Fed Ahead • Yields Rise • REIT Earnings Updates

- U.S. equity markets rebounded Monday while benchmark Treasury yields climbed to their highest levels since 2018 in another volatile session ahead of a critical Federal Reserve meeting on Wednesday.

- Bouncing back from the worst one-day declines since 2020, the S&P 500 advanced 0.6%- finishing more than 2% above its intra-day lows - while the tech-heavy Nasdaq 100 rallied nearly 2%.

- Real estate equities were laggards today, however, ahead of the business week of REIT earnings season as the Equity REIT Index declined 2.6% today with 18-of-19 property sectors in negative territory.

- VICI Properties (VICI) officially closed on its previously announced acquisition of MGM Growth Properties (MGP), making it the largest owner of hotel and conference real estate in America with an estimated enterprise value of $44B.

- A jam-packed week of REIT earnings kicked off this morning with results from Park Hotels (PK), which reported a slow but accelerating recovery in demand at its hotels. STR noted that Revenue Per Available Room was up 10% nationally in the most recent week compared to 2019-levels.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets rebounded Monday while benchmark Treasury yields climbed to their highest levels since 2018 in another volatile session ahead of a critical Federal Reserve meeting on Wednesday. Bouncing back from the worst one-day declines since 2020, the S&P 500 advanced 0.6% - finishing more than 2% above its intra-day lows - while the tech-heavy Nasdaq 100 rallied nearly 2% but remains in "bear market" territory. Real estate equities were laggards today, however, ahead of the business week of REIT earnings season as the Equity REIT Index declined 2.6% today with 18-of-19 property sectors in negative territory while Mortgage REITs were flat.

As discussed in our Real Estate Weekly Outlook, equity markets enter the week in the midst of their worst start to a year since 1939 amid a myriad of investor concerns over inflation, tightening monetary policy, and slowing global growth. The focus will be on the Fed this week with the FOMC Interest Rate Decision on Wednesday in which the committee is expected to initiate a "double rate hike" of 50 basis points this meeting and market pricing implies a total of 250 basis points by year-end. Ahead of the meeting, the 10-Year Treasury Yield climbed above 3.0% for the first time since late 2018 while the 2-Year Treasury Yield finished roughly flat today at 2.74%. Five of the eleven GICS equity sectors finished higher today with the Communications (XLC0 and Energy (XLE) sectors leading to the upside.

Employment data highlights another busy week of economic data in the week ahead, headlined by ADP Employment data on Wednesday, Jobless Claims on Thursday, and the BLS Nonfarm Payrolls report on Friday. Economists are looking for job growth of 380k in April following three-straight months of stronger-than-expected job growth while the unemployment rate is expected to decline to 3.5% from 3.6% in the prior month. We'll also be watching Construction Spending on Monday and a flurry of Purchasing Managers' Index ("PMI") data throughout the week.

Real Estate Daily Recap

Last Friday, we published our REIT Earnings Halftime Report. We're now entering the busiest week of earnings season with nearly 100 REITs set to report results. Among the 41 REITs that provided full-year FFO guidance, 30 REITs (73%) raised their outlook - well above the historical guidance increase rate of 60%. Residential and industrial REITs have been the early upside standouts thus far as rents continue to soar by double-digit rates across these sectors amid a substantial and lingering demand/supply imbalance. We'll hear results this afternoon from Omega Healthcare (OHI), Apartment Income (AIRC), Brixmor (BRX), Boston Properties (BXP), Centerspace (CSR), InvenTrust (IVT), and Outfront (OUT).

Hotel: Park Hotels (PK) - which owns a portfolio of upscale hotels focused in NYC and California which were hit especially hard by the pandemic - finished lower by about 1% today after reporting mixed results this morning, noting that its RevPAR was $116.42 in Q1, a decrease of 32.8% from the same period in 2019 - a modest improvement from Q4 in which it reported declines of 40%. PK's average Daily Rate ("ADR") was up 0.1% for the quarter compared to 2019, but average occupancy was down 25.4 percentage points. PK has so far seen a more muted recovery than the broader hotel industry. STR reported last week that RevPAR was higher by 10.5% compared to 2019-levels for the week ending April 23rd driven by ADR increases averaging over 15%. We'll hear results this afternoon from Ryman Hospitality (RHP).

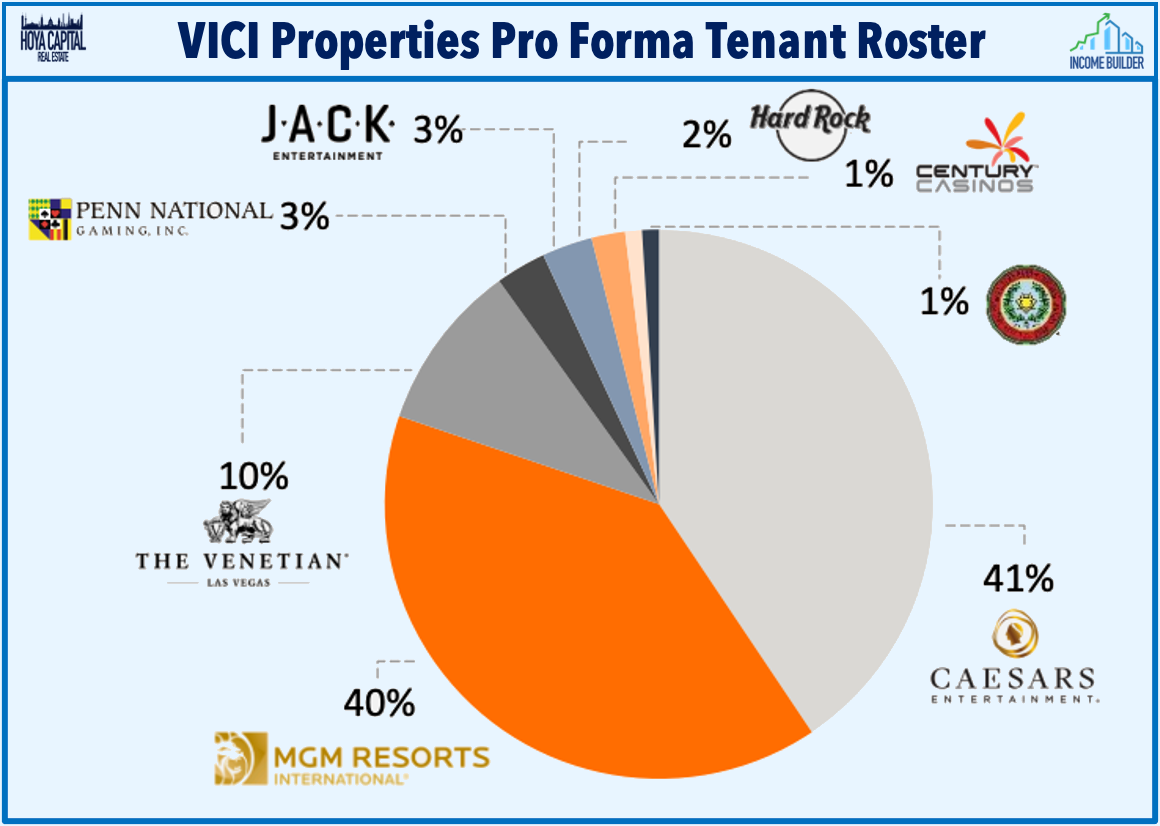

Casino: VICI Properties (VICI) officially closed on its previously announced acquisition of MGM Growth Properties (MGP), making it the largest owner of hotel and conference real estate in America with an estimated enterprise value of $44B. Simultaneous with the deal closing, VICI entered into an amended and restated triple-net master lease with MGM Resorts (MGM) which has an initial total annual rent of $860.0M and annual escalators of 2.0% per year for the first 10 years and thereafter at 2.0% per year or the annual increase in the consumer price index, subject to a 3.0% cap, whichever is greater. In addition, VICI (VICI) retains MGP's 50.1% ownership in the joint venture between MGP and Blackstone (BX) Real Estate Income Trust, which owns the real estate assets of MGM Grand Las Vegas and Mandalay Bay.

Speaking of Blackstone, today we published our final Student Housing REIT sector report on the Income Builder marketplace. American Campus (ACC) - the first of three student housing REITs and last one still publicly traded - was scooped-up last month by Blackstone- one of its five major REIT acquisitions since June to feed its fledging non-traded REIT business, BREIT. We discussed how BREIT has grown into a $100B behemoth in less than five years despite its high fee structure - including up-front commissions of up to 3.5% and annual fees of 0.85%, which Green Street estimates are 3x higher than comparable actively managed public REIT portfolios. The $100 in gross asset value - the vast majority of which has been acquired over the past five years alone - places BREIT among the five largest REITs alongside Prologis (PLD), American Tower (AMT), Crown Castle (CCI), and Equinix (EQIX).

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mREITs were mostly-higher today with residential mREITs gaining 0.5% while commercial mREITs declined by 0.4%. The busy week of mREIT earnings kicks off with reports this afternoon from AGNC Investment (AGNC), and Ellington Residential (EARN) while tomorrow morning we'll hear from New Residential (NRZ), Ares Commercial (ACRE), and Brightspire (BRSP). As noted in our Halftime Report, mortgage REIT earnings results haven't been as weak as feared given the historic bond rout in early 2022.

REIT Preferreds & Capital Raising

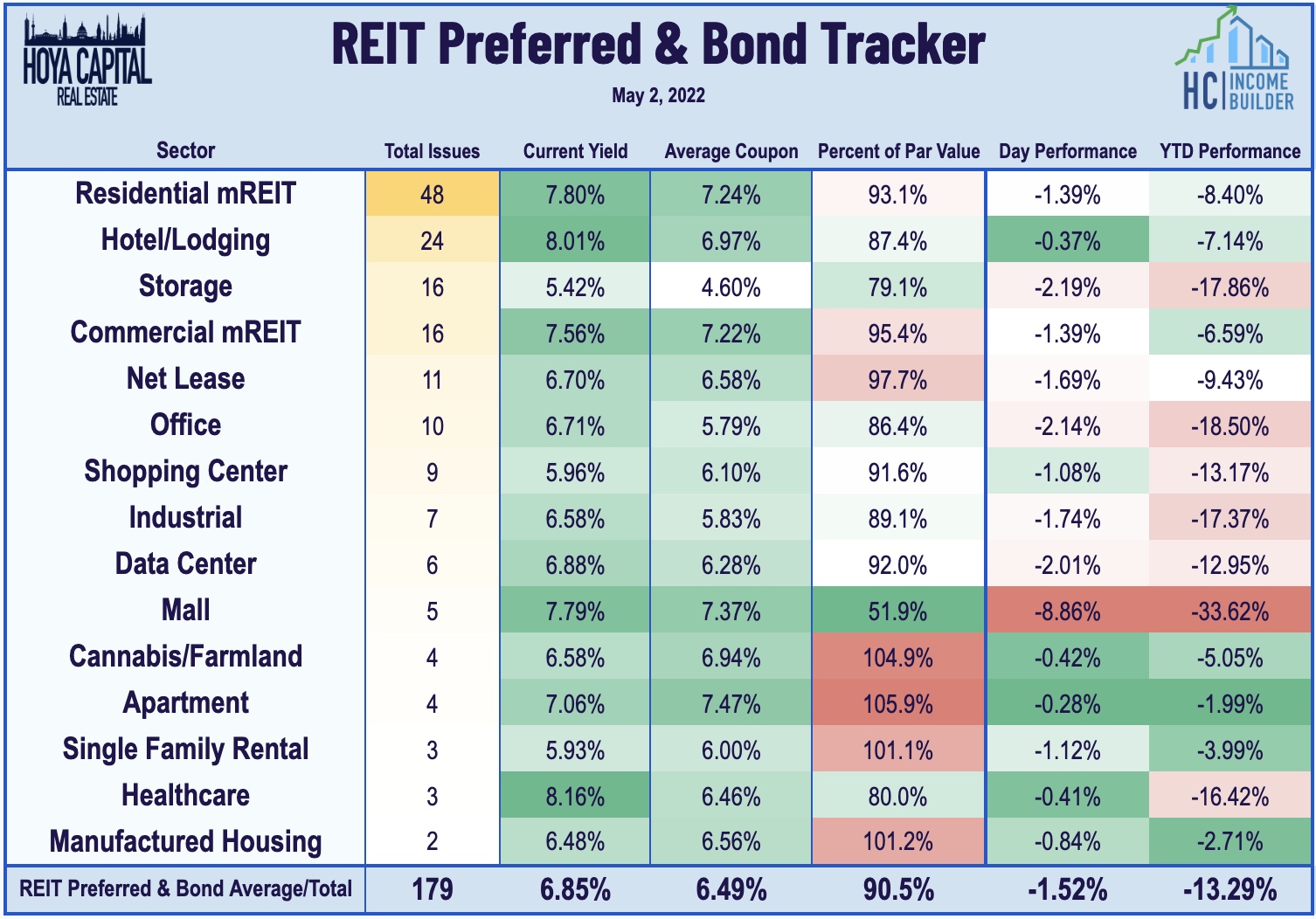

Per the Income Builder Preferred Tracker available to Income Builder subscribers, the Hoya Capital REIT Preferred Index finished lower by 1.52% today. The preferred securities of Pennsylvania REIT (PEI) were finished sharply lower today ahead of the company's earnings call on Thursday. REIT Preferreds ended 2021 with price returns of roughly 8.0% and total returns of roughly 14%. There are now 186 REIT-issued exchange-listed preferred and debt securities with an average current yield of 6.73%.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.