Rough Week • Travel Demand Cools • REIT Updates

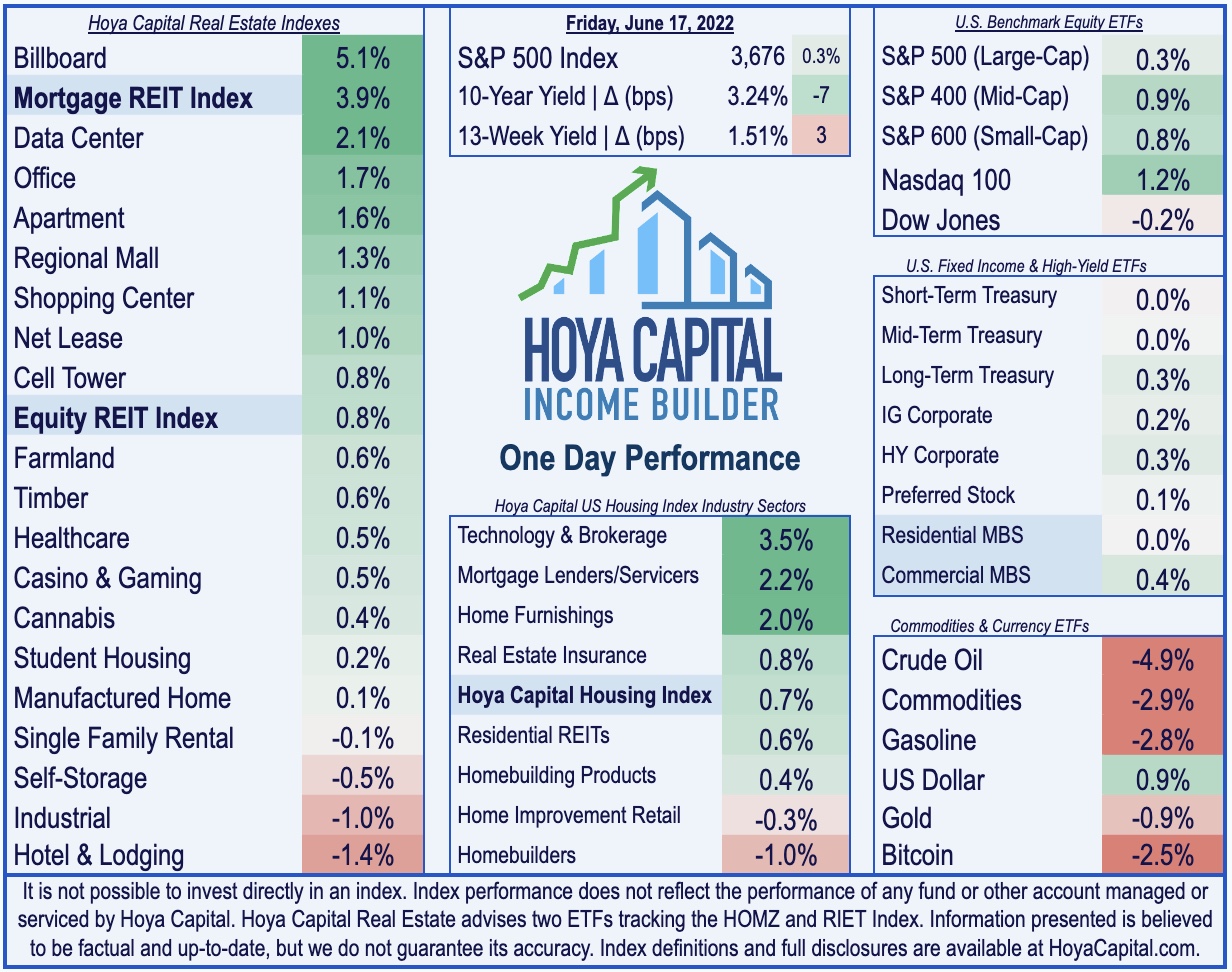

- U.S. equity markets stabilized Friday on an otherwise brutal week as mounting concerns over an economic "hard landing" has sent the major benchmarks to the lowest levels since late 2020.

- Posting weekly declines of more than 6% - its tenth decline in the past eleven weeks and its worst week since March 2022, the S&P 500 finished higher by 0.3% today.

- Real estate equities rebounded as well today with the Equity REIT Index advancing 0.8% today - ending the week with declines of 5.3% - while Mortgage REITs rebounded 4%.

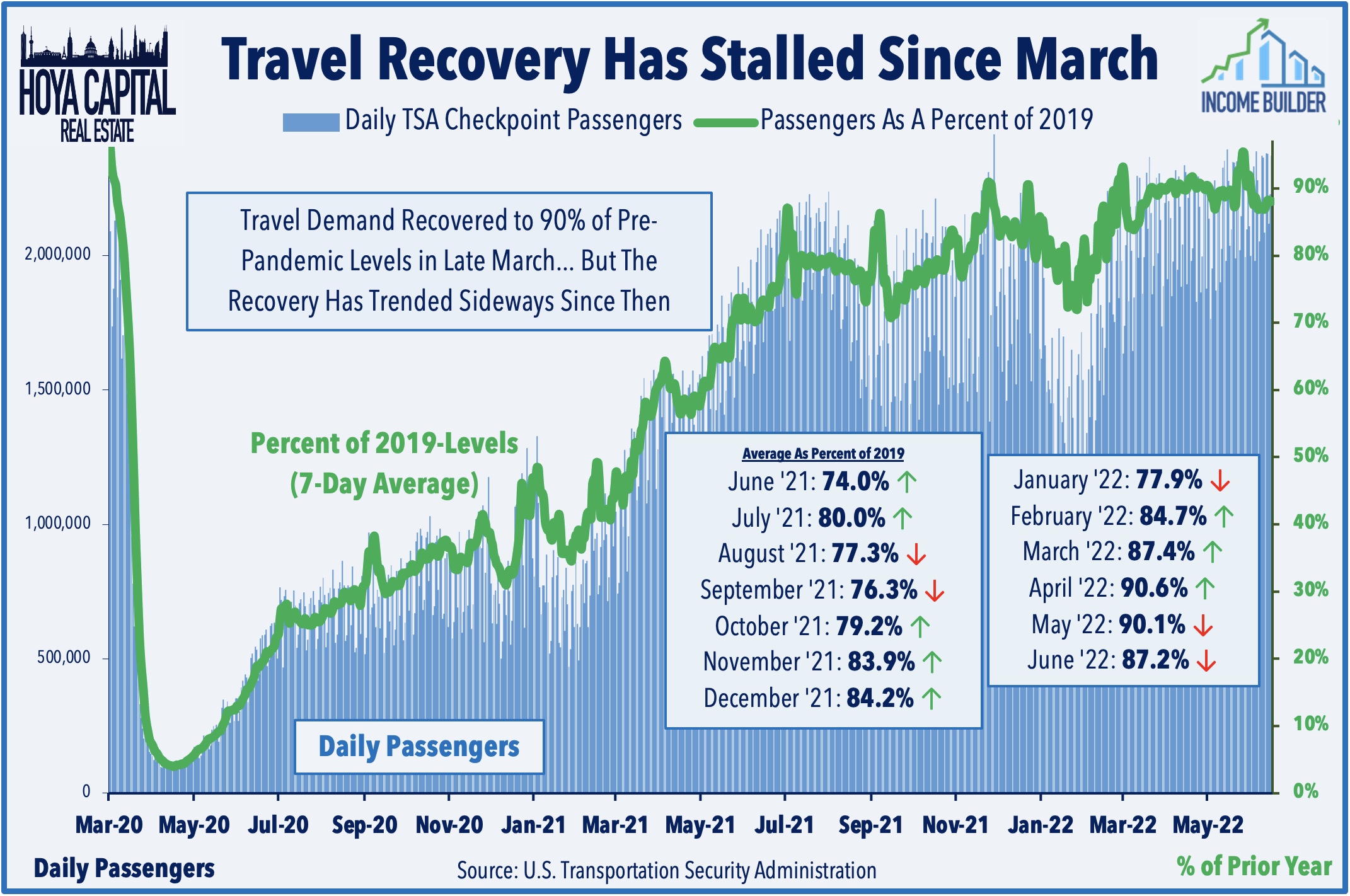

- Consistent with TSA data showing a notable slowdown in travel demand, Pebblebrook (PEB) was a laggard today after providing a business update in which it noted that its operating metrics softened a bit in May compared to April,.

- Ellington Financial (EFC) rallied more than 4% today after reporting that its Book Value Per Share was relatively flat in May, a positive read-through for the mREIT sector amid a particularly brutal week.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

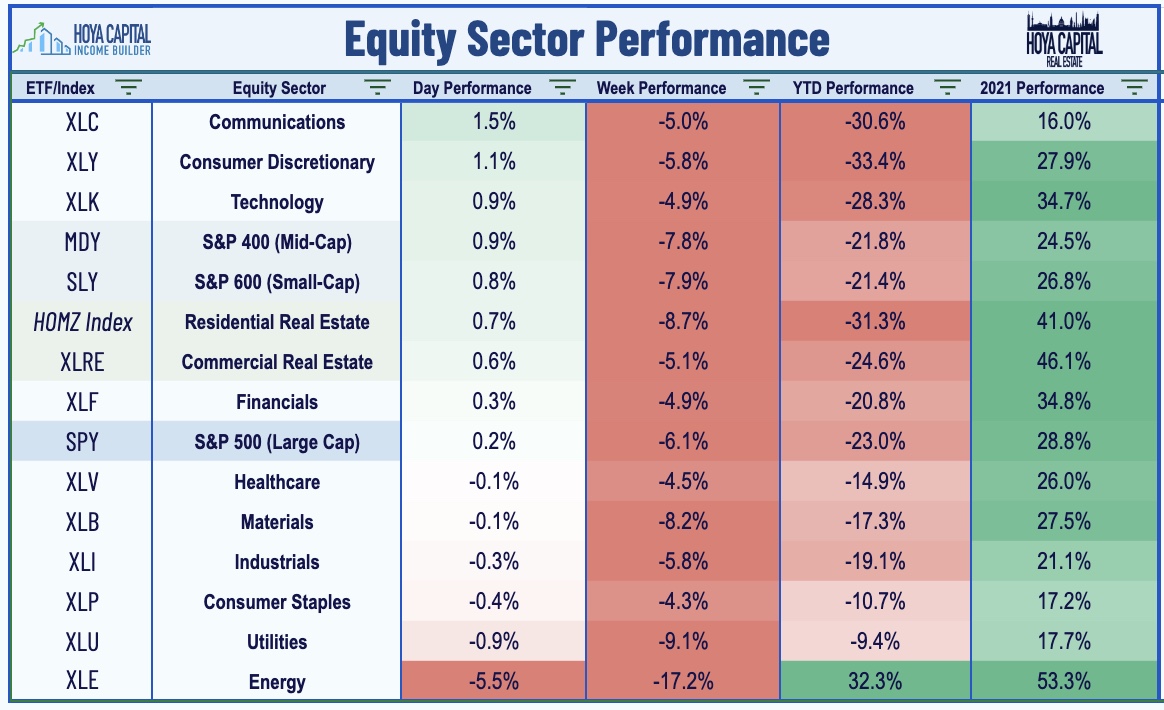

U.S. equity markets stabilized Friday on an otherwise brutal week as mounting concerns over an economic "hard landing" has sent the major benchmarks to the lowest levels since late 2020. Posting weekly declines of more than 6% - its tenth decline in the past eleven weeks, the S&P 500 finished higher by 0.3% today but remains more than 23% below its recent highs. The Mid-Cap 400 and Small-Cap 600 each advanced about 1% today, but posted notable declines of nearly 8% on the week. Real estate equities rebounded as well today as the Equity REIT Index advanced 0.8% today - ending the week with declines of 5.3% - while the Mortgage REIT Index rebounded 4% but still finished the week with declines of over 13%.

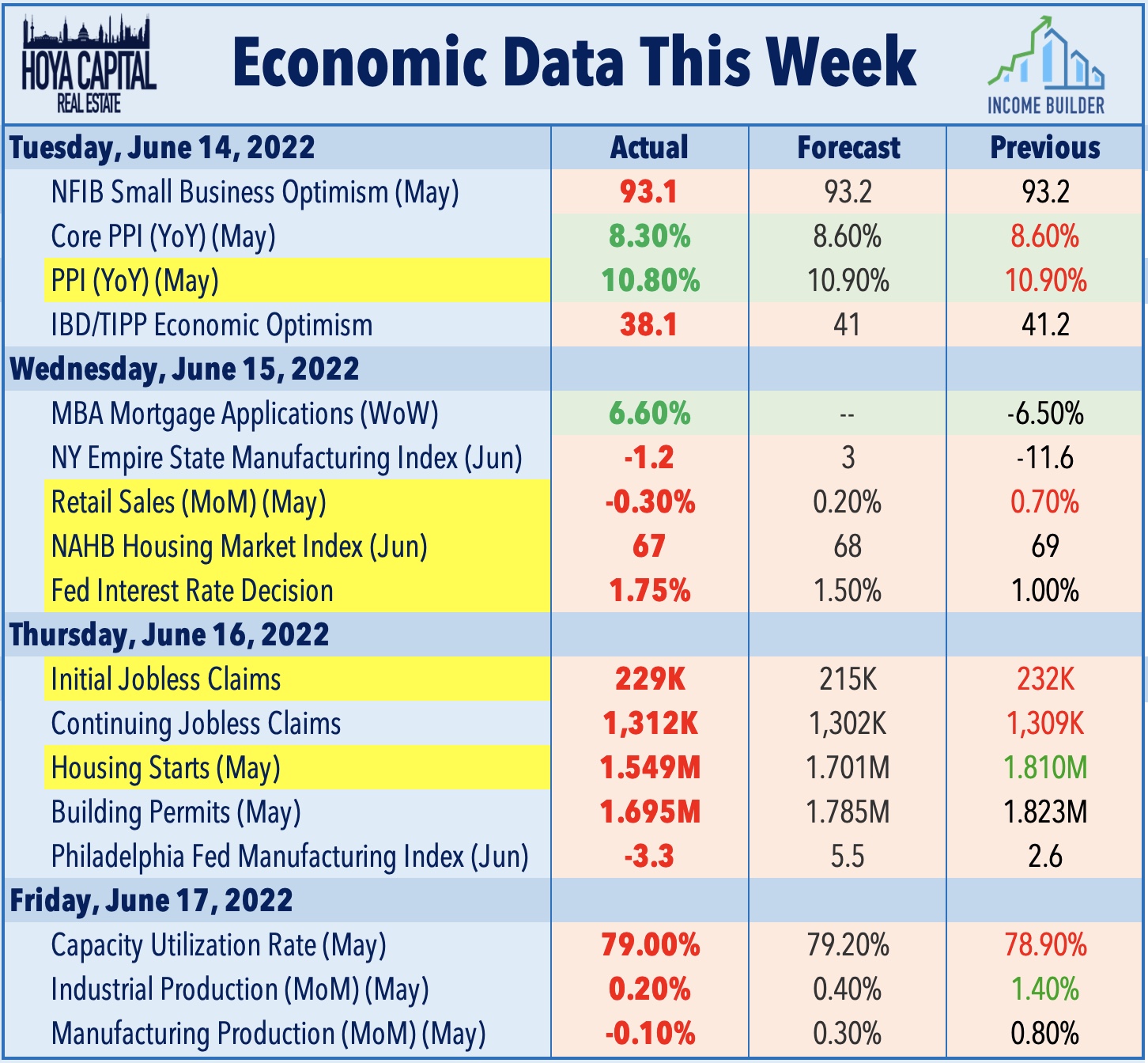

Recession worries dragged the previously-high-flying Energy (XLE) sector lower by another 5% today - extending its plunge to over 17% on the week - on a weakening demand outlook as persistently elevated prices have been a double-edged sword. A similar phenomenon has been at play across the new home construction markets in recent months as homebuilders posted another week of steep declines as surging mortgage rates have rapidly amplified affordability headwinds. The benchmark 10-Year Treasury Yield remained relatively steady today at 3.24% after finding resistance at the 3.50% level reached mid-week following the FOMC rate hike decision.

We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook published this weekend.

Real Estate Daily Recap

Hotel: Pebblebrook (PEB) was a laggard today after providing a business update in which it noted that its operating metrics softened a bit in May compared to April, but attributed the weakening to seasonal patterns rather than recent economic concerns. Its Revenue Per Available Room ("RevPAR") was 9% below comparable pre-pandemic levels in May, giving back some ground from April when its REVPar was within 5% of pre-pandemic levels. Recent TSA Checkpoint data has shown some signs of softening demand as well with June on pace to record the softest demand relative to pre-pandemic levels since the end of the Omicron outbreak back in early March.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs rebounded today amid an otherwise rough week. Ellington Financial (EFC) rallied more than 4% today after it reported that its estimated book value per share ("BVPS") was $16.94 as of May 31, 2022 a decline of about 1% since the end of April and 4.5% since the end of Q1. While June has been a particularly brutal month for fixed income portfolios - including mortgage-backed securities - the rather modest decline in BVPS is a decent read-through for the broader mREIT sector. Cherry Hill (CHMI), Granite Point (GPMT), and Franklin BSP (FBRT) were all higher today after holding their dividends steady.

In Mortgage REITs: Everything In Moderation, we highlighted the potential risks related to rate volatility while noting that - even the double-digit average dividend yield - most mREIT dividends are covered by EPS and not at immediate risk of reductions. We've now seen 12 mortgage REITs raise their dividend this year compared to four dividend reductions.

REIT Preferreds & Capital Raising

Per the Income Builder Preferred Tracker available to Income Builder subscribers, REIT Preferred stocks finished lower by 0.49% today, on average. REIT Preferreds are lower by roughly 13% on a total return basis this year after ending 2021 with price returns of roughly 8.0% and total returns of roughly 14%. There are now roughly 180 REIT-issued exchange-listed preferred and debt securities with an average current yield of 7.06%. As expected based on recent company commentary, UMH Properties (UMH) announced that it will redeem all outstanding shares of its 6.75% Series C Cumulative Redeemable Preferred (UMH.PC) on July 26th. Elsewhere, Welltower (WELL) announced an upsized and extended $5.2B credit facility which includes a $4.0 billion unsecured revolving line of credit, $1.0 billion term loan and CAD 250 million term loan.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing asset classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.