge of inflation - which is expected to show similar mixed signs of declining annual inflation but perky inflation in January as were on display in the CPI and PPI Price Indexes last week. On the housing-front, following Existing Home Sales data yesterday, we'll see New Home Sales data on Friday, which is expected to show a modest thawing in housing market activity following a sharp rate-driven cooldown. Jobless Claims and the first revision to fourth-quarter Gross Domestic Product data will be released on Thursday.

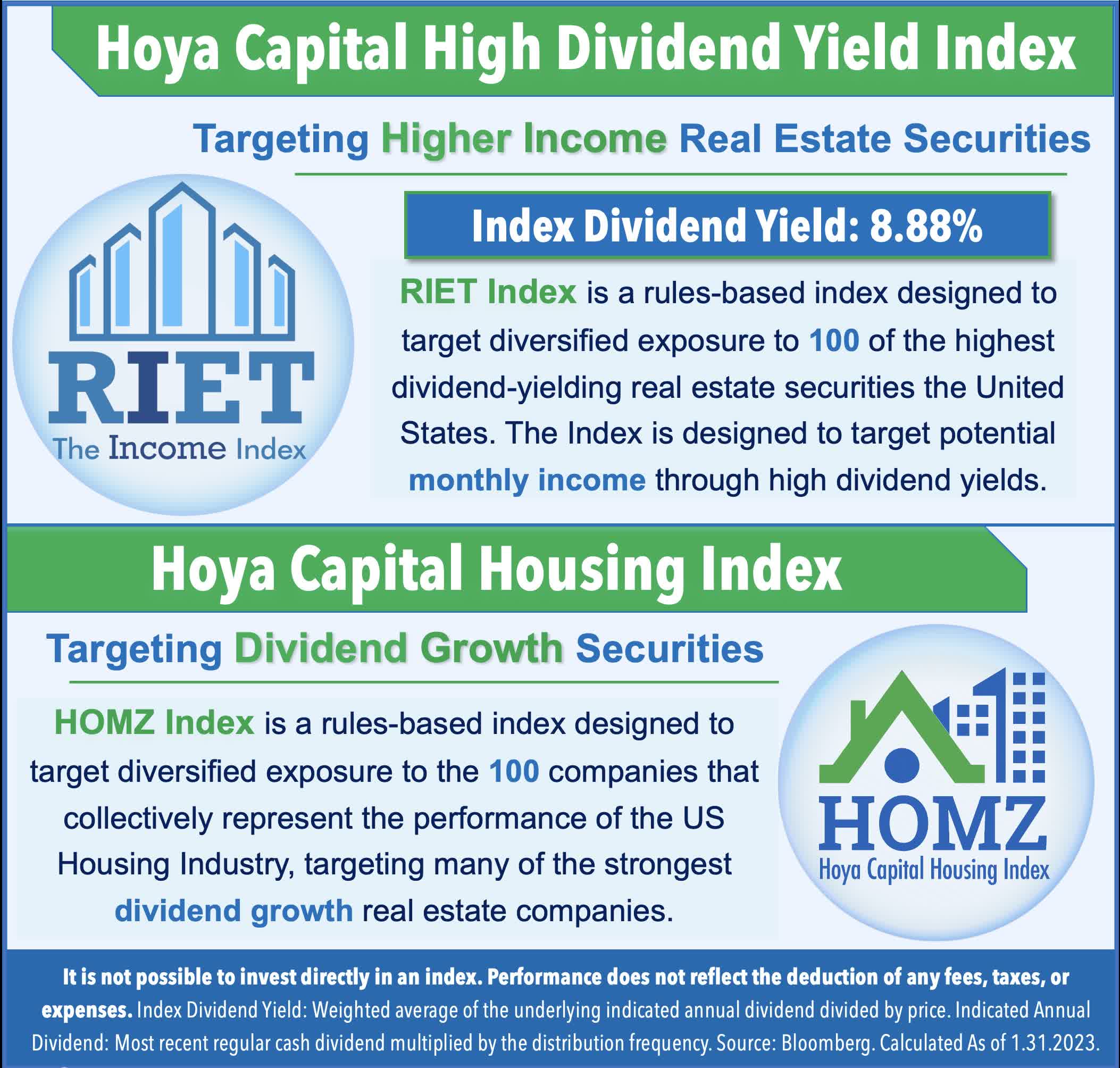

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.