Stocks Slide • Yields Retreat • Strong REIT Earnings

- U.S. equity markets slid Tuesday amid renewed COVID concerns in China and a mixed slate of corporate earnings results, sending yields lower and sparking a bid for safe-haven domestic asset classes.

- Retreating from gains of 0.6% on Monday, the S&P 500 declined by 2.9% today while the tech-heavy Nasdaq 100 dipped back into "bear market" territory. REITs were among the outperformers.

- NexPoint Residential (NXRT) - which we own in the Hoya Capital Housing Index - jumped 4% after reporting very strong results, highlighted by incredible 24.3% rent growth on new leases.

- PotlatchDeltic (PCH) was also among the leaders today after reporting strong Q1 results, highlighted by a substantial boost in adjusted EBITDDA, driven by large increases in timberlands and wood products revenues amid higher commodity prices.

- DR Horton (DHI) reported strong Q1 results and raised its full-year sales outlook, which now calls for 28% revenue growth this year. DHI commented, “Housing market conditions remain strong despite the rise in mortgage rates, as we continue to experience homebuyer demand that exceeds our pace of supply."

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets slid Tuesday amid renewed COVID concerns in China and a mixed slate of corporate earnings results, sending yields lower and sparking a bid for safe-haven domestic asset classes. Retreating from gains of 0.6% on Monday, the S&P 500 declined by 2.9% today while the tech-heavy Nasdaq 100 slid nearly 4% - dipping back into "bear market" territory. Real estate equities were again among the outperformers following strong earnings reports, but the Equity REIT Index still finished off by 1.7% today with all 19 property sectors in negative territory while Mortgage REITs slipped 2.9%.

The tug-of-war on interest rates continues between the upward pressure from a hawkish Federal Reserve and the downward pressure from a dimming outlook for global economic growth and inflation expectations. The 10-Year Treasury Yield declined another 5 basis points to 2.77% while the 2-Year Treasury Yield dipped 14 basis points to 2.49% - down sharply from the high of 2.85% last week. Energy (XLE) was the lone GICS equity sector in positive territory today while large-cap technology stocks dragged on the Technology (XLK) and Consumer Discretionary (XLY) sectors.

Real Estate Daily Recap

Timber: PotlatchDeltic (PCH) - which we own in the REIT Dividend Growth Portfolio - was also among the leaders today after reporting strong Q1 results, highlighted by a substantial boost in adjusted EBITDDA, driven by large increases in timberlands and wood products revenues amid higher commodity prices. Today, we published Buy Land, They're Not Making It Anymore - which discussed our newly-launched Landowner Portfolio. The strategy targets exposure to publicly-traded companies that own or control significant acreage of land across North America, diversified across regions and across distinct productive uses. This portfolio is comprised of 18 companies that collectively own or control over 50 million acres of land across the United States- larger than the entire landmass of New England.

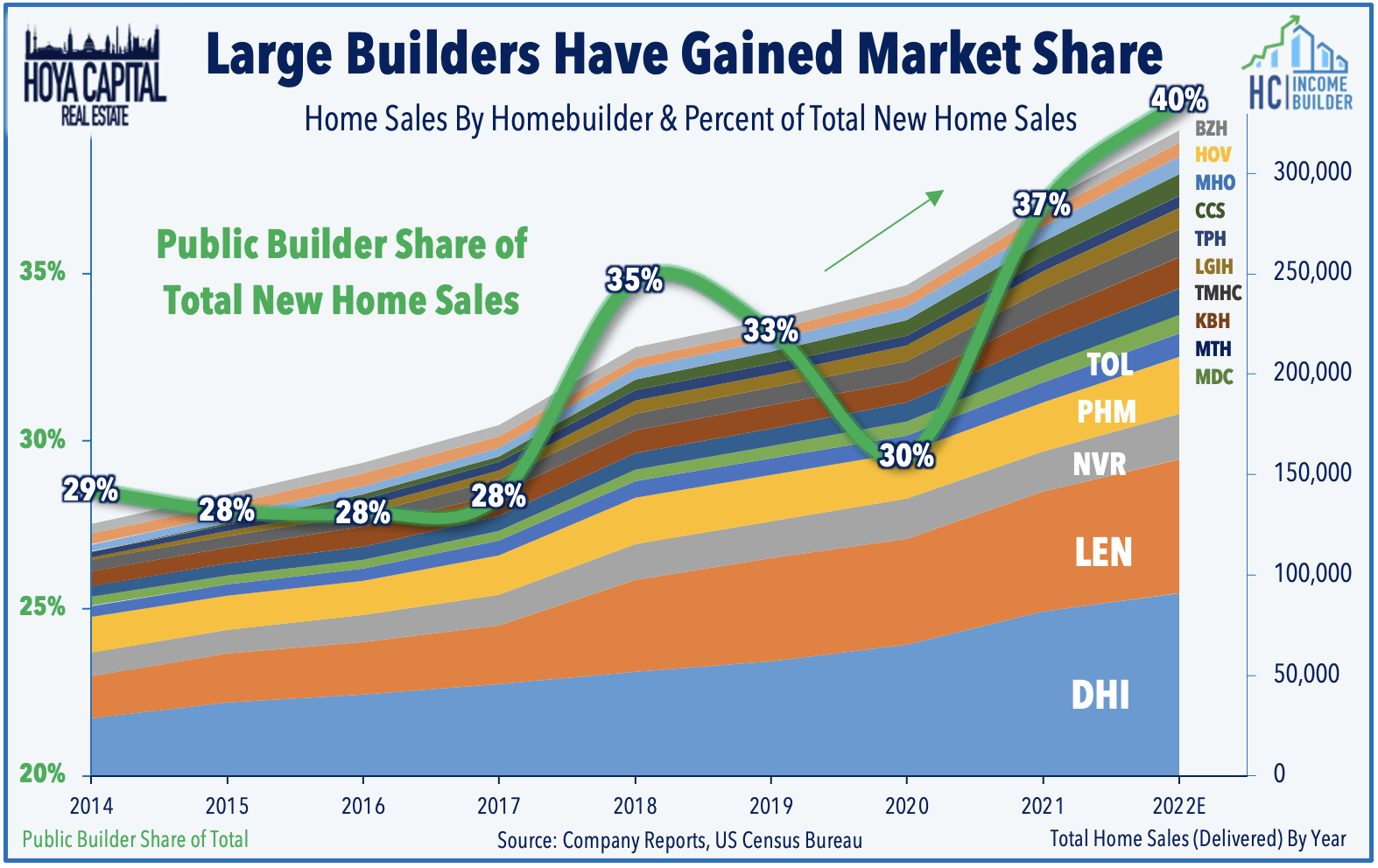

Homebuilders: DR Horton (DHI) - the largest homebuilder in the U.S. and also a constituent in our newly-launched Landowner portfolio - reported strong Q1 results and raised its full-year sales outlook, which now calls for 28% revenue growth this year. DHI commented, “Housing market conditions remain strong despite the rise in mortgage rates, as we continue to experience homebuyer demand that exceeds our pace of supply." As with earnings results from Tri Pointe (TPH) last week, the positive outlook was partially offset by commentary nothing that there are "still significant challenges in the supply chain." NVR (NVR) was among the better performers as well after reporting similarly strong Q1 results with revenues jumping nearly 17% from last year. In our Landowner article today, we noted that homebuilders are the single-largest non-commercial landowners in the United States, and a growing share of total lot ownership has accrued to the largest builders in the country.

Apartment: Sticking with the housing theme, small-cap NexPoint Residential (NXRT) - which we own in the Hoya Capital Housing Index - jumped 4% after reporting very strong results, highlighted by incredible 24.3% rent growth on new leases and 18.2% on renewals as market rents across its Sunbelt markets continue to soar. NXRT also raised its full-year guidance across the board and now sees 23.9% FFO growth in 2022 - up 170 basis points from its prior outlook - and now projects 14.3% same-store NOI growth this year - up 130 basis points. We'll hear results this afternoon from Equity Residential (EQR) and Essex Property (ESS).

Manufactured Housing: Sun Communities (SUI) - which we hold in the REIT Dividend Growth Portfolio - reported solid results this afternoon and raised its full-year outlook. SUI now sees full-year FFO growth of 11.5% - up 170 basis points from its prior outlook - and sees NOI growth of 6.9% - up 40 bps. As anticipated, the strong results were driven by stellar performance in its RV segment, which recorded same-store NOI growth of 23% in Q1. Including its completed acquisition of Park Holidays UK, SUI acquired 45 properties year-to-date totaling 17,646 sites, wet slips and dry storage spaces, and 1,710 sites for expansion for a total purchase price of $1.6 billion.

Healthcare: Alexandria Real Estate (ARE) - which we hold in the REIT Dividend Growth Portfolio - reported strong results this afternoon as lab space demand remains insatiable. ARE reported the second-highest leasing volume in company history for both total space and development and redevelopment space, achieving GAAP rent growth spreads of 32.2% while reporting cash same-store NOI growth of 7.3%. ARE boosted its full-year outlook and now sees adjusted FFO growth of 8.0% - up 30 basis points - and NOI growth of 6.9% - up 40 basis points. During the quarter, ARE completed the sale of a 70% interest in 100 Binney Street in Boston for a sales price of $713.2 million, or $2,353 per RSF, at capitalization rates of 3.6% and 3.5% (cash basis).

Cell Tower: SBA Communications (SBAC) slumped 2.4% despite reporting very strong results yesterday afternoon, commenting that it's "off to a very strong start to 2022... producing double-digit growth in AFFO per share while operationally executing at a very high level." SBAC boosted its full-year outlook across the board and now sees AFFO/share growth of 10.8% this year - up 120 basis points from its prior outlook - driven by site leasing revenue growth of 8.5% - up 180 basis points. SBAC noted, "Based on our backlogs and conversations with our customers, we expect elevated leasing activities to continue through 2022 and into 2023. All of our US wireless carrier customers are actively engaged in building out their 5G networks and we are committed and have the resources to help them achieve their goals."

Last week, we published our Real Estate Earnings Preview which discussed the major themes and metrics we'll be watching across each of the real estate property sectors this earnings season. Despite the historic surge in interest rates over the past quarter driven by expectations of Fed monetary tightening, REITs enter the first-quarter earnings season with some momentum at their backs. Having lagged for most of this year, the broad-based Equity REIT Index jumped ahead of the S&P 500 on a year-to-date performance basis in early April following several weeks of outperformance. In addition to the aforementioned REITs, the earnings slate this afternoon includes office REIT Highwoods (HIW), industrial REITs EastGroup (EGP) and Industrial Logistics (ILPT), net lease REIT Four Corners (FCPT), and hotel REIT Pebblebrook (PEB).

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mREITs were broadly lower today as earnings season kicked-off with a pair of results. KKR Real Estate (KREF) was among the better performers today after reporting that its Book Value Per Share ("BVPS") increased 0.4% during Q1 to 19.46/share. Apollo Commercial (ARI) slumped 4% after reporting that its BVPS slipped 1.6% in the quarter to $15.01/share. With MBS pricing down considerably over the last quarter, the effectiveness of mREITs rate-hedging strategies will become apparent. Analysts are expecting average BVPS declines of 8-15% in Q1, but several more highly-levered mREITs may see 20%+ declines while REITs with effective hedging strategies should see more muted declines. Tomorrow, we'll see results from Blackstone Mortgage (BXMT), Annaly Capital (NLY), and Dynex Capital (DX).

Economic Data This Week

We'll see another jam-packed week of economic data in the week ahead, along with the busiest week of corporate earnings season. Today, we saw New Home Sales and the Case Shiller Home Price Index, and tomorrow we'll see andPending Home Sales on Wednesday. On Thursday, we'll get our first look at first-quarter Gross Domestic Product, which is expected to show a slowdown to 1.0% growth in Q1. Then on Friday, we'll get another look at inflation with the PCE Price Index for March which is expected to show another month of multi-decade-high rates of consumer price increases. Also on Friday, we'll also see Personal Income and Spending data and the revised look at Consumer Sentiment.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.