REIT Merger Monday • Hopes Of Peace • Week Ahead

- U.S. equity markets were mixed Monday as investors assessed developments in the Russia/Ukraine conflict and parsed the financial and geopolitical ramifications of the latest round of sanctions and potential peace talks.

- Retreating after a two-day rally but paring its losses with a rebound into the close, the S&P 500 finished lower by 0.3% today while the tech-heavy Nasdaq 100 gained 0.4%.

- Real estate equities were among the laggards today despite the sharp retreat in long-term interest rates as the Equity REIT Index slipped 1.5% with 17-of-19 property sectors in negative territory.

- Confirming reports last week, medical office building owners Health Trust of America (HTA) and Healthcare Realty Trust (HR) announced an agreement to merge in an $18B deal that will create the largest pure-play medical office building owner in the United States.

- W.P. Carey (WPC) announced that it will acquire Corporate Property Associates 18 (CPA:18), a non-traded REIT managed by WPC, in a transaction valued at $2.7B that will "essentially conclude the company's exit from investment management."

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets were mixed Monday as investors assessed developments in the Russia/Ukraine conflict and weighed the financial and geopolitical ramifications of the latest round of sanctions and potential peace talks. Retreating after a two-day rally but paring its losses with a rebound into the close, the S&P 500 finished lower by 0.3% today while the tech-heavy Nasdaq 100 gained 0.4%. Real estate equities were among the laggards today despite the sharp retreat in long-term interest rates as the Equity REIT Index slipped 1.5% with 17-of-19 property sectors in negative territory while the Mortgage REIT Index declined 0.3%.

As discussed in our Real Estate Weekly Outlook, both equity and bond valuations have been buoyed over the last several trading sessions by expectations of a less aggressive path of monetary tightening by the Federal Reserve in light of the geopolitical instability. The 10-Year Treasury Yield plunged 15 basis points today back down to 1.84% while the 2-Year Treasury Yield saw the biggest one-day yield drop in two years. The Energy (XLE) sector was the leader today among the 11 GICS equity sectors as domestic oil and gas production is now expected to climb to record-highs by late 2022 as Western nations seek to reduce their dependence on Russia.

Employment data highlights the busy economic calendar in the week ahead, headlined by ADP Employment data on Wednesday, Jobless Claims on Thursday, and the BLS Nonfarm Payrolls report on Friday. Economists are looking for job growth of 438k in February following stronger-than-expected job growth of 467K in January which included significant revisions to prior months while the unemployment rate is expected to decline to 3.9% after ticking up to 4.0% last month. We'll also see Construction Spending data on Tuesday and a flurry of Purchasing Managers' Index ("PMI") data throughout the week.

Real Estate Daily Recap

This weekend, we published our REIT Earnings Recap & Ratings Updates as an exclusive report for Income Builder members. Nearly 200 REITs have reported earnings results over the past five weeks, providing critical information on the state of the real estate industry amid the extreme volatility in early 2022. Results were generally better-than-expected with roughly 90% of equity REITs beating consensus FFO estimates while more than 75% of the REITs that provide forward guidance beating their full-year outlook. The thesis for maintaining an overweight allocation to U.S. real estate equities in a balanced portfolio remains especially compelling given their minimal international exposure and inflation-hedging attributes.

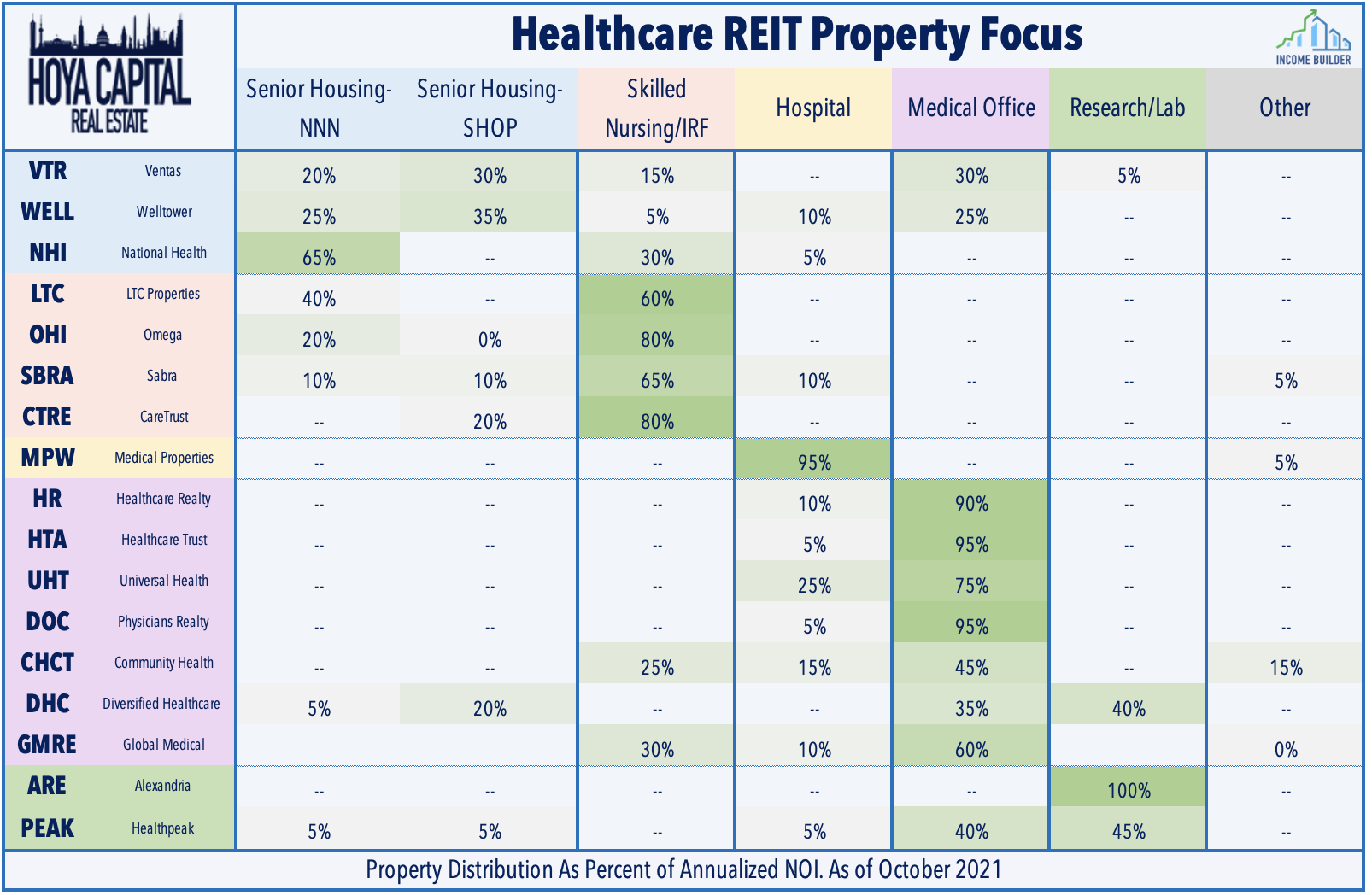

Healthcare: Confirming reports last week, medical office building owners Health Trust of America (HTA) and Healthcare Realty Trust (HR) announced an agreement to merge in an $18B deal that will create the largest pure-play medical office building owner in the United States. Under the terms of the deal, HTA shareholders receive total consideration of $35.08 per share, comprised of a special cash dividend of $4.82 per share and a transaction exchange ratio of 1-to-1 based on HR's share price of $30.26 on Feb. 24, 2022. HR shares have slid nearly 15% since the initial report last week on concerns that the deal will be dilutive to existing shareholders while HTA shares are roughly unchanged since the initial report. Upon closing in Q3, the new company will continue to operate with the Healthcare Realty name and trade on the NYSE under the ticker symbol HR.

Net Lease: W.P. Carey (WPC) traded flat today after announcing that it will acquire Corporate Property Associates 18 (CPA:18), a non-traded REIT managed by WPC, in a transaction valued at $2.7B that will "essentially conclude the company's exit from investment management." CPA:18 owners will receive 0.0978 shares of WPC stock and $3.00 of cash for each share of CPA:18, representing a total value of $10.45/share, a 15% premium to its last reported NAV as of 9/30/21 of $9.07/share. CPA:18 is one of a handful of non-traded REITs managed by WPC that have been internalized over the last decade as the net lease REIT simplifies its operating structure. Compared to WPC, CPA:18's portfolio is heavier on office and self-storage assets with a similar geographical diversification with 65% in the U.S. and 35% in Europe.

We're now 95% complete with REIT earnings season with a handful of REITs left to report results this week, which will include Centerspace (CSR), SBA Communications (SBAC), Global Medical REIT (GMRE), Tricon American (TCN), and Postal Realty (PSTL). We'll continue to provide real-time coverage with our Earnings QuickTake posts for Hoya Capital Income Builder members and will publish follow-up articles summarizing our thoughts and analysis throughout REIT earnings season.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, commercial mREITs gained 1.0% today while residential mREITs finished lower by 0.5%. Highlights of this week's earnings calendar include Broadmark Realty (BRMK) this afternoon, Arlington Asset (AAIC) on Wednesday, and Western Asset (WMC), ACRES Commercial (ACR), and Great Ajax (AJX) on Thursday. The average residential mREIT pays a dividend yield of 11.33% while the average commercial mREIT pays a dividend yield of 7.47%.

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.