Stocks Rebound • S&P Reshuffle • Jobless Claims Jump

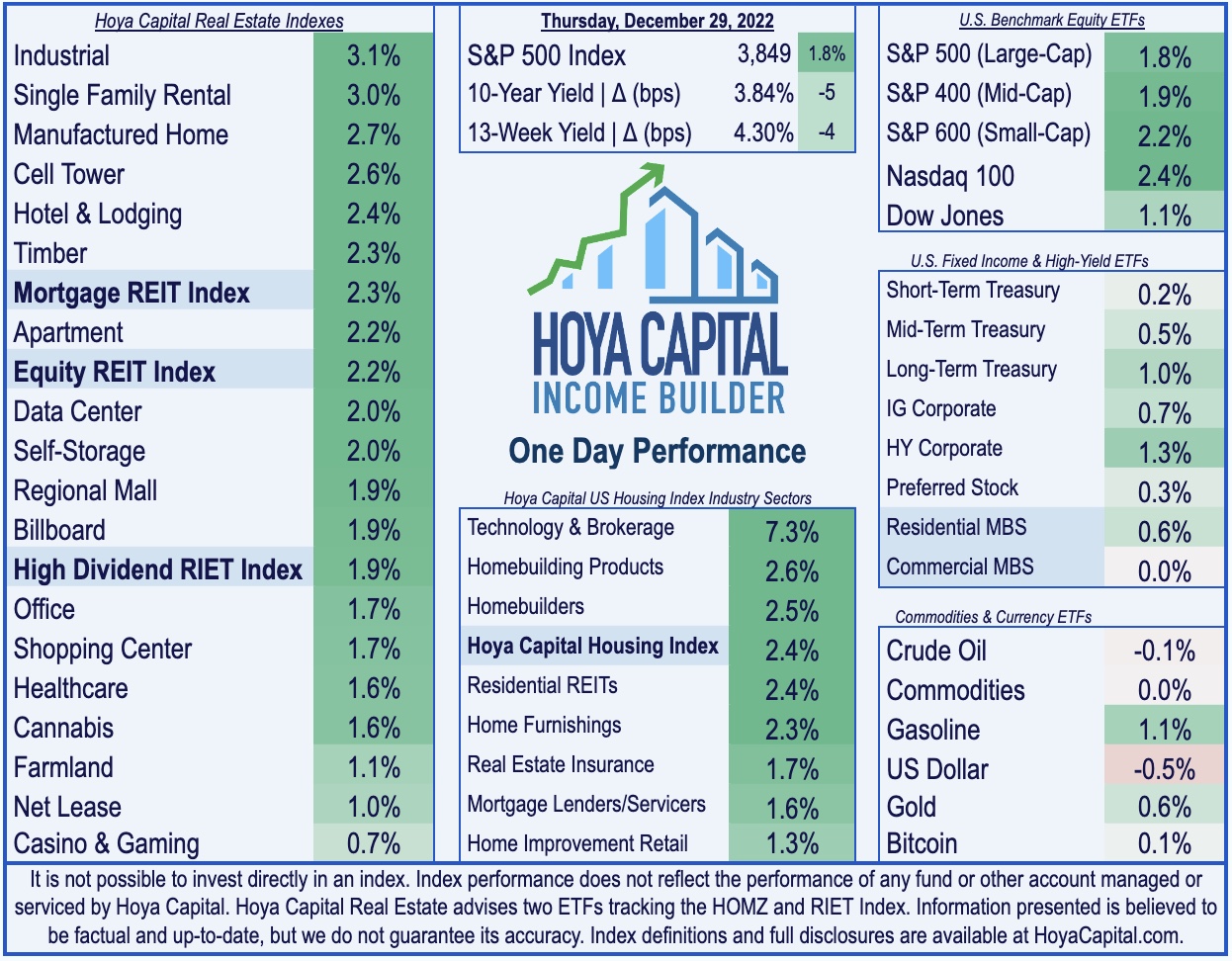

- U.S. equity markets rebounded Thursday- posting their best day of gains this month- as benchmark yields pulled back on jobless claims data showing signs of softening in the historically-tight labor market.

- Erasing its weekly declines and climbing back above the "bear market" threshold, the S&P 500 rebounded by 1.9% today while the tech-heavy Nasdaq 100 jumped nearly 3%.

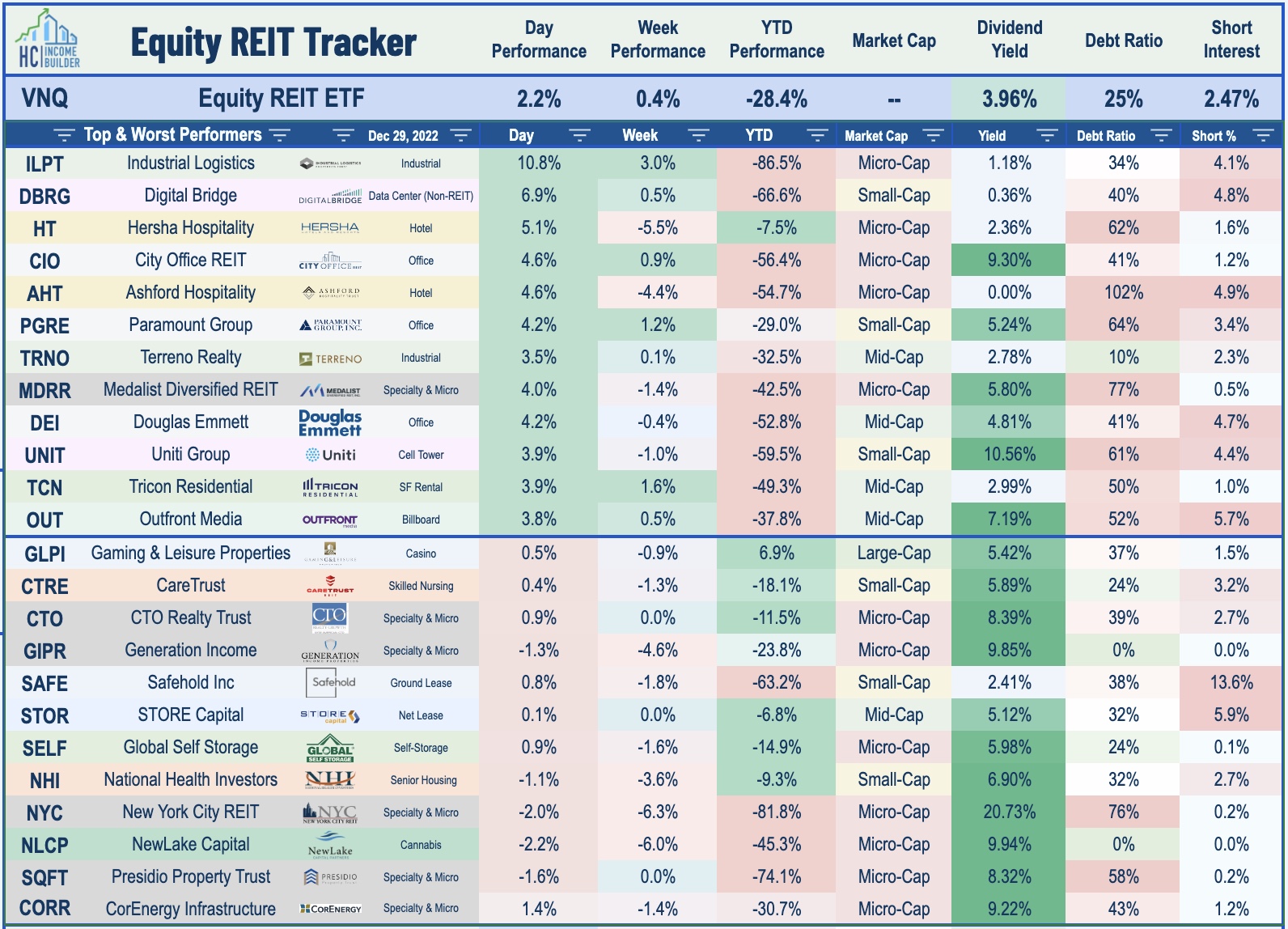

- Real estate equities were among the better performers today with the Equity REIT Index rallying 2.2% with all 18 property sectors in positive territory, while Mortgage REITs gained 2.3%.

- Vornado Realty (VNO) advanced 1.6% today after S&P announced an index reshuffling that will send the office REIT from the S&P 500 to the S&P Mid-Cap 400 to make room for GE HealthCare Technologies.

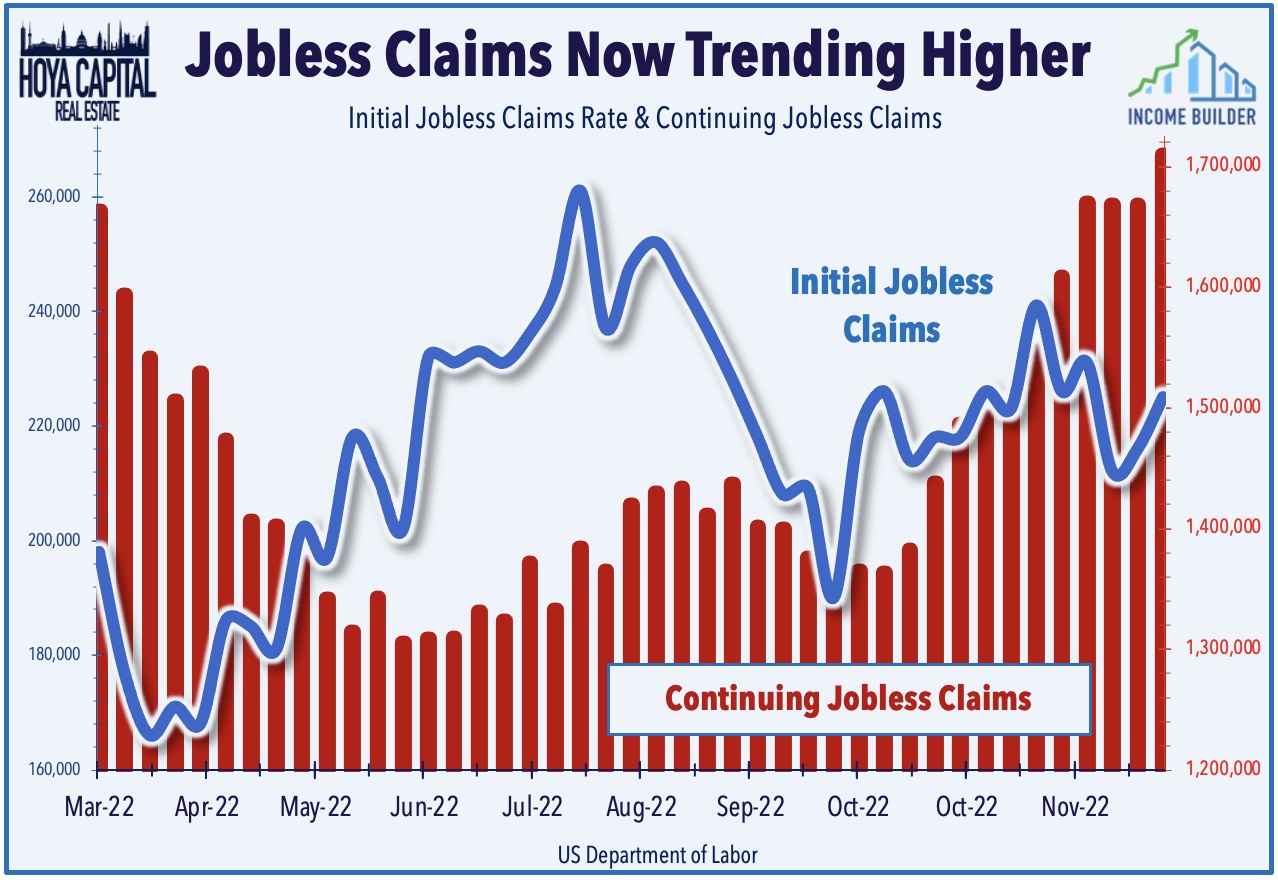

- Weekly jobless claims data this morning showed that filings for Continuing Jobless Claims rose to the highest levels since early February at over 1.7 million.

Income Builder Daily Recap

U.S. equity markets rebounded Thursday - posting their best day of gains this month - as benchmark yields pulled back following jobless claims data showing signs of softening in the historically tight U.S. labor markets. Erasing its weekly declines and climbing back above the "bear market" threshold, the S&P 500 rebounded by 1.9% today while the tech-heavy Nasdaq 100 jumped nearly 3%. The Mid-Cap 400 and Small-Cap 600 each gained over 2% as well. Real estate equities were among the better performers today with the Equity REIT Index rallying 2.2% with all 18 property sectors in positive territory, while the Mortgage REIT Index gained 2.3% and Homebuilders advanced 2.5%.

After rebounding to the highest levels since early November on concern over the potentially inflationary impact of China's pivot away from "COVID zero" policies, weaker-than-expected employment data today pulled the benchmark 10-Year Treasury Yield (US10Y) lower by 5 basis points to 3.84% while the U.S. Dollar Index slid to its lowest levels in over six months. Weekly jobless claims data this morning showed that filings for Continuing Jobless Claims rose to the highest levels since early February at over 1.7 million. With the Fed leaning heavily on tight labor markets to justify their historically swift monetary tightening course, we've noted how the strength seen in the primarily BLS nonfarm establishment survey has been at odds with most other employment metrics including the BLS' household survey in the same report.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Office: Vornado Realty (VNO) advanced 1.6% today after S&P announced an index reshuffling that will send the REIT from the S&P 500 (SPY) Index to the S&P Mid-Cap 400 (MDY) Index to make room for GE HealthCare Technologies in the large-cap benchmark following its spin-off from General Electric (GE). All index moves are effective prior to the open of trading on Thursday, Jan. 5. Vornado was one of 30 REITs included in the S&P 500, but REITs are better represented in the Mid-Cap 400 with 32 names comprising about 10% of the total weight and in the Small-Cap 600 as well with 58 REITs including with an 8% total sector weighting. Elsewhere, Easterly Government (DEA) advanced 2.5% after it announced that closed on its previously-announced $205M sale of a 10-property portfolio.

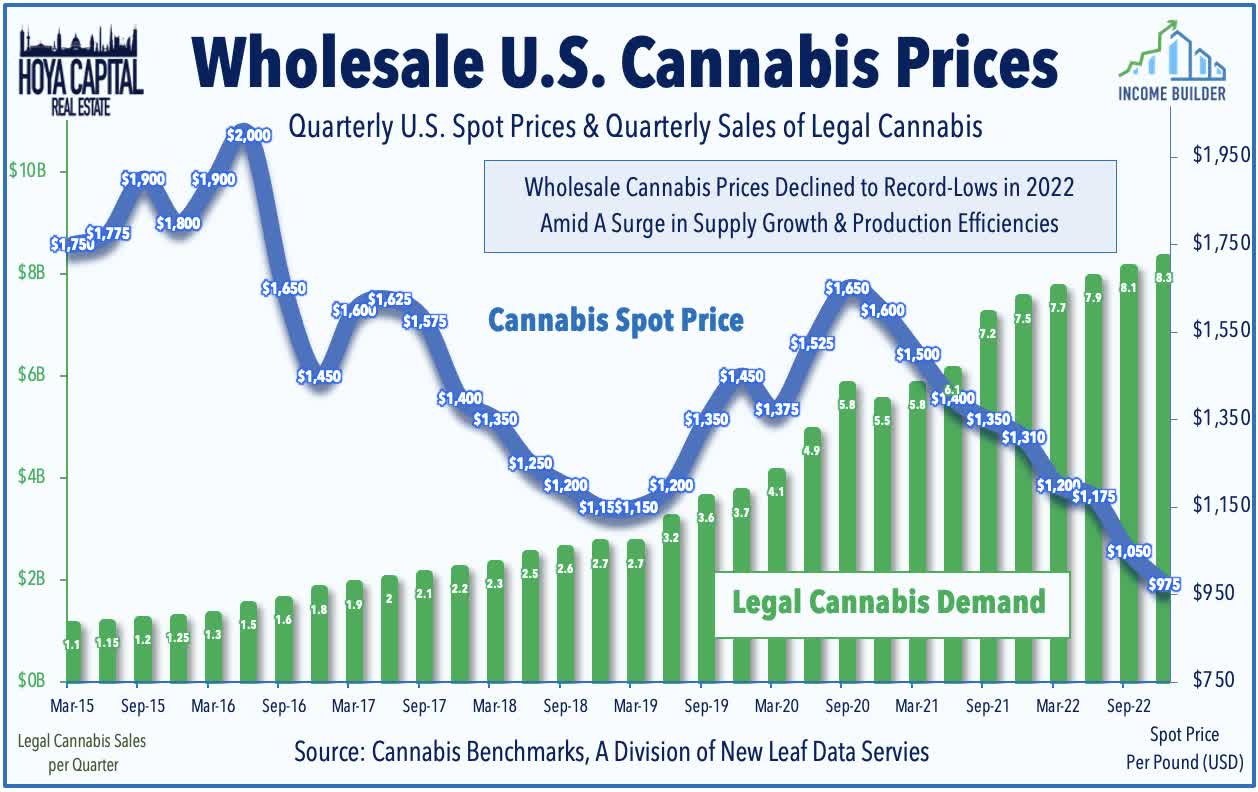

Cannabis: Today we published Cannabis REITs: Smoked Out. A perennial performance leader in the REIT sector before this year, Cannabis REITs have been slammed in 2022 amid concern over defaults from their cannabis cultivator tenants, which have in turn been smoked by plunging wholesale cannabis prices and setbacks on federal legalization. Production efficiencies fueled by industry consolidation and the "institutionalization" of cannabis supply chains have pushed wholesale prices down 60% since 2020, which has begun to "weed out" some smaller operators. For Cannabis REITs - which have concentrated leasing and lending efforts on larger multi-state operators ("MSOs") and publicly-traded firms in recent years - tenant default issues have remained limited to a handful of smaller single-state operators. In the full report on Income Builder, we discuss our recent portfolio trades and rankings.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were broadly higher today with residential mREITs advancing 1.7% while commercial mREITs declined 2.4%. On an otherwise quiet day of mREIT newsflow, ARMOUR Residential REIT (ARR) advanced 1.7% after it maintained its current monthly dividend rate of $0.10/share. Last month, we published Mortgage REITs: High Yields Are Fine, For Now, which noted that despite paying average dividend yields in the mid-teens, the majority of mREITs have been able to cover their dividends, but we flagged a handful of mREITs with payout ratios above 100% of EPS.

Economic Data This Week

We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook this weekend.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.