Rates Moderate • Builders Lead • Recession Watch

- U.S. equity markets advanced Thursday - on pace for just their second positive week in three months - as benchmark interest rates moderated following weaker-than-expected employment and manufacturing data.

- Extending its week-to-date gains to over 3%, the S&P 500 advanced 1.0% today while the tech-heavy Nasdaq 100 rallied 1.5% to push its weekly gains to nearly 4%.

- Real estate equities were once again among the leaders today on similar leadership from residential REITs and homebuilders. The Equity REIT Index advanced 1.9% with 16-of-19 property sectors in positive territory.

- Homebuilders were notable outperformers following surprisingly strong results from KB Home, which surged nearly 9% after recording improving margins while maintaining its full-year outlook.

- Benchmark interest rates extended their weekly declines today following notably weak PMI data both in the U.S. and Europe showing the weakest readings since 2020 across several metrics.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets advanced Thursday - on pace for just their second positive week in three months - as benchmark interest rates moderated following weaker-than-expected employment and manufacturing data. Extending its week-to-date gains to over 3%, the S&P 500 advanced 1.0% today while the tech-heavy Nasdaq 100 rallied 1.5% to push its weekly gains to nearly 4%, but both benchmarks remain in "bear market" territory. Real estate equities were once again among the leaders today, driven by leadership from residential REITs, technology REITs, and homebuilders. The Equity REIT Index advanced 1.9% with 16 of the 19 property sectors in positive territory while Mortgage REIT Index gained 2.1%.

Benchmark interest rates extended their weekly declines today following notably weak PMI data both in the U.S. and Europe showing the weakest readings since 2020 across several metrics. Further fueling the bid for bonds and recession worries was weaker-than-expected Jobless Claims data which - while still historically low - have been on a mild uptrend since bottoming in April. The benchmark 10-Year Treasury Yield pulled back 9 basis points to 3.07% today - well below its high last week of 3.50% before the FOMC meeting. Homebuilders and the broader Hoya Capital Housing Index were notable outperformers today following surprisingly strong results from KB Home (KBH), which surged nearly 9% after reporting strong revenue growth and improving margins while maintaining its full-year outlook.

Real Estate Daily Recap

Apartments: Blackstone (BX) officially closed on its acquisition of Preferred Apartments Communities (APTS) for its nontraded REIT platform Blackstone Real Estate Income Trust ("BREIT"), paying $25.00 per share of common stock in an all-cash transaction valued at approximately $5.8 billion. As a result of the transaction, APTS' common stock will no longer be listed on any public market. The deal was one of five major acquisitions over the past year for BREIT, having previously closed on deals to acquire Bluerock Residential and QTS Realty while its acquisitions of American Campus (ACC) and PS Business Parks (PSB) are expected to close within the next several months.

Cell Tower: Today we published Cell Tower REITs: For 5G, 4 Beats 3 on the Income Builder marketplace, which discussed our recent trade and updated outlook for the cell tower REIT sector. After uncharacteristically lagging for most of the year, Cell Tower REITs have been the best-performing property sector over the past quarter, benefiting from favorable macro shifts and positive industry-specific catalysts. One of the most “recession-resistant” property sectors, strong earnings results highlighted the underappreciated inflation-hedging characteristics of cell tower REITs as international lease escalators are typically linked with local CPI. DISH Network commercially launched its 5G network, becoming the fourth national wireless carrier alongside AT&T, Verizon, and T-Mobile. Given the industry skepticism over DISH’s viability, any level of success is incremental for tower REITs.

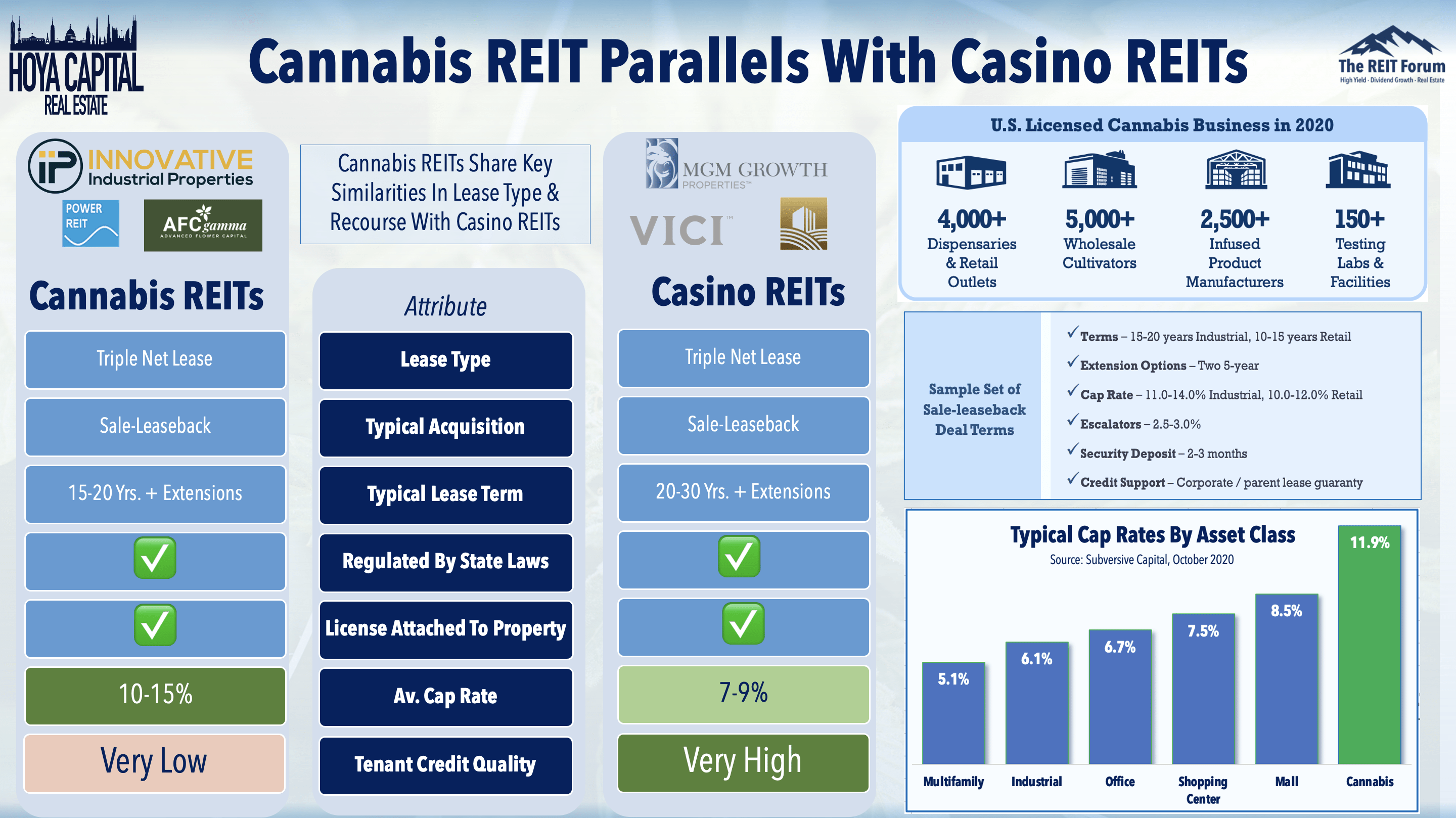

Cannabis: Earlier this week, we published Cannabis REITs: Weeding Out The Weak. A perennial performance leader over the past half-decade, cannabis REITs have been slammed in 2022 amid concerns over tenant financial health given the sharp re-pricing of risk and tighter financial conditions. Owning the "Pharmland" - the physical real estate - had been one of the few cannabis plays that was working amid a decade-long stretch of dismal investment performance from broader cannabis ETFs. Marijuana legalization has progressed at the state level, but federal legalization efforts remain stalled, a "double-edged sword" for cannabis REITs that thrive in the murky legal environment, but also need healthy operators that will pay the rent. Cannabis REITs have faced remarkably few tenant non-payment issues thus far.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs continued their strong week today with residential mREITs advancing nearly 3% - pushing their weekly gains to over 7% - while commercial mREITs gained another 1% today and are now higher by 4% on the week. After the close yesterday afternoon, Two Harbors (TWO) rallied nearly 5% today after it held its quarterly dividend steady at $0.17/share, representing a forward yield of 14.5%. TWO also authorized the repurchase of up to 5M preferred shares which may include its 8.125% Series A (TWO.PA), 7.625% Series B (TWO.PB), and/or its 7.25% Series C (TWO.PC) preferreds.

REIT Preferreds & Capital Raising

Per the Income Builder Preferred Tracker available to Income Builder subscribers, REIT Preferred stocks finished higher by 0.27% today, on average. REIT Preferreds are lower by roughly 13% on a total return basis this year after ending 2021 with price returns of roughly 8.0% and total returns of roughly 14%. There are now roughly 180 REIT-issued exchange-listed preferred and debt securities with an average current yield of 7.06%. Over in the capital markets today, Invitation Homes (INVH) entered into a new $725m seven-year sustainability-linked unsecured term loan maturing in June 2029 with a variable interest rate structure priced at SOFR plus 125 bps.

Economic Data This Week

The busy slate of economic data concludes on Friday with New Home Sales data which is expected to show a contraction to the lowest level since late 2018. We'll also see Michigan Consumer Sentiment, a report that has also suddenly been thrust back into focus after Fed Chair Powell specifically cited the hotter-than-expected consumer inflation expectations survey as a primary rationale for the FOMC's decision to hike rates by 75 basis points rather than 50 basis points this month. We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook published this weekend.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing asset classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.