Stocks Slide • Yields Jump • REIT Dividend Hike

- U.S. equity markets slumped Tuesday while benchmark interest rates surged as concerns over persistent inflation were worsened by a ratcheting-up of geopolitical tensions and cautious commentary from retailers.

- Following declines of 0.2% last week, the S&P 500 dipped 2.0% today - its worst day since December - while the tech-heavy Nasdaq 100 fell 2.4% and the Dow slid nearly 700 points.

- Real estate equities and other yield-sensitive segments were also under pressure today as benchmark interest rates climbed to the highest-levels of the year. The Equity REIT Index fell 2.0%.

- The busiest week of REIT earnings season kicked-off with a strong report from NexPoint Residential (NXRT) this morning. NXRT hiked its quarterly dividend by 10%, becoming the 25th REIT to raise its dividend this year.

- DiamondRock Hospitality (DRH) was also among the better-performers today after reporting solid results and providing a relatively upbeat outlook for 2023. DRH reported that January was its best month since July with Revenue Per Available Room exceeding 2019-levels by 10%.

Income Builder Daily Recap

U.S. equity markets slumped Tuesday while benchmark interest rates surged as concerns over persistent inflation were worsened by a ratcheting-up of geopolitical tensions and cautious commentary from retailers. Following declines of 0.2% last week, the S&P 500 dipped 2.0% today - its worst day since December - while the tech-heavy Nasdaq 100 fell 2.4% and the Dow slid nearly 700 points. Real estate equities and other yield-sensitive segments were also under pressure today as benchmark rates climbed to the highest levels of the year across the curve. The Equity REIT Index declined 2.0% today with all 18 property sectors in negative territory while the Mortgage REIT Index dipped 3.5% and Homebuilders declined 2.2%.

Bonds were under pressure across the credit and maturity curve as the 10-Year Treasury Yield jumped another 13 basis points today to 3.96% - its highest close since November 9th. As discussed in our Weekly Outlook, the early-year optimism has soured in recent weeks after January payrolls and inflation data provided a mixed signal on the path of inflation, sparking concern of a "no landing" scenario of stubbornly elevated inflationary pressures. Meanwhile, geopolitical tensions have intensified in recent weeks with mounting concern that the Ukraine conflict is descending into a "proxy war" between major Western and Eastern powers. Stateside, cautious commentary on the state of the U.S. consumer from retail giants Walmart (WMT) and Home Depot (HD) sparked broad-based selling with all 11 GICS equity sectors finishing in negative territory for the session.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Apartments: Sunbelt-focused NexPoint Residential (NXRT) - which we own in the REIT Dividend Growth Portfolio - was among the best-performers today after reporting solid results, noting that its full-year FFO increased 28.8% in 2022 - the strongest in the apartment REIT sector and 210 basis points above its prior guidance. NXRT also hiked its quarterly dividend by 10% to $0.42/share, becoming the 25th REIT to raise its dividend this year. NXRT sees strong property-level trends continuing this year, calling for same-store NOI growth of 11.0% at the midpoint of its range, but higher interest expense is expected to negate much of the property-level growth with expectations of flat FFO in 2023 at the midpoint of its guidance. NXRT's relatively high debt-load has weighed on its share price over the past year, but the firm reported progress in de-levering its balance sheet and fixing its interest rate expense through asset sales, refinancings, and swap agreements. We'll hear results from Centerspace (CSR) and Veris (VRE) this afternoon.

Hotels: Diamondrock Hotels (DRH) was also among the better-performers today after reporting solid results and providing a relatively upbeat outlook for 2023. DRH - which owns an urban-heavy portfolio that was hit especially hard early in the pandemic - reported a full recovery in Revenue Per Available Room ("RevPAR") in 2022 driven by a slow-but-steady recovery in business and group demand alongside continued strength from its leisure-focused resort assets. DRH also provided strong preliminary January results, noting that its RevPar was 10.5% above 2019-levels for the month - its best month since July 2022 - driven by a 22.5% comparable increase in Average Daily Rates offset by a 6.2% comparable decline in occupancy. In Hotel REITs: Dividends Are Back, we discussed why we've become more optimistic about the future of business travel. We'll hear results this afternoon from Apple Hospitality (APLE), Pebblebrook (PEB), and Ashford Hotels (AHT).

The holiday-shortened week is also the busiest week of real estate earnings season with results from over 50 equity REITs, a dozen mortgage REITs, and three homebuilders. In addition to the aforementioned reports, we'll also hear results this afternoon from net lease REIT Realty Income (O), storage REIT Public Storage (PSA), retail REIT Tanger Outlets (SKT), cell tower REIT SBA Communications (SBAC), and healthcare REITs Sabra Healthcare (SBRA) and National Health Investors (NHI).

Additional Headlines from The Daily REITBeat on Income Builder

- Morningstar downgraded Americold (COLD) to Hold from Buy

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs finished broadly lower today with residential mREITs dipping 3.5% while commercial mREITs declined 3.3%. BrightSpire Capital (BRSP) slipped 3.7% despite reporting slightly better-than-expected results, noting that its distributable EPS increased to $0.27/share from $0.25/share in the prior quarter - and covering its $0.20/share dividend - while its Book Value Per Share ("BVPS") was roughly unchanged during the quarter at $12.06. BRSP struck a cautious tone in commentary, warning of increased distress in coastal office markets, in particular, which is the "more significant issue in commercial real estate than interest rates." We'll see results from Invesco Mortgage (IVR) and TPG Real Estate (TRTX) this afternoon.

Economic Data This Week

Housing and inflation data headline the busy slate of economic data this week. The most closely-watched report of the week will be the PCE Price Index on Friday - the Fed's preferred gauge of inflation - which is expected to show similar mixed signs of declining annual inflation but perky inflation in January as were on display in the CPI and PPI Price Indexes last week. On the housing-front, following Existing Home Sales data this morning, we'll see New Home Sales data on Friday which is expected to show a modest thawing in housing market activity following a sharp rate-driven cooldown. Minutes from the Federal Reserve's early-February meeting will be released on Wednesday which investors will parse for indications about the path of future rate hikes. Jobless Claims and the first revision to fourth-quarter Gross Domestic Product data will be released on Thursday.

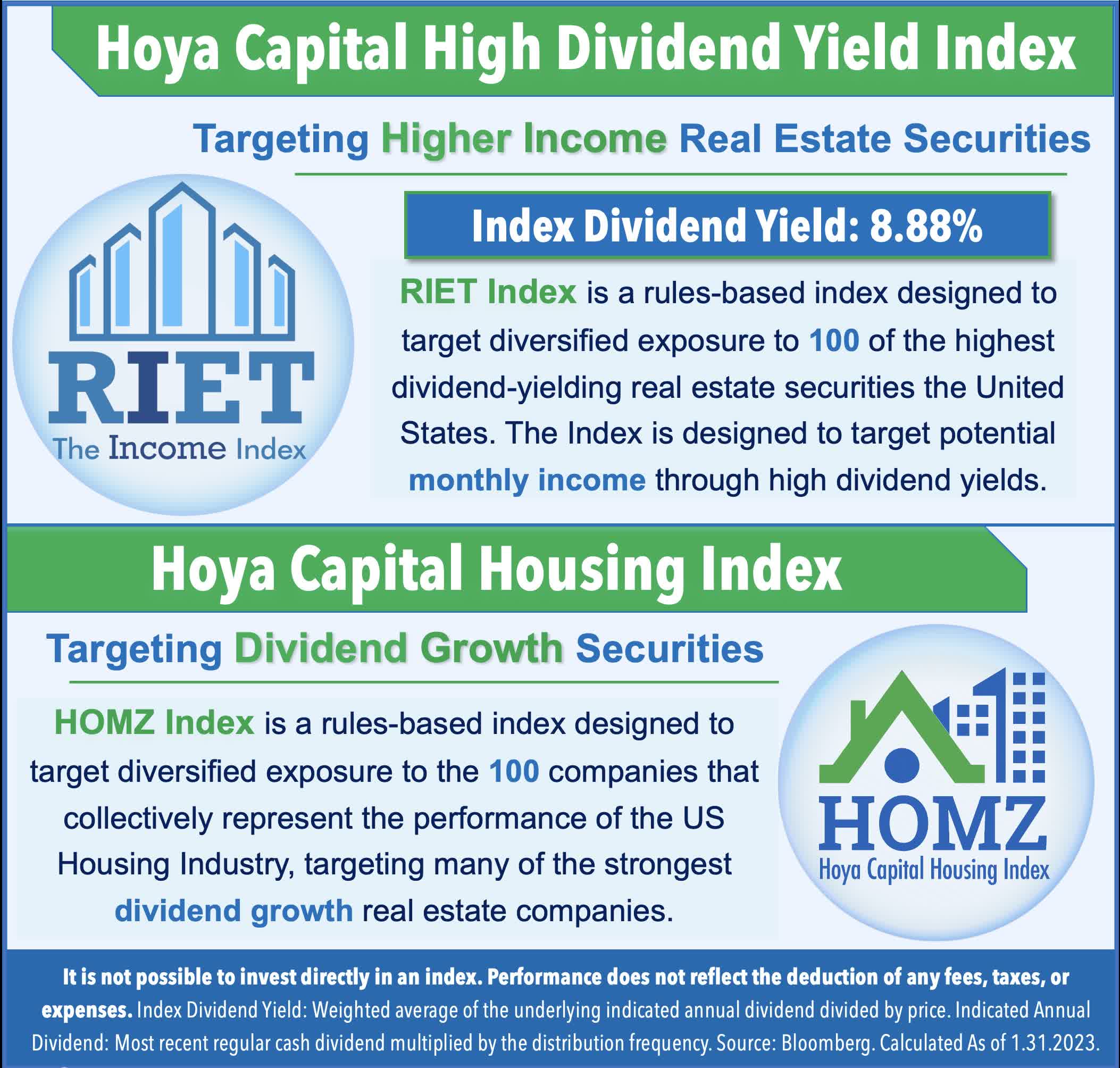

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.