Stocks Slide • REIT Earnings • Landowner Portfolio

- U.S. equity markets slid Friday- extending their losses to a third-straight week- as a solid start to corporate earnings season has been unable to ease concerns over tightening monetary policy.

- Sliding throughout the session and bringing the benchmark back into "correction" territory, the S&P 500 finished lower by 2.8% today while the Mid-Cap 400 and Small-Cap 600 declined 2.7%.

- Real estate equities were again among outperformers today - and were the top-performing sector on the week. The Equity REIT Index finished lower by 1.8% today but gained 1% this week.

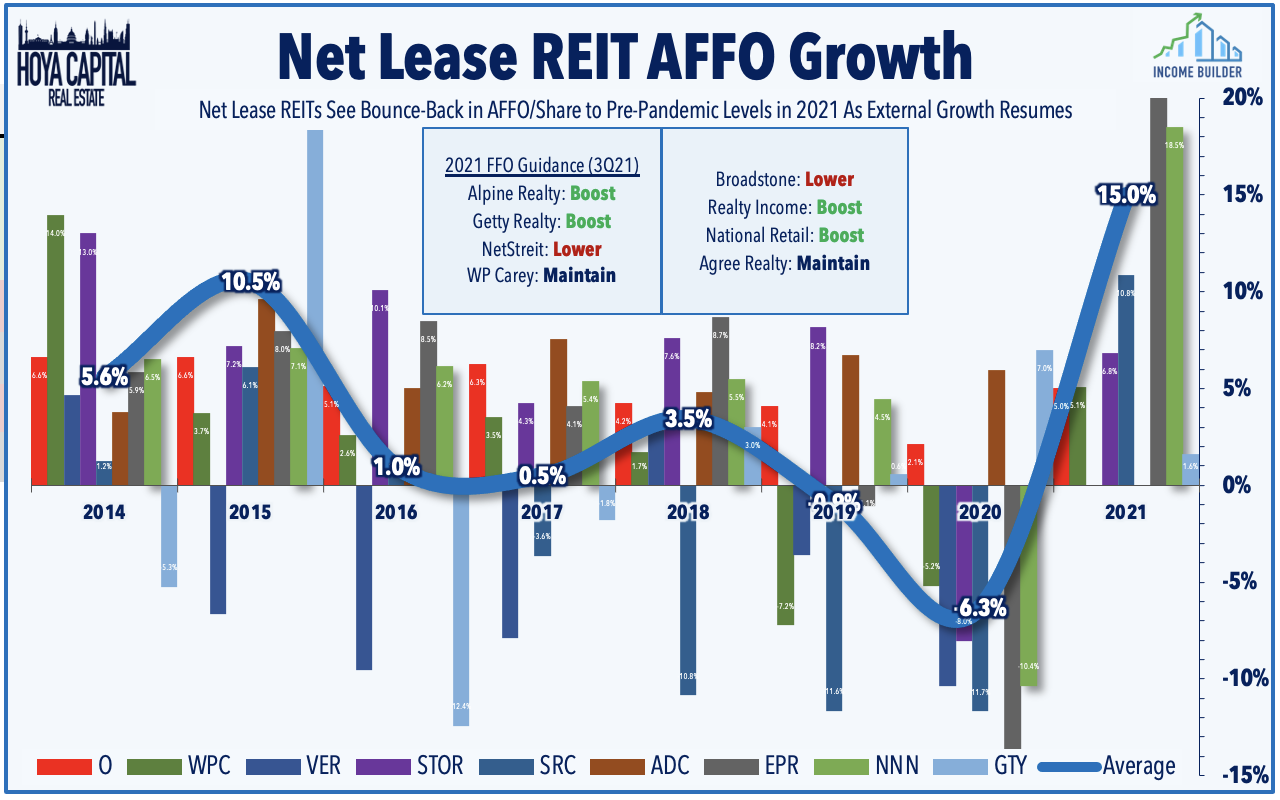

- Net Lease REIT Alpine Income (PINE) was among the better performers today after reporting solid Q1 results and raising its full-year outlook. Five of the ten REITs that reported results this week boosted their full-year FFO guidance.

- Today, we launched our Landowner Portfolio - a custom strategy we've developed exclusively for Income Builder members. The strategy targets exposure to publicly-traded companies that own or control significant acreage of land across North America, comprised of 18 companies that collectively own over 50 million acres.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets finished sharply lower Friday - extending its stretch of losses to a third-straight week - as a solid start to corporate earnings season has been unable to ease concerns over inflation and tightening monetary policy. Sliding throughout the session and bringing the benchmark back into "correction" territory, the S&P 500 finished lower by 2.8% today while the Mid-Cap 400 declined 2.7% and the Small-Cap 600 slipped 2.6%. Real estate equities were again among outperformers today - and were the top-performing sector on the week - as the Equity REIT Index finished lower by 1.8% with 18-of-19 property sectors in negative territory while Mortgage REITs declined by 2.1%.

Positive earnings results have done little to improve the sour sentiment. At the quarter-way-point in corporate earnings season, 79% of S&P 500 companies have beat analyst expectations according to FactSet, which is above the 5-year average, but the magnitude of these positive surprises is below average. All eleven GICS equity sectors were lower on the day, dragged on the downside by the Healthcare (XLC) and Materials (XLB) sectors. The 10-Year Treasury Yield retreated slightly from three-year highs to 2.91% but the 2-Year Treasury Yield climbed another 4 basis points to 2.71%.

Fixed income securities across the credit and maturity spectrum are in the midst of the most significant pull-back since the Great Financial Crisis, which has started to raise some questions about potential instability if the sell-off deepens. The iShares Core Bond ETF (AGG) - the largest bond fund - has now recorded a drawdown of roughly 11.3% - its most significant sell-off since the 12.8% sell-off in 2008 during the worst of the Great Financial Crisis. The 15.5% decline from the Vanguard Corporate Bond ETF (VCIT) is also historically significant, nearly as large as the 17.9% plunge in March 2020 during the period of violent volatility. We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook published this weekend.

Real Estate Daily Recap

Today, we launched our newly-developed Landowner Portfolio - a custom strategy we've developed exclusively for Income Builder members. The strategy targets exposure to publicly-traded companies that own or control significant acreage of land across North America, diversified across regions and across distinct productive uses. This portfolio is comprised of 18 companies that collectively own or control over 50 million acres of land across the United States- larger than the entire landmass of New England. Holdings include Timber REITs, Farmland REITs, Ground Lease REITs, Triple Net Lease REITs, and substantially land-owning companies across the homebuilding, land development, agriculture, mining, and energy sectors.

Net Lease: Alpine Income (PINE) was among the better performers today after reporting solid Q1 results and raising its full-year outlook. PINE now sees 2022 full-year FFO of $1.55-1.60 per diluted share vs. $1.53-1.58 in its prior view. PINE also boosted its acquisition target to $232M from $225M but also raised its disposition target to $88M from $45M, citing "very strong cap rates on things that we're looking to sell." On the rising rate environment, PINE commented, "Although with year-to-date acceleration interest rates, we're hopeful we'll start to see incremental cap rate expansion, as we prudently look for opportunities to add to our pipeline." We'll hear results from a handful of net lease REITs next week including WP Carey (WPC), Essentials Properties (EPRT), and Netstreit (NTST).

Yesterday, we published our Real Estate Earnings Preview which discussed the major themes and metrics we'll be watching across each of the real estate property sectors this earnings season. Despite the historic surge in interest rates over the past quarter driven by expectations of Fed monetary tightening, REITs enter the first-quarter earnings season with some momentum at their backs. Having lagged for most of this year, the broad-based Equity REIT Index jumped ahead of the S&P 500 on a year-to-date performance basis in early April following several weeks of outperformance. REITs with better inflation-hedging characteristics have led the gains in 2022 while large-cap technology REITs have continued to lag. We emphasize the importance of diversification across property sectors and market capitalization tiers.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mREITs were today as commercial mREITs slipped 1.8% while residential mREITs also declined 1.8%. Mortgage REIT earnings season officially kicks off next Monday with results from KKR Real Estate (KREF) and Apollo Commercial (ARI).

Economic Data This Week

We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook published this weekend.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.