Builders Bounce • Luxury Strength • REIT Dividend Hike

- U.S. equity markets rebounded Wednesday in another choppy session after strong results from Toll Brothers and Nordstrom revealed surprising strength in the luxury segment of U.S. consumer spending.

- Back on pace to snap a seven-week streak of declines, the S&P 500 advanced 1.0% today - pushing its week-to-date gains to 2.0% - while the Mid-Cap 400 and Small-Cap 600 each rallied 2%.

- Homebuilder Toll Brothers surged 8% after reporting better-than-expected results and maintaining its full-year outlook which calls for revenue growth of 20% this year, refuting dire housing market forecasts.

- Simon Property is reportedly not planning to a make bid for the department store chain Kohl's, contrary to reports last week that Simon may partner with Brookfield on a bid for Kohl's after the pair successfully purchased JC Penny out of bankruptcy in 2020.

- Another day, another REIT dividend hike. Presidio Property (SQFT) - a microcap diversified REIT that owns office, industrial, retail, and single-family residential properties which went public in 2020 - rallied 5% after increasing its dividend - the 63rd equity REIT to hike its payout.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

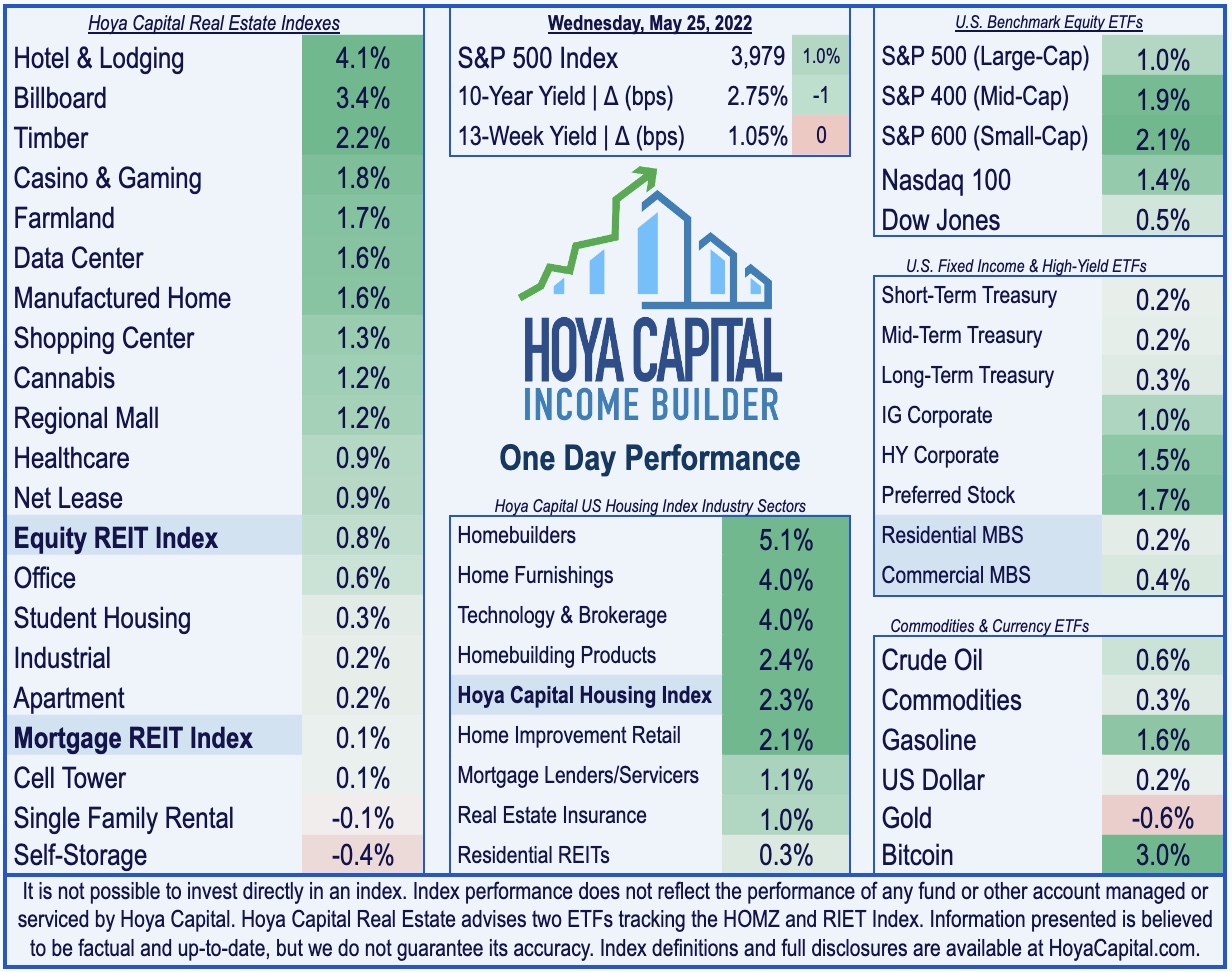

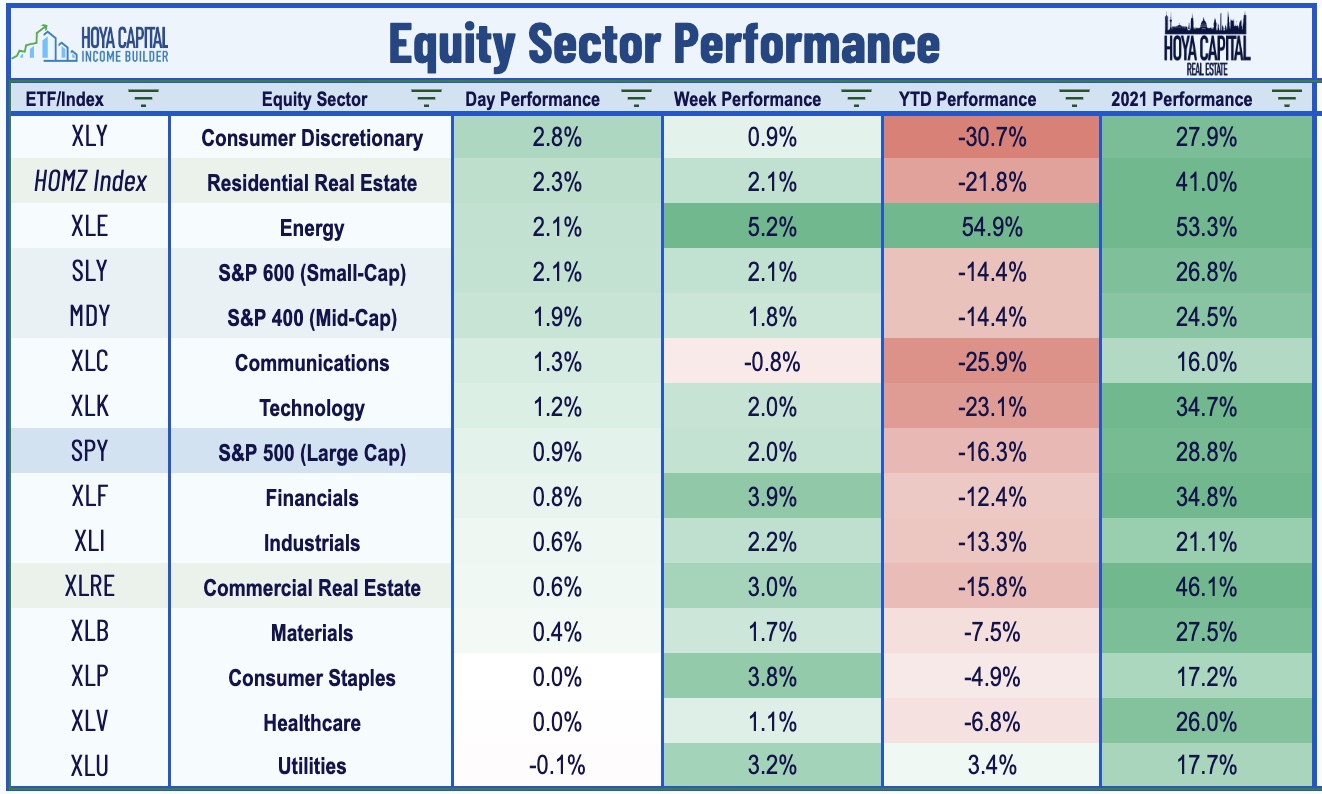

U.S. equity markets rebounded Wednesday in another choppy session after strong results from Toll Brothers and Nordstrom revealed surprising strength in the luxury segment of U.S. consumer spending. Back on pace to snap a seven-week streak of declines, the S&P 500 advanced 1.0% today - pushing its week-to-date gains to 2.0% - while the Mid-Cap 400 and Small-Cap 600 each rallied 2%. Led by a rebound in the beaten-down hotel and retail property sectors, real estate equities were also broadly higher today as the Equity REIT Index gained 0.8% today with 17-of-19 property sectors in positive territory while Mortgage REITs advanced 0.1%.

Brightening the outlook following several downbeat retail earnings reports last week from Walmart (WMT) and Target (TGT), strong results from Nordstrom (JWN) and Express (EXPR) indicated that the slowdown in consumer spending may not be as broad-based as previously suspected. Ten of the eleven GICS equity sectors were higher on the day, led to the upside by the Consumer Discretionary (XLY) sector while Homebuilders and the broader Hoya Capital Housing Index also delivered a strong rebound after strong results from Toll Brothers (TOL) and data showing that mortgage rates declined for a second week. Bonds also advanced today as the 10-Year Treasury Yield declined 1 basis point to close at 2.75% - well below the recent 3.20% peak.

Real Estate Daily Recap

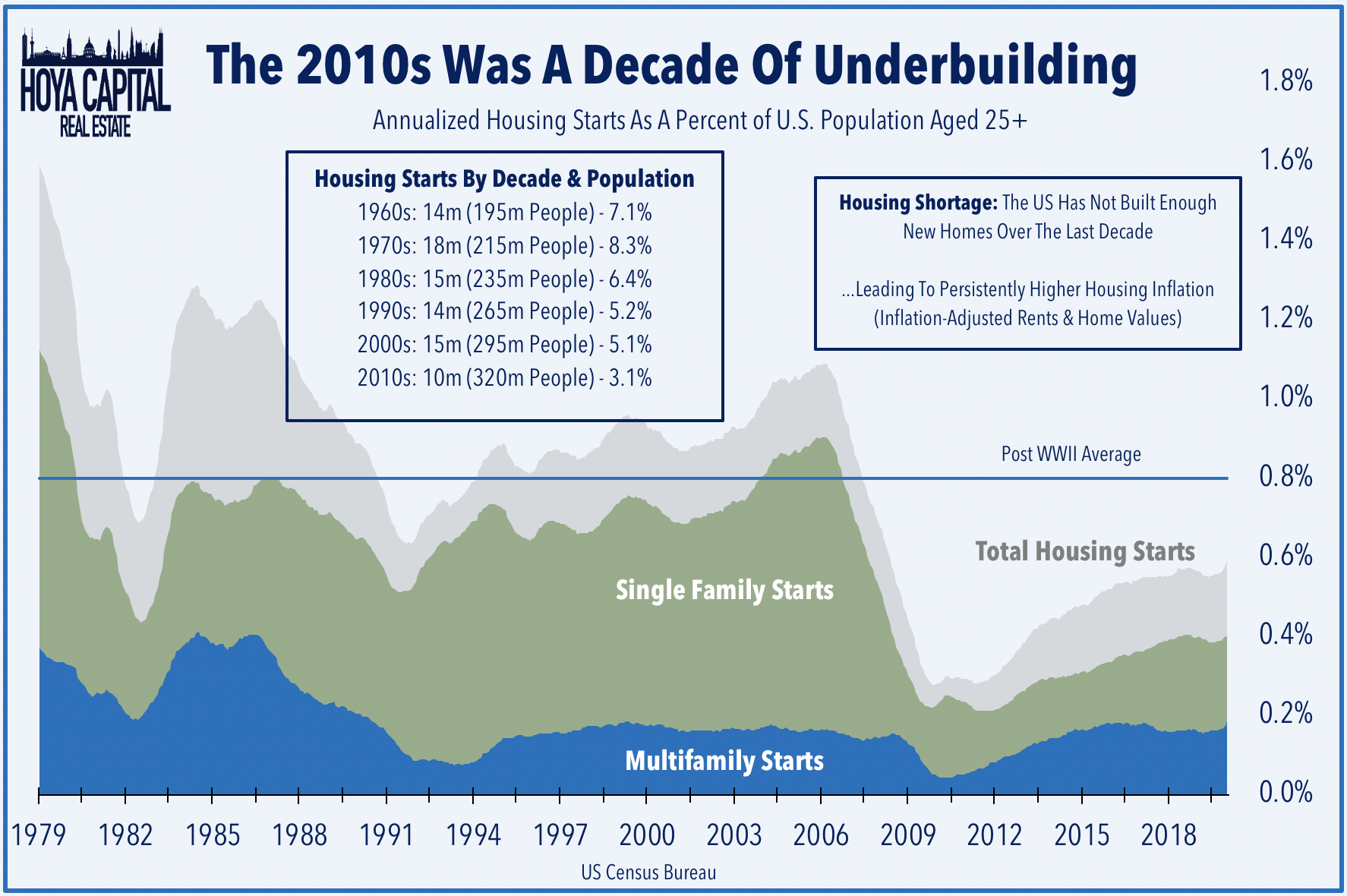

Homebuilders: On that point, Toll Brothers (TOL) surged 8% after reporting better-than-expected results and maintaining its full-year outlook which calls for revenue growth of 20% this year, refuting the dire forecasts that have fueled a 30-40% decline in homebuilders this year. TOL delivered a record 2,407 homes in Q2 and, rather remarkably, reported an impressive increase in gross margins to 26.1% compared to 24.4% in the second quarter of 2021. TOL commented that the "many fundamental drivers that have supported the housing market in recent years remain firmly in place" and cited the "supply and demand imbalance resulting from over a decade of underproduction... will continue to support housing demand in the long-term."

Another day, another REIT dividend hike. Presidio Property (SQFT) - a microcap diversified REIT that owns office, industrial, retail, and single-family residential properties which went public in 2020 - rallied more than 5% today after it raised its quarterly dividend to $0.106/share, a 1% increase from its prior dividend of $0.105. In our State of the REIT Nation report published last week, we noted that FFO growth has significantly outpaced dividend growth over the past several quarters, driving the dividend payout ratios to just 68.8% in Q1 - well below the 20-year average of 80%. With a historically low dividend payout ratio, we believe that REITs are well-equipped to deliver another year of robust dividend growth that may meet or exceed the record year in 2021 in which 130 equity and mortgage REITs raised their payout.

Mall: Contrary to reports last week, CNBC reported today that Simon Property (SPG) is reportedly not planning to a make bid for the department store chain Kohl's (KSS), but that the retail chain does still have several interested bidders including Sycamore Partners and Franchise Group (FRG) are also expected to make offers. Reuters reported last week that Simon may partner with Brookfield Asset Management (BAM) on a bid for Kohl's after the pair successfully purchased JC Penny out of bankruptcy in 2020. In Mall REITs: Retail Rout, we discussed Simon's strategy and history of buying distressed retail brands. Through its 50/50 joint venture with Authentic Brands on the SPARC Group - and a separate partnership with Brookfield - SPG has accumulated a portfolio of brands with value that extends beyond the immediate benefit of keeping these tenants in business. This vertical retail integration strategy is consistent with our long-held view that mall REITs would actually benefit if they performed more like retailers - which have substantially outperformed their REIT landlords across most measurement periods.

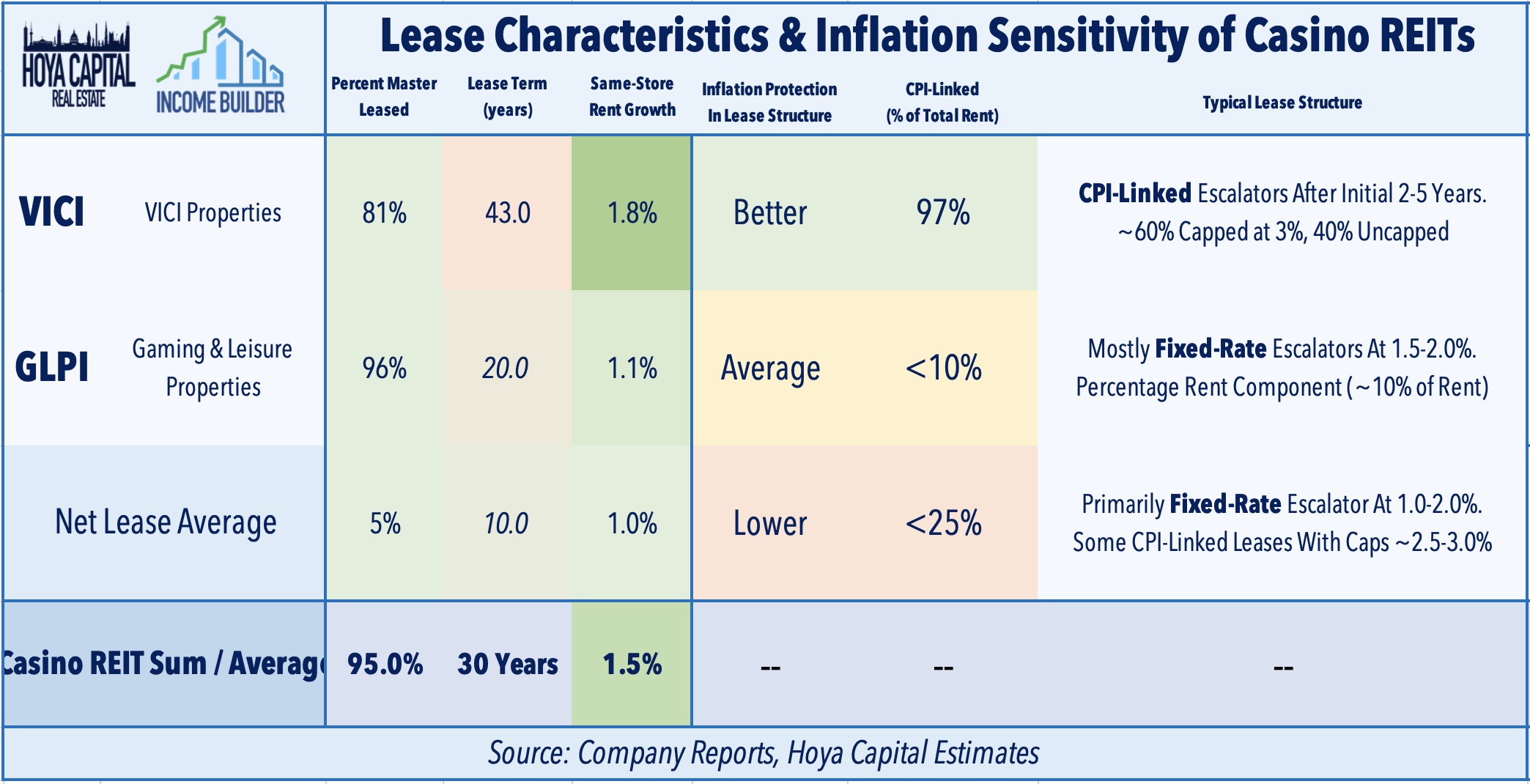

Casinos: This evening we'll publish an updated report on the Casino REIT sector on the Income Builder marketplace. Despite concerns over the impact of inflation on their ultra-long-duration leases, casino REITs have been among the best-performing REIT sectors this year as the positive tailwinds from the demand recovery in Las Vegas have offset the inflation headwinds. As projected, casino REITs - which emerged in the late 2010s - have indeed benefited from an upward "re-rating" from investors as the sector matured, now trading with multiples that are more in line with their traditional net lease peers. This month, VICI Properties (VICI) completed its $17.2 billion strategic acquisition of MGM Properties, giving the company a dominant share of the critical Las Vegas market. In the report, We'll discuss our updated outlook on the casino REIT sector.

Mortgage REIT Daily Recap

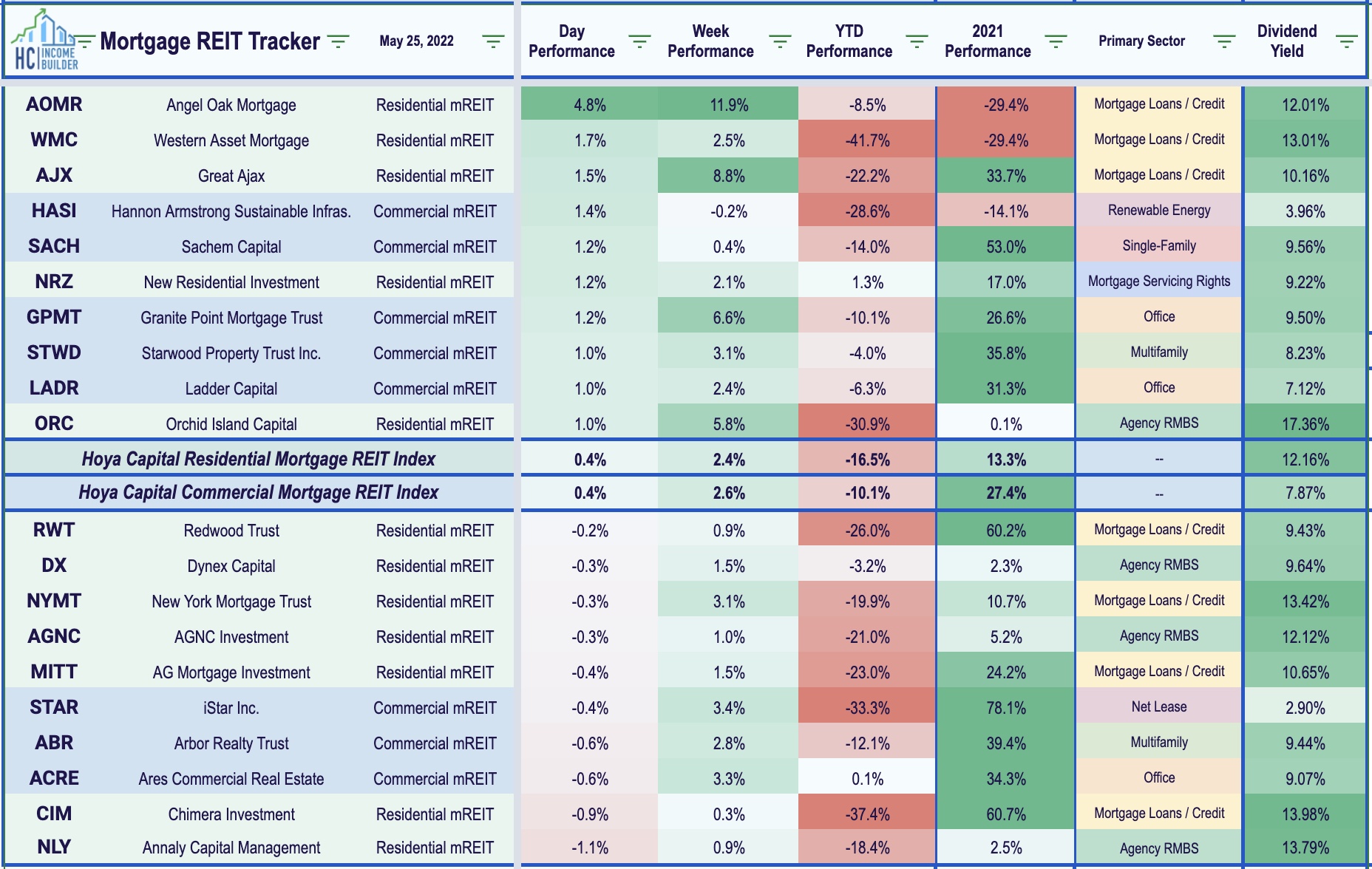

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs delivered another solid day as residential mREITs advanced 0.4% while commercial mREITs also gained 0.4%. On another slow day of newsflow, Angel Oak Mortgage (AOMR) and Western Asset (WMC) led to the upside while Annaly Capital (NLY) was the laggard. In our Earnings Recap published last week, we noted that mREITs have been an upside standout over the past several weeks after earnings season showed that Book Value declines were generally not as steep as analysts projected. Residential mREIT Book Value Per Share ("BVPS") metrics declined by 8.4%, on average while commercial mREIT reported an average BVPS increase of 0.1%.

REIT Preferreds & Capital Raising

Per the Income Builder Preferred Tracker available to Income Builder subscribers, the Hoya Capital REIT Preferred Index finished higher by 1.55% today. REIT Preferreds ended 2021 with price returns of roughly 8.0% and total returns of roughly 14%. There are now roughly 180 REIT-issued exchange-listed preferred and debt securities with an average current yield of 6.96%.

Economic Data This Week

We have another busy week of economic and housing data in the week ahead, highlighted by New Home Sales on Tuesday and Pending Home Sales on Thursday which are each expected to show a similar moderation in housing market activity as that seen this week in Housing Starts and Existing Home Sales. Before the three-day Memorial Day weekend, we'll get another look at inflation with the PCE Price Index on Friday which investors - and the Fed - are hoping will finally show some signs of moderating price pressures. Last month, the PCE increased by 6.6%, which was the highest rate since 1982. Also on Friday, we'll also see Personal Income and Spending data and the revised look at Michigan Consumer Sentiment - which dipped to decade-lows in the initial reading for May.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing asset classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.