Amazon Cost Cutting • Hotel Recovery • Week Ahead

- U.S. equity markets rebounded Monday as investors cautiously waded back into beaten-down equity sectors after the major benchmark briefly dipped into intra-day "bear market" territory last Friday.

- Seeking to snap a stretch of seven-straight weeks of declines, the S&P 500 advanced 1.8% today while the Dow rallied 2% as it seeks to snap its worst weekly skid since the Great Depression.

- Led by a rebound across growth-oriented property sectors, real estate equities were also broadly higher on the day as the Equity REIT Index gained 1.1% today while Mortgage REITs advanced 1.7%.

- Industrial REITs remained under pressure, however, on further details about Amazon's plan to cut costs in its logistics network, which may include subletting space or renegotiating leases. AMZN's overcapacity appears company-specific, however, as logistics vacancy rates remain at historic lows.

- Pebblebrook Hotel provided reported that its Revenue Per Available Room ("RevPAR") was back to within 6% of 2019-levels in April, citing a long-awaited recovery in its business-heavy urban portfolio. TSA data indicates that travel demand has moderated a bit over the past month amid soaring fuel prices.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets rebounded Monday as investors cautiously waded back into beaten-down equity sectors after the major equity benchmark briefly dipped into "bear market" territory last Friday. Seeking to snap a stretch of seven-straight weeks of declines, the S&P 500 advanced 1.8% today while the Dow Jones Industrial Average rallied over 2% as it seeks to snap its worst stretch of declines since the Great Depression. Led by a rebound across growth-oriented property sectors, real estate equities were also broadly higher on the day as the Equity REIT Index gained 1.1% today with 17-of-19 property sectors in positive territory while Mortgage REITs gained 1.7%.

All eleven GICS equity sectors were higher on the day, led to the upside by the Financials (XLF) sector following an upbeat outlook from JP Morgan (JPM), which noted that it expects to benefit from rising interest rates while commenting that the "near-term credit outlook, especially for the U.S. consumer, remains strong." As discussed in our Real Estate Weekly Outlook, bonds have caught a bid this month amid an otherwise dismal start to the year, but the major bond benchmarks pulled back today as the 10-Year Treasury Yield rebounded 7 basis points to close at 2.86% - still well below the 3.20% peak seen in early May. Also of note, the US Dollar Index remained under pressure after climbing to 20-year highs in early May.

We have another busy week of economic and housing data in the week ahead, highlighted by New Home Sales on Tuesday and Pending Home Sales on Thursday which are each expected to show a similar moderation in housing market activity as that seen this week in Housing Starts and Existing Home Sales. Before the three-day Memorial Day weekend, we'll get another look at inflation with the PCE Price Index on Friday which investors - and the Fed - are hoping will finally show some signs of moderating price pressures. Last month, the PCE increased by 6.6%, which was the highest rate since 1982. Also on Friday, we'll also see Personal Income and Spending data and the revised look at Michigan Consumer Sentiment - which dipped to decade-lows in the initial reading for May.

Real Estate Daily Recap

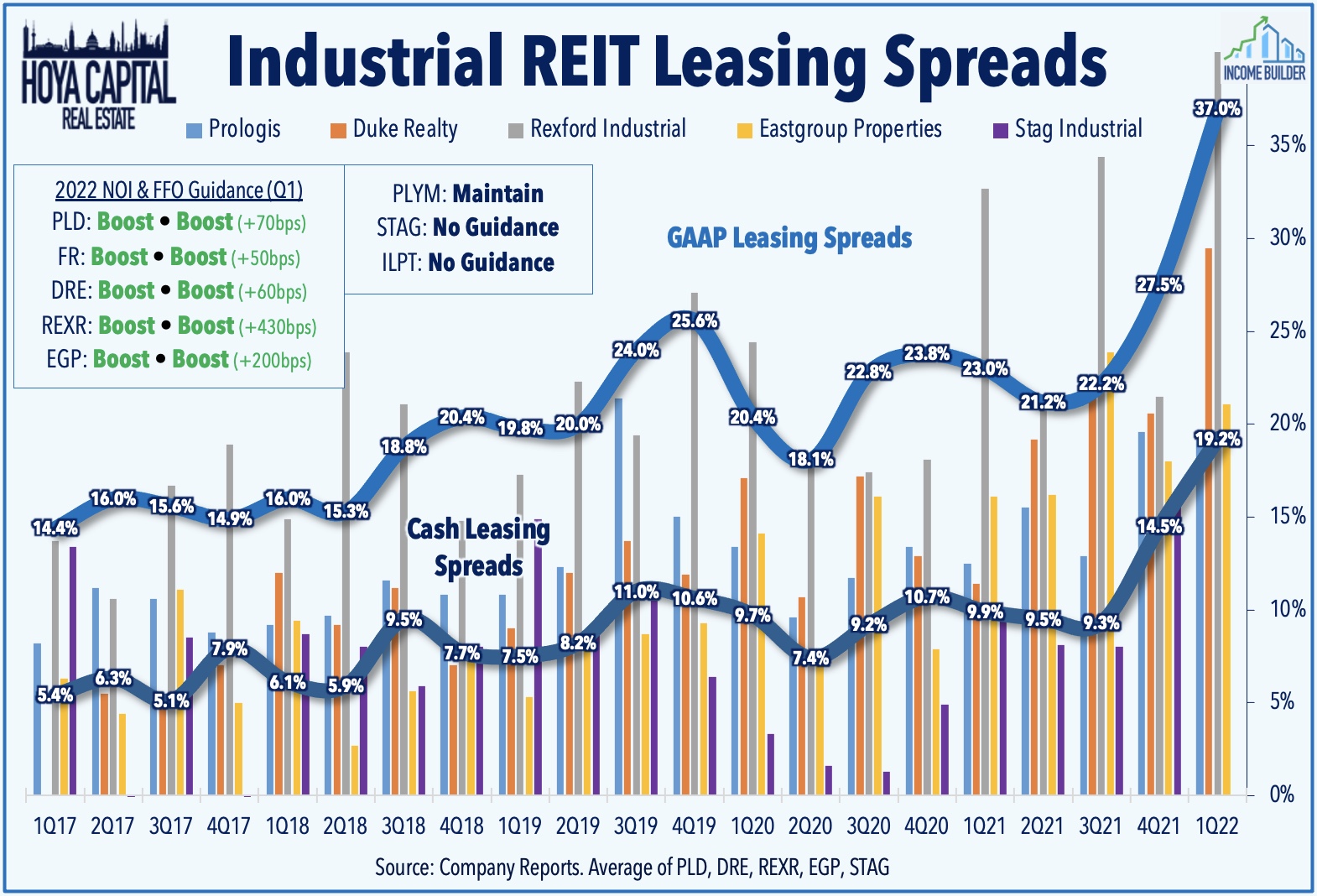

Industrial: Slammed in recent weeks following the earnings results from Amazon (AMZN) in which the e-commerce giant indicated plans to improve “productivity and cost efficiencies” throughout its logistics network after a massive expansion in its footprint over the past several years, industrial REITs were laggards again today after Bloomberg provided further reporting that Amazon is seeking to sublet at least 10 million square feet of space and "could try to negotiate lease terminations with existing landlords, including Prologis (PLD) - which has plunged 30% over the past month - a sell-off is substantially overdone and unwarranted. While Amazon is one of the largest industrial tenants, Amazon still only comprised roughly 5% of national leasing activity last year and roughly 3% in 2022 according to JLL - and this overcapacity at Amazon appears to be company-specific and comes as broader industrial vacancy rates are at record lows. We're finalizing an updated Industrial REIT report that will publish this evening on Income Builder that will discuss the recent carnage and our updated outlook for the sector.

Hotel: Pebblebrook Hotel (PEB) - which owns an "urban-heavy" hotel portfolio that was among the hardest-hit during the pandemic - finished little changed today after providing a business update in which it reported that its same-store occupancy rate for April rose to 68% from 62% in March, reaching its highest level since the beginning of the pandemic. Notably, the company reported that its Revenue Per Available Room ("RevPAR") was back to within 6% of 2019-levels in April as a nearly 20% comparable increase in room rate helped to offset a roughly 10% comparable decline in occupancy rates. PEB commented that "seasonality is driving May demand to track roughly in line with April; however, June is seeing a reacceleration in the demand recovery." Recent TSA Checkpoint data has shown that domestic travel recovered to 90% of pre-pandemic levels by late March, but has trended sideways since then as headwinds from rising fuel and airline prices appear to be causing some households and businesses to re-think summer travel plans.

Mall: Last Friday, we published Mall REITs: Cracks In Consumer Dims Outlook on the Income Builder marketplace. One step forward, one back. After nearly doubling in value last year, mall REITs have been the worst-performing major property sector in 2022 as the stimulus-fueled retail strength has stalled. The tech wreck has spilled over to become the retail wreck in recent weeks. Retail stocks are now off by nearly as much as the depth of the pandemic lockdowns in 2020. Mall REITs earnings results were actually quite encouraging with Simon (SPG) and Tanger (SKT) boosting their full-year FFO outlook, noting a recovery in tenant sales and rent collection back to pre-pandemic levels. Soaring fuel prices and persistent inflation have triggered a "rapid slowdown" in several retail categories in recent months, however, and a recession could be a final death blow to lower-tier malls.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were broadly higher today as residential mREITs rallied 1.6% while commercial mREITs advanced 1.6%. On a slow day of newsflow, Great Ajax (AJX) and Angel Oak (AOMR)ed to the upside while ACRES Realty (ACRE) was the laggard. In our Earnings Recap published last week, we noted that mREITs have been an upside standout over the past several weeks after earnings season showed that Book Value declines were generally not as steep as analysts projected. Residential mREIT Book Value Per Share ("BVPS") metrics declined by 8.4%, on average while commercial mREIT reported an average BVPS increase of 0.1%.

REIT Preferreds & Capital Raising

Per the Income Builder Preferred Tracker available to Income Builder subscribers, the Hoya Capital REIT Preferred Index finished lower by 0.03% today. REIT Preferreds ended 2021 with price returns of roughly 8.0% and total returns of roughly 14%. There are now roughly 180 REIT-issued exchange-listed preferred and debt securities with an average current yield of 6.96%. Preferred Apartments (APTS) announced that its acquisition by Blackstone (BX) is expected to close on or about June 9, 2022. Upon closing, the company will suspend redemptions of shares of its unlisted Series A, Series A1 Series M, and Series M1 Redeemable Preferred Stock after June 2, 2022. Elsewhere, last Friday, Fitch Ratings affirmed Invitation Home's (INVH) “BBB” credit rating with a stable outlook.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing asset classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.