Value Rotation • Million COVID Cases • Jobs Data Ahead

Summary

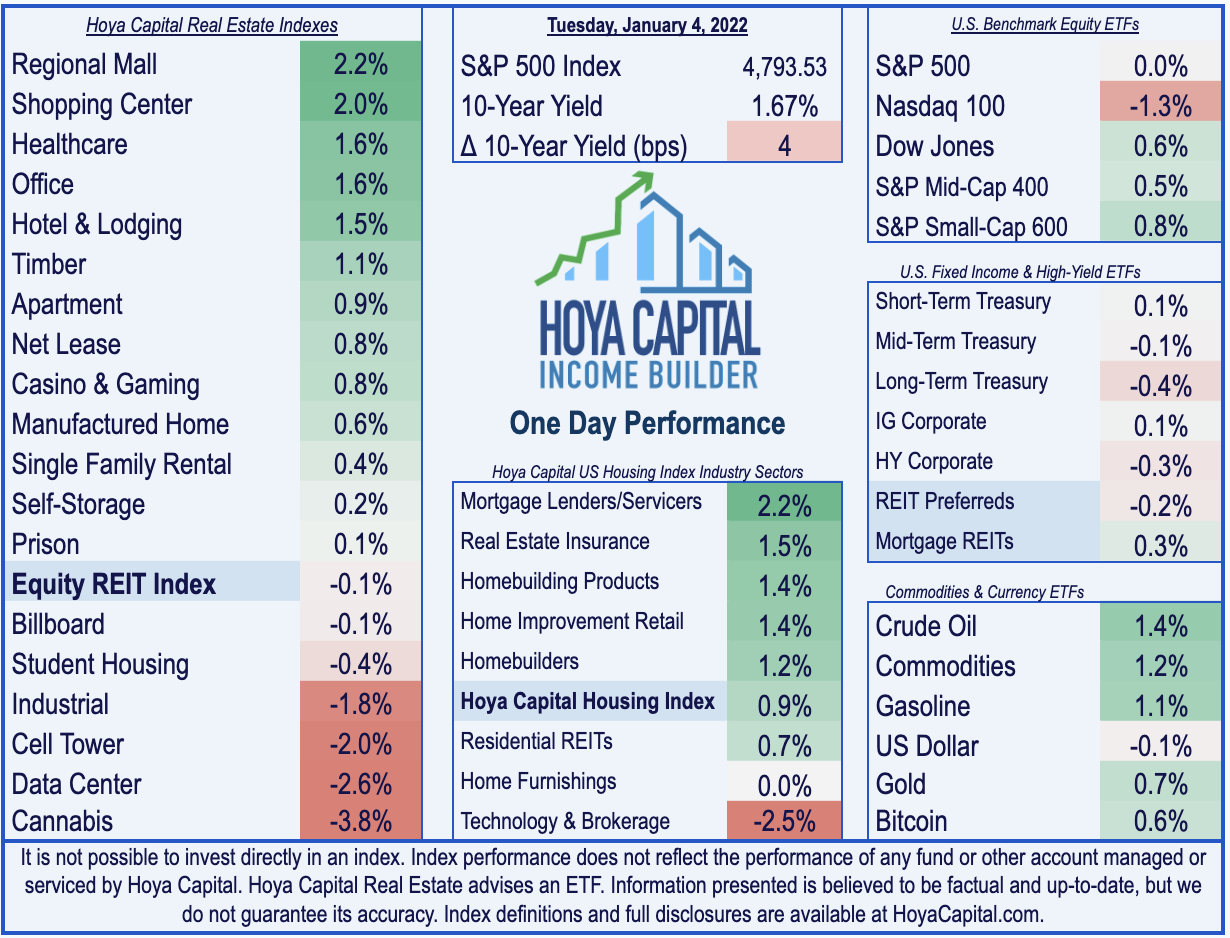

- U.S. equity markets were mixed Tuesday amid an apparent revival of the "reopening trade" as COVID-sensitive equity sectors rallied while technology stocks and longer duration bonds were again under pressure.

- Retreating slightly from yesterday's first record-high of 2022, the S&P 500 finished fractionally lower today while the Mid-Cap 400 advanced 0.5% and the Small-Cap 600 climbed 0.8%.

- Real estate equities were mixed as strong performance from economically-sensitive property sectors was offset by weakness from technology and industrial REITs.

- Today's rotation from growth to value came despite a record-high quantity of COVID cases recorded in the U.S. with more than 1,000,000 cases recorded on Tuesday alone while hospitalizations have surged more than 50% in the last two weeks.

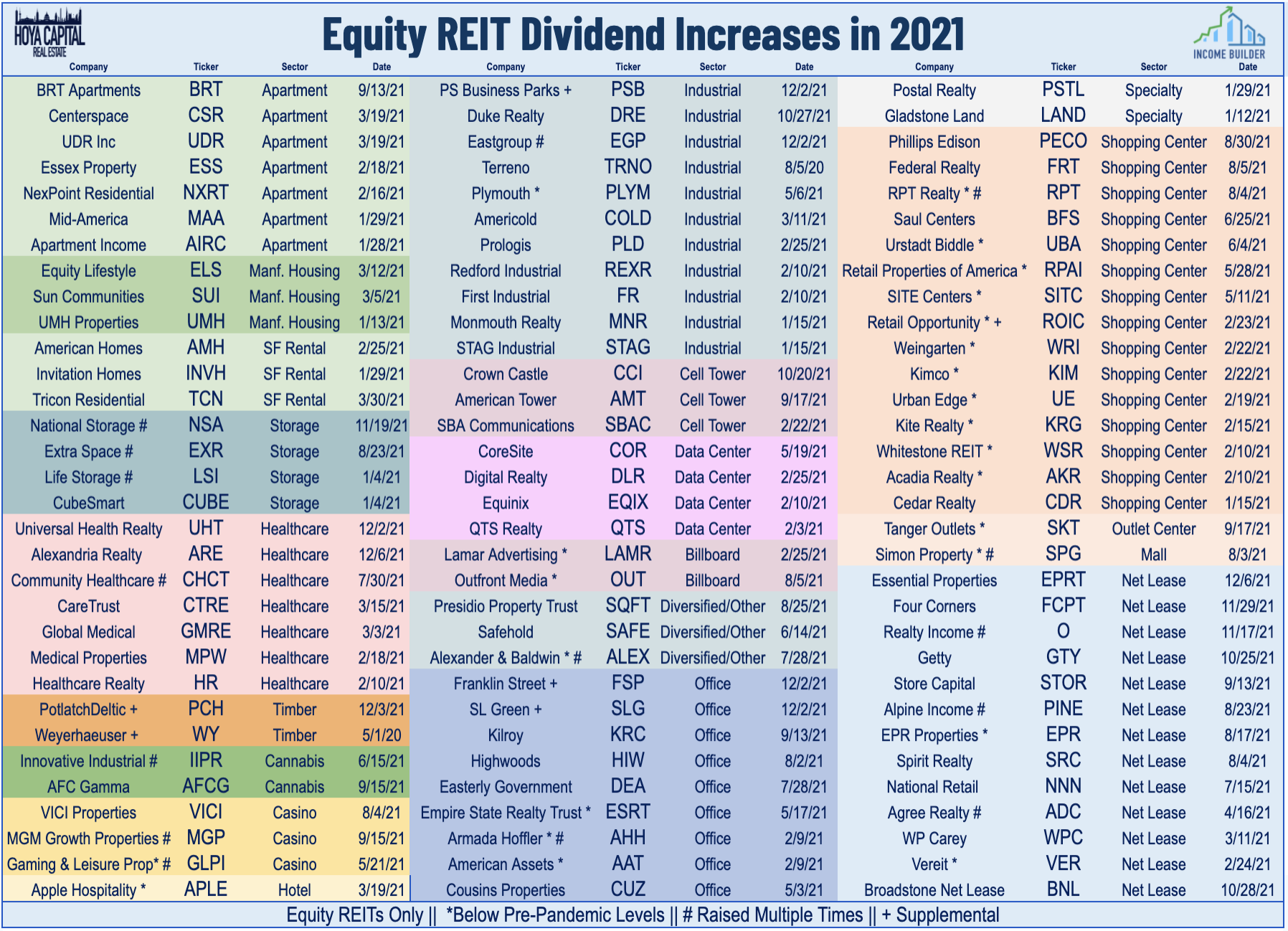

- Yesterday afternoon, Life Storage (LSI) became the first REIT to raise its dividend this year following a historic wave of over 130 REIT dividend increases in 2021.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets were mixed Tuesday amid an apparent revival of the "reopening trade" as COVID-sensitive equity sectors rallied while technology stocks and longer duration bonds were again under pressure. Retreating slightly from yesterday's first record-high of 2022, the S&P 500 finished fractionally lower today while the Mid-Cap 400 advanced 0.5% and the Small-Cap 600 climbed 0.8%. Real estate equities were mixed as strong performance from residential, office, and retail REITs were offset by weakness from technology and industrial REITs. The Equity REIT Index slipped 0.1% while Mortgage REITs gained 0.3%.

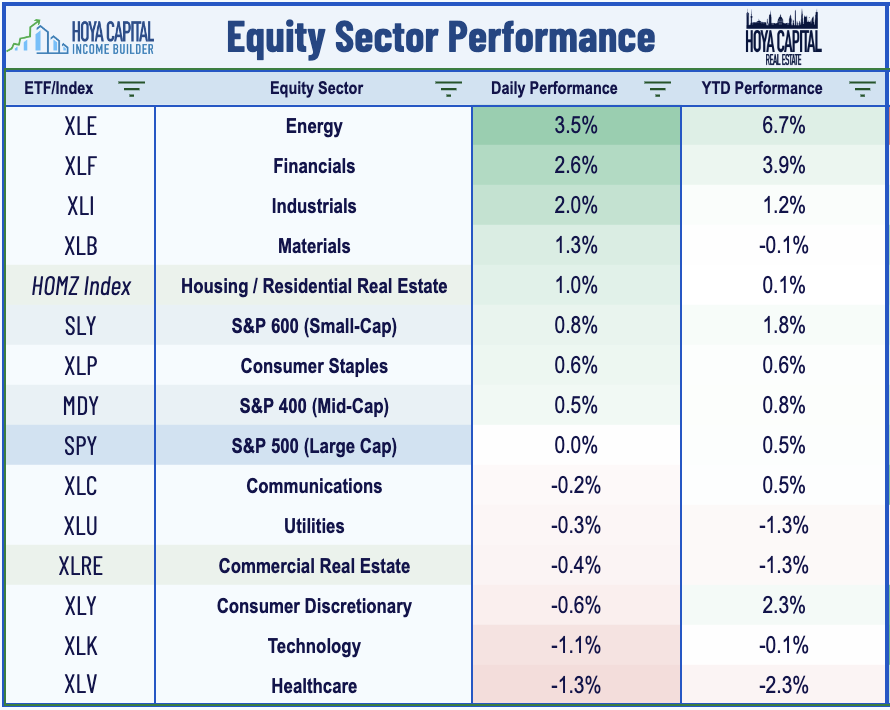

Today's 'reopening trade' patterns came despite a record-high quantity of COVID cases recorded in the U.S. with more than 1,000,000 cases recorded on Tuesday alone while hospitalizations have surged more than 50% in the last two weeks. Five of the eleven GICS equity sectors finished higher on the day, led to the upside once again by the Energy (XLE) and Financials (XLF) sectors while the 10-Year Treasury Yield climbed to the highest level since before the Omicron outbreak in late November. Elsewhere, Homebuilders and the broader Hoya Capital Housing Index climbed to fresh record-highs today.

Equity REIT & Homebuilder Daily Recap

Storage: Life Storage (LSI) became the first REIT to raise its dividend this year following a historic wave of over 130 REIT dividend increases in 2021. LSI declared a $1.00/share quarterly dividend, a 16.3% increase from its prior dividend of $0.86, representing a forward yield of 2.73%. Storage REITs stumbled into the pandemic with challenged fundamentals and an outlook for near-zero growth amid oversupply challenges. Catalyzed by the suburban housing boom, self-storage demand is suddenly insatiable.

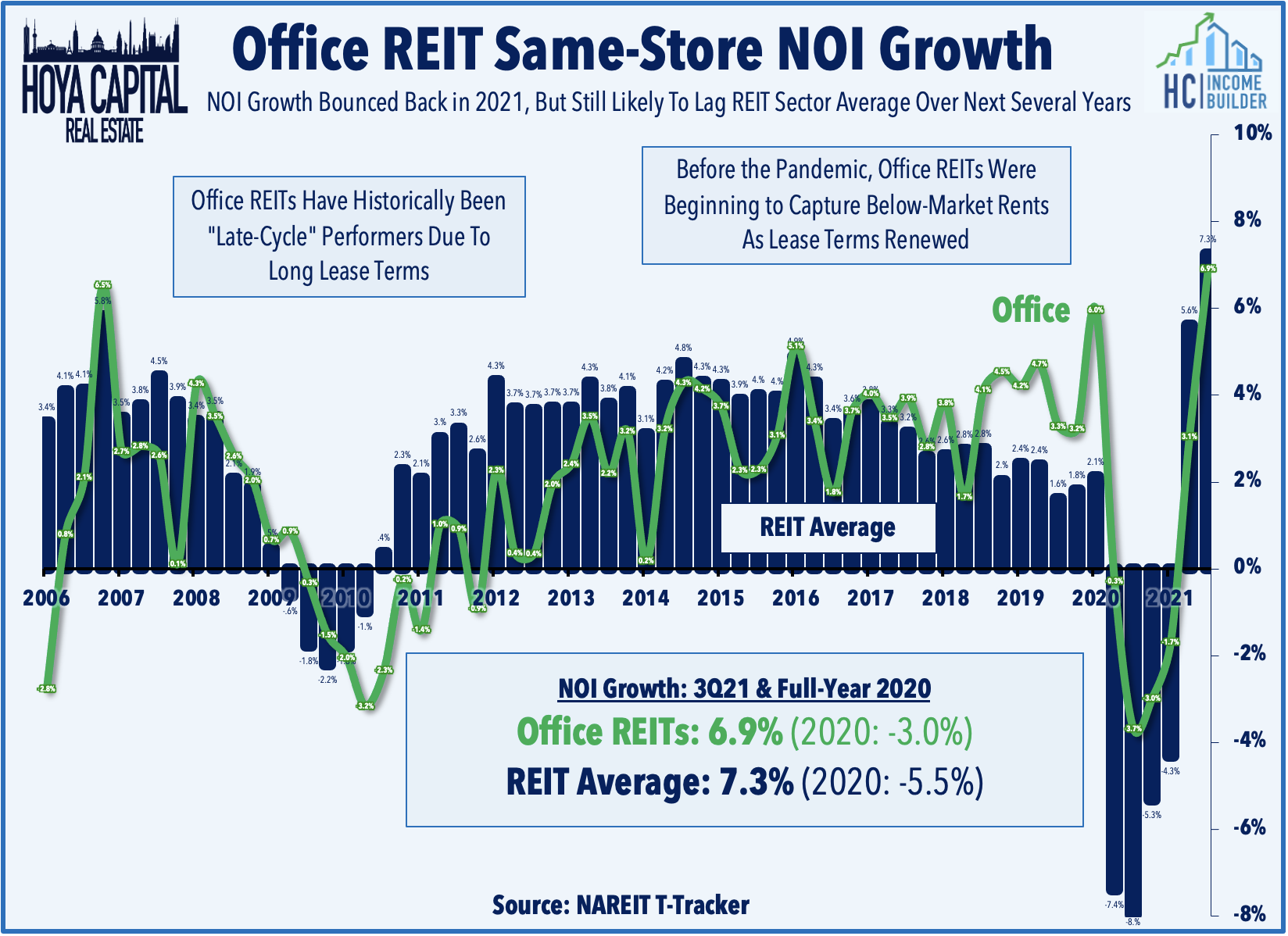

Office: Today we published Sunnier in the Sunbelt, an exclusive report for Hoya Capital Income Builder members which discussed our updated outlook and top picks in the office REIT sector. The long-delayed 'return to the office' has been postponed yet again by another wave of the pandemic, but office demand has been stronger than many assume. The office REIT outlook has brightened in recent months - particularly for REITs focused on business-friendly Sunbelt regions - following solid earnings results, favorable leasing trends, and strong comparable pricing. Start a free two-week trial to read the full report here.

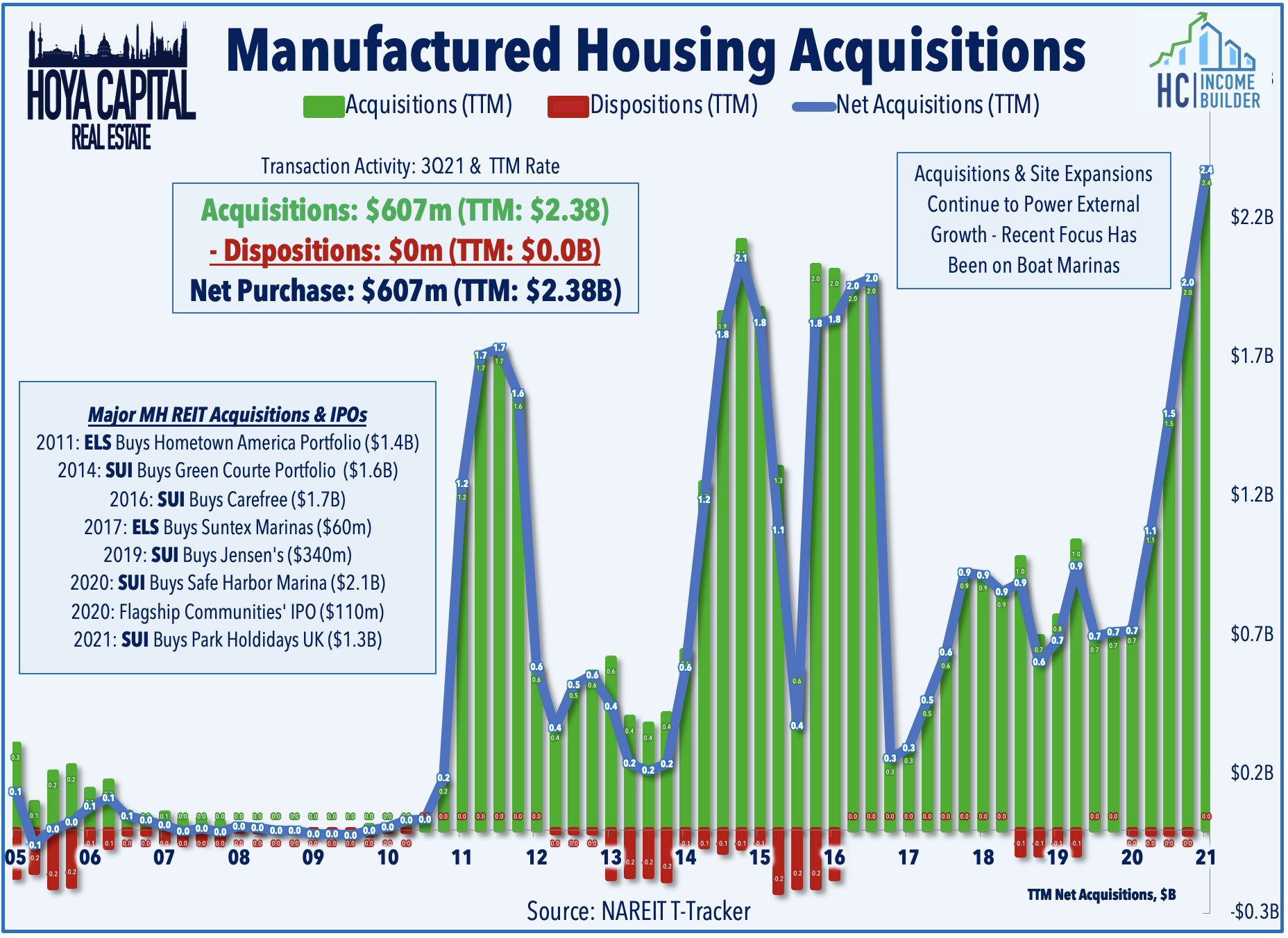

Manufactured Housing: Yesterday we published Don't Mess With The Best, an abridged article of our full report published to Hoya Capital Income Builder last week. Manufactured Housing REITs - the best-performing property sector of the past decade – continued their stellar performance in 2021, riding favorable fundamentals of robust rent growth and limited housing supply. MH REITs edged out the REIT Index on the final day of 2021 to push their remarkable streak of outperformance to nine years, the longest of the Modern REIT Era. The secular tailwinds resulting from the intensifying affordable housing shortage should persist into the back half of the 2020s, if not longer. While never "cheap," MH REITs remain an essential component of dividend growth-oriented real estate portfolios.

Economic Data This Week

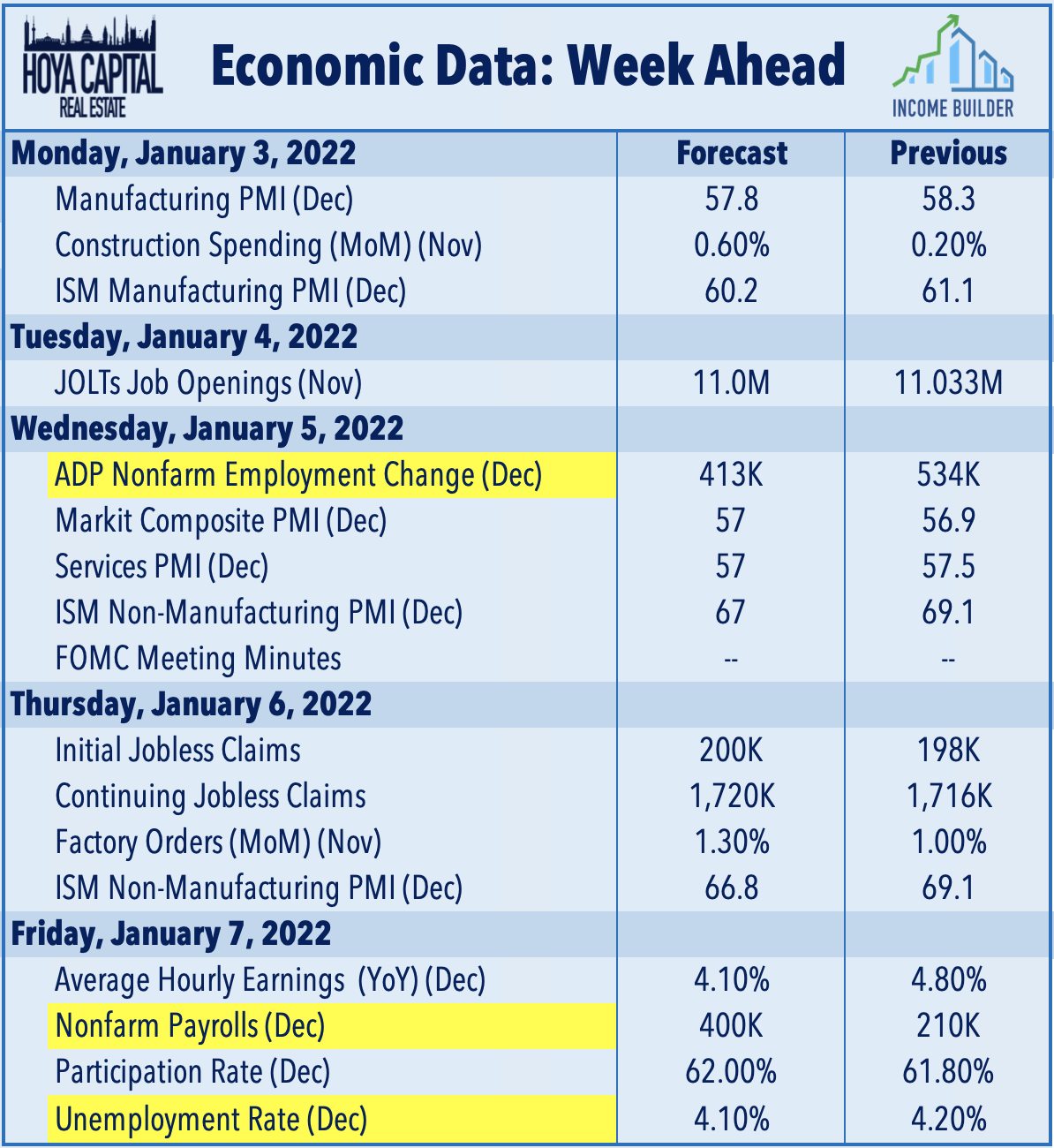

Employment data highlights the busy economic calendar in the week ahead, headlined by ADP Employment data on Wednesday, Jobless Claims on Thursday, and the BLS Nonfarm Payrolls report on Friday. Economists are looking for job growth of 400k in December following last month's weaker-than-expected employment growth of 210k and for the unemployment rate to tick lower to 4.1%. We also saw Construction Spending yesterday and JOLTs Job Openings data today, and will see and a flurry of Purchasing Managers' Index ("PMI") data throughout the week.

We're excited to announce the launch of our new investment research service here on Seeking Alpha - Hoya Capital Income Builder. We've put together a great team of contributors from across the REIT, dividend, and ETF industry, so whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.