Relief Rally • Tensions Ease • Inflation Cools

- U.S. equity markets rebounded Tuesday as concerns over financial instability were eased by indications of an orderly liquidation of SVB's assets and CPI data showing an easing of core inflation.

- After closing at its lowest-levels since early January on Monday, the S&P 500 advanced 1.7% today- closing near the highs of the session- while the tech-heavy Nasdaq 100 rallied 2.3%.

- Real estate equities advanced for a second session, with the Equity REIT Index gaining 0.9% today with 16-of-18 property sectors in positive territory, while the Mortgage REIT Index gained 1.0%.

- As expected, the Consumer Price Index showed a modest month-over-month uptick in inflation in February but a continued moderation in the annual rate, providing fodder to both sides of the inflation debate.

- The metric that we watch most closely - CPI-ex-Shelter Index - showed an eighth straight month of cooling in the year-over-year rate. Using a real-time rent index, we observe a sharp decline in inflation since mid-2022, with this "Real-Time CPI" slowing to 3.16% in February and averaging less than 1% over the past eight months.

Income Builder Daily Recap

U.S. equity markets rebounded Tuesday as concerns over financial instability were eased by indications of an orderly liquidation of SVB's assets and by CPI data showing an easing of core price pressures in February. After closing at its lowest-levels since early January on Monday, the S&P 500 advanced 1.7% today - closing near the highs of the session - while the tech-heavy Nasdaq 100 rallied 2.3% and the Dow rebounded by 336 points. Real estate equities advanced for a second session, with the Equity REIT Index gaining 0.9% today with 16-of-18 property sectors in positive territory, while the Mortgage REIT Index gained 1.0%. Homebuilders were among the leaders as well as mortgage rates fell sharply this week alongside the dip in Treasury yields.

A partial recovery in regional bank stocks helped to stabilize equity and bond markets, reflecting a degree of confidence that emergency measures by regulators would be enough to prevent further contagion from the collapse of Silicon Valley Bank and Signature Bank. The policy-sensitive 2-Year Treasury Yield rebounded to 4.25% today after its largest three-day plunge in history briefly sent the bench to below 4%, while swaps markets now imply an 80% chance that the Fed will hike rates by 25 basis points at its March meeting, up from about 50% on Monday. The 10-Year Treasury Yield rebounded to 3.64% while the US Dollar Index traded flat on the day. Crude Oil prices dipped another 4% today to its lowest-levels since late 2021. All eleven GICS equity sectors trade higher on the session with Technology (XLC) and Financials (XLF) stocks leading on the upside.

As expected, the Consumer Price Index showed a modest month-over-month uptick in inflation in February but a continued moderation in the annual rate, providing fodder to both sides of the inflation debate. The metric that we watch most closely - CPI-ex-Shelter Index - showed an eighth straight month of cooling in the year-over-year rate and since July, this CPI ex-Shelter Index has declined by about 1% on an absolute basis. The delayed recognition of shelter inflation continues to heavily distort the headline and core metrics. Despite real-time rent and home prices metrics showing muted - or negative - increases since mid-2022, the CPI Shelter Index soared 8.1% - the highest in four decades - and accounted for 70% of the monthly CPI increase. When the BLS Rent Index is replaced with the Zillow ZRI Rent Index, we observe a sharp decline in the CPI Index since mid-2022 with this "Rent-Adjusted CPI" slowing to 3.16% in February and averaging less than 1% over the past eight months.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Net Lease: Small-cap One Liberty Properties (OLP) rallied more than 6% after reporting better-than-expected fourth-quarter results, noting that its AFFO for full-year 2022 rose about 2% to $1.98/share driven by an improvement in its occupancy rate to 99.8%. OLP owns a portfolio of 125 net lease properties - split roughly 60/40 between industrial and retail assets - with a concentration along the US East Coast. In our State of the REIT Nation report, we noted that net lease REITs have been far-and-away the most active acquirers in recent quarters - accounting for more than a third of total net purchases across the REIT industry - taking a surprising "business as usual" approach to external growth despite the shifting interest rate environment. We noted in our Earnings Recap that net lease REITs reported an average increase in acquisition cap rates of just 30 basis points between Q4 2021 and Q4 2022, during which time the benchmark 10-Year Treasury Yield increased roughly 230 basis points. Most other REIT sectors have been more reluctant to "hit the bid" on slow-to-adjust private market valuations.

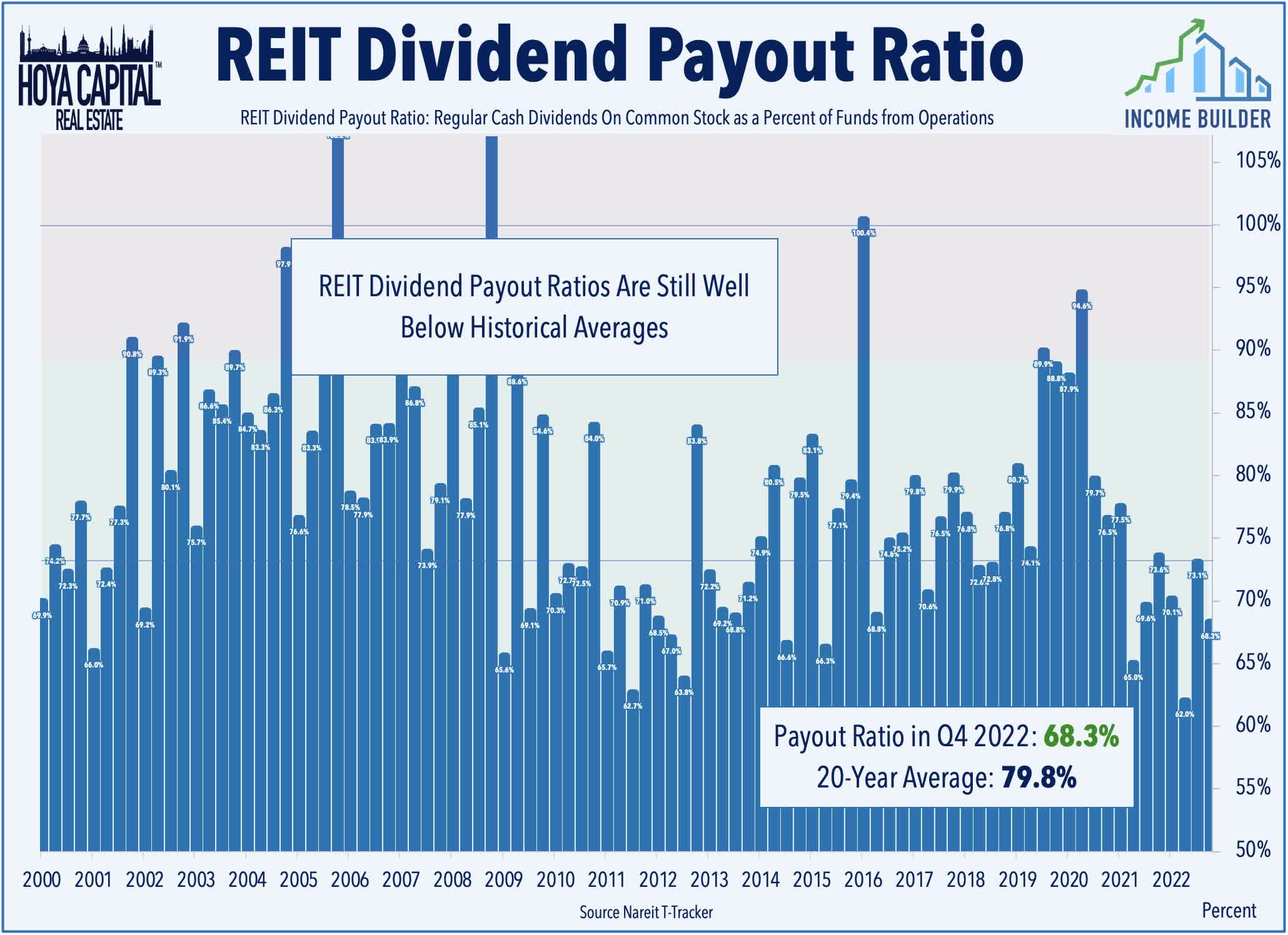

Amid lingering concerns over the potential fallout from several major tech-focused bank failures, our State of the REIT Nation examines high-level REIT fundamentals to chart the likely path forward for the real estate industry. Owing to the harsh lessons from the Great Financial Crisis, most REITs have been exceedingly conservative with their balance sheet and strategic decisions, ceding ground to higher-levered private-market players. With commercial property values now 15-20% below 2022 highs, and with interest rates doubling from last year, distress will become ever-apparent from private-market firms and lenders that pushed leverage limits. Most public REITs are prepared to weather the storm. With the exception of office, malls, and some sub-sectors of healthcare and mortgage REITs, fundamentals across the REIT industry are stronger than before the pandemic. REIT FFO is 10% above pre-pandemic-levels while dividend coverage remains historically strong.

Additional Headlines from The Daily REITBeat on Income Builder

- FCPT announced the acquisition of a WellNow Urgent Care in New York for $2.1 million at a cap rate "in range with previous transactions"

- UMH secured a $30 million revolving line of credit with Triad Financial Services secured by rental homes and rental home leases

- COLD announced a $3.9 million strategic investment into RSA Cold Chain in Dubai to "provide a scalable, investable operating platform for market entry and expansion in the Middle East and India."

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs rebounded today with residential mREITs rallying 3.0% while commercial mREITs advanced 0.7%. Arbor Realty (ABR) - which has been among the strongest performing mREITs over the past five years - dipped more than 6% after NINGI Research published a short report which accused Arbor and its auditor, Ernst & Young, of various "misstatements and misconduct." Among several claims that appear unfounded, the thesis is centered on a supposed "severely understated" loan loss reserve, but we note that Arbor's Current Expected Credit Losses ("CECL") assumptions do not appear to be out of line with the industry average for residential-backed loans. For ABR, which concentrates exclusively on residential lending, the short thesis' use of a peer group that included mREITs with exposure to office and retail lending appears inappropriate, but we await a response from ABR on various other claims made in the report.

Economic Data This Week

The busy week of inflation, retail, and the U.S. housing market data continues on Wednesday with the Producer Price Index, which is expected to slow to a 5.5% year-over-year rate on the headline index - down from the recent peak in March at 11.8%. We'll also see an important slate of housing market data with NAHB Homebuilder Sentiment data on Wednesday and Housing Starts and Building Permits data on Thursday, which have been closely correlated to changes in mortgage rates. On Wednesday, we'll also see Retail Sales data, which is also expected to show a decline in spending in February after a strong January, and later in the week on Friday, we'll get the first look at March Consumer Confidence data from the University of Michigan.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.